Money, Output, and Inflation

advertisement

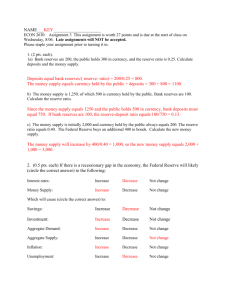

FIN 30220: Macroeconomic Analysis Money, Output, and Prices Why does this piece of paper (cloth, actually)have value? In the early 1920’s, Germany experienced a period where the monthly inflation rate was 29,500% per month! Prices doubled roughly every four days!!! Money was more valuable as the paper it was printed on! Using money to stoke a furnace! All time top inflation rates Hungary (1946) • 13,600,000,000,000,000 %/mo. • Prices double every 15 hours Zimbabwe (2008) • 79,000,000,000 %/mo. • Prices double every 24.7 hours Yugoslavia (1994) • 313,000,000 %/mo. • Prices double every 34 hours What is Money? ANY commodity that satisfies three basic properties can be called money Unit of Account Store of Value Medium of exchange “I can’t define it, but I know it when I see it!” Throughout history, many different commodities have been used as money The earliest money was commodity money whose value comes from the commodity itself Cowrie Shells Cocoa Beans Animal Skins Salt Tobacco Leaves Precious Metals Coinage began with King Sadyattes of Lydia, most commonly dated to 630-620 BC. While remaining a topic of debate by some, this type is now commonly considered to be the first official coin, meeting all of the requirements laid out in the dictionary definition: it is the first coin to have certified markings which signify a specific exchange value and be issued by a governmental authority for use as money. The Chinese were also developing metal coins around 600BC …and time marches on…. Leonidas I Sparta C. 480BC Alexander the Great C. 330BC Julius Caesar Romans C. 120AD Constantine I Byzantine Empire C. 330AD Charlemagne Franks C. 800AD Henry VIII England C. 1520AD Can you guess who these people are? Cleopatra and Mark Antony Egypt. 80-77BC Elizabeth Taylor and Richard Burton from the 1963 film “Cleopatra” The English Penny was introduced around 785AD by King Offa of Mercer. Originally, it was a coin of 1.3 - 1.5 grams of pure silver The penny was eventually standardized to 1/240 of a Tower pound (350g) of 92.5% silver (sterling silver)…this was later switched to 1/240 of a Troy pound (373g) Note: Avoirdupois LB = 453G From the time of King Offa, the penny was the only denomination of coin minted in England for 500 years, until the gold coinage issue of King Henry III around 1257 AD. Early on, the colonies (being British colonies) used British money Pound (20 shillings) Guineas or Sovereigns were gold coins with a value of one pound sterling Shilling (12 pence) All these coins are during the reign of Charles I (1625 – 1649). Inadequate supply of British money put commerce in jeopardy in the colonies. Pence (Penny) Taking matters into their own hand, Boston authorities allowed John Hull and Robert Sanderson to set up a mint in 1652. “Pine Tree” shillings were minted until 1674 when the mint was shut down All the coins bear the date 1652. Why? Coinage was the sole prerogative of the king, but in 1652 there was no king (King Charles I had been beheaded three years earlier). They kept the date so they could deny any illegality if and when a monarchy was once again reestablished which it was in 1660. Spain established a mint in what is now Mexico City in 1535. Spanish ships returning to Europe would stop off in the colonies to buy supplies. This made Spanish money widely available in the colonies. Spanish dollar = 8 Reals (.88 ounces of silver) Doubloon = 4 dollars (1/5 oz. of gold) 2 Bits is still considered slang for a quarter! Spanish coins remained legal tender until the coinage act of 1857! The Constitution (1787) gives the congress the right to “To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures” (Section 8, Clause 5) On April 2, 1792 Congress passed the coinage act which created the mint. The Coinage Act of 1792 defined a US Dollar as .0538 ounces of pure gold or .86 ounces of pure silver (15:1 ratio) – same (almost) as the Spanish dollar The US mint began production