Chapter 15 How Banks and Thrifts Create Money

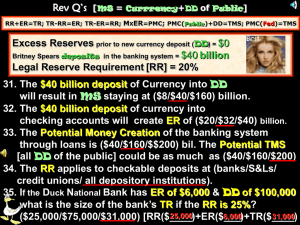

advertisement

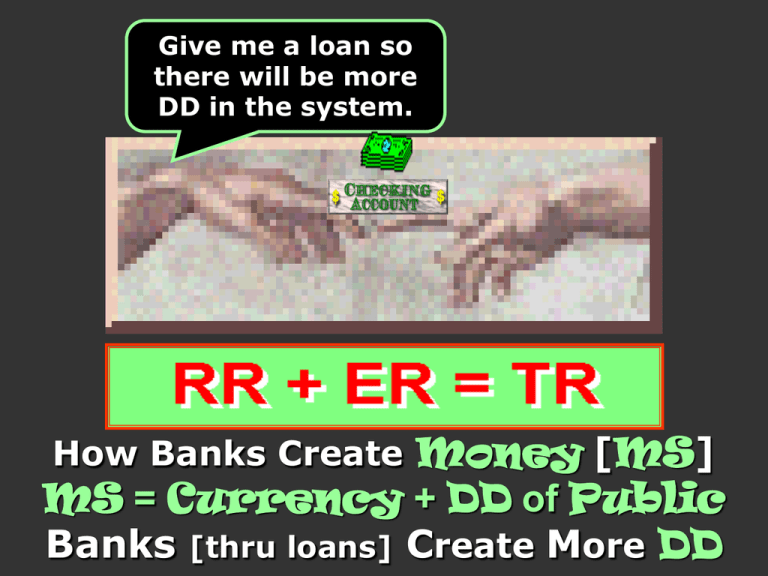

Give me a loan so there will be more DD in the system. How Banks Create Money [MS] MS = Currency + DD of Public Banks [thru loans] Create More DD 1. Fractional Reserve Banking System – a fraction of DD are kept in reserve(say, 10%) at either the bank’s vault or at the Fed. 2. Vault cash – cash held by a bank (banks rarely keep more than 2% of their in cash) 3. Required Reserve(RR)–specified percentage of DD that banks must keep as RR. 4. Excess reserves – total reserves(TR) – RR. ER is what can be loaned out. 5. 6. Also some ER is used to meet sudden withdrawal demands. Actual(Total) reserves – RR + ER. Deposit Multiplier – one/RR or 1/.10 or $1/10 cents or 10 Multipliers 1/RR[$1/5 cents = 20] 1/5% = 20 1/25% = 4 1/10% = 10 1/33.3%= 3 1/12.5% = 8 1/40 = 2.5 1/20% = 5 1/50% = 2 7. Balance Sheet–statement of assets & liabilities[assets=liabilities]. 8. Discount Rate – when banks borrow from the Fed. [symbolic-emergencies] “wholesale price of money” 9. Federal Funds Rate – banks borrow from other banks for overnight loans. 10. Prime Rate – when a bank’s prime customers [good credit] get loans. “retail price of money” 11. Buying Bonds – “buying” bonds means “bigger ” supply of money and “lower interest rates”. [So, more “C”, “Ig”, and “Xn” ] 12. Selling Bonds – “selling” bonds mea ns “smaller” supply of money and “higher interest rates”. [So, less “C”, “Ig”, and “Xn”] How Banks and Thrifts Create Money Dennis Rodman deposits $1 with A 10% RR Rodman’s .10 RR 90 cents Excess Reserves Total (Actual) Reserves One Dollar One bank’s loan becomes another bank’s DD. PMC = M x ER, so 10 x .90 =$9 TMS = PMC[$9] + DD[$1] = $10 [MS = Currency + DD of Public] Rodman’s Bank Borrows $1 From The Fed [10% RR] Rodman’s Bank 0 Fed One Dollar RR Excess Reserves Total(Actual) Reserves One Dollar PMC = M x ER, so 10 x $1 = $10 TMS [$10] = PMC[$10] [MS = Currency + DD of Public] BALANCE SHEET OF A COMMERCIAL BANK ASSETS [cash] = [The cash is property of the bank] Cash $100,000 LIABILITIES[DD] [“liable”, DDs are owed to depositors] DD $100,000 The Goldsmiths Fractional Reserve Banking System Money Creation & Reserves [The current 10% RR is kept in a bank’s vault or in a Fed vault.] Bank Panics and Regulation $1,000 DD by Calli [MS=Currency+DD of Public] New Deposits [New Reserves] DD Bank DD Created By New Loans [equal to new ER] New Required Reserves RR=10% A $1,000.00 $100.00 900.00 900.00 B 900.00 $90.00 810.00 C 810.00 $81.00 729.00 D 729.00 $72.90 656.10 PMC = ER[$900] x M[10] Erin’s DD + PMC $1,000.00 + $9,000.00 = = Dog that can YoYo One year “all u can eat” hot wings at Hooters $729.00 for a “cat bodyguard” PMC = $9,000.00 TMS Smoking cat $10,000.00 MS grows by multiple of 10 $1,000 DD by Marie [MS=Currency+DD of Public] New Deposits [New Reserves] Bank DD DD Created By New Loans [equal to new ER] New Required Reserves RR=20% A $1,000.00 $200.00 800.00 B 800.00 $160.00 640.00 C 640.00 $128.00 512.00 D 512.00 $102.40 + PMC $1,000.00 + $4,000.00 Purchase of a donkey Two Monkeys 409.60 PMC = ER[$800 x M[5] Marie’s DD Hair care for 1 year = = PMC = $4,000.00 TMS A chauffeur dog $5,000.00 MS grows by multiple of 5 $1,000 DD by Emily [MS=Currency+DD of Public] New Deposits [New Reserves] DD Bank DD Created By New Loans [equal to new ER] New Required Reserves RR=25% A $1,000.00 $250.00 750.00 B 750.00 $188.00 562.00 C 562.00 $140.00 422.00 D 422.00 $105.00 317.00 E 317.00 $80.00 237.00 PMC = ER[$750] x M[4] Em’s DD + PMC $1,000.00 + $3,000.00 PMC = $ = 3,000.00 Shark to keep in bathtub Prom date w. Linda Blair Frog with teeth Teach Stuart Little how to brush his teeth Cat with human teeth TMS = $4,000.00 MS grows by multiple of 4 MS = DD + Currency of the Public [A DD of $10,000 will increase MS by another $40,000($50,000 MS] RR=20% MS $10,000 $8,000 $6,400 $24,400 MS is $10,000 1. Joe Biker deposits $10,000 in his bank. RR = 20% 4. 