Proceedings of 3rd Asia-Pacific Business Research Conference

advertisement

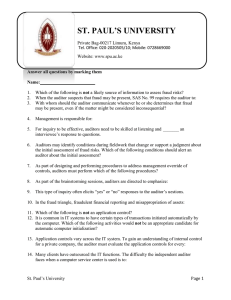

Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 Corruption Awareness, Ethical Sensitivity, Professional Skepticism and Risk of Corruption Assessment: Exploring the Multiple Relationship in Indonesian Case Ashari* Muhamad Masruri** and Nafi Inayati Zahro*** This study examine the multiple relationship between corruption awareness as proxied by perception about corruption existence and support to anti corruption program, ethical sensitivity, professional skepticism and risk of corruption assessment of government internal auditor in Indonesia. Based on the model of ethical decision making proposed by Rest (1986) and Jones (1991) and response on questionnaire from 33 regional government internal audit office of three province, I investigate the hypothesis of (1) the effect of perception of corruption existence on support to anti corruption program, (2) perception about corruption existence on professional skepticism, (3) support to anti corruption program on risk assessment, (4) ethical sensitivity on perception about corruption existence, (5) ethical sensitivity on risk assessment, (6) professional skepticism on ethical sensitivity, and (7) professional skepticism on risk assessment. My result show that for hypothesis no. 1,3,4, and 7, there are significant positive relationship, and for hypothesis no.2,5,6 there are no significant relationship. This study contribute to theoretical consideration about the variables in exploring auditor risk assessment. Also this study providing preliminary evidence in practicing area about team selection in conducting audit task. 1. Introduction Internal auditor has critical function in preventing and detecting fraud due to plethora of financial statement fraud (Siegel and Miller, 2010). Besides its role in serving the need of management, internal auditor are take more responsibility in detecting fraud. Compared with external auditor, internal auditor tends to find fraud often (Corless, 2009). A study conducted by KPMG (2003) and the Association of Fraud Examiner (2008) found that external auditor is rarely discovering fraud. Internal auditor receive an advantage in that they work for single company where they get to know its people and policies in much greater depth than is possible for external auditor (Corless, 2009). Because its * Lecturer of Accounting Department, Faculty of economics University of Muria Kudus Indonesia Email: ashari_umk@yahoo.com ** Lecturer of Dean of Faculty of economics University of Muria Kudus Indonesia Email:m_ruri56@yahoo.com *** Lecturer of Accounting Department, Faculty of economics University of Muria Kudus Indonesia Email: nafi_umk@yahoo.co.id 1 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 advantageous, fraud detection in company must be rely on internal auditor function. The implementation of SAS 82, SAS 99, and section 10A, also gives new meaning to the importance of the role and responsibility of internal auditors in deterrence, detecting, investigating and reporting of fraud (Hillison et al., 1999, Kranacher et al., 2008). As implication for this standard implementation, the effectiveness of internal auditor function in organization can be measured by how they can deter, prevent and detect fraud, which government organization is how government internal auditor can deter, prevent and detect corruption. Most of important factors in the determination of the auditor’s effectiveness in his job is how successful he is in developing a good relationship with his associates not to whom he report, so the critical factor may be in the personality of auditor and not in the characteristics of his position or the degree of independences (Nelson, 1973). Research on the fraud risk assessment by auditor has been lie on auditor sensitiveness to quantitative and qualitative fraud indicators (red flags) which are defined as a condition or circumstances that indicate potential fraud. Auditor sensitiveness to fraud indicators will help to assess risk of fraud in planning the audit examination (Pincus, 1989). In the auditing literature, research studying on the factors that affecting auditor risk assessment incorporates psychological and sociological factors (Ramamoorti, 2008). As widely disseminated by Association of Certified Fraud Examiner (ACFE), fraud can viewed from conceptual framework that so called as fraud triangle. The fraud triangle is having three elements viz., perceived incentives/pressure, perceived opportunities, and rationalization of fraud behavior, and therefore all three elements of fraud triangle are influenced by fraud perpetrator’s psychology (Ramamoorti, 2008). As consequences, these element of fraud triangle can be analyzed using psychology and sociology perspectives. From psychology perspective, fraud viewed as a deviant behavior, and it can be analyzed as impact of culture and context of behavior. From criminology perspective which is the branch of sociology, fraud can be explained by three factor: supply of motivated offender, the availability of the suitable targets, and the absence of capable guardians (Ramamoorti 2008). When assessing fraud risk, the auditor must make a judgment about the existence of all three element of fraud triangle, therefore the process as described by Libby and Lewis (1977) auditor assess risk of fraud is an interaction between (1) the cues an auditor receives and (2) the auditor’s assessment of those cues. Hammerley (2011) propose that fraud risk factor characteristics will effect auditor performance in risk factors identification, hypothesis generation, risk assessment and audit program modification. Because two auditors may make different assessments of the same cues, the fraud literature should benefit from understanding which personal characteristics affect auditor judgment (Watson 2004). Researches conducting in investigating effect of auditor personal characteristics have mixed result. Pincus (1989) reported that when auditors have cues that allow identification of a seeded fraud, they rate seeded fraud as the most likely cause of misstatement form among possible cues. However, when the fraud risk identification process distracts auditor from identifying other cues, it appear that this impairs fraud risk assessment (Pincus 1989;Hackenberg 1992; Asare 2 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 and Wright 2004). Additionally, increased risk assessments do not indicate that auditor know how to determine whether their fraud hypothesis is true (Hammersley 2011). Because only a few researches have been conducted to explore the relationship among corruption awareness, ethical sensitivity, professional skepticism and risk of corruption assessment, I am interest to investigate their relationship. International comparative studies have reported that Indonesia has suffered significantly from