NEFE® High School Financial Planning Program

advertisement

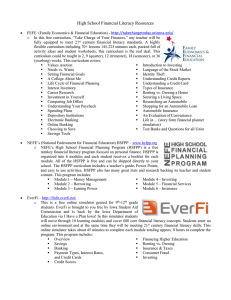

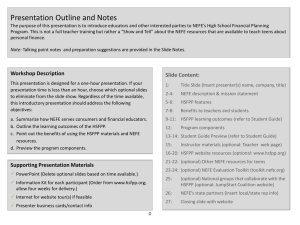

NEFE® High School Financial Planning Program (HSFPP) Fahzy Abdul-Rahman Family Resource Management Extension Specialist New Mexico State University HSFPP is sponsored by National Endowment for Financial Education® (NEFE®), Copyright 2007 NMSU Extension • Land-grant university mandate – teaching, research, … & extension. • Provides practical, research-based knowledge and programs to improve their quality of life – http://extension.nmsu.edu/ • County extension offices in each county HS Financial Literacy in NM • Governor Bill Richardson has approved financial literacy as a possible subject in fulfilling math high school credit requirement in March 2010. – one of the four mathematics units required for high school graduation • 46 percent are functionally illiterate – Financial functionally illiterate? Why NEFE’s HSFPP? The winner of two national awards: The Institute for Financial Literacy's EIFLE (Excellence in Financial Literacy Education) Award for Institutional Book of the Year Award in the General Children Category was awarded to the HSFPP. The Association for Financial Counseling, Planning and Education also gave its Outstanding Financial Education Program of the Year award to the NEFE HSFPP. Why NEFE’s HSFPP? • Complete, money management curriculum • Over 6,500,000 student guides sent out to an estimated 200,000 classrooms • Tested • Teacher Training Program • Materials are free • Online resources available: – For parents – For students: Games, quizzes Certificate of Completion Instructor Manual Presentation Visuals Online Training Data Disk Take-Home Brochure Spanish Version Program Materials Student Guide 6 Modules/Chapters Student Guide vs. Instructor's Manual Overview for Instructor • Instructor’s Manual is very detailed • Training provided by NEFE representative – In NM, Family Resource Management Extension Specialist • Flexible: Focus on selected topics/chapters • Supplemental materials’ suggestions Unit 1 – Financial Plan • Examine the value of having a process of planning how to use money • Create personal financial SMART goals • Analyze how money is received and used • Use the decision-making process to create a financial plan • Identify guidelines to implement a personal financial plan • Monitor and modify a personal financial plan Sample Wants and Needs NEEDS • Food for breakfast • Clothes for school • Transportation to school or work WANTS • An iPOD • DVD Players • Cell Phone • Hot Car Don't Buy Stuff on Hulu: http://www.hulu.com/watch/1389 The Five-Step Financial Planning Process 1-B Step 1: Set up SMART Goals SMART Goals for lodging, transportation, meals for Specific…….. “Pay a 5-day trip to Washington, D.C.” through fundraising, $50 from Measurable… “$300 birthday money, save $25 a week.” Attainable….. “IfwhenI stickI needto myit.”plan, I’ll have the money “I still have enough money to live on Realistic……. while I work toward this goal.” “I need to have all the money by 6 months Time-Limited.. from now.” Unit 2 – Budgeting • • • • • • • • Examine spending habits Benefits of having a spending plan, or budget Identify various sources of income Identify types of expenses Importance of saving (paying yourself first) Constructing a budget [e.g. here] Record keeping involved with budgeting How a budget will change throughout your life NEFE High School Financial Planning Program Unit Two – Budgeting: Making the Most of Your Money ? NEFE High School Financial Planning Program Unit Two – Budgeting: Making the Most of Your Money Unit 3 – Investing A. B. C. D. Differentiate between saving and investing Assess the time value of money Compare investment options Compare the relationship between risks and returns related to saving and investments E. Recommend ways to integrate savings and investing strategies into financial planning Investing Weekly at 5% Interest Amount Saved Per Week Value After 10 Years $ 7.00 $ 4,720 $ 14.00 $ 9,440 $ 21.00 $ 14,160 $ 28.00 $ 18,880 $ 35.00 $ 23,600 3-B 1 Financial Planning Pyramid Highest Risk Highest Earnings Commodities Collectibles Blue-Chip Common Stock Insured Savings / Checking Accounts 3-J Speculative Stock / Bonds / Mutual Funds Growth Mutual Funds Real Estate Balanced Mutual Funds Money Market Accounts or Mutual Funds Penny Stock High-Grade Preferred Stock High-Grade Convertible Bonds High-Grade Municipal Bonds or Mutual Funds U.S. Savings Bonds Certificates of Deposit High-Grade Corporate Bonds or Mutual Funds Treasury Issues Lower Risk Lower Earnings Unit 4 – Good Debt, Bad Debt • Explain what credit is • Compare the advantages and disadvantages of using credit • Outline the process of applying for credit • Explain what a credit history is and why it is important • Explain how to manage credit responsibly • Explore the consequences of excessive debt and how to correct it • Determine what to do in the event of inaccurate reporting Unit 5 – Your Money • Examine the various types of financial services providers, especially credit union • Explain how a savings account works • Practice using a checking account and debit card • Explain how a credit card is used to make purchases • Explore the features of automated financial services • Respond to situations involving identity theft and deceptive practices Savings Deposit Exercise 5-C, Page 62 6 1 Today’s date goes here 2Print Your Name Here 3Print Your Address Here 4 Sign Your Name Here 5 3 33 3 3 3 3 Click the numbers 7 8 9 10 11 x 1 25 0 9 375 2 5 5 00 34 75 0 0 425 3 4 Savings Deposit Exercise 5-C, Page 62 x Today’s date Your Name Your Address Here 1 0 1 - 2 3 4 56 - 6 7 8 Click Here to Go to the Next Slide 1 00 0 0 1 00 0 0 Check Details Click the numbers 1 2 3 4 5 6 7 8 9 10 11 Enter Put Here your just the personal date number you check signature write ofNumber. this number each Check. here. check. again (see above right). On Here This Legibly Place Make the isisthe sure to lower