2nd Bank lends Sports Shop $6,400. MS $10,000 $8,000 $18,000 2. Suzie Rah Rah borrows $8,000 5. Eventually the MS will be $50,000 Joe 3. Suzie pays $8,000 for a new car. GoNow Auto deposits the $ in 2nd Bank. $10,000+$40,000=$50,000 Most Famous “Panic Run” in Movie History Another Famous “Panic Run” in Movie History The children wanted to use their tuppance to buy bread crumbs to feed the pigeons, instead of investing it at the bank. When they said, “We want our money”, the other depositors thought it was a “bank run”. [nominated for a record 13 academy awards - won 6] History of Deposit Insurance In 1934, federal deposit insurance made its debut at $2,500 to protect the average family’s savings and end the bank runs that had shut down businesses and contributed to the Great Depression. Through the years the coverage rose in $5,000 increments until the 70s when it jumped to $40,000. In 1980, it was raised to $100,000. The Very Early Days Of Banking Greatest invention since sliced bread There were more claims to gold than there were ounces of gold. “Wow, you mean we can create money out of thin air.?” The fractional banking system began when someone issued claims for gold that already belonged to someone else. Once upon a time there was a gold-smithy who offered to store people’s gold in his vault. He issued paper receipts for the gold, and it was not long before the townsfolk used the paper to purchase eggs and beer. The smithy’s paper receipts [first checks] became as “good as gold.” Our Smithy was not stupid. He said to himself. “I have 2000 ounces of gold stored in my vault, but in the last year I was never called upon to pay out more than 100 ounces in a single day. What harm could it do if I lent out say, half the gold I now have? I’ll still have more than enough to pay off any depositors that come in for a withdrawal. No one will know the difference. I could earn 30 additional ounces of gold each week. I think I’ll do it.” “The smithy has invented the Fractional Reserve Banking System.” Advantages of Lending [One disadvantage was the possibility of “bank runs”] 1. Depositors haven’t lost money [Goldsmiths paid them instead of other way] 2. With the interest you earned you could give some to depositors. 3. The loans benefited the community thru loans FORMATION OF A COMMERCIAL BANK In Lovelady, Texas ASSETS [own] LIABILITIES & NET WORTH [owe] TRANSACTION 1 Creating a bank $250,000 Cash for Capital Stock FORMATION OF A COMMERCIAL BANK In Lovelady, Texas LIABILITIES & NET WORTH [owe] ASSETS [own] Cash $250,000 Capital Stock $250,000 Deposit Added to Vault Cash FORMATION OF A COMMERCIAL BANK In Lovelady, Texas LIABILITIES & NET WORTH [owe] ASSETS [own] Cash $250,000 TRANSACTION 2 Acquiring Property and Equipment $240,000 Cash Capital Stock $250,000 Birth OF A COMMERCIAL BANK In Lovelady, Texas ASSETS [own] Cash Property LIABILITIES & NET WORTH [owe] $ 10,000 240,000 Capital Stock Lovelady Bank $250,000 FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank ASSETS Cash Property LIABILITIES and NET WORTH $ 10,000 240,000 Capital Stock $250,000 TRANSACTION 3 Accepting Deposits $100,000 Cash $250,000 $250,000 FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank LIABILITIES and NET WORTH ASSETS [Was $10,000] Cash Property $110,000 $240,000 DD Capital Stock $100,000 250,000 FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank ASSETS [Was $10,000] Cash Property LIABILITIES and NET WORTH $110,000 240,000 $350,000 DD Capital Stock $100,000 250,000 $350,000 FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank ASSETS Cash Property LIABILITIES & NET WORTH $110,000 240,000 $350,000 TRANSACTION 4 A $50,000 check is written against the bank DD Capital Stock $100,000 250,000 $350,000 FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank ASSETS [was $110,000] Cash Property LIABILITIES & NET WORTH $ 60,000 240,000 $300,000 DD Capital Stock $ 50,000 250,000 $300,000 FORMATION OF A COMMERCIAL BANK In Lovelady, Texas NOTES: Banks create money by lending ER and destroy money by loan repayment. Purchasing bonds from the public also creates money. FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank LIABILITY and NET WORTH ASSETS Cash Property $ 60,000 240,000 TRANSACTION 5 Make a loan from excess reserves of $50,000 DD Capital Stock $ 50,000 250,000 FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank LIABILITIES and NET WORTH ASSETS Cash Loans Property $ 60,000 50,000 240,000 DD Capital Stock Making the loan created money! $100,000 250,000 FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank LIABILITIES AND NET WORTH ASSETS Cash Loans Property $ 60,000 0 240,000 DD Capital Stock $ 50,000 250,000 After a check for the $50,000 is written against the bank Balance Sheet: Lovelady Bank [Joe Bozo buys 50 HP computers at $1,000 each, so writes $50,000 check to Best Buy in Hateman, Texas] Joe Bozo Federal Reserve Bank of Dallas Assets Liabilities & Net Worth FEDERAL RESERVE BANK OF THE U.S. Dallas Big “D” (c) Cleared check is returned to Lovelady Bank Reserves -$50,000 Lovelady Bank (b) Hateman Bank sends check for collection Hateman Bank Lovelady Bank Assets Reserves of Lovelady Bank - $50,000 Reserves of Hateman Bank + $50,000 Liabilities & Net Worth Assets DD -$50,000 Reserves Liabilities & Net Worth +$50,000 DD +$50,000 Hateman Bank (a) Joe Bozo pays Best Buy (a) Joe Bozo pays Best Buy with a $50,000 check. a $50,000 check And What Happens If A Turtle Doesn’t Keep Up with His Mortgage Payments This turtle is subject to foreclosure on his house. Here, he has lost his house. FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank ASSETS Reserves Loans Property LIABILITIES and NET WORTH $ 10,000 50,000 240,000 TRANSACTION 6 Repaying a loan with cash $50,000 DD Capital Stock $ 50,000 250,000 FORMATION OF A COMMERCIAL BANK In Lovelady, Texas Lovelady Bank ASSETS Reserves Loans Property LIABILITIES and NET WORTH $ 10,000 0 240,000 DD Capital Stock $0 250,000 $50,000 in money supply is destroyed! MULTIPLE DEPOSIT EXPANSION PROCESS RR= 20% Bank Acquired reserves Required and deposits reserves A $100.00 B 80.00 C 64.00 D 51.20 E 40.96 F 32.77 G 26.22 H 20.98 I 16.78 J 13.42 K 10.74 L 8.59 M 6.87 N 5.50 Other banks 21.97 $20.00 16.00 12.80 10.24 8.19 6.55 5.24 4.20 3.36 2.68 2.15 1.72 1.37 1.10 4.40 P MC in the banking system [MxER] Excess reserves $80.00 64.00 51.20 40.96 32.77 26.22 20.98 16.78 13.42 10.74 8.59 6.87 5.50 4.40 17.57 Amount bank can lend - New money created $80.00 64.00 51.20 1st 40.96 10 32.77 $357 26.22 of 20.98 the 16.78 $400 13.42 10.74 8.59 6.87 5.50 4.40 17.57 $400.00 TMS = $500.00 THE Money [Deposit] MULTIPLIER MM = 1 RR The MM is the reciprocal of the RR. Maximum Potential money checkableCreation in the Bankingdeposit System expansion [PMC] = ER x MM Ashley Olsen Deposits $1,000 in her bank RR = 25% Ashley Olsen’s $1,000 New reserves $750 $250 Excess reserves RR Ashley Olsen deposits $1,000 $3,000 PMC thru bank lending TMS = $4,000 $1,000 Initial Deposit Fed Buys A $1,000 Bond From Ashley’s Bank Ashley Olsen’s New reserves $1,000 Excess Reserves 25% RR $4,000 PMC thru Bank Lending TMS is $4000 NS 31-35 AP Econ [MS = Currrency + DD of Public] RR+ER=TR; TR-RR=ER; TR-ER=RR; MXER=PMC; PMC(Public)+DD=TMS; PMC(Fed)=TMS Excess Reserves prior to new currency deposit (DD) = $0 Britney Spears deposits in the banking system = $40 million Legal Reserve Requirement [RR] = 20% 31. The $40 million deposit of Currency into DD would result in MS staying at ($8/$40/$160) million. [MS composition changed from currency to DD] 32. The $40 million deposit of currency into checking accounts will create ER of ($20/$32/$40) million. 