BusOrg (Fall 2014) - Ch09

advertisement

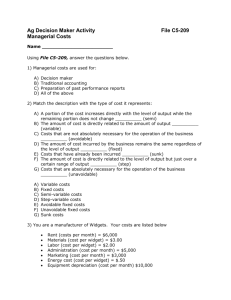

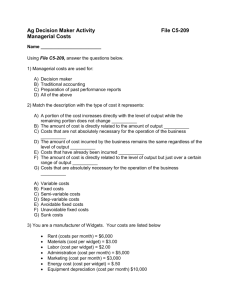

BusOrg (Fall 2014) Chapter 09 - Accounting Hypos [RA - Michael Klotz <klotzmm@wfu.edu>] Please answer the following 16 questions using the financials for Widget, Inc. at pp 20203 of the casebook – along with a calculator or spreadsheet, if you need to. 1. Balance sheet analysis: Suppose that Widget decides that half of its inventory is outdated and can only be sold for 75 cents on the dollar. Should “inventory” be revalued? What will be the effect on the balance sheet? A. Nothing should be done, because assets are carried at “historic cost” and the current account reflects historic costs for inventory B. Inventory should be written down $164,000, and “retained earnings” in the equity accounts should be reduced by a like amount C. Inventory should be marked to $655,000, given than half is no longer sellable; the same amount goes into equity account “revaluation deficit” D. Not sure 2. Balance sheet - current ratio: What is the current ratio for Widget, Inc. in the last two years? Has it risen or fallen? What does this mean? A. It’s the ratio of “current assets” to “current liabilities” and has risen from 1.29 to 1.62 in the last two years; this is a troubling development B. It’s the ratio of “current assets” to “current liabilities” and has risen from 1.29 to 1.62 in the last two years; this is a good development C. It’s the ratio of “current assets” to “current liabilities,” and unless it’s above 2.0 the company will not be able to get short-term credit D. Not sure 3. Balance sheet - debt-equity ratio: What is the debt-equity ratio for Widget, Inc. for the last two years? Has it risen or fallen? What does this mean? A. It’s fallen, which is not good. There is more equity (which must be paid dividends) compared to debt (which can be paid whenever) B. It’s risen, which is good. This means there is more debt than equity, a sign that the business is able to attract lenders C. It’s fallen, which is good. This means that the business is less leveraged and can ride out an economic downturn while still meeting its debt load D. Not sure 4. Balance sheet - inventories: What are the inventories for Widget, Inc. in the most recent year? Suppose there are 1,310 widgets in inventory? What if one was sold this year? How much should “cost of goods sold” be for that widget? A. $1000, because inventory of $1,310,000 divided by 1,310 is $1000. GAAP requires average cost valuation of inventory B. C. D. Under FIFO, the assumption is that older inventory is sold first, thus it’s likely COGS is less than $1000, increasing net income and taxes Under LIFO, the assumption is that the most recent item is sold, thus its’ likely to have cost more than $1000, increasing cash flows Not sure 5. Balance sheet - land: What is the land value for Widget, Inc. for the last two years? Has it risen or fallen? What if an appraisal shows the land is worth $5,000,000? A. The land is $775,000 – likely historical cost. The company should increase it to $5,000,000 – this is fair market value! B. The land has been constant, probably based on historical cost. But “marking to market” is inappropriate even if the appraisal was reliable C. The land value should reflect reality, one of the basic principles of GAAP. It should be increased to $5,000,000; otherwise, there is accounting fraud D. Not sure. 6. Balance sheet - book value: What is the book value for Widget, Inc. for the last two years? Has it risen or fallen? What does this mean? A. The book value has gone up. This is a clear sign that the business is worth more. The owners should hold out for a higher price! B. The book value has gone up. This doesn’t mean much. It could be that accounts receivable increased while R&D fell, not a good sign. C. The book value has gone down. This is because a number of accounts (like accounts receivable and inventories) should be marked to market. D. Not sure. 7. Income statement - net income: What is the income for Widget, Inc. for the last three years? Has it risen or fallen? What does this mean? A. It has risen each of the last years – 12.4% and then 53.5%. A growth rate of 20% seems reasonable. B. It has risen each of the last years – an internal growth rate of 31.5%. This is the more reasonable growth rate to use in predicting the future. C. It has risen each of the last years. But this may have been because of rising accounts receivable, lower machinery purchases and less R&D. D. Not sure. 8. Income statement - EBITDA: What is EBITDA for Widget, Inc. for the last three years? Has it risen or fallen? What does this mean? A. B. C. D. It has risen, a sign that the core business is good. This will be a useful number for calculating value based on “comparables.” [AP: also true} It has risen, but not as fast as net income. This