corruption. Transparency International (TI) for example reported that Indonesia’ corruption perception index (CPI) was 3.2 and rated as a country more afflicted with corruption (TII 2012). This corruption index score placed Indonesia in rank 118th together with Argentina, Benin, Surname, and others developing countries. Among ASEAN Countries, Indonesia’ rank is placed below Singapore (9.2), Brunei (5.2), Malaysia (4.3) and Thailand (3.4). Another corruption index is Bribery Index (0-10 where higher score showing higher bribery) were scored (7.1) for Indonesia parallel with corruption perception index (Kompas 2011). Although the corruption index was increase compared with prior year (2010 index was 2.80), but this condition is unfavorable because Indonesian Government has targeting that CPI is 5.5. This indicators also showing that there are not improvement in anti corruption program and Indonesia is still having high risk of fraud and corruption. With the high risk of corruption in Indonesia, government internal auditors have a crucial function in creating good government governance and in supporting successful of anti corruption programs. The importance role of the internal auditor in preventing and detecting fraud, contradicted with Indonesia’ internal auditor condition. Recent data from Indonesia Government Internal Auditor Association (AAIPI) showing that 94% of government internal auditor cannot detect fraud and corruption (Bisnis.com 2012). This lack of ability in detecting fraud, because, internal auditor is not well developed and it is often underfunded in government (Dye 2007). Contradicted with performance of internal auditor in private firm, according to data from AAIPI, Indonesia’s government internal auditor, are less likely to discover fraud. This unfavorable condition of government internal auditor, need capabilities improvement in detecting fraud and corruption. This study provides the preliminary evidence for government and other parties who concern with improvement of capabilities of government internal auditor in preventing and detecting corruption. This research is contributed to literature in several ways. First, it’s giving a preliminary evidence about corruption awareness, ethical sensitivity, professional skepticism and risk of corruption assessment among government internal auditor in Indonesia. Second, its study providing evidence about relationship among corruption awareness, ethical sensitivity, professional skepticism and risk of corruption assessment. Finally, this study providing basic guidance for government agencies in selecting personal team for audit engagement based on personal characteristics of internal auditor. The remainder of the paper is presented in three main parts. The second section describes the theoretical foundation and development. The third section describes the research method and procedures used in this study. The fourth 3 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 section presents and discusses the results. The fifth section concludes and highlights for future research. 2. Literature Review 2.1. Corruption Corruption is defined as the use of public office for private gain, or in other words, use of official position, rank or status by an office bearer for his own personal benefit (Myint, 2000). Such behavior included this are: (a) bribery, (b) extortion, (c) fraud, (d) embezzlement, (e) nepotism, (f) cronyism, (g) appropriation of public assets and property for private use, and (h) influence peddling. In government activities, corruption can arise under circumstance such as government contracts, government revenues, government benefits, time saving and regulatory avoidance, and influencing outcomes of legal and regulatory processes. According to Klitgaard (1998) corruption can be set by following equation. C = R+D-A Where C is corruption, R is economics rent, D is discretionary power, and S for accountability. Economics rent arises when a person has something unique or special, so he can charge more than normal price for it use and earn economics rent or monopoly profit. If applied for government official, some bureaucrat working in the business license issuing office, so they own special authorization to grant permission and they can use their official position as economics rent. If more economics rent (R) exist in a country, the possibility of corruption exits will be larger. The discretionary power arise because it is not possible to devise rules and regulations that are watertight and foolproof and will take care of all contingencies that can crop up in trying to control an economics activities. Similarly, the greater the discretionary power (D) granted to administrator, there will be greater the corruption occur. Accountability has to do with that fact that for proper observance of rules and regulation, where for the ones who has economics rent and discretionary power must be held for responsible and accountable for their actions. From those equation, its seems that corruption occurrence can be reduced by accountability. If accountability can be increased in the same amount of economics rent and discretionary power, then we can reduce the corruption occurrence. In the government bodies, one of the important bodies in creating accountabilities is government internal audit. 2.2. Risk of Corruption Assessment Public had been expected that government internal auditor has a duty in respect of the risk of corruption in public sector. ISA 240 (IFAC 2004), states that the primary responsibility to prevent and detect fraud rest with management and those charged with governance. Auditor performing a preliminary overall fraud risk assessment during planning based on fraud risk identified and fraud hypothesis generated. The audit preliminary risk assessment is important determinant of audit effectiveness because its guide auditor decisions about whether changes to audit program are necessary (Hammersley, 2011). A number of studies has examined the effect of auditor risk assessment during audit planning stage of audit identification. Knap and Knap (2011), reported that auditor manager assess fraud risk higher when fraud is present than when fraud 4 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 is absent. Zimbelman (1997) reported that auditor who separately assess fraud risk and error risk, assess fraud risk higher when red flags are present. Apostolou et al. (2001) report that auditors rank red flags related to management characteristics and influence over the control environment as much more important to the fraud risk assessment that red flags related to operating, financial stability, and industry conditions. Asare and Wright (2004) provide the basis for generating specific fraud hypotheses and report that auditors who generate fraud hypotheses unaided assess fraud risk higher than auditors who use a red flags checklist that lacked the specific fraud present. Wilk and Zimbelman (2004) also report that when fraud risk is low, decomposition of red flags into opportunity and incentives cues, makes fraud risk assessment more sensitive to these cues, but when fraud risk is high, auditor equally sensitive to these cues with or without decomposition. Hammersley et al. (2011) also reported that auditor seniors assess fraud risk higher when they receive material weakness information that makes fraud cues more salient. 