03.06.2011

advertisement

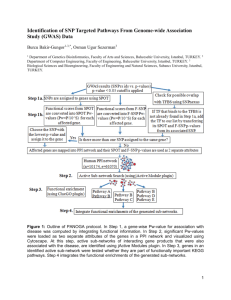

INVESTOR PRESENTATION June 2011 1 Turkish economic outlook 3 Listed REIC's Operational review Financial review Development review Future outlook Appendix (Portfolio review) 2 Turkey both an anchor emerging economy and a CIVETS country >In the developed economies, final demand is unlikely to demonstrate a strong recovery in the near future. The world needs anchor countries growing at a dynamic pace. These countries should have the following characteristics: 1.Young population to support growth and spending 2.Low debt burden to feed credit channels 3.Diversified economy to generate employment opportunities and long term growth 4.Capital accumulation to finance high savings or growth >Turkey meets with the first three out of these four criteria Turkey has a young population: in 2025 what % of the population will be older than 60 ? Source: United Nations 3 Economic Highlights Real GDP Growth Fiscal Balances as % of GDP 8,0 12 10 8 6,0 9,4 8,9 8,4 4,7 2,3 1,3 1,2 2 3,1 5,4 5,0 4,8 4,6 5,2 4,2 3,5 2,9 1,6 1,9 1,8 0,9 0,7 1,7 1,9 1,9 1,9 -2,0 2001 2002 2003 2004 2005 -1,3 -4,0 2006 -0,6 2007 -1,6 2008 2003 2004 2005 2006 2007 2008 2009 2010 2011F 2012F 2013F 2014F 2015F -4 -4,8 -6 Turkey -10,0 -4,2 0,1 2010 -3,6 2011 F -3,3 -5,5 -5,4 -8,0 2009 -1,8 -6,0 2002 0,8 0,1 -8,8 -12,0 -14,0 EU27 -11,9 -12,0 Budget balance Primary balance Source: EIU (May 2011) Source: EIU (May 2011) Interest Rates Consumer Price Inflation Benchmark bond yield Turkey 18,0% 35,0% 30,0% 16,2% 29,7% 16,0% 14,0% 25,0% 12,0% 18,4% 20,0% 10,0% 15,0% 9,3% 10,0% 10,5% 10,5% 8,7% 9,0% 8,0% 10,4% 8,6% 6,3% 5,6% 7,5% 9,0% 7,1% 6,0% 4,0% 5,0% 2,0% 0,0% 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 F 2012 F 0,0% 2008 Turkey Source: EIU (May 2011) 0,1 0,0 0 -2 5,5 2,0 5,3 4 5,8 4,7 4,0 2,8 4,0 6,9 6,2 6 5,1 2009 2010 F 2011 F Benchmark bond yield Source: Deutsche Bank 4 2012 F -2,5 Economic Highlights Consumer loans and mortgage loans (bn TRY) Loan Growth (%) 70 140 61 127,3 143 116,5 60 107,8 120 99,4 100 80 86,4 38,6 37,5 37,0 43,2 40,6 64,2 12 7 10 0 Jan.09 Apr.09 CONSUMER LOANS (BILLION TRY) Jul.09 Oct.09 Jan.10 Apr.10 Jul.10 Oct.10 Jan.11 May.11 2006 2007 MORTGAGE LOANS (BILLION TRY) Consumer Loans 50,0 50 125,72 122,67 40,4 121,66 120 117,17 113,98 2011* Interest Rate on Mortgages(%) 131,41 127,53 130 113,66 2010 Mortgage Rates (%) REAL EFFECTIVE EXCHANGE RATE(CPI BASED) (2003=100) 135 125 2009 Source: Turkish Statistical Institute (annualized as of March 25, 2011) Real Effective Exchange Rate 115 2008 Total Loans Source: Turkish Statistical Institute(January 2011) 110 29 20 20 42 38 23 58,5 53,6 50,1 46,7 34 30 28 30 60 40 42 41 40 83,5 81,4 80,4 50 91,6 119,07 40 27,8 30 115,14 17,7 20 18,2 18,3 18,6 15,6 11,1 105 10 9,7 100 Jan.09 Apr.09 Jul.09 Oct.09 Jan.10 Apr.10 Jul.10 REAL EFFECTIVE EXCHANGE RATE(CPI BASED) (2003=100) Source: Central Bank (May 2011) Oct.10 Jan.11 Apr.11 0 2002 2003 2004 2005 2006 2007 2008 2009 2010 Mar./11 Interest Rate on Mortgages(%) Source: Central Bank (February 2011) 5 Turkish economic outlook 3 Listed REIC's Operational review Financial review Development review Future outlook Appendix (Portfolio review) 6 TRY SATIŞ/SALES VAFÖK/EBITDA NET KAR/NET PROFIT 2010-3 % 2010-3 21,3 1.943.574..780 2011-3 % 2010-3 2011-3 % 2010-3 25.045.000 42.038.000 67,85 15.728.000 21.823.000 38,75 21.007.000 8.771.000 AKFEN 4.241.876 5.812.725 37,03 2.813.123 49.665.231 1665,48 7.807.328 32.540.328 316,79 AKMERKEZ 13.198.717 14.101.743 6,84 8.866.178 9.623.499 8,54 7.723.141 8.673.387 12,30 819.748.386 825.958.170 0,76 821.366.501 804.679.057 -2,03 ALARKO 2.430.444 10.057.787 313,83 593.747 757.122 27,52 263.800 2.401.456 810,33 257.378.000 268.650.571 4,38 255.492.608 265.049.905 3,74 ATAKULE 2.653.149 2.419.562 -8,80 1.316.844 848.856 -35,54 3.179.729 2.915.793 -8,30 190.931.162 211.676.492 10,87 189.930.525 210.198.438 10,67 AVRASYA 138.417.339 48.065.282 -65,28 9.144 -393.774 -4406,36 -144.962 -689.944 375,95 4.304.495 77.248.129 1694,59 3.287.186 30.291.579 821,50 2.353.627 2.889.577 22,77 1.348.044 1.846.111 36,95 1.449.244 2.177.565 50,26 161.248.260 172.996.182 7,29 169.315.368 179.399.106 5,96 21.016 112.961 437,50 21.077 171.927 715,71 20.528 170.773 731,90 38.925.089 40.503.628 4,06 20.603.006 18.977.220 -7,89 214.380.000 171.129.000 -20,17 177.666.000 59.138.000 -66,71 150.417.000 73.234.000 -51,31 -69.835 -1.351 -98,07 -65.165 1.786 -102,74 19,08 9.770 DOĞUŞ EGS EMLAK İDEALİST 396.040 % NET AKTİFLER/NET ASSETS 2010-3 TORUNLAR 2011-3 PORTFÖY DEĞERİ/PORTFOLIO VALUE -58,25 2.655.996.970 2011-3 3.222.121.000 723.897.000 11.550.620 2.541.071.000 % 30,7 589.486.000 7.281.157.575 9.700.000 2011-3 5.655.659.556 22,38 KİLER 28.034.081 53.045.734 89,22 3.797.227 15.976.281 320,74 736.352 11.679.869 1486,18 İŞ 23.546.331 26.836.080 13,97 16.318.467 17.566.804 7,65 