in 1793 US coins made in 1792 were not minted for circulation and are EXTEMELY valuable. This 1792 penny sold for $603,750! Where does the dollar sign come from? US Imagine a U and an S (for United States overlapping) The dollar was fashioned after the Spanish peseta - the P stands for Peseta, the “s” makes it plural (what if the P and S overlap), the line indicates an abbreviation S PP 8 The back of a Spanish peseta had two columns (the pillars of Hercules) wrapped with a scroll that reads “plus ultra”beyond the pillars, there are other lands. Could this be the origin of the dollar sign? All American coins must have “an impression emblematic of liberty and the word liberty as well as the year. On the reverse of copper coins was required the denomination. The first circulated penny was released in 1793 The “Chain link penny” caused a lot of controversy..many believed that the chains represented slavery! The chain was immediately replaced with a victory wreath. Note that from 1793 to 1857, the cent was larger than a modern quarter Half penny 1793 On the reverse of gold and silver coins will be an eagle and “United states of America” . Denominations didn’t begin showing up on silver coins until 1804 Half dime introduced in 1794 1794: US Half dollar The dime was first issued in 1796 Quarter: 1796 1794: US dollar (A gold dollar was released in 1849) Production of silver coins ceased in 1964 On the reverse of gold and silver coins will be an eagle an “United states of America” . Denominations didn’t begin showing up on gold coins until 1807 1796: Quarter Eagle ($2.50) US Half eagle ($5) - 1796 US eagle ($10) - 1795 US double eagle ($20) - 1849 Production of gold coins ceased in 1934 1909: Lincoln appeared on the cent to commemorate the 100 anniversary of his birth 1932, George Washington appears on the quarter 1938: Jefferson appears on the nickel 1946: FDR appears on the dime due to his big support for the march of dimes 1964: JFK appears on the half dollar Women finally made it onto US coins! Susan B. Anthony was the first non-mythical woman to appear on a US coin in 1978 Sacagawea followed in Susan’s footsteps in 2000 Currently, the US mint produces between 4B and 10B coins annually. As a self funded agency, the mint generated 3.89B dollars of revenues in 2010. The US mint has facilities in Washington DC, Philadelphia, West Point, Denver , San Francisco, and the bullion depository at Fort Knox. None of our coins has any precious metal content 99% Zinc, 1%Copper 75% Copper, 25% Nickel 75% Copper, 25% Nickel Annual Production: 6.8M Annual Production: 1.4B Annual Production: 2.5B 75% Copper, 25% Nickel 75% Copper, 25% Nickel Annual Production: 2.4B Annual Production: 5.8M 88% Copper, 6% Zinc, 3% Magnesium, 3% Nickel Annual Production: 5.3M Paper money first makes an appearance in China around 900AD Due to a severe copper shortage, the Chinese begin issuing paper currency. Frequent reissues fuel inflation Each of the colonies issued currency. Most of these were “bills of credit” Beginning in 1775, the Continental congress issued currency to finance the revolutionary war. Continentals were bills of credit – not backed by gold or silver. Easily counterfeited, the notes quickly devalued, giving rise to the phrase “not worth a continental!” The founding fathers feared fiat money (for good reason with the failure of the continental). In fact, the constitution forbids states from issuing paper fiat money. A private business chartered by the confederation congress. Was the first IPO in the United States and the first Private Commercial bank. Later re-chartered as the Bank of Pennsylvania. Eventually acquired by Wells Fargo Bank of North America (1782 – 1786) The founding fathers feared fiat money (for good reason with the failure of the continental). In fact, the constitution forbids states from issuing paper fiat money. The First bank of the US was chartered in 1791. While officially a private bank, the US government controlled 25%. The charter was not renewed in 1811. The Second Bank of the US was chartered in 1816. Its charter renewal was vetoed by Andrew Jackson in 1836 The second bank of the US existed for five more years until going bankrupt in 1841 Prior to 1838, a bank charter could be obtained only by a specific legislative act. However laws passes by various states after 1838 allowed the automatic chartering of banks by the states without any special legislative consent. From 1840 – 1863 all banking business was done by state banks Anyone who satisfied the chartering requirements could become a bank and issue currency! 