1. State Revenue

advertisement

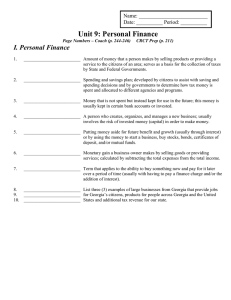

Sources of State Revenue SS8E4 The student will identify revenue sources for and services provided by state and local governments. a. Trace sources of state revenue such as sales taxes, federal grants, personal income taxes, and property taxes. Sources of State Revenue It costs money to run a state government. Where does this money come from? Sources of State Revenue Sales taxes- Also known as a “consumption tax,” a sales tax is paid on things that people buy and consume. These include items like cars or any merchandise you would buy from a store. Sources of State Revenue Federal Grants- The U.S. government gives states federal grants to help fund education or build interstate highways. Sources of State Revenue • Personal income taxes- States and the U.S. government tax the earnings of individual citizens and the money they earn from investments. • Taxes are due on April 15th each year. Sources of State Revenue Sources of State Revenue Property Taxes- Private homes, land, and business property are taxed according to their value. Property taxes are a major source of revenue for local government. Activity 1 Write T for true and F for False Who gets the Money? SS8E4 The student will identify revenue sources for and services provided by state and local governments. b. Explain the distribution of state revenue to provide services. Who Gets the Money? • State revenue is distributed among state and local programs to provide citizens with services like education, roads, public transportation, and police and fire protection. • Elected officials have to make choices to allocate limited funds for services that citizens need and want. Who Gets the Money? • How does a state decide how to spend its revenue? • The Georgia Constitution requires that the state government operate under an annual budget. The budget details how much revenue should be available, how much the government plans to spend, and where the money will be spent. • The General Assembly must pass legislation known as an “appropriation,” which permits spending from the budget. Who Gets the Money? • Many people and groups have input into the state budget. • They include the governor, the Office of Planning and Budget (OPB), a state economist, top officials in state departments and agencies, the legislature, special interest groups, and the state auditor. Balancing the Budget SS8E4 The student will identify revenue sources for and services provided by state and local governments. a. Evaluate how choices are made given the limited revenues of state and local governments. So Many Choices… • Spending choices are difficult because of the limited revenues of state and local governments. • In addition, state law requires that the Georgia budget must be balanced. This means that spending cannot exceed revenues—in other words, the state operating budget cannot go into debt. So Many Choices… • The budget process begins in the spring when state agencies submit their budget requests. • The head of each agency decides how much money he or she will need during the year. • In the fall, the OPB looks over the requests and decides what items must be cut or modified. So Many Choices… • The OPB considers what programs are important to the governor and the performance of each agency in previous years. • Finally, the governor’s budget proposal is presented to the General Assembly in January of each year. Balancing a Budget The state of Georgia requires a balanced budget. What are the positives and negatives of a balanced budget? Balancing a Budget The U.S. does not require a balanced budget. What are the positives and negatives of not having a balanced budget? Activity 2 Quick Quiz