33. The Potential Money Creation of the banking system through loans is ($40/$160/$$200) mil. The Potential TMS [all DD of the public] could be as much as ($40/$160/$200) mil. 34. The RR applies to checkable deposits at (banks/S&Ls/ credit unions/ all depository institutions). 35. If the Duck National Bank has ER of $6,000 & DD of $100,000 what is the size of the bank’s TR if the RR is 25%? 25,000 6,000 31,000 ($25,000/$75,000/$31,000) [RR($____)+ER($___)+TR($____) NS 36-45 [MS = Currrency+DD of Public] RR+ER=TR; TR-RR=ER; TR-ER=RR; MXER=PMC; PMC(Public)+DD=TMS; PMC(Fed)=TMS 36. A stranger deposits $1,000 in a bank that has a RR of 10%. The maximum possible change in the dollar value of the local bank’s loans would 900 be $______. PMC[M X ER] in the banking system is $_____. 9,000 Potential TMS 10,000 could become as high as $_______. 37. Suppose a commercial bank has DD of $100,000 and the RR is 10%. If the bank’s RR & ER are equal, then its TR are ($10,000/$20,000/$30,000). 38. Total Reserves (minus/plus) RR = ER. 39. Suppose the Thunderduck Bank has DD of $500,000 & the RR is 10%. If the institution has ER of $4,000 then its TR are ($46,000/$54,000/$4,000). 40. If ER in a bank are $4,000, DD are $40,000, & the RR is 10%, then TR are ($4,000/$8,000). 41. The main purpose of the RR is to (have funds for emergency withdrawals/ influence the lending ability of commercial banks). 42. If I write you a check for $1 & we both have our checking accts at the Poorman Bank, the bank’s balance sheet will (increase/decrease/be unchanged). 43. Banks (create/destroy) money when they make loans and repaying bank loans (create/destroy) money. 44. When a bank loan is repaid the MS is (increased/decreased). 45. The Fed Funds rate is a loan by one bank (to another bank/from the Fed). NS 46-47 [MS = Currrency+DD of Public] RR+ER=TR; TR-RR=ER; TR-ER=RR; MXER=PMC; PMC(Public)+DD=TMS; PMC(Fed)=TMS 46. If the RR was lowered [say, from 50% to 10%], the size of the monetary multiplier [MM] would (increase/decrease). Leakages (limitations) of the Money Creating Process 1. Cash leakages [taking part of loan in cash] 2. ER (banks don’t loan it or we don’t borrow] 47. If borrowers take a portion of their loans as cash, the maximum amount by which the banking system increases the MS by lending will (increase/decrease). Money Supply = DD + Currency of the Public ER “PMC” Loans $100[10% RR] [1st Bank] [1st Bank] Banks/Public DD [$100] $90 $90 Fed /Public/Banks DD[$100] $90 $90 “PMC” Crea. In “TMS” “Potential” System Total MS $900 $1,000 $900 $1,000 [*Fed buys bonds from public who put the money in their DD] Banks/Fed Fed Loan[$100] $100 [or sells bonds to Fed] ER $100 “PMC” Loans $1,000 $100 [20% RR] [1st Bank] [1st Bank] Banks/Public DD [$100] $80 $80 Fed/Public/Banks DD [$100] $80 $80 “PMC” Crea. In $1,000 “TMS” “Potential” System Total MS $400 $500 $400 $500 [*Fed buys bonds from public who put the money in their DD] Banks/Fed Fed Loan[$100] $100 [or sells bonds to Fed] $100 $500 $500 Sanjaya Deposits $1,000 In His Bank [RR is 20%] New reserves $800 $200 Excess Reserves RR Sanjaya’s Sanjaya [member of the public] $4000 PMC thru Bank Lending TMS is $5,000 $1000 Initial Deposit Fed buys a $1,000 Bond from Sanjaya’s Bank New reserves 20% RR Fed $1,000 Sanjaya’s Excess Reserves $5,000 PMC thru Bank System Lending TMS is $5000 Eva Longoria Deposits $1 with a 20% RR Eva Longoria’s .20 80 cents RR Excess Reserves Total(Actual) Reserves One Dollar PMC = M x ER, so 5 x .80 = $4 TMS = PMC[$4] + DD[$1] = $5 [MS = Currency + DD of Public] Eva’s