FRL 300-1&2 - California State Polytechnic University, Pomona

advertisement

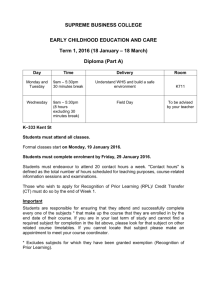

California State Polytechnic University, Pomona Finance, Real Estate and Law College of Business Administration Managerial Finance I FRL 300 Section 01: Class #14223 1:30 p.m. - 2:45 p.m. Section 02: Class #14224 3:00 p.m. – 4:15 p.m. Monday & Wednesday Building 163 – Room 1005 P. Sarmas Winter Quarter 2016 www.cpp.edu/~psarmas Catalog Description: This is the first of two-course sequence for College of Business Administration majors. Topics include the role of a financial manager; financial statement analysis; financial planning and control; time value of money; bond and stock valuation; investment analysis techniques; and short-term financial management. 3 Lecture/Problem solving. Required Background or Experience: Understanding of all topics in ACC 207/207A, and EC 201 and knowledge of algebra, good comprehension of written and spoken English, and knowledge of computer spreadsheet analysis. 1. Prerequisite: Pass ACC 207/207A, EC 201, MAT 125, and microcomputer proficiency with a “C” or better. 2. Prerequisite Justification: Mastery of the principles and methods of managerial finance sequence requires knowledge of the principles and methods of financial statement construction and basic principles of micro- and macroeconomics. Modern financial analysis also requires the ability to utilize a variety of computer software programs. 3. General Education Contribution The communication skills and analytical skills learned in English and mathematics courses greatly enhance the students' ability to understand the concepts and apply the techniques of financial management introduced in this course. Good comprehension of written and spoken English and competency in college level algebra are essential for good performance in this course. Managerial Finance I – FRL 300 – Winter 2016 2 Course Objectives: The objectives of Managerial Finance I are to provide students with a sound introduction to the role of finance in a business firm, especially firms organized as corporations, and to the principles and methods of financial analysis and valuation. Topics covered include the role of a financial manager in business firm, the operation of financial markets and the determination of interest rates, the interplay of accounting and finance, the interpretation of financial statements, the use of financial ratios as a tool to evaluate firm financial performance, financial forecasting and planning, the principles of the time value of money, present and future values, rate of return, effective interest rates, techniques of bond valuation, the effects of interest rate changes on bond prices, techniques of stock valuation, an overview of the capital budgeting process, the sources and instruments of long-term financing, and the process and procedures involved in raising funds for business firms. Expected Outcomes: In this course, business students, as prospective managers, will gain knowledge and acquire skills related to financial decision-making process in a business firm. Upon successful completion of the course, the student should be able to do the following: interpret financial statements and financial ratios and to use them to assess the financial strengths and weaknesses of a firm, forecast external financing requirements, employ simple techniques of financial planning, apply compounding and discounting techniques to calculate present and future values of money and rates of return, value bonds and stocks, utilize basic investment performance measures in making investment decisions, interpret them, and explain the strengths and shortcomings of each measure, assess the impacts of changes in the economic environment on investment values and financial decisions, and describe the basic sources and types of long-term financing. Required Text: Text: Authors: Publisher: Fundamental of Corporate Finance Stephen A. Ross, Randolph W. Westerfield and Bradford D. Jordan Irwin-McGraw-Hill, 2016, Eleventh Edition Recommended Texts: Brealey, Myers, and Marcus Fundamentals of Corporate Finance Fundamentals of Financial Management Brigham and Houston 3 Managerial Finance I – FRL 300 – Winter 2016 Academic Integrity: Violation of academic integrity include, but are not limited to, the following: cheating on an examination, test or quiz; plagiarism on any paper or report; falsifying data, research or report; representation of forged documents; misrepresentation of information in oral or written form. Such violations will be dealt with severely by the instructor, the associate dean and the standard committee." Course Requirements: 1. 2. 3. 4. 5. 6. Class attendance and participation is required. Reading the assigned chapter(s) prior to the meeting. Practice problem assignments listed in the lecture schedule section. Completing the homework assignments by stated due date. Completing the mid-term and final examinations. Please note that there are NO late assignment and NO make-up examination. Examination: 1. 2. 3. 4. 5. 6. 7. 8. Please note that you will need to present your Bronco ID at the time of examination. You may be asked to sign the attendance sheet during the exam. Turn-off your cell phones. You will not be permitted to leave the classroom after examinations are distributed. You will have to bring your own scantron and calculator (TI-BA II, HP 12C, or HP 10B). You will be provided with a formula sheet. Each examination is composed of true-false, multiple-choice and short-problem questions. There are special instructions on Common Final Examination (topics, formula sheet, exam schedule), which will be posted on the Blackboard. 