10.825.461 9.787.515 -9,59 1.524.282 1.160.708 -23,85 569.771 456.857 -19,82 -171.281 122.265 -171,38 969.694 37.163 -96,17 -67.726 -194.055 186,53 80.706 184.128 128,15 22.269.000 91.881.000 312,60 17.549.000 101.131.000 476,28 -314.482 -414.500 31,80 -334.516 -1.091.984 226,44 128.758.280 191.792.190 48,96 100.364.300 140.608.570 40,10 MARTI NUROL ÖZDERİCİ PERA 243.967 REYSAŞ 4.338.543 3.169.870 -7.063 1.039.906.607 11.957 754.210.121 1.281.939.734 1.491.649.308 16,36 1.241.082.359 185.009.000 202.571.553 9,49 167.253.987 59.600.455 1.198.647 -17070,79 1.392.820.873 12,23 216503164 29,45 59.597.205 289.453.129 324.298.424 SAĞLAM 2.107.160 1.831.702 -13,07 1.364.696 2.828.001 107,23 -106.564 2.290.369 -2249,29 120.119.463 104.444.103 -13,05 71.621.251 75.531.743 5,46 SİNPAŞ 28.305.332 73.532.281 159,78 -7.192.312 12.864.338 -278,86 -4.574.167 11.757.823 -357,05 1.421.219.196 1.669.946.009 17,50 1.098.673.738 1.229.285.416 11,89 TSKB 3.675.478 3.576.199 -2,70 422.784 1.487.503 251,84 2.248.977 -4.368.381 -294,24 279.003.950 309.758.440 11,02 166.381.700 216.565.358 30,16 VAKIF 1.014.496 1.554.630 53,24 641.547 820.693 27,92 1.227.685 780.595 -36,42 101.451.107 114.910.133 13,27 102.171.457 112.197.361 9,81 YEŞİL 753.814 6.299.894 735,74 -514.540 339.328 -165,95 -484.620 85.137 -117,57 16.374.107 456.756.736 2689,51 21.487.812 187.810.342 774,03 3.636.851 3.116.335 -14,31 -989.158 -998.968 0,99 -1.170.589 -1.528.660 30,59 111.578.213 110.339.337 89.237.664 -19,12 YK KORAY TOTAL 496.308.687 472.595.913 -4,78 222.328.596 197.380.773 -11,22 199.928.024 161.093.467 110.875.107 -19,42 7.805.954.412 18.969.304.137 -0,63 143,01 6.500.504.685 15.194.621.059 133,74 7 MCAP & NAV of the REIC Sector NAV ($ mn) REIT's MCAP ($ mn) 31.03.2011 % 31.03.2011 % Emlak Konut 2.361 30,7 4.424 52,2 Torunlar 1.632 21,2 998 11,8 İş 900 11,7 509 6,0 Sinpaş 839 10,9 659 7,8 Akmerkez 520 6,8 701 8,3 Reysaş 209 2,7 134 1,6 Alarko 171 2,2 114 1,3 Martı 140 1,8 80 0,9 TSKB 140 1,8 89 1,1 Atakule 136 1,8 70 0,8 Y&Y 121 1,6 222 2,6 Doğuş 116 1,5 117 1,4 Vakıf 72 0,9 44 0,5 Pera 91 1,2 59 0,7 Özderici 65 0,8 78 0,9 Yapı Kredi Koray 58 0,8 58 0,7 Sağlam 49 0,6 32 0,4 Nurol 38 0,5 32 0,4 Avrasya 20 0,3 24 0,3 EGS 12 0,2 11 0,1 İdealist 8 0,1 16 0,2 TOTAL 7.698 100,0 8.471 100,0 8 Relative post-IPO performance of Torunlar REIC’s share 9 Turkish economic outlook Listed REIC's Operational review Financial review Development review Future outlook Appendix (Portfolio review) 10 Shareholding Structure March 2011 Mahmut KARABIYIK Torun Pazarlama 0% A.Ş. 0,03% Free Float 25% Aziz TORUN 38% Y.Emre TORUN 0,03% Ali COŞKUN 0% Mehmet TORUN 37% 11 Strategy highlights Strategy focus Primary focus on development of shopping malls Increased focus on mixed-use projects Creating ‘life centres’ with extensive leisure and entertainment avenues Focus investments in urban centres with limited supply Development portfolio Successful track record of liaising with local municipalities in contributing to and working on urban transformation projects Leverage the development platform for performing value-adding tasks such as land development, funding and identify potential growth areas of development Opportunistic development of other asset classes Leverage track-record of JV development Access to attractive development opportunities Diversification of risk Developing residential neighbourhoods in cities with good connectivity to metro etc. Opportunistic investments in non shopping mall related projects Asset management Active asset management targeting occupancy optimisation and rent increase Active refurbishment and extensions in-line with increased demand and evolving consumers and market trends Tenant rationalisation opportunities Ensure appropriate shop and tenant mix Leveraging Torunlar Group’s reputation and network of contacts to attract known Turkish/international tenants 12 History of Torunlar REIC–key milestones Construction for the company’s needs and third party use (smallscale residential units) Active in the Turkish Torunlar bought the land to be used for Torun Tower Delivery of Korupark Residences phases I&II Torunlar REIC became a listed company as of October 21st, 2010, emerging as one of the biggest listed Turkish real estate companies construction and real estate market since 1977 Foundation of Toray Construction 1977 Opening of Zafer Plaza; the first shopping mall of Bursa Opening of the biggest mall in Turkey in 1999, Ankamall 1996 Opening of one of the biggest shopping malls in Turkey, Korupark Acquisition of the Netsel Marina in Marmaris 1999 The residential compound at Korupark was Bursa’s first gated community 2004 2005 Opening of the biggest outlet of Antalya, Deepo Outlet Torunlar bought the land for the Mall of Istanbul project, which will be one of Turkey’s largest mixed use projects including a shopping mall, residences, offices and a hotel 2007 Delivery