Bank Borrows $1 From The Fed [20% RR] Fed Eva Longoria’s 0 RR One Dollar Excess Reserves Total(Actual) Reserves One Dollar PMC = M x ER, so 5 x $1 = $5 TMS [$5] = PMC [$5] [MS = currency + DD of Public] $1,000 DD by Katy New Deposits [New Reserves] DD Bank [MS=Currency+DD of Public] DD Created By New Required Reserves New Loans [equal to new ER] RR=50% A $5,000.00 $2,500.00 2,500.00 B 2,500.00 $1,250.00 1,250.00 C 1,250.00 $625.00 625.00 D 625.00 $312.50 312.50 PMC = ER[$2,500 x M[2] Katy’s DD + PMC $5,000.00 + $5,000.00 = = PMC = $5,000.00 Duck that can dance Dance Lessons w. Laura Bush Hunting with Dick Cheney Prom Dance lessons with N. Dynamite TMS $10,000.00 MS grows by multiple of 2 Money Creation Formulas [MS = Currency + DD of public] Public RR + ER = TR TR - RR = ER TR - ER = RR Public: Student deposits $1.00 in a bank 1. ER [DD-RR] x MM = PMC 2. PMC + 1st DD =TMS Fed No Public: [Fed gives $1.00 loan to a bank] 1. ER x MM = PMC & TMS Banks and the Fed [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=TMS] MS = Currency + DD of Public [Money borrowed from the Fed [or gained thru bond sales] is ER & can be loaned out] 9. RR is 25%; Econ Bank borrows $25,000 from the Fed; its ER are increased by 25,000 Potential Money Creation in the system is $_______. $______. 100,000 100,000 Potential TMS is $_______. 10. RR is 50%; a bank borrows $20,000 from the Fed; this one bank’s ER are increased 40,000 40,000 Potential TMS is $______ by $_____. 20,000 Potential Money Creation in the system is $______. 11. RR is 20%; the Duck Bank sells $10 M of bonds to the Fed; Duck Bank’s ER are increased by $___million. PMC in the system is $__________. 50 million 50 million TMS is $__________. 10 12. RR is 20%; Fed buys $50,000 of securities from Keynes Bank. Its ER are increased by $___________. Potential Money Creation in the banking system is 50,000 $______________. Potential TMS is $___________. 250,000 250,000 13. 25% RR; Fed buys $400 million of bonds from the Friar Bank. This one 400 bank’s ER are increased by $_____million. 14. RR is 50%; the Fed sells $200 million of bonds to a bank; its ER are (increased/decreased) by $_______. 200 M Potential Money Creation in the 400 M banking system is (increased/decreased) by $________. 15. RR is 10%; a bank borrows $10 million from the Fed; this one bank’s ER are increased by $_______ million. PMC in the banking system is 10 $_______million. Potential TMS is $_______million. 100 100 Banks and the Public RR+ER=TR; TR-RR=ER; TR-ER=RR; M x ER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=TMS MS = currency + DD of Public Banks & Public (all DD of Public are subject to the RR; rest is ER & can be loaned out) 1. No ER & RR is 20%; DD of $10 M is made in the Thunder Bank. MS is $___million. ER increase by $___million. Potential Money Creation in the 10 8 banking system is $_____M. Potential TMS is $____million. 40 50 2. There are no ER & RR is 25% & $16,000 is deposited in the Duck Bank. MS is $_______. 16,000 This one bank can increase its loans by a maximum of 48,000 $_______. 12,000 Potential Money Creation in the banking system is $_______. 64,000 Potential Total Money Supply could be $__________. 3. Econ Bank has ER of $5,000; DD are $100,000; RR is 25%. TR are $_______. 30,000 4. DD are $10,000; ER are $1,000; TR are $3,000; RR are $2,000 _________. [TR-ER=RR]. $50,000 5. Nomics Bank has ER of $10,000; DD of $100,000; RR of 40%. TR are _________. With ER above, Potential Money Creation in the banking system is $__________. 25,000 6. Friar Bank has DD of $100,000; RR is 20%; RR & ER are equal. TR are $________. 40,000 7. If ER in a bank are $10,000; DD are $200,000, & the RR are 10%. TR are $_______. 30,000 100,000 This single bank can 8. No ER & RR is 25%. DD of $100,000 is made. MS is $_______. 