2.3. Corruption Awareness Awareness is almost of cognitive behavior in bottom rung of affective domain (Krathwohl et al., 1964). The concept of corruption awareness can be derived from concept of situation awareness. Situation awareness is the perception of the elements in the environment within a volume of time and space, the comprehension of their meaning, and the projection of their status in the near future (Endsley, 1995). Based on this definition, there are three element of situation awareness: perception of element in the environment, the comprehension of their meaning and projection of future status. Perception of element in the environment involves making distinction about relevant and irrelevant information. The higher risk of corruption environment may contain considerable information, which is relevant to internal auditor in order to complete fraud assessment task. When the fundamental perception of information is occur, it is possible to achieve the comprehension, which is the synthesis of information perceived during the perception. The comprehension is go beyond the perception and includes an in-dept of understanding of the significant of the information. After perception and comprehension, the final level is the ability to project of future course of action based on knowledge of the environmental information and comprehension of the situation. In internal audit profession, perceived element of environment can be measured by perceived of corruption existence in organization. The level of comprehension for internal auditor is in-dept understanding of the significant of the corruption information. The level of the ability to project of future course of action to assess risk of corruption based on perceived corruption information and awareness about the corruption issues and attitude to support anti corruption program. I expect that if auditor perceive that corruption is exist in his environment, he will support to anti corruption program. Also if auditor where perceived that corruption is exist in his environment, he will have higher professional skepticism as required by audit standard. 5 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 H1: Perception about corruption existence will has positive effect on attitude to support anti corruption program. H2: Perception about corruption existence will has positive effect on professional skepticism. Previous study has been submitted that in order to give due to regard to the possibility of corruption, an auditor needs to be sensitive to the possibility of corruption (Labuschagne and Els, 2006). Research conducted by Abdolmohammadi and Owhoso (2000), concluded that if auditors are not sensitive to fraud issues, they can’t perceive or assess them and will therefore be unable to incorporate the in audit judgment. The essential behavior to be measured at the level of awareness is whether the internal auditor is conscious with something whether he is aware of the existence of some person, phenomenon, event if state of affairs (Krathwohl et al., 1964). Based on those literature, I proposes that higher level of attitude to support anti corruption program will increase auditor risk of corruption assessment. H3: attitude to support anti corruption program has positive effect on risk of corruption assessment. The tasks undertaken in the internal audit function require a set of social skills which may vary across work environments and economies (Siegel & Miller, 2010). In order to act ethically, individuals must be aware of what is considered right and wrong within society (Diskerson 2009). But if the ambiguity is exist, it will increases the likelihood that individuals will be unaware of the ethicality of a given situation. Within auditing profession, Social consensus will reduces ethical ambiguity (Chia & Mee, 2000; Jones, 1991) and therefore heightens ethical awareness, judgment and behavior. Dickerson (2009) reported that auditor ethical sensitivity was heightened by the extent of social agreement surrounding the ethical issues. In this research I proposes that corruption awareness has a positive effect on ethical sensitivity. H4: Ethical sensitivity has positive effect on Perception about existence. corruption 2.4. Ethical Sensitivity Rest (1986) has developed a cognitive model for individual decision making include moral sensitivity, moral judgment, moral motivation and moral character. Ethical sensitivity is the ability to identify the salient aspect of ethical dilemma that involves ability to see the implication of action outside one’s environment within the context of broader social picture. While auditor able to identify ethical dilemma around his organization, it will affect his perception of risk in performing audit task and finally will increase his assessment on risk of corruption. Another ethical model is the Jones’ (1991) model, that focuses on ethical issues (magnitude of consequences, social consensus, probability of effect, temporal immediacy, proximity and concentration of effect) is related to ethical decision making and behavior. The second component of Rest’s and 6 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 Jones’ model (moral judgment), incorporate the process by which individuals define what ethical/moral means to them. This moral judgment component is actually based on Kohlberg’s (1976) model of cognitive moral development. Generally, individual’s ethical decision making schema will not be accessed if she/he does not perceive a situation as involving ethical issues (Rest, 1979). This condition can lead to potentially unethical decisions, wherein the individual is only considering economic impacts in the decision making process to the exclusion of ethical considerations. Yetmar and Eastman (2000) investigated whether five factors affected a model of ethical sensitivity using tax practitioners, while Shaub et al. (1993) found a negative relationship between auditors’ ethical orientation and ethical sensitivity using a survey with a single ethical scenario. If the auditor is work in high level of unethical environment (high risk of corruption), he should incorporate this situation on his judgment about risk assessment. Abdolmohammadi and Owhoso (2000) reported that senior auditors were sensitive to ethical information in their assessment of the likely of fraud. Awhoso (2002) also reported that practicing male and female auditor are sensitive to ethical information when assessing client’s likely of fraud. Based on those study, here I proposes that ethical sensitivity will increase auditor’ risk of corruption assessment. H5: Ethical sensitivity has positive effect on risk of corruption assessment Within the ethical decision making literature, ethical sensitivity is generally measured as dependent variables (Dickerson, 2009). The numerous independent variables include: cognitive moral development, ethical orientation, professional commitment, organizational commitment, professional skepticism, cultural environment, professional code of conduct, and personal characteristics (i.e. age, education, training and experience). Bases on those literatures, I propose the effect of professional skepticism on ethical sensitivity. H6: Professional skepticism has positive effect on ethical sensitivity. 