of Nish İstanbul residences and offices 2008 2009 2010 Conversion to Torunlar REIC Opening of Torium Shopping Mall, October 30th, 2010 Torium Shopping Mall is the 3rd largest shopping mall in Istanbul 13 Key investment highlights •2nd largest listed retail property company in Turkey Residenti al 7,90% Shopping malls; 76,30% Office 9,90% Hotel 2,10% Marina 1,10% Others 2,80% • Included in ISE National XU 100, MSCI Turkey, EPRA indices •Portfolio value: TRY3.2 bn (2011/03) •Gross rental income: TRY 42.0 m(2011/03) •Market capitalisation: TRY1,5 bn(31/03/2011) •Listed on 21.10.2010 on Istanbul Stock Exchange •Diversified investment portfolio •5 cities, Istanbul added in October 2010 •Portfolio ‘primarily’retail (76% shopping centres) •Resilient operations: 98% occupancy rate (2011/03) •Financial strength •Healthy financial structure with leverage at 25.4 % •Stable shareholder structure with 25.16 % free float 14 Breakdown of Portfolio Value 2011/03 Money and Capital Market Instruments 16% Land 10% Participations 12% Building 40% Project 22% Land Building Project Participations Money and Capital Market Instruments 15 Shopping Mall Portfolio Zafer Plaza (SM) Occupancy 99% Ankamall+ Crowne Plaza (SM+Hotel) Korupark (SM) Occupancy 97% Occupancy 100% Istanbul Black Sea Region (Karadeniz Bölgesi) Deepo Outlet Centre (SM) Torium Istanbul (SM) Occupancy 100% Occupancy 99% Samsun Bursa Ankara Marmara Region (Marmara Bölgesi) Eastern Analtolia Region (Doğu Anadolu Bölgesi) Kutahya Izmir Central Anatolia Region (Iç Anadolu Bölgesi) Aegean Region (Ege Region) Southeastern Anatolia Region (Güneydoğu Anadolu Bölgesi) Mugla Antalya Key portfolio information Mediterranean Region (Akdeniz Bölgesi) Torunlar REIC’s presence Additional target cities Operational Shopping Malls Pipeline Shopping Malls Total Shopping Malls Number 5 2 7 GLA(m²) 214,697 181,116 395,913 16 Turkey Residential Sales ( in units ) 194.743 200.000 150.000 112.168 108.861 113.088 109.333 116.229 97.517 92.516 100.000 111.913 85.857 90.270 91.071 83.697 50.000 0 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Source: Turkish Statistical Institute 17 TURKEY RESIDENTIAL PRICES 2011 April Index Variance (m-o-m) Variance (Y-o-Y) Turkey Composite 95,4 +0,19% +3,76% Adana 110,6 +0,80% +7,16% Ankara 93,4 +0,46% +4,78% Antalya 82,2 -0,51% -2,61% Bursa 90,5 -0,33% -0,66% İstanbul 95,2 +0,23% +5,19% İzmir 97,6 +0,09% -0,19% Kocaeli 108,3 -0,46% +2,34% Source: Reidin Turkey June: 2007=100 beginning of the index 18 TURKEY SHOPPING MALL SALES TURNOVER AND FOOTFALL SALES TURNOVER INDEX (GENERAL) 140 120 100 100 92 91 93 Feb-10 Mar.10 Apr-10 101 102 101 May.10 Jun-10 Jul-10 108 114 122 113 112 108 103 96 80 60 40 20 0 Jan-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar.11 SALES TURNOVER INDEX (GENERAL) FOOTFALL INDEX (GENERAL) 100 100 93 93 Feb-10 Mar.10 89 93 99 89 92 92 Jun-10 Jul-10 Aug-10 98 101 97 99 97 95 Jan-11 Feb-11 Mar.11 80 60 40 20 0 Jan-10 Apr-10 May.10 Sep-10 Oct-10 Nov-10 Dec-10 FOOTFALL INDEX (GENERAL) Source: Council of Shopping Centers- Turkey *January 2010 beginning of the index 19 Footfall and turnover (March 2011) YoY variance(%) Torunlar REIC Retail spending* Turkey 10.8* 14.8 Footfall* 0 1.7 Occupancy ratio (%) 98 90 *Ankamall and newly opened Torium excluded Source: Council of Shopping Centers Turkey 20 Resilient retail operations through active hands-on management. March 2011 GLA ( m2 ) Bursa Zafer Plaza Bursa Korupark Antalya Deepo Outlet İstanbul Torium (1) 16.968 71.267 18.069 95.280 (1) 2.100.000 11.870.000 3.273.000 11.847.000 0 36.9 18.7 NA 3.8 (4.9) 1.5 NA 125 181 81 180 99 97 100 99 Turnover rent (as % of fixed rent) 2.8 4.2 17.2 13.8 Breakdown of rental revenues 64%USD 36%€ 86%€ 14%USD 82%€ 18%USD 72%USD 28%€ Revenues Revenues % growth % Footfall growth Number of stores Occupancy (%) (1)72,26% share. Receives rental income. 21 Shopping centers by value (TRY 000) 31-03-11 Nr of contracts 143.156 125 540.510 181 138.274 315 180.492 81 549.876 180 1.552.308 882 Bursa Zafer Plaza Bursa Korupark Ankara Ankamall Antalya Deepo Outlet İstanbul Torium TOTAL 22 Turkish economic outlook 3 Listed REIC's Operational review Financial review Development review Future outlook Appendix (Portfolio review) 23 Financial highlights TRY (000) 2010 2009 Sales revenue 232.928 120.158 93.9 Residences sold 160.585 65.380 145.6 Rental revenue 58.584 39.859 47.0 EBITDA 55.377 71.700 -22.8 EBITDA margin 23.8% 59.7% -35.9 4.745 4.536 4.6 Net gains from fair value adjustment 166.660 488.159 -65.8 Net profit 214.245 535.641 -59.4 1.16 TRY 3.04 TRY -68.0 0,0 Dividend income EPS Variance % LfL rental revenue growth 33% Occupancy ratio 98% 98% 2010 2099 Total Assets 3.203.839 2.509.787 27.7 Total Equity 2.369.083 1.805.168 31.2 -344.619 -547.895 37.1 Portfolio value 3.130.000 2.603.000 20.2 Market cap 1.420.160 TRY (000) Net debt Variance % 24 Financial highlights TRY (000) 2011/03 2010/03 Sales revenue 42.038 25.045 67.8 Residences sold 12.869 10.786 19.3 Rental revenue 24.711 12.223 102.1 EBITDA 24.131 17.791 35.6 EBITDA margin 57.4% 71% -19.1 2.308 2.063 11.8 -15.085 6.716 -324.6 8.771 21.007 -58.2 0.04 TRY 0.11 TRY -63.6 98% 98% 0,0 2011/03 2010/12 Total Assets 3.250.496 3.203.839 1.4 Total Equity 2.377.854 2.369.083 0.3 -498.440 -344.599 44.6 Portfolio value 3.222.000 3.130.000 2.9 Market cap 1.532.160 1.420.160 7.8 Dividend income Valuation gain from financial assets and liabilities Net profit EPS LfL rental revenue growth Occupancy ratio TRY (000) Net debt Variance % 27.4% Variance % 25 Maturity of Financial Loans (TRY m) 400 357 350 300 258 250 200 Maturity of debt 150 102 108 63%USD, 35%€, 2%TRY 100 50 0 2011 2012 2013 2014+ *The graph excludes TRY 516.4 m of cash and cash deposits and long-term financial investments as of March 2011. 26 Income statement 1 Rental revenues relate to the 1 2 3 3 (000 TL) Satışlar/Sales Konut/Residence AVM kira/ Mall rental Diğer/Other SMM/Cost of sales Brüt kar/Gross profit Brüt marj/Gross margin Faaliyet giderleri/Opex Diğer gelir(gider)/Other income(expenses) Faaliyet karı /Operating profit İştiraklerden alınan temettü/Share of profit of associates (recurring) VFOK/EBIT VFOK marjı /EBIT margin (%) Amortisman/Depreciation VAFOK/EBITDA VAFOK marjı/EBITDA margin (%) İştiraklerden gelir (gider)/share of profits (non-recurring) Net faiz geliri(gideri)/Net financial interest income(expense) 4 Net diğer finansal gelir (gider)/Other net financial income (expense) Kur farkı geliri (gideri)/Valuation gain from financial assets and liabilities Vergi öncesi kar/Profit before tax Vergi gideri/Corporate tax Net kar/net profit Net kar marjı/Net profit margin (%) 2011/03 42.038 12.869 24.711 4.458 16.571 25.467 60,6 -4.062 337 21.742 2010/03 Fark/Variance % 25.045 67,85 10.786 19,31 12.223 102,17 2.036 118,96 7.713 114,85 17.332 46,94 69,2 -8,62 -1.533 164,97 -98 -443,88 15.701 38,48 2.308 24.050 57,2 81 24.131 57,4 874 2.063 17.764 70,9 27 17.791 71,0 -64 11,88 35,39 -13,72 200,00 35,64 -19,19 -1465,63 -1.952 -3.530 -44,70 1.329 121 998,35 -15.085 9.216 -445 8.771 20,9 6.716 21.007 0 21.007 83,9 -324,61 -56,13 rental income from operating shopping malls. 2 Other revenue consists of electricity sales income, excavation site rent income, construction site rent income and sales of other services and goods. 3 Share of profits of associates are minority stakes in assets held by Torunlar REIC. The latter in counterparty receives dividends from those assets. The split is into ‘dividends from associates’ which are considered as recurring item and the gain in fair value adj. of Investment Properties’ are considered non recurring. 4 Financial income includes gains and loss of financial instruments as well as the sale of share of profits from associates. -58,25 -63,01 Note: Sales are accounted when properties are physically transferred to buyers 1 EBIT includes operating profit and share of profits from associates excluding any effect of fair value changes 2 EBITDA = EBIT + Depreciation expenses ³ Excludes fair value gains/losses from “Investment Properties” and financial instruments 27 Balance sheet (‘000 TL) (000 TL) 1 2 NAKİT VE NAKİT BENZERİ/CASH AND CASH EQUIVALENTS FINANSAL YATIRIMLAR/FINANCIAL INVESTMENTS TİCARİ ALACAKLAR/TRADE RECEIVABLES STOKLAR/INVENTORY 1 DİĞER DÖNEN VARLIKLAR/OTHER CURRENT ASSETS DÖNEN VARLIKLAR/CURRENT ASSETS FİNANSAL YATIRIMLAR/FINANCIAL INVESTMENTS TİCARİ ALACAKLAR/TRADE RECEIVABLES ÖZKAYNAK YÖNTEMİ İLE DEĞ.YAT./INVEST.IN ASSOCIATES YATIRIM AMAÇLI GAYRIMENKULLER/INVESTMENT PROPERTY MADDİ DURAN VARLIKLAR/TANGIBLE FIXED PROPERTY MADDİ OLMAYAN DURAN VARLIKLAR/INTANGIBLE FIXED ASSETS DİĞER DURAN VARLIKLAR/OTHER NON-CURRENT ASSETS DURAN VARLIKLAR/NON-CURRENT ASSETS TOPLAM VARLIKLAR/TOTAL ASSETS FİNANSAL BORÇLAR/FINANCIAL LIABILITIES FİNANSAL KİRALAMA BORÇLARI/FINANCE LEASE LIABILITIES DİĞER FİNANSAL YÜKÜMLÜLÜKLER/OTHER FINANCIAL LIABILITIES TİCARİ BORÇLAR/TRADE PAYABLES DÖNEM KARI VERGİ YÜKÜMLÜLÜĞÜ/TAX PAYABLES DİĞER YÜKÜMLÜLÜKLER/OTHER CURRENT LIABILITIES KISA VADELİ YÜKÜMLÜLÜKLER/CURRENT LIABILITIES FİNANSAL BORÇLAR/FINANCIAL LIABILITIES ÇALIŞANLARA SAĞLANAN FAYDALARA İLİŞKİN KARŞILIKLAR/PROVISION FOR EMPLOYMENT TERMINATION BENEFITS DİĞER YÜKÜMLÜLÜKLER/OTHER NON-CURRENT LIABILITIES UZUN VADELİ YÜKÜMLÜLÜKLER/NON-CURRENT LIABILITIES ÖDENMİŞ SERMAYE/SHARE CAPITAL HİSSE SENEDİ İHRAÇ PRİMLERİ/SHARE PREMIUM KARDAN AYRILMIŞ KISITLANMIŞ YEDEKLER/RESTRICTED RESERVES GEÇMİŞ YIL KARLARI/RETAINED EARNINGS NET DÖNEM KARI/NET PROFIT ÖZKAYNAKLAR/ TOTAL EQUITY TOPLAM KAYNAKLAR/TOTAL LIABILITIES AND EQUITY 2011/03 2010/12 Fark/Variance % 93.446 235.694 25.572 47.947 33.713 436.372 187.300 4.565 126.332 2.416.077 1.932 73 77.845 2.814.124 3.250.496 438.664 0 49.706 51.769 39.642 579.781 29.459 4.729 125.458 2.388.865 1.115 82 74.350 2.624.058 3.203.839 