Optimal Growth and Dynamic Multisectoral Model

advertisement

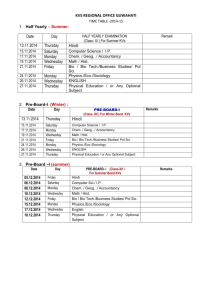

Optimal Growth Models One Sector Ramsey Model Role of the Financial Sector Cass (1965) Koopman(1965) type Optimal Growth Model Ut t ln Ct 0 1 t 0 Yt AKt 0 1 K t 1 I t C t I t Yt K t 1 I t C t Yt I t K0 K0 K t 1 K t 1 I t Ct AK t K t 1 K t 1 0 1 Steady State in an Optimal Growth Model Ut t ln AK t K t 1 t 0 1 U t t ln AKt K t 1 t 1 ln AKt1 K t 2 .. C t 1 t 1 t AK t11 Ct U t AK t11 0 K t 1 Ct Ct 1 t t 1 U t ln AK C t 1 AK t11 Ct t C t 1 C AK 1 Ct C 1 1 .. Ct 1 Ct Ct 1 .. C 1 K A Y AA1 1 C Y I AK K AA K t 0 .. K t 1 K t K t 1 .. K Y AK 1 1 A 1 A 1 A 1 1 1 1 1 Optimal Growth Model with less than 100% depreciation K t 1 K t 1 I t ln AK K t t K t 1 K t 1 I t Ct AKt K t 1 K t 1 C t Yt I t Ut 0 1 t 1 K t 1 t 0 U t t ln AKt K t 1 K t 1 t 1 ln AKt1 K t 2 K t 1 1 .. U t Ct Ct 1 t t 1 AK t11 1 0 Ct Ct 1 K t 1 Ct Ct 1 C t 1 AK t11 1 Ct .. Ct 1 Ct Ct 1 .. C .. K t 1 K t K t 1 .. K U t ln AK K K 1 t 0 t Steady State in an Optimal Growth Model with less than 100% depreciation AK C t 1 C AK 1 1 Ct C K 1A 1 1 1 1 1 K A Y AK I K 1 K C Y I 1 1 1 K 1A 1 1 1 1 1 0 1 A K 1 1 Y A I K A C 1 1 2 1 1 1 1 1 1 A I K 1 1 1 A 1 1 1 1 1 1 Optimal Growth Model with Financial Intermediation S t I t Ct AK t K t 1 K t 1 U t t ln AK t K t 1 K t 1 t 0 Ct 1 AK t11 1 Ct U t t ln AK t K t 1 K t 1 t 1 ln AK t1 K t 2 K t 1 1 .. U t t t 1 AKt11 1 0 Ct Ct Ct 1 .. K t 1 K t K t 1 .. K .. Ct 1 Ct Ct 1 .. C U t ln AK K K 1 t t 0 Steady State in Optimal Growth Model with Financial Intermediation Ct 1 C AK 1 1 Ct C AK 1 1 1 K A Y AK 1 1 1 1 A K 1 A Y 1 A I K 1 C Y I K 1A 1 K 1A 1 1 1 I K 1 K 1 1 1 A C 1 1 A 1 1 1 Table 5 Capital Stock, Output, Consumption and Investment in the Steady State Technology Capital share: alpha Beta Initial capital K0 Delta Intermediation cost Capital Stock Output Consumption Investment I 44.025 0.4 0.9 100 1 1 100 278 178 100 Parameters of the Infinite Horizon Model II II IV V VI 44.025 44.025 44.025 44.025 44.025 100 VIII 100 0.6 0.9 100 0.05 0.4 0.9 100 1 0.4 0.9 100 0.05 0.6 0.9 100 0.05 1 1 1 1.2 1.05 Infinite Horizon Economy in the Steady State 2,499 149 344,202 218,202 304,677 9,750 2,472 420,017 319,518 390,376 7,251 2,323 75,815 101,315 85,699 2,499 149 344,202 218,202 304,677 1 1 1.05 392 1,090 698 392 9,807 62,607 52,800 9,807 2,369,142 4,214,584 1,845,441 2,369,142 0.4 0.9 100 0.05 0.2 0.9 100 0.05 0.6 0.9 100 0.05 0.6 0.9 100 0.05 VII IX 100 Computations for Optimal Growth Excel based model GAMS based Models Basics of an Optimal growth Model Yt K t Lt1 Ct I t Capacity constraint Accumulation K t 1 1 K t I t Terminal Capital First order condition For investment Lt 1 g L0 t 1 K0 K0 I T g KT Pt PKt 1 First order condition for consumption First order condition of capital market The marginal revenue product of capital PT PTCT 1 g Pt Ct C0 C0 1 r Pt k RK t 1 Pt k 1 t PTCTk RK t 1 Pt k 1 RK t Pt K t Lt1 K t t Steps for Implementing a Dynamic Optimal Growth Model • *1. declare the time and define the first and last periods • *2. declare and assign the values for the benchmark parameters • *3. calibrate the model – discount factors and assign the value for initial capital stock • *4. declare variables and equations • *5. derive the first order conditions for optimisation and market clearing conditions • *6. write all equations • *7. declare the model • *8. Solve the model • *9. produce the results in readable format • *10. Interpret them using economic theory • *11. modify the model to incorporate new issues. set t /t1*t30/ set tfirst(t) set tlast(t) ; tfirst(t) = yes$(ord(t) eq 1); tlast(t) = yes$(ord(t) eq