st. paul's university

advertisement

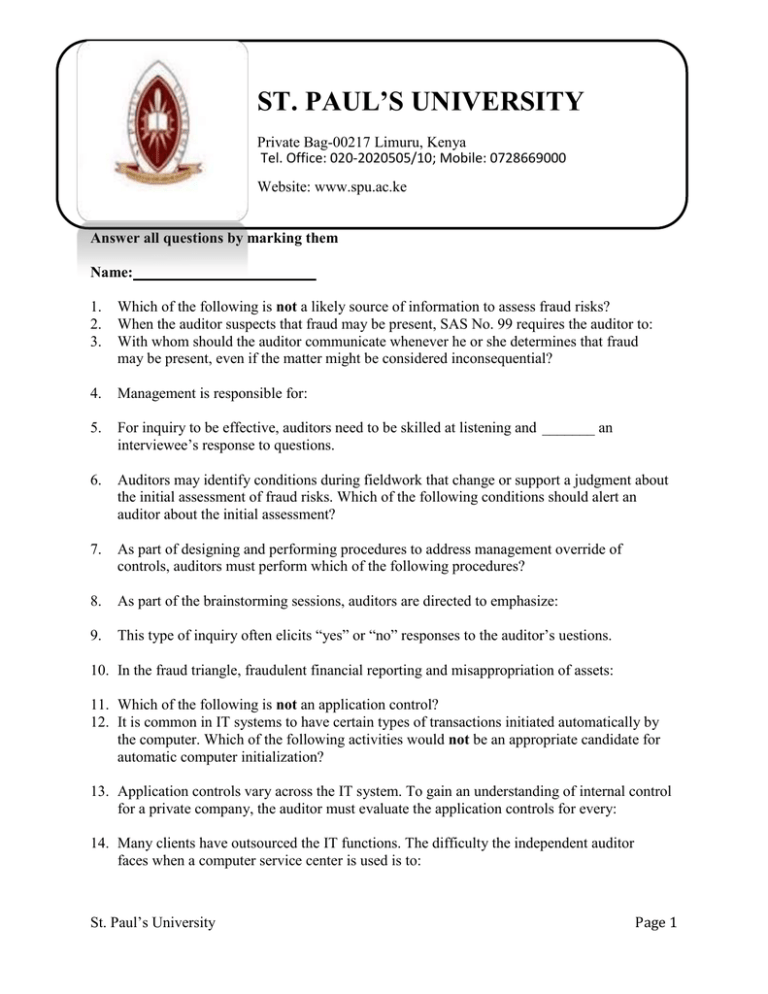

ST. PAUL’S UNIVERSITY Private Bag-00217 Limuru, Kenya Tel. Office: 020-2020505/10; Mobile: 0728669000 Website: www.spu.ac.ke Answer all questions by marking them Name: 1. 2. 3. Which of the following is not a likely source of information to assess fraud risks? When the auditor suspects that fraud may be present, SAS No. 99 requires the auditor to: With whom should the auditor communicate whenever he or she determines that fraud may be present, even if the matter might be considered inconsequential? 4. Management is responsible for: 5. For inquiry to be effective, auditors need to be skilled at listening and _______ an interviewee’s response to questions. 6. Auditors may identify conditions during fieldwork that change or support a judgment about the initial assessment of fraud risks. Which of the following conditions should alert an auditor about the initial assessment? 7. As part of designing and performing procedures to address management override of controls, auditors must perform which of the following procedures? 8. As part of the brainstorming sessions, auditors are directed to emphasize: 9. This type of inquiry often elicits “yes” or “no” responses to the auditor’s uestions. 10. In the fraud triangle, fraudulent financial reporting and misappropriation of assets: 11. Which of the following is not an application control? 12. It is common in IT systems to have certain types of transactions initiated automatically by the computer. Which of the following activities would not be an appropriate candidate for automatic computer initialization? 13. Application controls vary across the IT system. To gain an understanding of internal control for a private company, the auditor must evaluate the application controls for every: 14. Many clients have outsourced the IT functions. The difficulty the independent auditor faces when a computer service center is used is to: St. Paul’s University Page 1 15. An auditor who is testing IT controls in a payroll system would most likely use test data that contain conditions such as: 16. Which of the following is not a general control? 17. The most important output control is: 18. ______ link equipment in large geographic regions. 19. When using the test data approach: 20. What tools do companies use to limit access to sensitive company data? 21. Collectively, procedures performed to obtain an understanding of the entity and its environment, including internal controls, represent the auditor’s: 22. Which of the following procedures are frequently performed in response to the auditor’s assessment of the risk of material misstatement? 23. The purpose of tests of controls is to provide reasonable assurance that the: 24. The most important consideration in developing the audit plan and audit program is the: 25. When the auditor finds that there are missing controls in an area of the accounting system, the audit program in that area would be modified in such a way as to: 26. A procedure designed to test for monetary misstatements directly affecting the correctness of financial statement balances is a: 27. The primary emphasis in most tests of details of balances is on the: 28. Which of the following audit tests is usually the least costly to perform? 29. Auditors who test manual controls that rely on IT-generated reports must consider: 30. Which of the following types of evidence is not available when using substantive tests of transactions? 31. Which of the following is not one of the five classes of transactions included in the sales and collection cycle? 32. What event initiates a transaction in the sales and collection cycle? 33. What critical event must take place before goods can be shipped? St. Paul’s University Page 2 34. Which of the following is not a business function within the “Sales” class of transactions? 35. The process which postpones entries for the collection of receivables to conceal an existing cash shortage is referred to as: 36. When sales invoices are automatically calculated and posted by a computer, the auditor may be able to reduce substantive tests of transactions for which, if any, objective? 37. The most important aspects of the billing function include all but which of the following? 38. In which of the following will sales return and allowances not be recorded? 39. Who is generally responsible for opening receipts when a company uses a lockbox to speed the handling of cash receipts? 40. For most firms, the function of indicating credit approval is recorded on the: 41. Describe the sources of information gathered to assess fraud risks. 42. Describe three computer auditing techniques available to the auditor. 43. There are seven types of audit evidence: physical examination, confirmation, documentation, observation, inquiries of the client, reperformance, and analytical procedures. For each of the following types of audit tests, indicate the type(s) of evidence that can be obtained through the test: (1) tests of controls, (2) substantive tests of transactions, (3) analytical procedures, and (4) tests of details of balances. 44. State the five classes of transactions that comprise the sales and collection cycle. St. Paul’s University Page 3