2.5. Professional Skepticism Auditing Standard Setter Body has recognized the importance of professional skepticism. From beginning codification of auditing standard (SAS no 1), trough today, Professional skepticism has been widely recognized as one of auditor professional attribute. These requirements also supported with other audit statement, (AU 230.07, PCAOB 2007 AS no 5. PCAOB 2008). According to SAS no 1, ―an auditor must have questioning mind and critically assess the evidence obtained‖. Auditing Standard Setter Body has recognized the importance of professional skepticism. From beginning codification of auditing standard (SAS no 1), trough today, Professional skepticism has been widely recognized as one of auditor professional attribute. SAS No 1, mandates that auditor must use professional skepticism due to professional care. These requirements also supported with other audit statement, (AU 230.07, PCAOB 2007 AS no 5.4, PCAOB 2008). Skepticism is formed when individuals create cognitive ―categories‖ of incoming information and treat all information according to a set of stereotypes or beliefs regarding what they feel a particular message is trying to accomplish (Friestad 7 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 and Wright 1999). According to those definition, in conducting assessment of audit evidence is auditor need skepticism or suspicion (see Kerler and Killoug 2009; Nelson 2009; Rose 2007; Quadackers et al. 2009) as required by auditing standard. Hurtt (2010), has been developing a scale to measure professional skepticism comprising six characteristics which can be both a trait and a state. This scale was described as follows: Questioning mind: This characteristic was found in the SAS No. 82 (AICPA, 1997a), SAS 99 (AICPA, 2002) and ISA 240 (IFAC 2009) definition of professional skepticism. SAS 99 defines professional skepticism as requires an ongoing questioning whether the information and evidence obtained suggest that a material misstatement due to fraud has occurred. In ISA no 240, professional skepticism was proposed as an attitude that includes questioning mind and critical assessment of audit evidence. In philosophy literature, skepticism is also includes the concept of questioning mind or disposition toward inquiry. Suspension of judgment: The Auditing Standards, SAS no. 1 indicates the importance of suspension of judgment when accepting management assertion until sufficient evidence is collected. Search for Knowledge: In auditing literature, Mautz and Sharaf (1961) indicate the importance of curiosity when performing audit. Search for knowledge is different from concept of questioning mind where questioning mind is related with some sense of disbelief or doubt, while search for knowledge is more of general curiosity or interest (Hurtt 2010). Interpersonal understanding: Interpersonal understanding is much related with evidence evaluation, which deal with the motivation and integrity of the individual whose provide evidence. Auditing Standard, SAS no. 82, recognize that potentially misleading evidence might come from client personnel and recommends corroboration. Wilk and Zimbelman (2004) highlighted that fraud is considered occurred when there are any interaction of three causal influences: incentive, attitude, and opportunity. Two causal factors were much related with subject factor. Thus by having interpersonal understanding, its posited that auditor will recognize the potential bias, inaccurate, or misleading information provided by client. Autonomy: Autonomy is important aspect of auditor characteristics, while he or she decide when a sufficient level of information has been obtained to personally satisfy. Mautz and Sharaf (1961) noted that auditor must have professional courage not only to critically examine and perhaps discard the proposal from other, but also to submit his own inventions to same kind of detached and searching evaluation. Self Esteem: Self esteem refers to individual overall evaluation of his/her competencies (Rosenberg 1965). Skepticism required a certain level of self esteem (Hurtt 2010). Self esteem was an important aspect in successful inquiry (Hookway 1990). By having self-esteem, auditor able to resist persuasion attempts and challenges another’s assumption 8 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 or conclusion. When evaluating evidence, self esteem also increasing auditor awareness about trustfulness assertion and explanation from client. Nelson (2009), defines Professional skepticism as indicated by auditor judgments and decisions that reflect a heightened assessment of the risk that an assertion is incorrect, conditional on the information available to the auditor. SAS no 109, stated that auditor performing risk assessment procedures to obtain understanding of entity and its environment by inquiries of management and others within the entity, analytical procedures and observation and inspection. Risk assessment is one of important part of auditor task during the beginning of engagement and presenting audit report. The two of the dimension of skepticism from Hurtt’ professional skepticism is questioning mind and suspension of judgment. These two dimension is consistent with the concept disbelieve which opposite of trust. Kerler and Killough (2009) proposed that trust about management will negatively affect perceived risk of management fraud. Many of research conducting in professional skepticism area have been trying to investigate the relationship between professional skepticism and fraud detection skill (Carpenter and Reimers 2011; McMillan and White 1993; Payne and Ramsay 2005; Rose 2007; Saksena 2010). All of these research have been recognized that professional skepticism is one of auditor’s attribute that will increase auditor skill especially in performing fraud detection task (Harris and Brown 2000; Munter and Ratcliff 1999; Sandra et al 2001; Saksena 2010). Payne and Ramsay (2005) indicated that auditor with low level of skepticism anchoring low fraud risk assessment. Consistent with that studies, Kerler and Killough studies (2009) also confirmed that trust about management negatively affected perceived risk of management fraud. Using professional skepticism in performing audit task will increase auditor sensitiveness of fraud (Carpenter and Reimers 2011). McMillan and White (1993), Payne and Ramsay (2005), stated that auditor who having higher professional skepticism also showing higher fraud risk assessment compared with low professional skepticism. Another research also showing that higher auditor skepticism increasing auditor sensitiveness to fraud possibility conducted by management (Rose 2007; Carpenter and Reimers 2011). Based on those research, I expect that higher level of professional skepticism to be related with higher risk assessment, stated formally: H7 : Auditor’ professional skepticism will be positively related to risk assessment. Based on previous literature review, the research framework can be depicted as following image 1. 