UsingTraditional Advertising Media

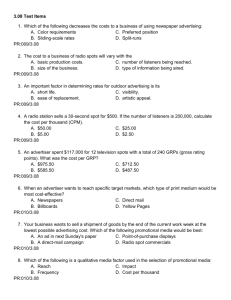

advertisement

Chapter Fourteen Using Traditional Advertising Media 2007 Thomson South-Western Chapter Fourteen Objectives • Describe the four major traditional advertising media. • Discuss newspaper advertising and its strengths and limitations. Chapter Fourteen Objectives • Evaluate magazine advertising and its strengths and limitations. • Discuss radio advertising and its strengths and limitations • Discuss television advertising and its strengths and limitations Traditional Major Advertising Media Out-of-home advertising Magazines Newspaper Radio Television Advertisers attempt to select the media and vehicles whose characteristics are most compatible with the advertised brand in reaching its target audience and conveying its intended message Which Media Do It Best? Consider: •Advertiser’s objectives •Creative needs •Competitive challenge •Budget availability Buying Newspaper Space Standard Advertising Units (SAU) Six column widths 1 column=2 1/16 inches Depth from 1” to 21 Premium charges for preferred space Space rates apply to ROP (Run of Press) Newspaper • Audience in right mental frame • Mass audience coverage • Flexibility • Ability to use detailed copy • Timeliness • Clutter • Not highly selective • Higher rates for occasional advertisers • Mediocre reproduction quality • National Buying complicated • Changing composition of readers Buying Magazine Space • Selecting magazines that reach the target market • Cost considerations – Media Kits – CPM (Cost-per-thousand) – Mediamark Research, Inc. (MRI) – Simmons Market Research Bureau (SMRB) Magazine • • • • • • Can reach large audiences Selectivity Long life High reproduction quality Detailed information possible Convey information with authority • High involvement potential • • • • Not intrusive Long lead times Clutter Limited geographic options • Circulation patterns vary by market Magazine Audience Measurement • The number of subscriptions to a magazine and the number of people who read the magazine are not equivalent. • MRI and Simmons specialize in measuring magazine readership and determining audience size. • Each use different research methods, and their results are often discrepant. The advertiser must weigh: • The size of the potential audience that a vehicle might reach. • The attractiveness of its coverage as revealed by the total product purchasers exposed to that vehicle and compared with other media. • Its cost compared with other vehicles • Its appropriateness for the advertised brand Radio Advertising • Over 11,000 commercial radio stations in the U.S. • Nearly 100% of home and cars have radios. • Radio reaches about 94% of all persons ages 12 and over. Buying Radio Time • Matching station format with target market • Geographic coverage using ADIs • Day part choice Radio • Can reach segmented audiences • Intimacy • Economy • Short lead times • Transfer of imagery from TV • Use of local personalities • Clutter • No visuals • Audience fractionalization • Buying difficulties Radio Audience Measurement • Arbitron is the major company involved with measuring listenership and audience demographics. • RADAR (Radio’s All Dimension Audience Research) • Arbitron uses a paper-based diary approach to measure listener behavior. • Navigauge new service tracks radio-listening behaviors in motor vehicles using continuous tracking devices. Television Advertising • Slightly more than 98% of all households have televisions • Uniquely personal and demonstrative, yet expensive to produce and broadcast Television Programming Segments 8p.m.-11p.m. (7p.m.-10p.m.) Prime Time Early morning news - 4:30p.m. Daytime Preceding and following prime time Fringe Time Television Network Spot Syndicated Cable Local • Market product nationally • Major networks (ABC, CBS, Fox, NBC) • Expensive but can be a cost efficient means to reach mass audience Television Network Spot Syndicated Cable Local • Advertising is placed only in selected markets • Regional-oriented marketing and geodemographic segmentation of consumer markets Television Network Spot Syndicated Cable Local Syndicated programming occurs when an independent company markets a TV show to as many network-affiliated or cable TV stations as possible Television Network Spot Syndicated Cable Local • 80% of households with television sets • Narrow areas of viewing interest • Cable subscribers are more economically upscale and younger Television Network Spot Syndicated Cable Local • Local advertisers are turning to television • Inexpensive during the fringe time Television • Demonstration ability • Intrusion value • Ability to generate excitement • One-on-one reach • Ability to use humor • Effective with sales force and trade • Ability to achieve impact • Escalating costs • Erosion of audience • Audience fractionalization • Zipping and zapping • Clutter Infomercials • • • • Introduced in the early 1980s Long commercial (28 to 30 minutes) The production cost is expensive Especially effective promotional tool for moving merchandise Brand Placements in TV Programs • Reason: fear that TV advertising is no longer as effective as it used to be • Brand managers pay to get prominent placement for their brands • “Survivor” program is the poster child for this trend • Advertisers who purchased commercial time in “Survivor” got prime brand placement in the program Television Audience Measurement • Higher rated programs command higher prices • Ratings are difficult to come by accurately • One primary rating service—Nielsen’s People Meter and one under development—SRI’s SMART System Measuring Away-from-Home Viewers and Listeners • College students viewing TV in dorms and people consuming radio and TV at bars, gyms, and restaurants are not accounted for in the typical at-home viewing measurements. • Nielsen and Arbitron are testing PPM (portable people meter) technology that can track radio and TV exposure at any location. • Competition has come and gone and Nielsen remains the one company measuring TV viewership.