75,000 PMC in the system is $________. increase its loans by $_______. 300,000 TMS is $________. 400,000 Fed and the Public [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=TMS] MS = Currency + DD of the Public [When Fed buys securities from Public, they will put the money in their DD] 16. RR is 50%; Fed buys $10 M of bonds from the Public. MS is increased by _______. $10 M $20 M ER are increased by $5 ____. _______. M PMC in the system is $10 M Potential TMS is _______. 17. RR is 25%; Fed buys $100 M of bonds from the Public. The MS is increased _______. $100 M ER are increased by ______. _______. ________. $75 M PMC in the system is $300 M Potential TMS is $400 M 18. RR is 50%; Fed sells $200 M of bonds to the Public. The MS is (incr/decr) by $100 M PMC in the banking system is __________. $200 M ER are (incr/decr) by _________. M (increased/decreased) by $200 _______. __________. M Potential TMS is (incr/decr) by $400 19. RR is 20%; Fed buys $5 million of securities from the Public. The MS $5 M ER are increased by _______. is increased by _______. $4 M Potential Money $25 M M Potential TMS is _________. Creation in the banking system is$20 _______. 20. RR is 10%; Fed buys $50 million of bonds from the Public. The MS is $50 M ER are increased by _______. $45 M PMC in the banking increased by _______. $500 M $450 M Potential Total Money Supply is __________. system is __________. 1. The RR is 20% & Boo Radley deposits $10,000 in the Econ Bank that he has been saving in a coffee can in a tree. The impact of this transaction on the ER of the Econ Bank & the potential increase in the money supply would be: [Remember: MS = Currency + DD of public] (A) ER would increase by $10,000 & the maximum increase in TMS would be $50,000. (B) ER would increase by $8,000 & the maximum increase in TMS would be $50,000 (C) ER would increase by $8,000 & the maximum increase in MS would be $40,000 (D) ER would increase by $10,000 & the maximum increase in MS would be $40,000. (E) ER would increase by $40,000 & the maximum increase in MS would be $50,000. Boo The MS [Cash or DD of the public] was $10,000 cash. When he deposited the $10,000, the Econ Bank could loan out ER of $8,000. The $8,000 x MM of 5 became $40,000 for TMS of $50,000. So, $10,000 MS of cash increased MS by $40,000 to get the total money supply of $50,000. Boo 1. RR is 20% & Boo Radley’s Bank borrows $10,000 from the Fed. The impact of this loan on the bank’s ER and then TMS are: [Remember again: MS = Currency + DD of public] (A) ER would increase by $10,000 & the maximum increase in TMS would be $50,000. (B) ER would increase by $8,000 & the maximum increase in TMS would be $50,000 (C) ER would increase by $8,000 & the maximum increase in MS would be $40,000 (D) ER would increase by $10,000 & the maximum increase in MS would be $40,000. (E) ER would increase by $40,000 & the maximum increase in MS would be $50,000. All of the $10,000 loan would be ER. Boo Bank could loan it all out so it could result in a PMC and TMS of $50,000. [MM of 10 x $10,000 = $50,000] Suppose that all banks keep only the minimum reserves required by law and that there are no currency drains. The legal RR is 10%. If Emilia deposits the $100 bill she received as a graduation gift from her grandfather into her checking account, the maximum increase in the total money supply will be a. $10 b. $100 c. $900 d. $1,000 e. $1,100 Remember that currency is also MS. So, the $100 bill was MS when this began. When little Emilia deposited the $100, the composition of the MS didn’t increase. It just changed from currency to DD. Now, with the RR at 10%, $90 was loaned by the first bank and with a MM of 10, the MS increased by $900 more as the TMS eventually became $10,000. [MS=Curr. + DD of Public] [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC(Public)+1stDD=TMS; PMC(Fed)=TMS] Commercial Banks Fed Public 1. The Hale Bank [with no ER] borrows $100,000 from the Fed. With RR of 50% $100,000 the Hale Bank can increase its loans by a maximum of __________. PMC in $200,000 Potential TMS is ______________. the banking system is __________. $200,000 $2,000 2. The Davis Bank has DD of $10,000; RR is 10%; RR & ER are equal. TR are ______. 