9 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 Image 1 Research Framework Perception of Corruption Support to Anti Corruption Professional Skepticism Risk Assessment Ethical Sensitivity 3. The Methodology and Model 3.1. Sampling and Respondent Data were collected by sending a questionnaire to government internal auditor in Indonesia. Total of 800 questionnaires were sent to 33 regional government internal auditor office which is randomly selected from three provinces. From the questionnaires have been sent, about 250 was returned but there are 24 questionnaires can not be analyzed because incomplete answer, therefore only 226 questionnaires were sufficient to analyze. The description of respondent presented in table 1. Table 1 Respondent Description Province Numbers Gov Quest Quest Incomplete Sufficient of gov Office Sent Return to office Selected Analyzed Central 34 12 315 110 12 98 Java East Java 37 14 343 86 8 78 West 26 7 241 54 4 50 Java Total 97 33 900 250 24 226 3.2. Variables Measurement Corruption awareness scales are measured by adopting corruption awareness scale developed by Bowman & Gilligan (2007) with adjustment for Indonesian context. The corruption awareness was divided onto two dimensions that are perception of corruption existence and attitude to support anti corruption programs. Perception of corruption existence are comprising 7 questions witch scaled form 1 to 6. Attitude to support anti corruption program scales are 10 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 comprising 2 question scaled from 1 to 10. The risk assessment material used in this research was adapting from Payne and Ramsay (2005). The professional skepticism scale is measured by Hurtt’ Scale of Professional Skepticism developed by Hurtt (2010) which answers are scaled from 1 to 6. The ethical sensitivity was measured three cases were developed in terms of relationship where its used as measure ethical sensitivity in the area of public administration. This indicator was developed by Choi and Perry (2010). The first indicator was developed in a situation regarding the relationship between administrators and citizens. The second indicator was made from a situation in which an administrator’s behavior is directly relevant to his or her responsibility. The third was developed in a work situation relevant to the hierarchical relationship between boss and subordinates. As much as possible, all cases were developed in the form of short stories, which help respondents maintain interest while concentrating on the questionnaire. Otherwise, subjects might lose interest in the survey and not respond well to the cases. All of instrument had been translated into Indonesian and adjusted to Indonesia’ condition. 3.3. Data Analysis As complex relationship among variables, I use structural equation modeling (SEM) analysis to explore its relationship. This method is benefit because compared with regression analysis that we can only analysis between one variable dependent and others independent variables, in SEM we can explore multiple relationship among one or more dependent and independent variable. Other benefit is that by using SEM, we can analysis relationship among observed variables and latent variables. I used AMOS software in conducting SEM Analysis. 4. The Findings 4.1. Descriptive Analysis The following table 2 presented descriptive statistics from the variables of the study. Table 2 Survey Respondent Std Variable Mean Dev Risk Assessment 15.48 2.53 Perception of Corruption Existence 27.18 3.37 Support to Anti Corruption Program 15.79 2.162 Professional Skepticism 135.28 13.493 Ethical Sensitivity 9.87 1.68 summarized item in Min 9 Max 20 19 35 10 95 5 20 166 12 4.2. Reliability The Cronbach alpha used to assess internal consistency which coefficient of Cronbach alpha for all variables are presented on table 3. Table 3 Cronbach Alpha Score 11 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 Variable Risk Assessment Perception of Corruption Existence Support to Anti Corruption Program Professional Skepticism Ethical Sensitivity Cronbach Alpha 0.89 0.715 0.835 0.795 0.851 From those table, its seems that all variables have Cronbach alpha more than 0.7 as proposed by Nunnaly (1978), and it can be concluded that all of variables have satisfactory internal consistency. 4.3. Normality Test One of the critical assumption in the conduct of Structural Equation Modeling (SEM) analysis and in the use of AMOS is hat data is normal. Based on AMOS output in the assessment normality section its seem that not any question who having the standardized kurtosis index more than value 3, so it can be concluded that all of item in questionnaires are normally distributed (Byrne 2010). This normality measurement is used as indicators of univariate normality. Byrne (2010) suggested that although the presence of nonnormal observed variables precludes the possibility of a multivariate normal distribution, the converse is not necessarily true. In this study, although its presence of univariate normality, I have to checks its multivariate normal distribution using CR of kurtosis value, which value greater than 5 present nonnormal distribution. According to AMOS output, its seem that value of CR is 10.1 indicate that data are not normally distributed. An alternative method when data is nonnormally distributed is by using Asymptotic Distribution Free (ADF) estimation (Byrne 2010). But it is well known that unless sample size is extremely large (1.0005.000 case), the ADF method performs poorly and yielded severely distorted estimated values, and because in this study sample size is only 226, it is not possible to perform analysis with ADF estimation. Another alternative method is by employing corrected the test statistics by incorporating a scaling correction for X2 statistics (Chou, Bentler and Satora 1991, Hu et al 1992). 4.4. Model Evaluation As SEM takes a confirmatory approach to the analysis of a structural theory bearing some phenomenon, I must evaluate model how fits is my model or how adequate is my model with the sample data. Following table 4 is present result of modal fit evaluation. 