ACC 630-01 - UNC Greensboro

advertisement

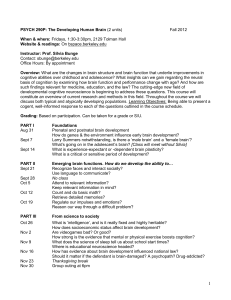

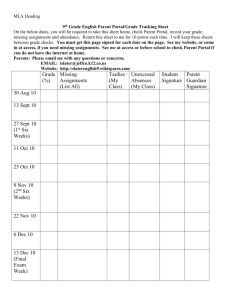

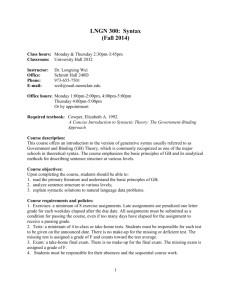

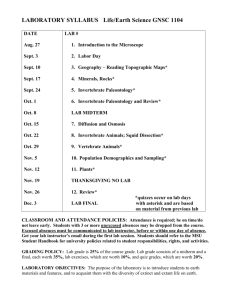

University of North Carolina at Greensboro Bryan School of Business and Economics Department of Accounting and Finance ACC 630: Seminar in Contemporary Accounting Issues Spring 2010 INSTRUCTOR: Dr. Linda Hughen OFFICE: 336 Bryan PHONE: 334-5603 E-MAIL: lmkolbas@uncg.edu OFFICE HOURS: Mondays and Wednesdays 11:30-12:30pm and by appointment Course Description: This seminar is designed to allow students to critically examine and discuss issues affecting the current financial reporting environment. Students are expected to read and analyze the assigned articles and develop ideas and opinions which will provide the basis for class discussions. Course Objectives: Understand why financial reporting is necessary and how the various users of accounting information affect the reporting environment. Learn how several accounting standards have changed over time and the economic implications of those changes. Critically analyze and discuss current issues affecting accounting practice. Propose solutions and formulate opinions to the issues being discussed. Effectively communicate ideas and opinions based on a thorough analysis. Course Resources: There is no required textbook for this course but I recommend that you have access to a recent Intermediate Accounting textbook. Assigned readings, discussion questions, and writing assignments are posted in Blackboard. Class Participation: Because this class is a seminar and not a lecture, you are expected to actively participate during class. The assigned readings, discussion questions and writing assignments will prepare you for class. I will not collect written responses to the assigned discussion questions but instead will call on students to discuss their responses. Additional questions may be presented in class based on the assigned readings and our class discussion. To receive full credit for class participation, responses should be based on sound reasoning and appropriate analysis. Writing Assignments: Ten writing assignments will be collected throughout the semester. Students are expected to turn in hard copies of the assignment at the beginning of class. Assignments turned in after 3:30pm on the due date will be penalized by one letter grade. The writing assignment may be one or two pages long but more important than the number of pages is that the question is answered sufficiently and concisely. 1 Quizzes: Three in-class quizzes will be given during the semester. Quizzes will be given during the first 10-20 minutes of class on the days noted below and will consist of one or more short-answer questions based on the assigned reading for that day. You must notify me in advance if you know that you will not be able to attend class on a day that a quiz will be given. Failure to notify me in advance will result in a quiz grade of zero. Exams: All exams, including the final, will be in-class and will consist of short-answer and/or essay questions. Laptops and notes are not allowed. You must notify me in advance if you know that you will not be able to attend class on a day that an exam will be given and arrangements for a make-up exam will be made. Grades will be determined as follows: Three exams (15% each): 45% Ten writing assignments (2% each): 20% Class participation: 20% Three quizzes (5% each): 15% Additional Information: Students are expected to abide by the UNCG’s Academic Integrity Policy and the Student Code of Conduct. Student Conduct: http://studentconduct.uncg.edu/policy/code/ Academic Integrity Policy: http://academicintegrity.uncg.edu/violation/ Student Disabilities: http://ods.dept.uncg.edu/services/ Any request for special accommodations must come through the Office of Disability Services with the appropriate paperwork. 2 SCHEDULE OF CLASS TOPICS (Items shown in bold are available in Blackboard) DATE TOPIC ASSIGNMENT Aug. 23 Standard Setting and Regulation Read pages 41-71 of the SEC Work Plan Answer Discussion Questions for Aug. 25 Aug. 25 IFRS and Convergence Read pages 27-40 of the SEC Work Plan (be prepared to discuss the reading on Aug. 30) Writing Assignment 1 Aug. 30 IFRS and Convergence None Sept. 1 IFRS and Convergence Writing Assignment 2 No class September 6 – LABOR DAY Sept. 8 IFRS and Convergence Read selected pages from the Comprehensive Income Project Answer Discussion Questions for Sept. 13 Sept. 13 Quiz 1 Comprehensive Income Project Read selected pages from the Project on Financial Statement Presentation Writing Assignment 3 Sept. 15 Financial Statement Presentation Project Read selected comment letters Answer Discussion Questions for Sept. 20 Sept. 20 Financial Statement Presentation Project None Sept. 22 Exam 1 Writing Assignment 4 3 DATE TOPIC ASSIGNMENT Sept. 27 Accounting for Financial Instruments Read ISDA News Release Answer Discussion Questions for Sept. 29 Sept. 29 Accounting for Derivatives Writing Assignment 5 Oct. 4 Accounting for Derivatives Read Efficient Market Theory: Its Impact on Accounting Answer Discussion Questions for Oct. 6 Oct. 6 Quiz 2 Fair Value Accounting Read pages 826-831 of The Crisis of Fair Value Accounting: Making Sense of the Recent Debate Be prepared to discuss the costs and benefits of FVA noted in the article No class October 11- FALL BREAK Oct. 13 Fair Value Accounting Read pages 1605-1618 of Accounting in and for the Subprime Crisis Answer Discussion Questions for Oct. 18 Oct. 18 Accounting and the Subprime Crisis Read pages 1618-1632 of Accounting in and for the Subprime Crisis Writing Assignment 6 Oct. 20 Accounting and the Subprime Crisis Read selected pages of the Financial Instruments Project Answer Discussion Questions for Oct. 25 Oct. 25 FASB’s Financial Instruments Project Writing Assignment 7 Oct. 27 FASB’s Financial Instruments Project None 4 DATE TOPIC ASSIGNMENT Nov. 1 Exam 2 Answer Discussion Questions for Nov. 3 Nov. 3 Accounting for Pensions Writing Assignment 8 Nov. 8 Accounting for Pensions Read selected pages of the IASB Proposal on Pension Accounting Answer Discussion Questions for Nov. 10 Nov. 10 Quiz 3 IASB Project on Pension Accounting Read selected articles on pension accounting Writing Assignment 9 Nov. 15 Accounting for Pensions Review and be prepared to discuss accounting standards related to Leases Answer Discussion Questions for Nov. 17 Nov. 17 Accounting for Leases Read selected pages of the Lease Accounting Project Writing Assignment 10 Nov. 22 FASB’s Project on Leases Review and be prepared to discuss accounting standards related to Revenue Recognition Answer Discussion Questions for Nov. 29 No class Nov. 24 – THANKSGIVING BREAK Nov. 29 Revenue Recognition Read selected pages of the Revenue Recognition Project Answer Discussion Questions for Dec. 1 Dec. 1 FASB’s Revenue Recognition Project None Dec. 6 Final Exam 5