3. RR is 20%; Fed buys $50,000 of securities from the public [Sarah Palmer] $200,000 Potential TMS is ____________. PMC in the banking system is __________. $250,000 4. RR is 40%; Buzon Bank borrows $1 million from the Fed. This bank can increase 1 million $2.5 mil. TMS is __________. $2.5 M its loans by a maximum of $_______ __. PMC is __________. 5. RR is 10% & there are no ER; $10,000 is deposited in the Rodriquez Bank. $9,000 Possible Money This bank can increase its loans by a maximum of __________. $100,000 Creation in the banking system is ___________. $90,000 Potential TMs is _____________. 6. There are no ER in the Vehslage Bank. Nicole now deposits $10.00. With $40.00 Potential TMS is ___________. $50.00 a RR of 20%, PMC in the system is __________. 7. The Terrones Bank has a RR of 50%; the Fed buys $50 million of bonds from this bank. PMC in the system is __________. $100 M Potential TMS is __________. $100 M $70,000 8. Marin Bank has ER of $50,000; DD of $100,000, & a RR of 20%. TR are ________. 9. RR is 40%; the Collins Bank borrows $10 million from the Fed. This bank’s ER $25 M $25 M are increased by _________. Potential TMS is ___________. $10 M PMC is __________. 10. RR is 10%; Tran Bank borrows $5 from the Fed; the Tran Bank’s ER $5.00 PMC is __________. are increased by _______. $50.00 Potential TMS is __________. $50.00 [MS = Currency + DD of Public] [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=PMC] Banks Fed Public $100,000 1. RR is 25% & the Boase Bank has no ER. Geof deposits(DD) $100,000 there. This bank can increase its loans by a maximum of $75,000 ______. PMC is $300,000 ______. TMS is $400,000 _______. 2. RR is 50%; the Stansbury Plaza Bank borrows $100,000 from the Fed. This one bank can $100,000 PMC is$200,000 increase its loans by a maximum of ________. _______. TMS is $200,000 ________. 3. RR is 25%; Fed buys $100,000 of securities from the public [Mary Gangel]. Potential Money Creation in the system is $300,000 ________. Potential TMS is _________. $400,000 4. The Curtis Bank has DD of $200,000; RR is 10%; RR & ER are equal. TR are _______. $40,000 5. The Recsnik Bank, with no ER, borrows $200,000 from the Fed. With a RR of 10%, $2 million this bank can increase its loans by _________. $200,000 PMC in the system is __________. 6. RR is 20%; the Morell Bank borrows $1 from the Fed; this bank can increase its loans by a maximum of _________. $1.00 PMC in the banking system is __________. $5.00 7. RR is 50%; the Cusimano Bank borrows $1 million from the Fed; this bank’s ER million TMS is $2 are increased by $1 _______. __________. __________. million mil. PMC in the system is $2 8. The Masters Bank has ER of $20,000; DD of $200,000, & a RR of 10%. TR are ______. $40,000 9. RR is 25%; Fed buys $100 million of bonds from the Green Bank. Potential $400 million $400 mil. Potential TMS is ____________. Money creation in the banking system is ________. 10. There are no ER in the Farrell Bank. Erin deposits $2.50. With RR of 20%, $12.50 PMC in the banking system is ____________. Potential TMS is _____________. $10.00 [MS = Curr. + DD of Public] [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC;PMC(Public)+1st DD=TMS; PMC(Fed)=TMS] Commercial Banks Fed Public 1. RR is 5% & there are no ER in the Vehslage Bank. Trey deposits[DD] $1.00 there. This one bank can increase its loans by a maximum of _______. .95 2. RR is 25%; the Rigal Bank borrows $1 million from the Fed. $1 million This one bank can increase its loans by a maximum of ____________. 