258.814 12 2.544 29.471 445 10.561 301.847 568.766 231.141 20 3.877 34.536 0 12.970 282.544 552.122 90 1.939 570.795 224.000 301.770 3.741 1.839.572 8.771 2.377.854 3.250.496 90 0 552.212 224.000 301.770 3.127 1.625.941 214.245 2.369.083 3.203.839 , , , , -78,70 -48,55 -7,38 -14,96 -24,74 535,80 -3,47 0,70 1,14 73,27 -10,98 4,70 7,24 1,46 11,97 -40,00 -34,38 -14,67 1 Inventories consist of construction cost of housing units (completed and in progress) as well as the cost of land used for these residential projects. In addition lands for future development of residential projects are also included in this line-item Investment properties are properties 2 held for long-term rental yields and/or for capital appreciation. This also includes landbank on which asset to be held for long term usage is planned. -18,57 6,83 3,01 0,00 3,37 0,00 0,00 19,64 13,14 -95,91 0,37 1,46 28 Financing ratios ‘Strong financing ratios’ 31-03-11 31-12-10 Leverage ( financial loans as% of total assets) 25.4 24.4 Average interest (year) (%) 5.10 5.22 5 5 Interest coverage ratio (times) (EBITDA/net interest expense) 12.3 2.6 Net debt/Assets (%) 15.3 10.7 Net debt/EBITDA (times) 5.1 6.2 Average maturity (year) 29 Turkish economic outlook 3 Listed REIC's Operational review Financial review Development review Future outlook Appendix (Portfolio review) 30 Evolution of the Projects (m2) GLA+GSA (m2) 2010 2011 2012 2013 2014 Retail 214.697 214.697 246.943 381.943 395.813 Residence 31.081 31.081 31.081 249.906 305.884 Office 2.964 2.964 3.345 78.105 131.876 Hotel 2.907 2.907 2.907 2.907 2.907 Marina 2.984 2.984 2.984 2.984 2.984 Other 15.599 15.599 15.599 18.014 18.014 270.232 270.232 302.859 733.859 857.478 56.893 56.893 56.893 56.893 56.893 Total Land 31 GLA Breakdown by City 2010 2014 MUĞLA 1% SAMSUN 1% MUĞLA 0% ISTANBUL 40% BURSA 22% ANTALYA 5% BURSA 46% ANKARA 2% ISTANBUL 70% ANKARA 6% BURSA ANTALYA ANTALYA 7% ANKARA ISTANBUL MUĞLA BURSA ANTALYA ANKARA ISTANBUL MUĞLA SAMSUN İstanbul grasps a larger share by 2014, overtaking Bursa. 32 Turkish economic outlook 3 Listed REIC's Operational review Financial review Development review Future outlook Appendix (Portfolio review) 33 Future Outlook The company will capitalise on its expertise to further extract operational efficiency from its shopping malls under its management. All the projects in the pipeline will start this year and be completed by 2013-2014. Total sales in 2011 are expected to reach TRY 150 million with 40% derived from residential sales. No new opening or delivery will take place in 2011. The major part of sales revenue will come from shopping malls including Torium which will operate full year. As EBITDA of shopping malls is at around 80%, company EBITDA is expected to be higher than in 2010 at TRY 90 million. For the upcoming years, 10% annual LFL growth is forecast in rental revenues. The company will chase further acquisition opportunities with its favorable position. cash 34 Turkish economic outlook 3 Listed REIC's Operational review Financial review Development review Future outlook Appendix (Portfolio review) 35 36 Zafer Plaza Shopping Mall Ownership Torunlar REIC (72.26%) Operational date 1999 Leasable are (m²) 23,449 (REIC share 16,944) Occupancy (m²) (as of date) 98% (as of March 2011) Number of stores 125 Anchor tenants 4% anchors (30% of GLA): Migros, YKM, Bimeks and Boyner Appraisal value TL143.2mm (US$92.6mm)¹ Average lease term as of Mar-2011 Average LTM NOI (per TL/m²/month) Leasehold / Freehold status 1.8 years TL42.6 Freehold Rental income (Mar 2011), last 12 months TL11.6mm •The Property is located at the most central part of the city •Close to the metro station, on major public transportation routes and at the junction of intercity roads •The property includes a movie theater with six screens and an amusement park for children and teenagers •In 2000, Zafer Plaza was selected "The Best Shopping Centre" by the AMPD, Trade Council of Shopping Centres and Retailers •Majority of rents (64%) are USD denominated Breakdown–tenants (GLA) Breakdown–income Kiosk 0.5% Leisure goods 1% Leisure goods 1% Restaurant 2% Kiosk 3% Jewellery 5% Health beauty 5% Home 5% Footwear 5% Service 7% Food café 8% Restaurant 2% Jewellery 3% Fashion 43% Fashion 37% Footwear 3% Home 5% Service 5% Food café 6% Health beauty 7% Dept & Anchor 15% Dept & Anchor 33% 37 Korupark shopping mall Ownership Torunlar REIC (100%) Operational date H2 2007 Leasable are (m²) 71,267 Occupancy (m²) (as of date) Number of stores 97% (as of March 2011) 181 Anchor tenants (39% of GLA): Tesco, Koçtaş, Beymen, C&A, Boyner and Electro World Appraisal value TL540.5mm (US$349.6mm)¹ Average lease term as of Mar-2011 Average LTM NOI (per TL/m²/month) Leasehold / Freehold status Rental income (March 2011), last 12 months 2.4 years TL36.4 Freehold TL36.8mm Korupark is the largest shopping mall in Bursa and is located on the