JESR 2010/2011 Report

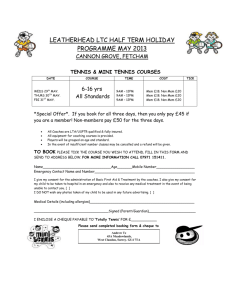

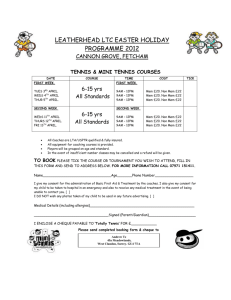

advertisement