1837 – 1863 over 8,000 “brands of currency issued by banks, state governments, private individuals, and private companies The US began issuing United States Notes in 1862 after passing the legal tender act. US Notes were not backed by gold, but were “legal tender for all debts public and private” US Notes were nicknamed “greenbacks” US notes were last placed into circulation in 1971 The National Banking Act of 1863 allowed Nationally chartered banks to distribute bank notes (deemed legal tender) backed by US Treasuries. National banknotes were printed by the US Treasury State bank notes were subject to very high taxes and soon disappeared The Federal Reserve was created in 1913 to as a solution to bank panics (particularly, the banking panic of 1907) William McKinley - $500 James Madison- $5,000 Grover Cleveland- $1,000 Salmon P. Chase - $10,000 (Treasury Secretary under Lincoln) Denominations of $500, $1,000, $5,000, and $10,000 were no longer printed after 1946 for fear of German counterfeiting!! The largest denomination ever printed was a $100,000 gold certificate. It was never circulated, but was used for inter-bank transfers The beginning of the end: 1934 During the great depression, US citizens were converting paper currency into gold in large quantities. The government didn’t have enough gold to back up the currency, so FDR passed an executive order that made it illegal for US citizens to hold gold. Only foreign central banks could convert paper dollars into gold This coin sold at auction in 1996 for $7.5M!! FDR put the Great Seal on US Currency in 1935 Old Version (prior to 1935) New version (began in 1935) Secretary of Agriculture (and later, vice president) Henry Wallace saw the Latin phrase “Novus Ordo Seclorum” which means a new order of the ages and thought it meant “The new deal of the ages” both were freemasons and saw the symbol above the pyramid as the “all seeing eye” – the Masonic symbol for the great architect of the universe. In God We Trust was adopted officially as the motto of the United States in 1956 as an alternative or replacement to E Pluribus Unum. In god we trust has appeared sporadically on coins since 1864 In God we trust has appeared on currency since 1957 Some atheists have been known to mark out the motto with a custom made stamp On August 15, 1971, Nixon closes the gold window and the US dollar ceases to be convertible into gold by anyone. This marks the beginning of a truly anchorless system The U.S. Department of the Treasury first issued paper currency of the United States in 1862 as a result of a shortage of coins and the need to finance the Civil War. Today, the BEP has facilities in Washington DC and Fort Worth Texas •Currently, the BEP produces around 38 million notes per day with a face value of approximately $500M (mostly to replace worn out currency) •Average Lifetime • • • • • • $ 1 ...............18 months $ 5 ................ 2 Years $ 10................ 3 Years $ 20 .............. 4 Years $ 50 ............... 