Mudanya Highway in the Nilüfer neighbourhood The property has three retail floors and two carpark floors with a capacity for 2,500 cars underground and 500 above ground The property includes a hypermarket (12,000m²), a do-it-yourself store (5,127m²), cinema complex (nine screens) and entertainment area (amusement park, children play centre) totalling 5,317m² Most of the rents (86%) at the shopping mall are Euro denominated Breakdown–tenants (Income) Storages 1% Kiosk 2% Leisure goods 4% Restaurant 4% Health beauty 4% Jewellery 4% Home 5% Footwear 7% Service 7% Food 8% Breakdown–tenants (GLA) Kiosk 0.5% Fashion 41% Dept & Anchor 44% Jewellery 1% Storages 2% Restaurant 2% Health beauty 2% Dept & Anchor 14% Food 3% Home 3% Footwear 4% Service 4% Leisure goods 9% Fashion 26% 38 Korupark Residences Phase I & II Ownership Torunlar REIC (100%) Start of construction May, 2006 Phase 1: January 2008/Phase 2: December 2008 Date of completion Operational date February 2008 Total investment TL107.3mm (US$74mm) Units sold (%) Appraisal value (remaining units)¹ Leasehold / Freehold status 87% (as of March 2011) TL50.1mm (US$32.4mm)¹,² Freehold •Located on the western side of Bursa (adjacent to Korupark Shopping Mall), the property is a residential settlement of luxurious units with sports and recreation facilities •The project is the first gated community in Bursa •Phase I: 343 units, six blocks •Phase II: 403 units, seven blocks •For Korupark residences I/II, sales are Turkish Lira denominated 39 Korupark Residences Phase III Ownership Estimated start of construction 2011 Estimated date of completion 2012 Estimated operational date 2012-2013 Estimated investment TL87.3mm (US$56.5mm) Appraisal value TL50.4mm (US$32.6mm)¹ Leasehold / Freehold status •The property, adjacent parcel to Korupark phase I & II, is a luxurious housing settlement that includes residences and office units Torunlar REIC (100%) Number of residential units/GSA Current status Freehold 680 units / 102.000 m2 residence Under construction •For Korupark Residences Phase III, sales will be denominated in Turkish Lira Map of Korupark Korupark Residences Phase I & II Korupark Residences Phase III Korupark Residences Phase I & II Korupark Residences Phase III Korupark Shopping Mall •Note: Exchange rate US$/TL=1.5460 as of December 31, 2010 ¹ Prime appraisal report (based on the CMB standards as of December 31, 2010) 40 Antalya Deepo outlet mall–Antalya Breakdown–income Breakdown–tenants (GLA) Antalya Deepo is the biggest outlet in the Mediterranean region. The property is located close to the Antalya Airport Leisure goods 1% ATM & Kiosks 1% The mall attracts annual foot traffic of c.5 mm Heath Beauty 1% Heath Beauty 1% ATM & Kiosks 2% Leisure goods 1% For Antalya Deepo, majority of rents (82%) are denominated in EURO Zoning of this region is expected to be approved in 2011. Deepo Antalya is not directly held by Torunlar REIC, but is instead held by a subsidiary which is 100% owned by Torunlar REIC Ownership Torunlar REIC (100%) Operational date October 24, 2004 Leasable area (m²) Occupancy (%) (as of date) Number of stores 18,069 Jewellery 2% Fashion 62% Service 3% Service 2% Home 3% Home 3% Source: Company as of Dec 31, 2010 Food 4% Restaurants 6% Food 8% Fashion 70% Restaurants 5% Footwear & Access. 10% Footwear & Access. 11% Antalya Deepo extension project Ownership Torunlar REIC + Hastalya 100% (as of March 2011) Estimated start of construction July 2011 81 Estimated date of completion March 2012 Estimated operational date March 2012 Anchor tenants LCW, Ayakkabı Dünyası, Mudo City, Collezione, Sarar, Aydınlı Group Appraisal value TL180.5mm (US$116.7mm)¹ Average lease term as of March 2011 Average LTM NOI (per TL/m²/month) Leasehold / Freehold status Rental income (Mar 2011), last 12 months Jewellery 3% Leasable area (m²) 26,651 2.8 years TL49.8 Freehold TL13.7mm Estimated investment TL31.2mm (US$20.2mm) Leasehold / Freehold status Partially freehold, partially leasehold from Hastalya Current status Under zoning process 41 Ankamall shopping mall + Crowne Plaza hotel–Ankara Yeni Gimat in which Torunlar REIC holds (14.83%) Ownership Operational date 1999¹ Leasable area (m²) 88,421³ (REIC’s share 13,112) Occupancy (%) (as of date) 100% (as of December 2010) Number of stores 318 Number of rooms 263 Migros, Koçtaş, Tepe Home, Electro World, Boyner, Mudo City, Marks&Spencer, LCW Anchor tenants •Ankamall is located in Yenimahalle, in the centre of Ankara. The shopping mall is considered to be the largest in Ankara and third largest in Turkey •Ankamall is owned by Yeni Gimat which was formed as a cooperative with over 1000 investors, and in which Torunlar REIC currently has 14.83% stake, making it the largest shareholder as of December 31, 2010 •The property includes the Crowne Plaza Hotel which is a 21–storey building with 263 rooms •For Ankamall, the rents in Phase 1 are