12 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 Indicators Chi Square Comparative Fit Index Relative Fit Index (RFI) Incremental Fit Index Tucker Lewis Index (TLI) RMSEA PCLOSE ECVI Hoelter (0.05) Table 4 Model Fit Evaluation Value Criteria 749 (0.330) Probability > 0.05 0.996 > 0.95 0.804 Value close to 0.95 0.996 Value close to 0.95 0.996 Value close to 0.95 0.01 <0.05 1 >0.5 < ECVI Independent Model 5.61 (21.74) 240 > 200 The chi Square value is used as fit indicators of model as a whole. From that table, it can be concluded that model as a whole having fit with sample data. Consistent with chi square, another goodness-of-fit measure, also showing that hypothesized model has been fit with sample data. From aspect of sample adequacy (Hoelter) it also can be concluded that model was adequately represent the sample data. 4.5. Regression Result AMOS presented unstandardized and standardized of regression weights and probability of each coefficients. I used standardized coefficients as presented in following table 5. Table 5 Regression weight and Probability Regression Coefficient Probability Hypothesis Decision H1 Accepted PC SAC 0.425 0.000 H2 Rejected PC PS 0.110 0.619 H3 Accepted SAC RA 0.574 0.000 H4 Accepted ES PC 1.108 0.000 H5 Rejected ES RA 0.036 0.559 H6 Rejected PS ES 0.325 0.113 H7 Accepted PS RA 0.419 0.000 Ref: PC : perception of corruption existence SAC: support to anti corruption program RA : Risk Assessment ES: Ethical sensitivity PS: Professional Skepticism That table can be interpreted that except for regression between perception of corruption to professional skepticism, ethical sensitivity and risk assessment and professional skepticism to ethical sensitivity, all regression coefficient is significant. The hypothesis testing The discussion for this result will be presented in following section. 13 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 5. Summary and Conclusions The first hypothesis is trying to explore relationship between perception of corruption existence and attitude to support anti corruption program. From above table, it is shows that there is positive relationship between perception toward corruption with attitude to support anti corruption program. According to psychological model developed by Rest (1986), when making individual ethical decision making, the first stages that individual proceeded is awareness about moral dilemma is exist. This finding also is consistent with Jones (1991) that if auditor is perceived about ethical issues, they will behaves ethically. This finding as supported the recent ethical theory about the relationship between perceived issues of ethic will affect individual ethical behavior. The second hypothesis concerning with the effect of perception of corruption existence on professional skepticism. Nelson’ model of determinants of professional skepticism (Nelson 2009) depicted that skeptical judgment is affected by evidential input such high risk of corruption environment. From that perspective, theoretically perception about corruption existence will affect professional skepticism. This study not supported the proposition that if auditor perceive that corruption is exist in his environment, auditor professional skepticism will be higher. This unfavorable finding may be because government internal auditor capabilities is low on detecting corruption as cited in research background. Future investigation about effect of corruption perception on professional skepticism may conducted by separating expert and novice internal auditor. The second stage after awareness about existence of moral dilemma is the judgment about what course of action to take. When individual has an awareness about moral dilemma, he will arrange about what action that must be taken when facing ethical dilemma situation. In investigating hypothesis no. 3, the SEM analysis showing that when auditors are support to anti corruption programs, they will anchoring high risk assessment (coefficient is 0.574, P value is 0.00). This finding providing a support to Rest’s model, and consistent with prior research (Jones 1991; Jones, Massey & Thorne 2003; Rest 1986). This result also confirm Abdolmohammadi & Owhoso (2000) Dickerson’s (2009) and Lam & Shi (2007) finding that when making ethical decision making in this case is risk assessment, auditor is heightened by the extent of social agreement surrounding the ethical issues. The fourth hypothesis is explaining effect of ethical sensitivity on perception of corruption existence. The results confirm that proposition that if auditor having higher ethical sensitivity, he will perceive higher about corruption existence in his environment especially with high risk of corruption environment. This result on supporting theoretical framework about Ethical sensitivity as the ability to identify the salient aspect of ethical dilemma that involves ability to see the implication of action outside one’s environment within the context of broader social picture. This result is consistent with Shaub 1989, Sweny 1995, Dauglas, Davidson, and Schwartz, 2001, about effect of ethical sensitivity on perception about ethical issues in this case is consideration about corruption existence. In the country that most afflicted with corruption such as Indonesia, government internal auditor must have ethical sensitivity that will effect on auditor response to red flags. From table 5, it shows that coefficient of regression is 0.036 with 14 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 non significant probability. This result is not consistent with prior research Ziegenfuus (2001) finding that auditor ethical sensitivity to ethical issues have positive effect on auditor assessment on fraud and corruption risk. The difference finding of this study compared with prior study may be because Indonesia’ internal auditor work in a culture that permissive to corruption activities. Professional skepticism is trait attribute of professional auditor especially when conducting audit task in high risk of corruption. By having professional skepticism auditor will evaluate his environment critically which is showing ethical sensitiveness. The regression coefficient for this prediction is 0.325 and not significant probability. This finding is not consistent with previous research finding (Valentine and Page, 2006) that professional skepticism has a positive effect on ethical sensitivity. The unsatisfactory result is may be coming from hopeless expectation of government auditor internal because there is no improvement in corruption reduction activities. When internal auditor have been hopelessness about anti corruption activities, it will make auditor apathetic on his environment issues of corruption. The last analysis concern with effect of professional skepticism on risk assessment, with the