where the your print add Routing your Account line, the any you personal amount information write write Number out the of information the money name for you (Note amount your want ofthis the that bank on like check toparty the sometimes related (used this. check is you for. for to are iselectronic this these correct. writing check. twoyour check transfers numbers to (the of arefunds payee). the reverse from Beyour sure of what account to write is shown to orthe print here.) payee’s legibly!account) January 15, 2009 25.65 Best Foods Supermarket Twenty-five and 65/100 - - - - - - - - - - - - - - - - - - - - - - - Snacks for Party John M. Smith Keep a Record Click Here 1 2 3 Deposit 1/11 Auto WD 100 1/11 Deposit to Checking Charge for Personalized Checks 1/15 Fine Foods Groceries 200 00 20 00 23 11 200 00 200 00 20 00 180 00 23 11 156 89 Does It Balance? Reconciling your checking account statements Why reconciling is important • Lets you check for mistakes and checks you wrote but did not enter. • Gives you a chance to subtract other charges that the financial institution may have added. • Lets you add any interest that your checking account may have earned. • Not all the checks you have written will always be shown, because they may not have been cleared by your bank or credit union. • Uncleared checks will show up on your next statement. Debit Cards vs. Debit Cards HOW TO USE A DEBIT CARD • How to Use • The Difference – Enter your PIN number – Enter the amount of cash back, if desired – Signature The Risks of Identity Theft IDENTITY THEFT VICTIMS COULD: • Have any and all of their financial accounts invaded and emptied. • Be asked to repay debts they did not incur. • Lose job opportunities. • Lose their good credit rating. • Be refused loans. • Be sued for things they have no part of. • Even be arrested for crimes they didn’t commit. SCAMMED! The news of my father death, and my uncle,s involvement in an air crash in december 2002 while on a business trip to benin republic caused my mother heartfailure and other related complications of which she later died in the hospital After we have spent a lot of money on her. What’s Going What’s Going on Here? on Here? Before our mother died, she told us that our father deposited some money which he made from diamond sales and contracts at this bank here in Ivory Coast and that we should pray and find a trust worthy foreign business partner who would help us to transfer and invest this money in profitable business venture overseas.She told us to do this quickly so that we can leave Ivory Coast and, then settle down abroad. She gave us the bank document to prove the deposit and then told us that my father used my name as the next of 1 money 2 kin and beneficiary to the in the bank Unit 6 – Insurance • Identify ways to manage risk • Describe how insurance is used to protect against financial loss • Explain the features and processes related to automobile insurance • Examine how insurance needs vary from person to person because of lifestyle and life situation • Assess how insurance fits into your financial planning Managing the Possibility of Loss Avoid it Reduce it Accept it Share it How much you use the car If you’re a good student Make of car Driver’s education Credit rating Factors Affecting Automobile Insurance Costs Where you live Gender Type of car Marital status Driving record Do you take the car to work? 6-F Your age Unit 7 – Your Career • The relationship between career choice and earning power • How education and training affect career choices and earning potential • The value and costs of career preparation • How employee benefits enhance earning potential • Factors that affect earning potential and financial planning • Pros and cons of working for yourself versus working for others. Relationship of Career and Earning Power Key Employee Skills Basic Skills Thinking Skills Personal Skills Resource Management Skills Interpersonal Skills Systems Skills Information Management Skills Technology Skills NEFE High School Financial Planning Program How Much is Class Worth? Worklife earnings estimates by highest level of educational attainment 4.5 4.4 4 Millions of 2006 dollars 3.5 3.4 3 2.5 2.5 2.1 2 1.5 1 1.5 1.6 1.2 1 0.5 0 Some1high school, no degree High 2 school diploma, or equivalent Some 3 college, no degree Associate 4 Degree Bachelor’s 5 Degree Master’s 6 Degree Doctoral 7 Degree Professional 8 Degree Source, US Census Bureau, current population survey, educational attainment in the US. 2005 1 of 2 Typical Employee Benefits • Hospitalization, Medical, and Disability Insurance • Dental and Vision Insurance • Accidental Death Insurance • Sick Leave • Paid Vacation Time and Holidays • Parental Leave 2 of 2 Typical Employee Benefits • • • • • Worker’s Compensation Insurance Life Insurance Retirement Benefits Retirement Savings Plans Employee Assistance Programs Factors that Can Affect Your Earning Potential Promotions Being Laid Off Additional Training A New Job Relocation Being Fired Advanced Degrees Business Downturn Changing Careers Life-Changing Situations Business Upturn What other factors can you think of? Web Site for • • • • • • All instructional materials All the best from 2001 & 1995 HSFPP Online Ordering Capability Links to Curriculum Resources on the Net Knowledge Sharing Online Training Teachers Teachers Resources Including Suppliments Supplement Materials • Banking – Practical: Fake accounts, on-line banking, debit card use, e-payment, writing check. – Credit union preferred • Junior Achievement (JA) materials – Games – Books Web Site for • • • • • • • Articles on Financial Topics HSFPP Related Content and Tools Financial Calculators Games NTRBOnline.com Content Monthly Polls Links to Web resources about money Students Students Web Site for Parents Tools for Parents to Help Their Kids Financial Ed Tools for Parents Themselves Links Web Resources HSFPP Curriculum Information Information on Financial Education How to get the HSFPP Parents • • • • • • Log-in 46 Ordering 47