denominated in Turkish Lira, while the rents in Phase 2 are denominated Appraisal value (REIC share) TL137.9m (US$89.2mm)³ Leasehold / Freehold status Freehold Dividends - Torunlar REIC share (TLmm)² 1.9 2.1 2.4 2.7 2007 2008 2009 2010 in USD 42 Mall of Istanbul–Istanbul Ownership Torunlar REIC (100%) Estimated start of construction H1 2011 Estimated date of completion H2 2013 Estimated operational date H1 2013 Estimated investment c.TL500.0mm (US$323mm) Number of residences/ GSA-GLA 135.000 m2 GLA mall, 116.000 m2 GSA residence 30.000 m2 GLA office Appraisal value TL637.1mm (US$411.5mm)¹ Leasehold / Freehold status •Mall of Istanbul is a mixed-use project with a large shopping mall development along with residential, office units •It is expected to be one of the largest mixed-use projects in Turkey •Planned to be built with 135.000 m² GLA enriched with 16,000 m² kids entertainment, 7,200 m² snowpark, cinema complex and conference / performance hall¹ •Mall of Istanbul is well connected to the city centre through the D100 and TEM highway. In addition, the site is located within 5km of the airport •For the Mall of İstanbul, rents will be denominated in USD. Sales will be denominated in Turkish Lira •Presales commenced on 23.04.2011 and 396 units were presold until 10.05.2011. •On 31.05.2011, the company signed USD 250 million loan agreement with Is Bank of Turkey for a term of 10 years with 3 years grace period. Freehold Current status Under construction Breakdown–Area¹ (GLA/GSA) Office 11% Retail Retail 48% Residential Office Residential 41% 43 Torium Istanbul shopping mall–Istanbul Ownership Torunlar REIC Start of construction H2 2008 Date of completion October 30th, 2010 Operational date October 30th, 2010 Number of stores 180 Appraisal value* TL549.8mm (US$355.1mm)¹ Leasehold / Freehold status Freehold 95.280 m2 GLA retail 5.318 m2 GSA resi GLA / GSA Rental income 2011 F •Torium is a mixed-use project of retail and residential use •It is located at the centre of high density residential settlements along one of the two major highways of Istanbul •The shopping mall provides a broad range of leisure and entertainment facilities •Majority of rents (72%) at the shopping mall are denominated in USD •Residential sales are expected to be denominated in Turkish Lira TL 35 mm GLA/GSA split¹ (‘000m²) GLA split¹ (‘000m²) Residential 5% MSU & small stores 35% Café/ Rest. 5% Anchor 25% Others 4% Hypermarket 10% Entertainment 15% Retail 95% Electronic stores 4% 44 Boulevard Samsun Shopping Mall Ownership share 40% Leasehold / Freehold status Leasehold Current Status Under construction Area breakdown •The property is located on the site of an ex-tobacco factory building at the city Completion date Land : 17.400 m2 Total Construction Area : 37.500 m2 Gross Leasable Area Mall : 14.700 m2 Office : 1.200 m2 Construction permit : Sept. 2010 Start of construction : Nov. 2010 End of construction : Q1 2012 center of Samsun on the Black Sea region in Northern Turkey. •The land is leased for 30 years from Samsun Metropolitan Municipality. ) Capex TRY 10.2mm(US$6.6mm Appraisal vale TRY 16.1mm(US$10.4mm) •The project is a mixed-use project developed in conjunction with the shopping mall developer Turkmall. •Leases will be denominated in €. •60% of the retail area has already been leased as of May 2011. 45 Torun Tower–Istanbul Ownership Torunlar REIC (100%) Estimated start of construction 2011 Estimated date of completion 2013 Estimated operational date 2013 Estimated investment c.TL128.3mm (US$83mm) Appraisal value GLA TL237.7mm (US$153.8mm)¹ Leasehold / Freehold status Freehold Current Status Office: 44760m2 Under project development Breakdown–Area (GLA) Other 4% •The property is located at the city centre in one of the most expensive commercial districts of Istanbul •It also has a subway connection •40 floor high-rise tower is planned •The building is planned to be a landmark for the city with very modern architecture and construction technology •The Property is planned as a mixed-use project with office and retail units and will be leased. •For Torun Tower, leases will be denominated in USD GLA Office 96% Office: 44.760m2 Other: 2.415m2 46 NishIstanbul mixed use project–Istanbul Ownership Start of construction Date of completion Operational date Number of residences / Sellable area (m²) Number of offices / Sellable area (m²) Number of retail units / Leasable area (m²) Appraisal value Leasehold / Freehold status Torunlar REIC (60%) H2 2008 November 2010 August 2010 585 / 53,204 63 / 16,925 52 / 10,937 TL32.5mm (US$22.4mm)³ Freehold •Located on the west-side of Istanbul in Yenibosna, 1.5 km away from Istanbul Atatürk Airport •Three residential blocks, one office block and retail units •As of March 2011, 58 offices and 574 residences were delivered. Remaining 34 retail units will be leased •For NishIstanbul, sales are denominated in Turkish