result of regression coefficient is 0.419 with significant probability, showing that there is positive effect of professional skepticism on risk assessment. This study finding is consistent with Payne and Ramsay’ (2005) result about the positive effect of professional skepticism on risk assessment. This finding corroborating the theory and auditing standard about the importance of professional skepticism in performing audit task. This current research reported about the multiple relationship among corruption awareness, as measured by perception about corruption existence and support to anti corruption program, ethical sensitivity, professional skepticism and risk assessment of corruption. There are positive effect of perception about corruption existence on support to anti corruption program, support to anti corruption program on risk assessment, ethical sensitivity on perception about corruption existence, and professional skepticism on risk assessment. Analysis of three hypothesis, the result is reject the proposition about the effect of perception about corruption existence on professional skepticism, ethical sensitivity on perception about corruption existence, and professional skepticism on ethical sensitivity. The study suffers from several limitations. The results of the current study cannot be generalized to all government internal audit office, and experience and expertise levels of internal auditors. This study only employing Indonesia’ government internal audit office from three province where there are 34 province with rich of culture each province. Sample size may be increased both in number of province included and in number of sample, in order to achieve generalization of the result. This study not separate experience and non experience level of internal auditor which future research should consider number of hour or years in audit engagement. Finally this study not divide auditor into level of expertise such certification of auditor. Future research may involved level of expertise of internal auditor (expert vs. novice) in defining multiple relationship of variables in this study. 15 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 References Abdolmohammadi, Mohammad J., And Owhoso , Vincent D. (2000). Auditors' ethical sensitivity and the assessment of the likelihood of fraud. Managerial Finance, 26 (11). 21-32 American Institute of Certified Public Accountants. 1988. Statement of Auditing Standards No. 53: The Auditors Responsibility to Detect Errors and Irregularities, New York: AICPA. ____ . 1996. Statement of Auditing Standards No. 78: Consideration of the Internal Control Structure in Financial Statement Audit: An Amendment to SAS 55. New York: AICPA. ____ 1997. Statement of Auditing Standards No. 82: Consideration of Fraud in a Financial Statement Audit: New York: AICPA. ____. 1997. Due Care in the Performance of Work. Statement on Auditing Standards No. 1. New York, NY:AICPA. ____. 2002. Consideration of Fraud in a Financial Statement Audit. Statement on Auditing Standards No.99. New York, NY: AICPA. ____. 2006. Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement. Statement on Auditing Standards No. 109. New York, NY: AICPA. Apostolou, Barbara A, Hassell, John M., Webber, Sally A. And Sumners, Glenn E. (2001) The relative importance of management fraud risk factors, Behavioral Research in Accounting, 13, 1-25 Asare, Stephen K. and Wright, Arnold M. (2004). The Effectiveness of Alternative Risk Assessment and Program Planning Tools in a Fraud Setting. Contemporary Accounting Research, 21( 2), 325-352. Association of Certified Fradu Examiner. (2008). 2008 Report To The Nation on Occupational Fraud & Abuse. Bisnis.com (2012). Auditor intern pemerintah belum bisa mendeteksi kecurangan. Bowman, Diana and Gilligan G. (2007). Public Awareness of Corruption in Australia. Journal of Financial Crime, 14 (4) , 438-452. Byrne, Barbara M. (2010). Structural Equation Modelling with AMOS : Basic Concepts, Application, and Programming. Routledge. New York. Carpenter Tina D. and Reimers, Jane L.. (2011), Professional Skepticism: The Effects of a Partner’s Influence and the Presence of Fraud on Auditors’ Fraud Judgments and Actions, available at: http://ssrn.com/abstract=1068942 Chia A. And Mee, L.S. (2000). The effect of issue characteristics on recognition of moral issues. Journal of Business Ethics, 27, 255-269. Choi, Do L. and Perry, James L. (2010). Developing A Tool To Measure Ethical Sensitivity In Public Administration And Its Application. International Review of Public Administration, 14(3), 1-12 Chou, C.O., Bentler P.M., and Satora, A. (1991). Scaled Test Statistics and robust standard error for non normal data in the covariance structure analysis: A mote Carlo case study. British Journal of Mathematical and Statistical Psychology, 44, 347-357. Corless, John C. (2009). Fraud Awareness of Internal Auditor. The Journal of Theoretical Accounting Research, 4 (2), 93-109 16 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 Douglas, Patricia C., Davidson, Ronald A., Schwartz, Bill N. (2001). The effect of organizational culture and ethical orientation on accountants' ethical judgments. Journal of Business Ethics; 34 (2). 101-121 Dickerson, Carol. (2009). Ethical Decision Making in Public Accounting: Investigating Factors that Influence Auditor Ethical Sensitivity. Dissertation Submitted to Faculty of Education Claremont Graduate University. Dye, Kennet M. (2007). Corruption and fraud detection by public sector auditors. EDPACS, 36( 5/6), 6-15 Endsley, M. R. (1995). Toward a theory of situation awareness in dynamic systems. Human Factors, 37(1), 32-64. Friestad, Marian R., and Wright, P. (1999). Everyday Persuasion Knowledge, Pshychology and Marketing, 16 (2), 185-194 Hackenbrack, K. (1992). Implications of seemingly irrelevant evidence in audit judgment. Journal of Accounting Research. 30 (spring), 126-136. Hammersley, Jacqueline S. (2011). A Review and Model of Auditor Judgments in Fraud-Related Planning Tasks. Auditing: A Journal of Practice & Theory,30 (4), 101–128 Hammersley, J. S., Johnstone, K., and Kadous, K. (2011). How do audit seniors respond to heightened fraud risk? Auditing: A Journal of Practice & Theory, 30 (3), 81–101. Harris, Cindy K., and Brown, Amy M. (2000). The qualities of a Forensic Accountant, Pennsylvania CPA Journal, 71 (1), 6-7 Hillison, W. Pacini, C, Sinason, D. (1999), The internal auditor as fraud-buster, Managerial Auditing Journal, 14(7), 351-362 Hu, L.T., Bentler, P.M., and Kano, Y. (1992). Can test statistics in covariance structure analysis be trusted?. Psychology Bulletin,112, 351-362 Hurtt, R. K. (2010). Development of a Scale to Measure Professional Skepticism. Auditing: A Journal of Practice &Theory, 29 (1), 149–171 Hookway, C. (1990). Skepticism. New York, NY: Routledge. International Federation of Accountant (IFAC). 