oilgas estimates - People Before Profit Alliance

advertisement

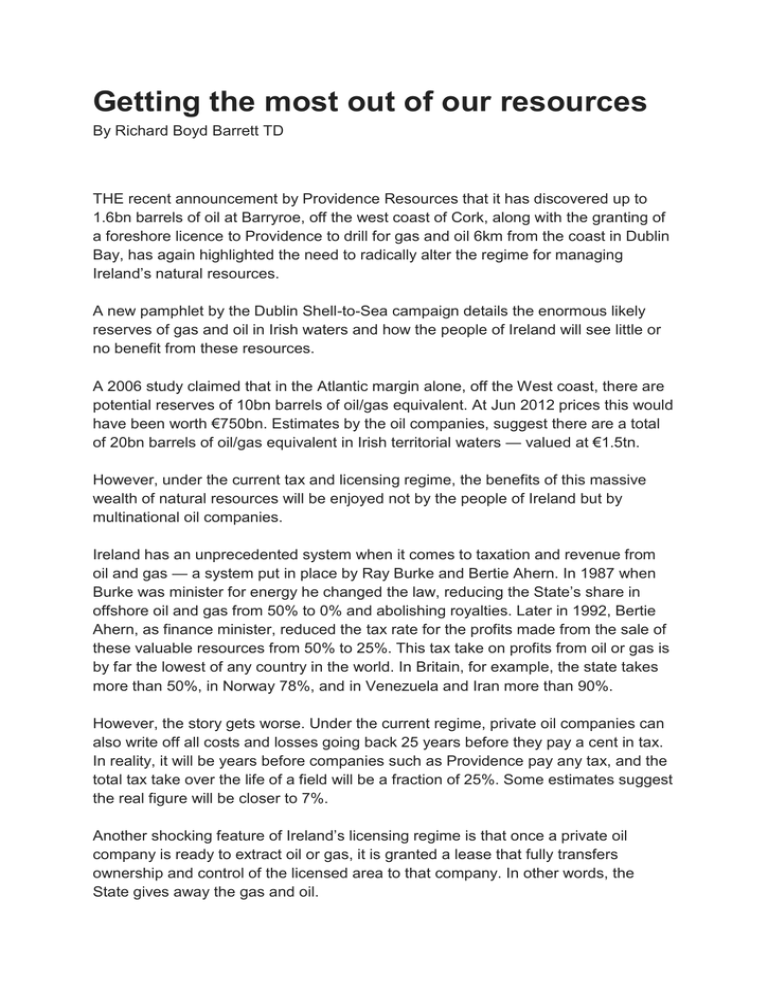

Getting the most out of our resources By Richard Boyd Barrett TD THE recent announcement by Providence Resources that it has discovered up to 1.6bn barrels of oil at Barryroe, off the west coast of Cork, along with the granting of a foreshore licence to Providence to drill for gas and oil 6km from the coast in Dublin Bay, has again highlighted the need to radically alter the regime for managing Ireland’s natural resources. A new pamphlet by the Dublin Shell-to-Sea campaign details the enormous likely reserves of gas and oil in Irish waters and how the people of Ireland will see little or no benefit from these resources. A 2006 study claimed that in the Atlantic margin alone, off the West coast, there are potential reserves of 10bn barrels of oil/gas equivalent. At Jun 2012 prices this would have been worth €750bn. Estimates by the oil companies, suggest there are a total of 20bn barrels of oil/gas equivalent in Irish territorial waters — valued at €1.5tn. However, under the current tax and licensing regime, the benefits of this massive wealth of natural resources will be enjoyed not by the people of Ireland but by multinational oil companies. Ireland has an unprecedented system when it comes to taxation and revenue from oil and gas — a system put in place by Ray Burke and Bertie Ahern. In 1987 when Burke was minister for energy he changed the law, reducing the State’s share in offshore oil and gas from 50% to 0% and abolishing royalties. Later in 1992, Bertie Ahern, as finance minister, reduced the tax rate for the profits made from the sale of these valuable resources from 50% to 25%. This tax take on profits from oil or gas is by far the lowest of any country in the world. In Britain, for example, the state takes more than 50%, in Norway 78%, and in Venezuela and Iran more than 90%. However, the story gets worse. Under the current regime, private oil companies can also write off all costs and losses going back 25 years before they pay a cent in tax. In reality, it will be years before companies such as Providence pay any tax, and the total tax take over the life of a field will be a fraction of 25%. Some estimates suggest the real figure will be closer to 7%. Another shocking feature of Ireland’s licensing regime is that once a private oil company is ready to extract oil or gas, it is granted a lease that fully transfers ownership and control of the licensed area to that company. In other words, the State gives away the gas and oil. In international terms Ireland has one of the worst deals in the world. In Iran, for example, they manage their natural resources with a "service agreement" pact where the state retains companies to carry out work at their own costs. The company can then off-set the costs later on as they get a share of the oil produced but they never get ownership. Most countries operate production sharing contracts where the state works with companies but without handing over ownership. Norway is one of the best examples of this model with a 78% tax rate, 67% state ownership of Statoil, in addition to having a state-owned company participating in production with the oil companies. Energy Minister Pat Rabbitte defends our licensing terms by arguing that Ireland cannot afford the cost of exploration and drilling, therefore we have no option but to leave it to the oil companies. This argument is ludicrous in the extreme; there are many options. Licences in future could stipulate that once a discovery is made, the state could step in and become a joint operator and take a share, on a sliding scale, depending on the size of the field. The other defence used by the Government is that, at least Ireland will have a security of gas or oil supply and there will be employment benefits. Again, this is a false and dishonest claim. Under the current regime, oil companies are under no obligation whatsoever to supply the Irish market. The oil companies will have complete control over what they produce and to whom they sell it. Hopes for jobs are likely to be equally illusory. Providence Resources indicated in a presentation to Dún Laoghaire-Rathdown Co Council, in relation to its plans for Dublin Bay, that employees would be flown in from abroad and brought to the rig. In addition to giving away huge revenue to the oil companies, the State has allowed the companies to bulldoze over environmental concerns, democratic consultation, and communities such as Rossport in Mayo at a huge environmental and social cost. Additional notes The estimates – from the Petroleum Affairs Division (PAD) of the Dept: 10 billion barrels of oil equivalent in the Atlantic Margin (doesn’t take onshore figures into consideration) Take the 10 billion and multiply by the current market price ($90) – 900 billion- could be over-estimated or under-estimated when gas estimate taken into account Ireland- has lowest returns. Minister cites 2007 terms of tax returns of 40% but this will not happen when tax paid and costs off-set are taken into consideration And even if we did get the whole 40% it’s still one of the lowest in the world and we have still handed over ownership AND Irish citizens will still have to pay exorbitant prices for oil and gas Ireland - licencing system, where the state transfers ownership of the oil and gas after production If we re-negotiated our contract with Shell we could see huge revenue and jobs being generated and never before have these issues been so urgent Iran - manage their natural resources with a ‘service agreement’ pact whereby the state retains companies to carry out work at their own costs. The company can offset the costs later on as they get a share of the oil produced but they never get ownership. Most countries however operate production sharing contracts where the state works with companies but again without handing over ownership. Norway is the best example of this with a 78% tax rate, 67% state ownership of Statoil and in addition to having a state owned company participating in production with oil companies. Point is that in the other agreements the other states do not transfer ownership Dublin Bay victory, oil rig stopped: Dalkey- Providence Resources (30% owned by O’Reilly)- last summer announced 870 million barrels of oil valued at $53 billion