9 Years $100 ...............9 Years •The average cost of a note is 9.1 cents The BEP has had a contract with the Crane paper company to supply the paper for our currency since 1879. •The “paper” is 75% cotton and 25% linen with blue and red silk threads running through it • Have you ever wondered how many times you could fold a piece of currency before it would tear? About 4,000 double folds (first forward and then backwards) are required before a note will tear. All bills, regardless of denomination, utilize green on the backs. Faces use black ink, color shifting ink, and metallic ink. Inks are formulated and blended by the BEP US currency utilizes a combination of offset and Intaglio printing. In Intaglio printing, images are engraved on plates. Ink is applied to the plate and then pressed into the paper under great pressure. Federal Reserve District Seal: Seal of the US Treasury A (1) = Boston, B (2) = New York, C (3) = Philadelphia, Federal Reserve D (4) = Cleveland, E (5) = Richmond, F (6) = Atlanta, G (7) = Chicago, District Number H (8) = St. Louis, I (9) = Minneapolis, J (10) = Kansas City, K (11) = Dallas, L (12) = San Francisco Signature of the Treasurer of the US (Note: Every Treasurer of the US has been a woman since 1949 under Truman) Series Date Signature of the Secretary of the Treasury Each printing plate has 32 objects. The plate, therefore, is divided into 32 locations… A1 E1 A3 E3 00000001 00800001 03200001 04000001 B1 F1 B3 F3 00200001 01000001 03400001 04200001 C1 G1 C3 G3 00400001 01200001 03600001 04400001 D1 H1 C3 H3 00600001 01400001 03800001 04600001 A2 E2 A4 E4 01600001 02400001 04800001 05600001 B2 F2 B4 F4 01800001 02600001 05000001 05800001 C2 G2 C4 G4 02000001 02800001 05200001 06000001 D2 H2 D4 H4 02200001 03000001 05400001 06200001 One press run will be 200,000 sheets. The serial numbers are applied use skip numbering. The numbers are placed so that when the sheets are stacked and cut, the stacks of bills will be sequential. This would be the serial number locations for the first page of the first run of 200,000 sheets. A1 E1 After the first run of 200,000, the process is repeated starting with 06400001 06400001 07200001 B1 F1 06600001 07400001 C1 G1 06800001 07600001 D1 H1 07000001 07800001 After 15 runs of 200,000 (1 cycle) we are at serial number 96000000. At this point, we go back to 00000001 Given the numbering system, each serial number is guaranteed to come from one particular plate location. This gives currency an anti counterfeiting device… Plate position Serial number Federal Reserve District Plate serial number This letter identifies the number of “cycles”: Y = 25 Can you find the owl on the $1 Bill? See it now? Did you know that the owl is a Masonic symbol of wisdom? Some argue that when looked at even closer, it’s a spider, not an owl. The narrowest definition of money would be the Monetary Base (also called M0, Inside Money, or High Power Money). The monetary base is a direct liability of the Federal Reserve – that is, cash! Federal Reserve System (2006) In Millions Assets $11,036 (Gold) $792,581 (US Bonds) $64 (Loans) $78,968 (Other) Total: $882,649 Liabilities $793,705 (Currency in Circulation) $12,346 (Reserve Deposits) $15,275 (US Treasury Deposits) $61,323 (Other) Total: $882,649 Reserves Monetary Base = Cash in Circulation + Vault Cash + Reserve Deposits Needless to say, we are living in interesting times. This can be seen in the Fed’s balance sheets Federal Reserve System (2006) In Millions Assets Liabilities Federal Reserve System (2015) In Millions Assets $11,041 (Gold) $11,036 (Gold) $793,705 (Currency in Circulation) $792,581 (US Bonds) $12,346 (Reserve Deposits) $64 (Loans) $15,275 (US Treasury Deposits) $179 (Loans) $78,968 (Other) $61,323 (Other) $2,068,658 (Other) Total: $882,649 Total: $4,541,691 Total: $882,649 $2,461,813 (US Bonds) Quantitative easing program QE1 (Nov. 2008): $2.1T in Bank Debt, Mortgage Backed Securities and Treasuries QE2 (Nov. 2010): $600B in Treasury Securities QE3 (Sept. 2012): $40B per month (increased to $85B/mo. In Dec. 2012) Liabilities $1,392,478 (Currency in Circ.) $2,657,762 (Reserve Deposits) $226 (US Treasury Deposits) $491,225 (Other) Total: $4,541,691 Quantitative easing QE1 QE2 QE3 Billions of dollars $4T $2.7T $1.7T Quantitative easing QE1 QE2 QE3 Billions of dollars $4T $2.3T $1.3T Monetary Base • Normal Annual Growth: 7% per year • 2006 – 2015 Growth: 21% per year Currency in Circulation • Normal Annual Growth: 7% per year • 2006 – 2015 Growth: 6% per year The lack of inflation from QE is largely because the cash injected isn’t circulating! M1 = Currency in Circulation + Checkable Deposits (Note: Bank Reserves ARE NOT included in M1) Billions of Dollars $3T $1.7T $1.3T M2 = M1 + Savings Deposits + MMM Funds + Small Time Deposits Billions of Dollars $11.8T $7.7T $3T $600B $500B Money in the United States “Quantitative Easing” M2 ($11.8T) M0 ($4T) M1 ($2.9T) By purchasing and/or selling securities, the Fed can directly control the quantity of M0. Suppose that the Federal Reserve wants to increase the Monetary Base. The Fed credits the reserve account of the dealer’s bank Federal Reserve Dealers Sell bonds to the Fed Bond Dealer This is called an open market purchase Suppose that the Federal Reserve purchases a $10,000 Treasury. It pays for it by crediting the bond dealer’s bank account at Citibank. Assets + $10,000 (Treasuries) Liabilities + $10,000 (Reserve Deposits) Citigroup’s balance sheet is affected as follow: Assets + $10,000 (Reserves Deposits) Citigroup’s reserve account Liabilities + $10,000 (Deposits) Bond dealer’s checking account The federal reserve requires that 5% of transaction deposits must be kept on reserve with the federal reserve. The remainder, the bank is free to lend out. Assets + $500 (Required Reserves) Liabilities + $10,000 (Deposits) + $9,500 (Excess Reserves) Suppose that Citibank makes a $9,500 car loan Assets + $500 (Required Reserves) + $9,500 (Excess Reserves) + $9,500 (Car Loan) Liabilities + $10,000 (Deposits) + $9,500 (Line of Credit) Eventually, the $9,500 will end up in the bank account of the car dealership. At that point, Citibank covers the credit line by a transfers a $9,500 credit into Bank of America’s account Assets Liabilities + $500 (Required Reserves) + $10,000 (Deposits) + $9,500 (Car Loan) Now, Bank of America has $9,500 in new reserves, 5% must be kept at the Fed, the rest can be lent out. Assets + $475 ( Required Reserves) + $9,025 (Excess Reserves) Liabilities + $9,500 (Deposits) Car dealer’s checking account The initial bond purchase creates a “ripple effect” through the banking system Assets + $10,000 (Treasuries) Assets + $500 (Required Reserves) Liabilities + $10,000 (Reserve Deposits) Liabilities + $10,000 (Deposits) + $9,500 (Car Loan) Assets + $475 ( Required Reserves) + $9,025 (Excess Reserves) Change in MB = $10,000 Change in M1=$19,500 Liabilities + $9,500 (Deposits) This process will continue as payments get passed from bank to bank. $ Change in M1 = (mm)$ Change in MB Cash 1 + Deposits mm = Cash Reserves + Deposits Deposits Reserves In our example, Deposits $ Change in M1 = Cash = 5% Deposits 1 $10,000 = $200,000 .05 = 0% Currently in the US…. • Currency in Circulation = $1.3T • Reserves = $2.3T • Checkable Deposits = $1.7T 1.3 C 1 1 1.7 .83 D mm C R 1.3 2.3 D D 1.7 1.7 Think of money demand as a portfolio allocation problem. You have a fixed amount of income and you are allocating it over several assets. More Liquid Lower Return Cash $400 Income $5,000/month Checking Account $2,000 Less Liquid Higher Return Savings Account $600 M1 M2 Stock/Bonds $2,000 Money Demand Suppose that you are planning on spending $120 over the coming month. You currently have all your money in a savings account earning interest. To buy things you will need cash. As long as your money is in a savings account it is counted as M2, but not M1 The cash you withdraw is included in M1 Suppose you go to the bank three times per month (every 10 days). You withdraw $40 each time. More generally, if you make plan on Spending PY dollars per month. If you make N trips to the ATM ATM Withdrawals PY N Cash Balance Hits Zero Average Cash Balances (Money Demand) Real Money Demand PY 0 N M d P, Y , N 2 M d Y , N Y P 2N What determines N? The objective here is to choose the number of times you go to the bank to get money There are two costs associated with money: Y Interest Cost i 2N Transactio n Cost tN If you make