suggests that there might be a disconnect between “core business” and “accounting results.” It has risen, but the number is meaningless because what business does not have interest, taxes, and declining-value plants, machinery and equipment. Not sure. 9. Income statement – operating margin: What is the operating margin for Widget, Inc. for the last three years? Has it risen or fallen? What does this mean? A. It has been rising, which is good. It takes less expenses (at least, as accounted for) to generate revenues. B. It has been rising, which is not good. It means that expenses are rising faster than revenues, an unsustainable trajectory. C. It has been falling, which is not good. Operating margins are a key measure of profitability: are revenues exceeding expenses? D. Not sure. 10. Financial statement – return on equity (ROI): What is the return on equity for Widget, Inc. for the most recent year? What does this mean? A. It’s well above what the stock market as a whole returned last year. This means this is a very healthy business. B. It’s well above what the stock market as a whole returned last year. But these are just accounting numbers. C. It’s not as good a return as you could get at a bank. The investors would have been better off putting their money in a bank savings account. D. Not sure. 11. Cash flow statement – cash position: What is the cash position for Widget, Inc. at the end of the last two years? Has it risen or fallen? What does this mean? A. It rose a bit two years ago, but fell significantly in the most recent year. This is a sign that the business may be in trouble. B. It fell significantly last year. This is OK given that higher accounts receivable and inventories will lead to large cash flows in the current year C. It has fallen both of the last two years, but this is probably because the business retired some debt – good for the long term, but not the short term D. Not sure. 12. Cash flow statement – accounts receivable: What are the changes in “accounts receivable” for Widget, Inc. over the last two years? Has “accounts receivable” risen or fallen? What does this mean to cash flow? A. There are more accounts receivable, which means there are more sales and customers. Just calm down. B. There are more accounts unpaid in the more recent year. This reduces net income, which we already know was rising. Don’t worry. C. There are more accounts that have not been paid in the more recent year. This reduces cash flow for that year and suggests something’s wrong D. Not sure 13. Cash flow statement – inventory: What are the changes in inventory for Widget, Inc. over the last two years? Has inventory risen or fallen? What does this mean to cash flow? A. Inventory increased by more than $200,000 last year – about 3% of sales. This indicates that the business is losing customers. B. Inventory increased more last year than the year before – this is a sign that the business might be faltering. C. Inventory actually decreased – it’s negative in the cash flow statement – a sign that the business is selling most of the widgets it manufactures D. Not sure. 14. Cash flow statement – machinery: What are the changes in machinery sales/purchases for Widget, Inc. over the last two years? Has machinery sales/purchases risen or fallen? What does this mean to cash flow? A. Machinery purchases fell a good deal in the past year, suggesting that the business is retrenching. The future may not be good. B. The business purchased more machinery two years ago, but less in the most recent year, suggesting that things are good going forward C. Machinery purchases reduce cash flow, which is not a good sign given than owners prefer cash flow (it’s king) D. Not sure. 15. Income statement – R&D: What are the changes in research and development for Widget, Inc. over the last two years? Has R&D risen or fallen? What does this mean to cash flow? A. R&D has fallen in the most recent year, which means that cash flow may be artificially inflated. This is troublesome. B. R&D had been stable, but was off significantly in the most recent year, which explains the increase in net income. A good sign. C. R&D has risen in each of the last three years. This may explain why cash flow has fallen off. The future may be brighter. D. Not sure. 16. Financial statement analysis: Based on the financial statement of Widget, Inc. is the business strong or weak? What additional questions might you have? A. Hard to tell. There’s a lot to ask management: how good are current accounts, how sellable is inventory, what’s are R&D/machinery plans B. Strong. The financial statements are pretty accurate and show net income is increasing. Investors (or new owners) should be pleased. C. Strong. The balance sheet is solid, with rising book value. Questions remain about FMV of accounts receivable, inventory, land and buildings D. Not sure.