Banking Industry in Thailand

advertisement

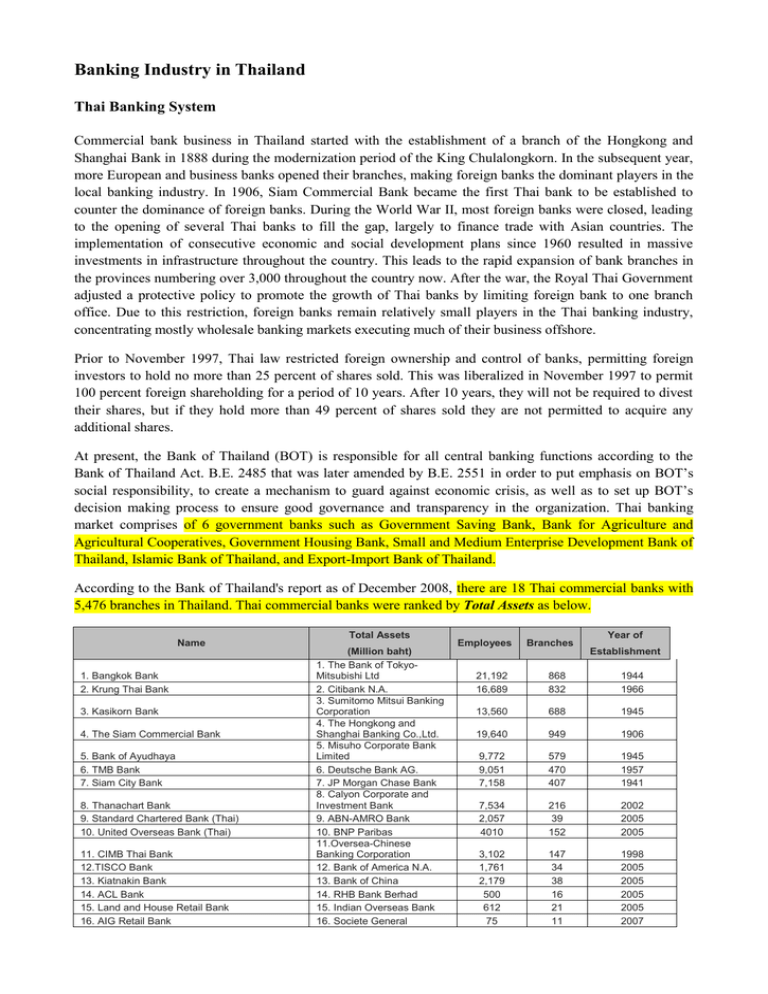

Banking Industry in Thailand Thai Banking System Commercial bank business in Thailand started with the establishment of a branch of the Hongkong and Shanghai Bank in 1888 during the modernization period of the King Chulalongkorn. In the subsequent year, more European and business banks opened their branches, making foreign banks the dominant players in the local banking industry. In 1906, Siam Commercial Bank became the first Thai bank to be established to counter the dominance of foreign banks. During the World War II, most foreign banks were closed, leading to the opening of several Thai banks to fill the gap, largely to finance trade with Asian countries. The implementation of consecutive economic and social development plans since 1960 resulted in massive investments in infrastructure throughout the country. This leads to the rapid expansion of bank branches in the provinces numbering over 3,000 throughout the country now. After the war, the Royal Thai Government adjusted a protective policy to promote the growth of Thai banks by limiting foreign bank to one branch office. Due to this restriction, foreign banks remain relatively small players in the Thai banking industry, concentrating mostly wholesale banking markets executing much of their business offshore. Prior to November 1997, Thai law restricted foreign ownership and control of banks, permitting foreign investors to hold no more than 25 percent of shares sold. This was liberalized in November 1997 to permit 100 percent foreign shareholding for a period of 10 years. After 10 years, they will not be required to divest their shares, but if they hold more than 49 percent of shares sold they are not permitted to acquire any additional shares. At present, the Bank of Thailand (BOT) is responsible for all central banking functions according to the Bank of Thailand Act. B.E. 2485 that was later amended by B.E. 2551 in order to put emphasis on BOT’s social responsibility, to create a mechanism to guard against economic crisis, as well as to set up BOT’s decision making process to ensure good governance and transparency in the organization. Thai banking market comprises of 6 government banks such as Government Saving Bank, Bank for Agriculture and Agricultural Cooperatives, Government Housing Bank, Small and Medium Enterprise Development Bank of Thailand, Islamic Bank of Thailand, and Export-Import Bank of Thailand. According to the Bank of Thailand's report as of December 2008, there are 18 Thai commercial banks with 5,476 branches in Thailand. Thai commercial banks were ranked by Total Assets as below. Name 1. Bangkok Bank 2. Krung Thai Bank 3. Kasikorn Bank 4. The Siam Commercial Bank 5. Bank of Ayudhaya 6. TMB Bank 7. Siam City Bank 8. Thanachart Bank 9. Standard Chartered Bank (Thai) 10. United Overseas Bank (Thai) 11. CIMB Thai Bank 12.TISCO Bank 13. Kiatnakin Bank 14. ACL Bank 15. Land and House Retail Bank 16. AIG Retail Bank Total Assets (Million baht) 1. The Bank of TokyoMitsubishi Ltd 2. Citibank N.A. 3. Sumitomo Mitsui Banking Corporation 4. The Hongkong and Shanghai Banking Co.,Ltd. 5. Misuho Corporate Bank Limited 6. Deutsche Bank AG. 7. JP Morgan Chase Bank 8. Calyon Corporate and Investment Bank 9. ABN-AMRO Bank 10. BNP Paribas 11.Oversea-Chinese Banking Corporation 12. Bank of America N.A. 13. Bank of China 14. RHB Bank Berhad 15. Indian Overseas Bank 16. Societe General Employees Branches Year of Establishment 21,192 16,689 868 832 1944 1966 13,560 688 1945 19,640 949 1906 9,772 9,051 7,158 579 470 407 1945 1957 1941 7,534 2,057 4010 216 39 152 2002 2005 2005 3,102 1,761 2,179 500 612 75 147 34 38 16 21 11 1998 2005 2005 2005 2005 2007 1. The Bank of TokyoMitsubishi Ltd 2. Citibank N.A. 8,774,146 17.MEGA International Commercial Bank 18. The Thai Credit Retail Bank Total 109 287 119,288 3 6 2005 2007 5,476 Source : Bank of Thailand The following table shows number of offices of Thai commercial banks as of December 2008. Offices in Thailand Bank Incorporated in Thailand Bangkok Metropolis* Total Branch Subbranch Oversea Offices Provincial Branch Subbranch Total Branch Subbranch 1. Siam Commercial Bank 