very few trips to the bank (N is small), you will need to withdraw more cash – having more cash entails more lost interest If you make a lot of trips to the bank, you will withdraw less each time (less interest cost), but you will pay more in transaction costs Yi Minimize tN N 2N Yi t 0 2 2N Yi N 2t Take the derivative with respect to ‘N’ Solve for N Money Demand This is the optimal behavior (i.e. trips to the ATM per month) Yi N 2t As the interest rate goes up, you hold less cash. Therefore, you make more trips to the bank As ATM fees rise, you make less trips to the bank, but withdraw more each time Money Demand Real Income d M Y Yt P 2N 2i Nominal Interest Rate Real Money Demand Transaction Costs Generally Speaking…. “is a function of…” d M M Y , i, t P Real Income (+) Real Money Demand Nominal Interest Rate (-) Remember, i r e Transactions Costs (Cost of obtaining money) (+) A common form of money demand can be written as follows: d M k (i, t )Y P Constant between 0 and 1 Real money demand is equal to a fraction (k is between zero and one) of real income. That fraction depends on interest rates (-) and transaction costs (+) The Quantity Theory of Money MV PY Money Supply Nominal Income Velocity – Measures the number of times a dollar changes hands Note: We could rewrite this as percentage changes… %M %V %P %Y The Quantity Theory of Money and Money Demand MV PY Money Demand S M k (i, t )Y P Equilibrium condition in the money market 1 M PY k S 1 V k When money demand drops– velocity increases. In 1995, we saw a dramatic change in household portfolio decisions…why? M1 Money Demand falls dramatically starting in 1995 M1 Demand Rises from 1980 - 1993 Trend As interest rates rose, households switched out of checking accounts and into savings accounts….technology (online banking, ATMs, etc. made this transition easier) Falling demand for M2 Rising Demand for M2 When the money market is in equilibrium, real money supplied equals real money demanded. Nominal Money Supply(determined by the Fed) real interest rate r r S r I Determined in capital markets Y C I G SI I * Ms P Price Level real output Transactions (determined in the costs labor market) Expected inflation M d Y , t, e M P real money Suppose that the Fed increases the money supply by 10% (assume inflation expectations are zero) r Nothing in the real economy has changed r Ms P At the existing interest rate, there is excess supply of money. Now what? S r* I Determined in capital markets Y C I G SI I M d Y , t, e M P The price level increases by an equal 10%. The price increase returns real money to its original level (Money is neutral) r r Ms P S r* I Determined in capital markets Y C I G SI I M d y, t , e M P This one time increase in the money supply creates no inflation…just a one time adjustment in prices M 10% 0% Growth 0% Growth Time P 10% 0% Growth 0% Growth Time Again, the real economy is unaffected and “money is neutral” Suppose that prior to the 10% increase in the money supply, there was $100M in circulation. Further, assume that there is only one good in the economy – beer – six packs of beer initially cost $10. Prior to the increase in money supply: M $100M 10M P $10 six packs of beer %P %M 10 After the increase in money supply: M $110M 10M P $11 six packs of beer No net gain/loss, right? However, there is something going on here! Remember, the government must use the newly printed currency to buy something in order to send it into circulation. In this example, the only thing available to buy is beer (Party at Janet’s house!!!). M $110M $100M $10M P $10 Janet uses the $10M in newly created money to buy 1M beers! If there is zero net gain, or loss, then this 1M gain in beers by the government must be offset somewhere! M ' M ' $110M $110M ' 1M P P $10 $11 Once prices rise, anyone holding money sees a drop in their purchasing power!!! Really, we can think of an increase in the money supply as an invisible tax – the inflation tax! Now, lets repeat the example, but now assume that the money supply