9. Check your common final examination schedule. 10. ABSOLUTELY NO MAKE-UP! Course Assistance: Office Information Location: Telephone: Fax: E-Mail: Building 164, #2053 (909) 869 2405 (909) 869 2124 psarmas@cpp.edu Office Hours Monday Wednesday Wednesday Others: 4:30 p.m. – 5:30 p.m. 9:00 a.m. – 11:30 a.m. 1:00 p.m. – 1:30 p.m. By appointment 4 Managerial Finance I – FRL 300 – Winter 2016 CONNECT: McGraw-Hill’s CONNECT is an online homework management system containing questions tied directly to your textbook. We will be using Homework Manager for several assignments in this course. Your CONNECT Access Code can be purchased one of several ways: 1) As part of the package with your new text in the bookstore 2) If you buy a used book, you can purchase access code for Connect online at www.mhhe.com/support. 3) As an alternative, if you need assistance, please contact McGraw-Hill Technical Support by visiting www.mpss.mhhhe.com/ or call: (800) 331-5094. 4) Once access code is purchased, to register for the course go to: Section 01 – 1:30 – 2:45 p.m.: https://connect.mheducation.com/class/p-sarmas-winter-2016---130-245-pm Section 02 – 3:00 – 4:15 p.m.: https://connect.mheducation.com/class/p-sarmas-winter-2016---300-415-pm 5) The homework assignments must be complete and submitted by the due date shown in Connect, in order, to earn credit toward the course grade. 6) Make sure that when your assignment is completed you SUBMIT it for GRADING. 7) Please note, all registration, access, and other technical problems should be resolved by you and McGraw-Hill’s technical support team. 8) Complete assignments by the due date. No Late Assignment. Course Grade: Grades are determined in the following format: Homework Assignment …………… 15 percent Mid-term Examination I…………….25 percent Mid-term Examination II……………25 percent Final Examination…………………...35 percent Score Grade Score Grade Score Grade Score Grade Score Grade 93 90 A A- 86 83 80 B+ B B- 76 73 70 C+ C C- 66 63 60 D+ D D- 0 F Managerial Finance I – FRL 300 – Winter 2016 LECTURE SCHEDULE Monday: January 4, 2016 Student List Check Introduction Chapter 1: Introduction to Corporate Finance Introduction to Study of Finance Financial Management Decisions Forms of Business Organization Wednesday: January 6, 2016 Chapter 1: Introduction to Corporate Finance The Goals of Financial Management The Agency Problem and Control of the Corporation Cash Flows between Firm and Financial Market Financial Market and the Corporation Monday: January 11, 2016 Chapter 2: Financial Statements, Taxes, and Cash Flow Balance Sheet Income Statement Taxes Wednesday: January 13, 2016 Chapter 2: Financial Statements, Taxes, and Cash Flow Cash Flow from Assets Cash Flow to Creditors Cash Flow to Stockholders Homework Assignment: See Connect for Due Date Monday: January 18, 2016 Academic Holiday Wednesday: January 20, 2016 Chapter 5: Introduction to Valuation: The Time Value of Money Future Value and Compounding Present Value and Compounding 5 Managerial Finance I – FRL 300 – Winter 2016 Monday: January 25, 2016 Chapter 5: Introduction to Valuation: The Time Value of Money More on Present Value and Future Value Homework Assignment: See Connect for Due Date Wednesday: January 27, 2016 Chapter 6: Discounted Cash Flow Valuation Future and Present Values of Multiple Cash Flows Valuing Level Cash Flows: Annuities and Perpetuities Monday: February 1, 2016 Midterm Examination I (Chapters 1, 2 and 5) Wednesday: February 3, 2016 Chapter 6: Discounted Cash Flow Valuation Comparing Rates: The Effect of Compounding Loan Types and Loan Amortization Homework Assignment: See Connect for Due Date Monday: February 8, 2016 Chapter 7: Interest Rates and Bond Valuation Bonds and Bond Valuation More on Bond Features Bond Ratings Bond Indenture Wednesday: February 10, 2016 Chapter 7: Interest Rates and Bond Valuation Some Different Types of Bonds Bond Markets and Quotations Monday: February 15, 2016 Chapter 7: Interest Rates and Bond Valuation Inflation and Interest Rates Determinants of Bond Yields Homework Assignment: See Connect for Due Date 6 Managerial Finance I – FRL 300 – Winter 2016 Wednesday: February 17, 2016 Chapter 8: Stock Valuation Common Stock Valuation Some Features of Common and Preferred Stocks Monday: February 22, 2016 Chapter 8: Stock Valuation Estimating Returns Stock Quotations The Stock Markets Homework Assignment: See Connect for Due Date Wednesday: February 24, 2016 Chapter 9: Net Present Value and Other Investment Criteria Conventional vs. Non-Conventional Net Present Value The Payback Rule The Discounted Payback Monday: February 29, 2016 Midterm Examination II (Chapters 6-8) Wednesday: March 2, 2016 Chapter 9: Net Present Value and Other Investment Criteria The Average Accounting Return The Internal Rate of Return The Profitability Index The Practice of Capital Budgeting Homework Assignment: See Connect for Due Date Monday: March 7, 2016 Chapter 3: Working with Financial Statements Statement of Cash Flow Common Size Analysis Ratio Calculation and Analysis Homework Assignment: See Connect for Due Date 7 Managerial Finance I – FRL 300 – Winter 2016 Wednesday: March 9, 2016 Chapter 4: Long-Term Financial Planning and Growth What is Financial Planning? Financial Planning Models Percentage of Sales Approach External Financing and Growth Some Caveats Regarding Financial Planning Model Homework Assignment: See Connect for Due Date Common Final Examination March 12, 2016 Saturday 10:00 a.m. - 12:00 noon Tentative Schedule 8