3. RR is 50%; the Fed buys $100,000 of securities from the public [Kate Wells]. $100,000 Potential Money Creation in the banking system is ____________. 4. The Secker-Dog Killing Bank has DD of $400,000; RR is 10%; RR & ER are equal. $80,000 TR are ____________. 5. The Terrones Bank , with no ER, borrows $500,000 from the Fed. With a RR $500,000 of 10%, how much can this single bank increase its loans? ____________ 6. RR is 20%; the Fed buys $25,000 of securities from the public [Natalie Marin]. Potential Money Creation in the banking system is ____________. $100,000 7. RR is 20%; the Rodriquez-Loser Bank borrows $1 million from the Fed. $1 million This single bank’s ER are increased by ____________. 8. RR is 25%; Fed buys $200 million of securities from the public [Rose]. $800 million Potential Total Money Supply[TMS] could be as much as _______________. 9. The RR is 25% & the Fed buys $10 million of bonds from the Hicks Bank. $30 million Potential Money Creation in the banking system could be ____________. 10. There are no excess reserves in the Stansbury Bank. With RR of 50%, Courtney $50.00 deposits [DD] $50.00 there. Potential Money Creation in the system is _________. RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC[Public]+1st DD=TMS; PMC[Fed]= TMS 1. If the RR is 40% and the Fed buys $100 M of bonds from $100 M ER are the public [Sarah], then the MS is increased by _______. $60 M PMC is _______. $150 M TMS would be ______. $250 M increased by ______. 2. RR is 50% and the Bolding Bank borrows $100 M from the 0 Fed. As a result, RR are increased by ______. ER is increased $200 M $100 M by _______. PMC and TMS is increased by ________. 3. Collins Bank has DD of $400,000 and the RR is 25%. If RR $200,000 and ER are equal, then TR are _______. 4. The Tran Bank has ER of $60,000 & DD is $200,000. $100,000 If the RR is 20%, TR are _________. 5. RR is 20% & the Fed buys $50 million of bonds from the $50 M ER are increased public [Geof B.]. The MS is increased by _______. $200 M $250 M $40 M by _______. PMC is _______. TMS would be _________. Banks Public Fed Money Creation Problems from the 2005 Macro MC Exam (87%) 40. Under a fractional reserve banking system, banks are required to a. keep part of their demand deposits as reserves b. expand the money supply when requested by the central bank c. insure their deposits against losses and bank runs d. pay a fraction of their interest income in taxes e. charge the same interest rate on all their loans (72%) 41. If a commercial bank has no ER and the RR is 10%, what is the value of new loans this single bank can issue if a new customer deposits $10,000? a. $100,000 b. $90,333 c. $10,000 d. $9,000 e. $1,000 The TR: $15,000, Securities: $70,000, and Liabilities Loan: $15,000 total up to the $100,000 DD. DD: $100,000 This bank would have to keep $12,000 of their $100,000 in RR. With TR of $15,000, they have $3,000 in ER to loan. Assets Total Reserves: $15,000 Securities: $70,000 Loan: $15,000 (37%) 42. A commercial bank is facing the conditions given above. If the RR is 12% and the bank does not sell any of its securities, the maximum amount of additional lending this bank can undertake is a. $15,000 b. $12,000 c. $3,000 d. $1,800 e. 0 (53%) 43. Assume the RR is 20%, but banks voluntarily keep some excess reserves. A $1 million increase in new reserves will result in They could increase M, but a. an increase in the MS of $5 million c. decrease in MSMS of by $1 $5 million they keeping in ER, somillion MS b. an increase in the MS of less than $5 million d. are decrease insome the MS of $5 will increase by less than $5 million. e. a decrease in the MS of more than $5 million The End