increase alters households expectations. Suppose households believe that the fed will increase the money supply by 10% every year r r Ms P 10% S 5% I I Determined in capital markets Y C I G SI Md Now, prices increase by more than 10% Y , t, M d Y , t, e 0 e 10 The rise in inflation expectations creates an “overreaction” in prices due to the drop in money demand M 0% Growth 10% Growth Time P 20% 0% Growth 10% Growth Time Lets make this example a little more specific. Suppose that prior to the 10% increase in the money supply, there was $100M in circulation. Further, assume that there is only one good in the economy – beer – six packs of beer initially cost $10. Prior to the increase in money supply: M $100M 10M P $10 six packs of beer %P %M 20 After the increase in money supply: M $110M 9.1M P $12 six packs of beer Now we have a very real loss…who pays here? Surely not the government! Remember, the government must use the newly printed currency to buy something in order to send it into circulation. In this example, the only thing available to buy is beer (Party at Janet’s house!!!). M $110M $100M $10M P $10 Janet uses the $10M in newly created money to buy 1M beers! If there is zero net gain, or loss, then this 1M gain in beers by the government must be offset somewhere! M ' M ' $110M $110 M ' 1.9M P P $10 $12 Now, the households loss is bigger than the governments gain! Essentially, the loss is coming from the fact that people are spending too much time trying to avoid holding money and too little time making beer!! Where do hyperinflations come from? Yugoslavia (1994) • 313,000,000 %/mo. • Prices double every 34 hours Hungary (1946) • 13,600,000,000,000,000 %/mo. • Prices double every 15 hours Zimbabwe (2008) • 79,000,000,000 %/mo. • Prices double every 24.7 hours MV PY Recall the quantity theory Or, in percentages %M %V %P %Y Inflation %P %M %V %Y %P %M %V %Y For relative low rates of money growth, money demand is relatively constant (change in velocity is close to zero) For high rates of money growth, money demand falls(change in velocity is close to positive) Rising velocity creates more inflation %P %M %Y %P %M %V %Y Rising inflation creates more velocity Money, Prices, and the Business Cycle…. Investment demand rises during expansions due to the rise in productivity. Anticipating the rise in income to be temporary, savings rises r r S r I I The Real interest rate falls. * M P s Prices need to fall to increase the real value of money circulating The increase in real output should increase money demand M d y, t , e M P At the new equilibrium real interest rate, we have excess demand for real money Money, Prices and the business cycle Given the mechanics of the money market, what relationships would we expect to see between money supply, prices and output? Just the facts ma’am. Output Money (Money is a policy variable) 0 Prices - % Deviation from Trend The Price level vs. GDP Correlation = -.21 % Deviation from Trend M1 Money Supply vs. GDP Correlation = -.02 % Deviation from Trend M2 Money Supply vs. GDP Correlation = .25 This is a problem % Deviation from Trend Real Interest Rate vs. M1 Correlation = -.09 Our model would also predict a zero correlation between the money supply and the real interest rate % Deviation from Trend Real Interest Rate vs. M2 Correlation = -.20 This is a problem Example: Oil Price Shocks in the 1970’s Dollars per Barrel 1979 Iranian Revolution (Temporary Shock) 1973 Arab Oil Embargo (Permanent Shock) In prior analyses, we already determined that both events looked like declines in productivity … S Y ,W r r r* S* I * The resulting decline in investment lowers the real interest rate I A, L S, I r New equilibrium interest rate * Ms P Price needs to increase so that the real supply of money equals the new demand at the new interest rate The decrease in real output should lower money demand M d y, t , e M P r Ms P r MD M P MD M P Price Level (% Dev. From trend) 1973 Arab Oil Embargo CPI (1972 – 1982) Ms P 1979 Iranian Revolution