card(t)); *declare the Key parameters to benckmark the economy scalar g /0.02/ R /0.05/ K0 /3/ kstock /1/ delta /0.07/ I0 c0 kvs ; I0 = (delta+g)*K0; C0 = 1-I0; *declare reference prices and quantities parameters qref(T) pref(t) alpha ; QREF(T) = (1+g)**(ord(t)-1); pref(t) = (1/(1+r))**(ord(t)-1); kvs = (delta+r)*K0; alpha(t) = ((1+g)/(1+r))**(ord(t)-1); alpha(tlast) = alpha(tlast)/(1-((1+g)/(1+r))); *declare variables Variables C(t) I(t) K(t) P(t) PK(t) RK(t) PTC(t) ; *Declare equations Equations capacity(t) capital(t) Terminal(t) Foc_con(t) Foc_K(t) Foc_I(t) rent_k(t) *declaration of model equations capacity(t).. (K(t)/K0)**kvs*qref(t)**(1-kvs) =e= C(t)+I(t); capital(t).. (1-delta)*K(t-1) +I(t-1) +K0*Kstock$tfirst(t) =G= K(t); Terminal(tlast).. I(tlast) =e= (g+delta)*K(tlast); Foc_con(t).. P(t)*C(t)=e=C0*Alpha(t); Foc_K(t).. Pk(t) +PTC(t)*(g+delta)$tlast(t)=e= P(t)*((kvs*K(t)**kvs*qref(t)**(1-kvs))/K(t)) +(1-delta)*pk(t+1); Foc_I(t).. P(t) =e= PK(t+1) +PTC(t)$tlast(t); rent_k(t).. rk(t) =e= P(t)*((kvs*K(t)**kvs*qref(t)**(1-kvs))/K(t)); model ramsey1/ capacity.p capital.pK Foc_con.c Foc_K.k Foc_I.I Terminal.ptc rent_k /; C.l(t)=c0*qref(T); I.l(t)=i0*qref(T); K.l(t)=k0*qref(T); P.l(t)=Pref(T); PK.l(t)=(1+R)*Pref(T); *RK.lo(t)=Pref(T); PTC.l(T)=PREF(T); pk.lo(t) =1e-6; pk.up(t) =+inf; solve ramsey1 using mcp; parameter base, report; base(t, "cons")= C.l(t); base(t, "inv") = I.l(t); base(t, "cap") = K.l(t); base(t, "labour") = qref(t); base(t, "price-y")= P.l(t); base(t, "price-k")= PK.l(t); base(t, "rent") = RK.l(t); base(t, "term-K")= PTC.l(T); Display base, report; Interpretation of Model Equations in GAMS Capacity constraint Yt K t Lt1 Ct I t (K(t)/K0)**kvs*qref(t)**(1-kvs) =e= C(t)+I(t); Accumulation K t 1 1 K t I t K0 K0 (1-delta)*K(t-1) +I(t-1) +K0*Kstock$tfirst(t) =G= K(t); Terminal Capital First order condition For investment I(tlast) =e= (g+delta)*K(tlast); I T g KT P(t) =e= PK(t+1) +PTC(t)$tlast(t); Pt PKt 1 PT PTCT First order condition for consumption 1 g t P(t)*C(t)=e=C0*Alpha(t); Pt Ct C0 C0 1 r First order condition of capital market Pt k RK t 1 Pt k 1 t (t) +PTC(t)*(g+delta)$tlast(t)=e= P(t)*((kvs*K(t)**kvs*qref(t)**(1-kvs))/K(t)) +(1-delta)*pk(t+1) PTCTk RK t 1 Pt k 1 RK t Marginal product of capital Pt K t Lt1 K t rk(t) =e= P(t)*((kvs*K(t)**kvs*qref(t)**(1-kvs))/K(t)); Ramsey Model: Benevolent Social Planner’s Problem U t ln Ct Instantaneous utility T Max U t ln C t 1 g t 1 r t Subject to 1 Yt K t Lt or K t 1 1 K t I t I T g KT Yt Ct I t Lt 1 g L0 t Yt K t 1 Lt t 1 Ramsey Model: Decentralised Market T Max U 1 ln C t t t Yt K t1 Lt K t 1 1 K t I t I T g KT Ct 1 Rt 1 Ct 1 1 Rt 1 1 K t Lt Lt 1 g L0 t 1 Yt Ct I t Optimal Consumption-Saving Model while Young, Adult and Old Max U C , C , C ln C ln C ln C 1 2 2 3 3 1 2 3 Subject to: 1. 2. C W C W C 2 3 W 2 3 1 1 r 1 r 2 1 1 r 1 r 2 ( W , W , W ) = (120, 1200, -120) 1 3. ( C1 0, 2 3 C2 0, C 3 0) What is the optimal consumption and saving in each period ? Derivation of the Marginal Productivity = User Cost of Capital Condition F K 1 P2K K k P K 1 r 1 1 r Producer’s Problem: Optimality Condition: Implication: K 1 P F ' K 2 0 Pk K 1 r 1 1 r MPK 1 r P1k 1 P2K MPK 1 r 1 1 K P1 MPK r K P1 Assumptions: K P2K K 1 P1 k k K 0 References • • Bhattarai (2003) Role of Financial Markets in an Economy, memio University of Hull. Cass, D. (1965): Optimum Growth in Aggregative Model of Capital Accumulation, Review of Economic Studies, 32:233-240. • GAMS User Manual, GAMS Development Corporation, 1217 Potomac Street, Washington D.C. • Stokey, N. L. and R.E. Lucas (1989) Recursive Methods in Economic Dynamics, Harvard UP, Cambridge, MA.