949 168 148 352 281 3 3 2. Bangkok Bank 868 127 96 375 270 21** 16 4 3. Krung Thai Bank 832 138 70 487 137 7 6 1 4. Kasikorn Bank 688 141 102 325 120 7 4 5. Bank of Ayudhaya 579 137 56 227 159 3 3 6. TMB Bank 470 135 26 256 53 3 3 7. Siam City Bank 407 104 37 213 53 8. Thanachart Bank 216 33 61 71 51 9. United Overseas Bank (Thai) 152 86 2 64 0 1 1 10.CIMB Thai Bank 147 43 32 46 26 11.Standard Chartered Bank (Thai) 39 24 4 10 1 12. Kiatnakin Bank 38 4 34 13. Tisco Bank 34 3 5 24 2 14. Land and Houses Retail Bank 21 4 10 5 2 15. ACL Bank 16 5 11 16. AIG Retail Bank 11 1 0 10 17. The Thai Credit Retail Bank 6 2 1 3 18. MEGA International 3 2 1 0 Commercial Bank*** Sub - Total 5,476 1,157 650 2,514 1,155 45 36 5 Banks Incorporated Abroad 16 16 Total 5,492 1,173 650 2,514 1,155 45 36 5 Remark: * Including Head Office, ** Bangkok Bank's Kuala Lumpur Branch was transformed into a local company named Bangkok Bank Berhad in September 1994, *** Subsidiary Repre sentat ive 1 3 4 4 Source: Bank of Thailand and The Thai's Bankers Association - Compiled from Individual Banks Meanwhile, there are 16 foreign bank branches/representative offices ranked by total assets as below. Name 1. The Bank of Tokyo-Mitsubishi Ltd 2. Citibank N.A. 3. Sumitomo Mitsui Banking Corporation 4. The Hongkong and Shanghai Banking Co.,Ltd. 5. Misuho Corporate Bank Limited 6. Deutsche Bank AG. 7. JP Morgan Chase Bank 8. Calyon Corporate and Investment Bank 9. ABN-AMRO Bank 10. BNP Paribas 11.Oversea-Chinese Banking Corporation 12. Bank of America N.A. 13. Bank of China 14. RHB Bank Berhad 15. Indian Overseas Bank 16. Societe General Total Total Assets Number of (Million Baht) Employees 246,141 201,401 196,117 159,193 149,957 119,958 73,149 35,399 25,144 20,722 13,310 11,284 7,710 6,071 5,202 3,453 1,274,211 468 2,410 329 1006 310 161 63 103 67 51 42 47 41 36 40 n.a. 5,174 Source : The Thai's Bankers Association - Compiled from Individual Banks Year of Opening 1962 1985 1997 1888 1997 1988 2001 2004 1888 1997 1909 1949 1997 1964 2007 2005 Banking Services and Technologies in Thailand Nowadays, Thai banks develop their banking technologies continuously and plan to increase IT spending moving forward by keeping two focus areas: Core IT Infrastructure and Customer Relationship Management (CRM) in order to enhance the capability of banking services as well as enhancing internal working systems and processes efficiency. Thai banks aim to further develop their customer information systems and business intelligence systems as well as their electronic networks. They focus on enhancing online services such as internet banking services and mobile banking services. Thai banks provide several services related to technological infrastructure such as ATMs, EFTPOS machines, debit cards, credit cards, and e-money cards. According to Bank of Thailand's report, it summarized technological infrastructure in Thailand as of December 2008 as below. Number of automated teller machines (ATM) 34,745 Number of EFTPOS machines 259,567 Number of Credit Cards 12,971,694 Number of Debit Cards 26,266,359 Number of ATM Cards 22,423,525 Currency in circulation per capita as of 31 December 2008 11,889 baht Average cheque usage per capita* 2 cheques per year Monthly average value of credit card payments** 3,395 baht per card Monthly average value of cash withdrawals via ATM card 6,056 baht per card Monthly average value of debit card payments*** 75 baht per card Monthly average value of cash withdrawals via debit card 7,640 baht per card Remark: * Includes intrabank and interbank cheque transactions. ** Only payments from credit cards issued in Thailand for goods and services via EFTPOS in Thailand and overseas. *** Only payments from credit cards issued in Thailand for goods and services via EFTPOS in Thailand and overseas. Thai banks also provide online services such as e-banking, mobile banking, and telebanking that serve both personal and corporate. They also provide several kinds of payment services such as bill payment, direct debit, and tax payment as well as providing e-cheque as one of electronic money transferring service. Sources: The Thai Bankers’ Association – http://www.tba.or.th Bank of Thailand – http://www.bot.or.th