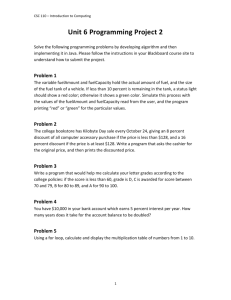

Financial Management 6 (Click to Download)

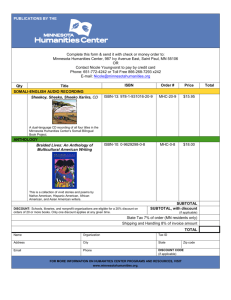

advertisement