Lira 47 Mecidiyeköy mixed-use project–Istanbul Location Istanbul Ownership Torunlar REIC (65%), Ascioglu (30%), Kapıcıoğlu (5%) Estimated start of construction H2 2011 Estimated date of completion H2 2014 Estimated operational date H2 2014 Estimated investment c.TL463.8mm (US$300mm) * Land acquired Land area (m²) 34.640 Sellable area (m²)1 GSA 55.978 m2 resi, 53.771 m2 office GSA 13.870 m2 retail Format PORTFOLIO OVERVIEW Revenue Share (45%) Mixed–use project Name of architect Emre Arolat Architects Number of residences 593 Appraisal value TL505.4mm (US$326.9mm)¹* Leasehold / Freehold status Revenue Share Current status Under project development Mecidiyeköy is a mixed-use project with unit residential complex, along with office and retail units. Its’ location is in the city center, on the land where the ex-stadium of Galatasaray is located. The project is planned on three high-rise blocks of 40 storey's each. Two of the blocks will be used as residential, one block will be developed as A- Class Office Tower. All of them will be sold. For the Mecidiyeköy Project sales will be denominated in Turkish Lira. 1. Torunlar’s share 48 Shopping Mall Development End 2009 Q1 2010 End 2010 Q1 2011 81 81 92 96 2,28 M 2,28 M 2,65 M 2,85 M 155 157 171 174 3,41 M 3,50 M 3,87 M 3,93 M 236 238 263 270 5,69 M 5,78 M 6,52 M 6,78 M Unit İstanbul GLA (sq m) Unit Rest of Turkey GLA (sq m) Unit Turkey GLA (sq m) Source: Jones Lang LaSalle Unit İstanbul GLA (sq m) Unit Rest of Turkey GLA (sq m) Unit Turkey GLA (sq m) Active Under Construction* Total 96 28 124 2,85 M 1,02 M 3,87 M 174 46 220 3,93 M 1,27 M 5,20 M 270 74 344 6,78 M 2,29 M 9,07 M *As of end 2013 Source: Jones Lang LaSalle 49 Retail Density-GLA per 1,000 Capita, Turkey City End 2010 Q1 2011 End 2013 İstanbul 200 sq m 215 sq m 280 sq m Ankara 202 sq m 202 sq m 239 sq m Denizli 118 sq m 154 sq m 166 sq m Bursa 130 sq m 130 sq m 135 sq m Tekirdağ 139 sq m 139 sq m 132 sq m İzmir 112 sq m 118 sq m 130 sq m Eskişehir 116 sq m 116 sq m 111 sq m Adana 59 sq m 59 sq m 86 sq m Turkey 88 sq m 92 sq m 118 sq m Source: Jones Lang LaSalle 50 Shopping Mall Development Prime Rent (EUR / sq m / month) Prime Yield Trend 95 € % 90 € % 9,0 8,5 8,0 85 € % 80 € % 7,5 75 € % 7,0 % 6,5 % 6,0 65 € Q1 2008 Q3 2008 Q1 2009 Source: Jones Lang LaSalle Q3 2009 Q1 2010 Q3 2010 Q1 2011 En d En 200 d 6 En 200 d 7 20 Q 08 1 2 Q 009 2 2 Q 009 3 2 Q 009 4 2 Q 009 1 2 Q 010 2 20 Q 10 3 2 Q 010 4 2 Q 010 1 20 11 70 € Source: Jones Lang LaSalle Prime Yield Trend 51 Office Market Overview Total Take up Volume ( sq m) 80,000 68,000 70,000 60,000 54,000 50,000 38,000 40,000 32,000 30,000 24,000 20,000 14,000 10,000 6,000 11,000 14,000 0,000 2009 2009 2009 2009 2010 2010 2010 2010 2011 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 52 Office Market Overview Existing Grade A Office Stock Europe Pipeline Projects Grade A Office Stock* Sub Market GLA (sq m) CBD 1,1 million Non CBD 0,73 million Sub Market Europe GLA (sq m) CBD 207,000 Non CBD 185,000 Asia 0,80 million Asia 229,000 Total 2,6 million Total 621,000 Source: Jones Lang LaSalle *For completion by end 2013 Source: Jones Lang LaSalle 53 Office Market Overview Prime Rent (EUR / sq m/ month) 45 40 Prime Yield Trend (%) % 8,2 % 8,0 % 7,8 % 7,6 % 7,4 % 7,2 % 7,0 % 6,8 35 30 25 20 15 10 5 Prime Rent ( € / sq m / month ) Source: Jones Lang LaSalle Q1 2 Q2 008 2 Q3 008 2 Q4 008 2 Q1 008 2 Q2 009 2 Q3 009 2 Q4 009 2 Q1 009 2 Q2 010 2 Q3 010 2 Q4 010 2 Q1 010 20 11 Q2 Q1 20 08 20 Q3 08 20 Q4 08 20 Q1 08 20 Q2 09 20 Q3 09 20 Q4 09 20 Q1 09 20 Q2 10 20 Q3 10 20 Q4 10 20 Q1 10 20 11 0 Prime Yield Trend(%) Source: Jones Lang LaSalle 54 Existing property performance Munich once again holds the top spot for performance of existing investments, Istanbul following very close. London and Paris also retain top positions. 2010 was a year of stabilisation, both in terms of valuation and the occupier side. A clear focus on asset management to maintain the value of existing assets. Secondary property is a “ ticking time bomb”. 55 New property acquisitions The answer is stock selection, not markets or cities. All markets have opportunities at the right price. Istanbul ranked top spot. “The biggest challenge is to find “good” new investments, i.e. core assets in top locations with strong tenants ” 56 City Development Further signs of recovery in sentiment Istanbul, with strong underlying fundamentals, again, stands out followed by London and Munich 57 Torunlar REIC: COMPETITIVE ADVANTAGES 1 One of the leading real estate developers in Turkey 2 Well established performance track record of development and asset management 3 Excellent growth potential 4 Professional management team with long-term local experience and deal sourcing capability 5 Turkey has strong long term economic fundamentals supporting RE growth 6 Stable financial structure and flexible tax efficient REIC regime 58