2004. The Auditor’s Responsibility To Consider Fraud In An Audit Of Financial Statements. ISA no 240. Jones, T.M. (1991). Ethical Decision making by individuals in organizations model. Academy of Management Review, 16 (2), 366-396 Jones, J., Massey, D.W., and Thorne, L. (2003). Auditor’ ethical reasoning: insight from past research and implication for the future. Journal of Accounting Literature, 22, 45-103. Kerler, William A. and Killough, Larry N. (2009). The Effects of Satisfaction with a Client’s Management During a Prior Audit Engagement, Trust, and Moral Reasoning on Auditors’ Perceived Risk of Management Fraud. Journal of Business Ethics, 85, 109–136 Kee, H. W., and Knox, R. E. (1970). Conceptual and methodological considerations in the study of trust and suspicion. The Journal of Conflict Resolution, 14, 357–366. Kiltgaard, Robert, (1998). ―International cooperation against corruption‖, IMF/World Bank, Finance and Development, 35(1), 3. 17 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 Knapp, Carol A. and Knapp, Michael C. (2001). The e€ects of experience and explicit fraud risk assessment in detecting fraud with analytical procedures, Accounting, Organizations and Society, 26, 25-37 Kranacher, Mary-Jo. Morris, Bonnie W., Pearson, Timothy A., and Riley, Richard A Jr. (2008). A Model Curriculum for Education in Fraud and Forensic Accounting. Issues in Accounting Education, 23(4), 505-519 Krathwohl, David R., Bloom, Benyamin S. Masia, Bertram B. (1964). Taxonomy of Educational Objectives The Classification of Educational Goals. Handbook II. Affective Domain. Longmans, Green and Co. Ltd. London Kompas. Indonesia Peringkat ke 100, Indeks Korupsi Indonesia. www.kompas.com, accessed November 5,2012 KPMG. (2003). Fraud Survey 2003 Labuschagne, H. And Els, G. (2006). Corruption and fraud: any lessons for the auditor?. Meditari Accountancy Research, . 14(1), 29-47 Lam, Kit-Chun and Shi, G. (2007). Factors Affecting Ethical Attitudes in Mainland China and Hong Kong. Journal of Business Ethics, 77, 463– 479 Libby, R., and Lewis, B. L. (1977). Human information processing research in accounting: The state of the art. Accounting, Organizations, and Society, 2(3), 245–268. Mautz, R. K., and Sharaf, H. A. (1961). The Philosophy of Auditing. American Accounting Association Monograph No. 6. Sarasota, FL: American Accounting Association. McMillan, Jeffrey J and White, Richard A. (1993). Auditors' belief revisions and evidence search: The effect of hypothesis frame, confirmation bias and Proffesional Skepticism. The Accounting Review, 68 (3),443-463 Myint U., (2000). Corruption: Causes, Consequences and Cures. Asia-Pacific Development Journal,. 7( 2), 33-58 Munter, P. and Ratcliffe, T.A. (1999). Auditors’ responsibilities for detection of fraud. The National Public Accountant, 43(7), 26-8. Nelson, Jeane H. (1973). Behavioral implications of internal auditing. Management Accounting, 47, 25-36 Nelson, Mark W. (2009). A Model and Literature Review of Professional Skepticism in Auditing. Auditing: A Journal Of Practice & Theory, 28(2), 1–34 Nunnally, J.C. (1978), Psychometric Theory, 2nd ed., McGraw-Hill, New York, NY. Owhoso, Vincent D. (2002). Mitigating gender-specific superior ethical sensitivity when assessing likelihood of fraud risk. Journal of Managerial Issues, 14 ( 3), 360-374 Payne, Elizabeth A., and Ramsay, Robert J. (2005). Fraud risk assessments and auditors' professional skepticism. Managerial Auditing Journal, 20 (3), 321-330 Public Company Accounting Oversight Board (PCAOB). 2007. An Audit of Internal Control over Financial Reporting That is Integrated with an Audit of Financial Statements. PCAOB Auditing Standard No. 5. 18 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 ———. 2008. Proposed auditing standards related to the auditor’s assessment of and response to risk. Available at: http://www.pcaob.org/Rules/Docket 026/2008-10-21 Release No 2008- 006.pdf Pincus, K. (1989) ―The efficacy of a red flags questionnaire for assessing the possibility of fraud‖, Accounting, Organizations and Society, 153-63. Quadackers, L., Groot, T., and Wright, A. (2009). Auditors’ skeptical characteristics and their relationship to skeptical judgments and decisions. Working paper, Vrije University. Ramamoorti, S., (2008). The Psychology and Sociology of Fraud: Integrating the Behavioral Sciences Component Into fraud and forensic accounting cirricula. Issues in Accounting Education, 23( 4), 521-533 Rest J.R. (1986). Moral Development: advances in research and theory.Minneapolis, MN: University of Minnesota Press. Rose, Jacob M. (2007). Attention to Evidence of Aggressive Financial Reporting and Intentional Misstatement Judgments: effect of experience and trust. Behavioral Research in Accounting, 19, 215-229 Rosenberg, M. (1965). Society and the adolescent self-image. Princeton, NJ: Princeton University Press. Sandra, W. Shelton, Whittington, O R., and Landsittel, D. (2001). Auditing firms' fraud risk assessment practices. Accounting Horizons, 15 (1), 19-33 Saksena, P.N. (2010). Four Tools (Under The Umbrella Of Continuous Improvement) To Help Auditors Prevent/Detect Frauds. The Journal of American Academy of Business, 15(2), 28-36 Shaub, M.K. & Lawrence, J. (1996). Ethics, experience and professional skepticism: A situational analysis. Behavioral Research in Accounting, 8 (Supplement), 124- 57. Shaub, M. K. (1989). An empirical examination of the determinants of auditor ethical sensitivity. Unpublished Doctoral Dissertation. Texas Tech University Siegel, Philip H. And Miller, Jeffrey R. (2010). An international comparison of social Interaction attributes of internal Auditors: an analysis using the firob. Academy of Accounting and Financial Studies Journal, 14(1),83-98 Sweeney, J. (1995). The ethical expertise of accountants: An exploratory analysis. Research on Accounting Ethics, 1, 213-234. Transparency International Indonesia. Rilis Indeks Korupsi TII: Indonesia di Urutan 118 dari 176 Negara. www.ti.or.id accessed November 5, 2012. Valentine, Sean and Page, K. (2006). Nine to Five: Skepticism of Women’s Employment and Ethical Reasoning. Journal of Business Ethics, 63, 53– 61 Watson, Stephanie F. (2004). The Effect Of The Implicit Theory Of Integrity On An Internal Auditor’s Assessment Of Management Fraud Risk, Dissertation Submitted to the Graduate Faculty of the Louisiana State University and Agricultural and Mechanical College Wilks T.J. and Zimbelman, M. F. (2004). Decomposition of fraud-risk assessments and auditors’ sensitivity to fraud-cues. Contemporary Accounting Research, 21(3), 719–745. 19 Proceedings of 3rd Asia-Pacific Business Research Conference 25 - 26 February 2013, Kuala Lumpur, Malaysia, ISBN: 978-1-922069-19-1 Ziegenfuss, Douglas E. (2001). The role of control environment in reducing local government fraud. Journal of Public Budgeting, Accounting & Financial Management, 13 (3), 312-324 Zimbelman, Mark .F. (1997). Effects of SAS 99. Journal of Accounting Research, 35 (1),76-97. 20