File

advertisement

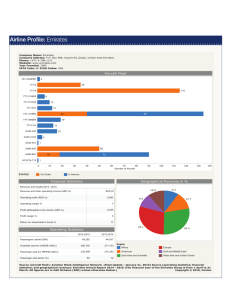

Running Head: ANALYZING FINANCIAL STATEMENTS Analyzing Financial Statements Singapore Air vs. Emirates Airlines Team Four Consultants Colin Boddy, Hana Matsui, Jake Lynch, Krista Alec, and Patrick Twinn Royal Roads University Mahesh Kumar International Hotel Management 320: Hospitality Finance 1 ANALYZING FINANCIAL STATEMENTS Introduction Emirates Airlines and Singapore Air are two of the largest and most successful global air transit companies operating in today’s market. Both operate flights to six continents daily and carried over 15 million passengers in 2012(Emirates Group, 2012) (Singapore Airlines, 2012). Singapore Air operated a fleet of 102 aircrafts in 62 destinations in 2012 (Singapore Airlines, 2012), while Emirates Airlines utilized a fleet of 186 in 127 destinations (Emirates Group, 2012). The two companies have similarly ambitious plans for expansion, and are well positioned to maximize their business potential in emerging markets. Their products are upper-mid range and luxury air-travel, which they market to a similar population of traveling professionals and upper-income leisure travelers (O’Reilly, 2012). Though both companies are typically highly profitable, they are certainly not immune to the financial volatility that has traditionally plagued the airline industry. Warren Buffet is arguably the most successful investor of all time. In a career that has spanned over four decades, his successful investments have earned him a personal net worth of over $46 billion in 2012, making him the third richest individual in the world (Forbes, 2012). The consistent return on his investments is 2 ANALYZING FINANCIAL STATEMENTS undisputable, “a $10,000 investment in Berkshire Hathaway in 1965, the year Warren Buffett took control of it, would grow to be worth nearly $30 million by 2005” (Investopedia, 2005). Buffet is a follower of the “value investing” model, and focuses on twelve tenets to guide his investing decisions. The tenets are all focused in the following areas: business, management, financial measures, and the intrinsic value of the company that he is considering (Harper, 2011). Team Four Consultants will be utilizing his distinct investing philosophy and methodology to analyze the financial position of Emirates Airlines and Singapore Air, and assess which is a more desirable investment. Furthermore, Singapore Air will serve as our primary company, and it is important to note that Emirates Airlines is not located on any stock exchanges, but is available for private investment. Several of the key considerations that Buffet takes into account are the company’s level of debt, their return on investment, and their current and potential profitability (Investopedia, 2005). Financial Analysis Debt Analysis Current Ratio (CR). CR examines the company’s current assets to current liabilities. Singapore Airlines had a CA/CL score of 1.1 in 2012, averaging 1.2 3 ANALYZING FINANCIAL STATEMENTS between 2009 and 2012. Emirates Airlines had a CR of 0.98 in 2012, averaging 1.004 over the last three fiscal years. It is considered industry best practice to have a CR of 2 or higher. In 2012 they actually have a ratio score of less than 1:1, meaning their current liabilities are greater than their current assets. Debt/ Equity. Buffett prefers companies that have a lower ratio in this regard as high debt can lead to volatile earnings and large interest expenses (Investopedia, 2005). Emirates displays a high level of debt to shareholders equity, with a ratio of 2.6 in 2012, averaging 2.3 for the past three years. Singapore has an extremely low ratio: 1.2 for 2012, as well as the yearly average since 2009. Debt Ratio. It is considered ideal for a business to have a debt ratio of less than 50%, meaning that they would be able to pay off their total debt twice using their assets. Emirates Airlines is carrying an excess amount of debt, with a 72% debt ratio in 2012, and a three-year average of 70%. Singapore Airlines, is on the opposite end of the debt spectrum, carrying 40% debt in 2012, averaging 39% since 2009. Return on Investment (ROI). When analyzing ROI, we used two calculations of ‘Return on Equity’ (ROE) and ‘Earnings per Share’ (EPS). After analysis, it was determined that Emirates Airlines provides investors with a 4 ANALYZING FINANCIAL STATEMENTS greater ROI, as their three-year EPS average was $4.00 and their three-year ROE average was 16.9%; compared to Singapore Airline’s three average EPS average of $0.31 and their three-year ROE average of 4.4%. Profitability. Looking at profitability, two analysis were used, ‘Profit Margin’ (PM) and ‘Interest Coverage Ratio’ (ICR). Comparing these two organizations, Emirates Airlines provides investors with greater profitability. Emirate’s three-year average PM is 6.7%, compared to Singapore’s three-year average of 5.3%; however, it’s important to note that Singapore’s PM for 2012 was 3.2%, compared to Emirate’s 2012 PM of 2.0%. Comparing the ICR of these companies, Emirate’s three-year average was 7.85 compared to Singapore’s threeyear average of 5.46; which demonstrates that Emirates Airlines will be less likely to be burdened by a debt expense. Additional Considerations Longevity. Another key consideration of Buffet’s when considering an investment is how long the companies have been publically traded. He will generally not consider companies until they have had their IPO filings in the last decade; citing longevity and historical performance as key indicators of future potential (Investopedia, 2005). Singapore Airlines was incorporated in 1972 5 ANALYZING FINANCIAL STATEMENTS (Mergent, 2011), while the Emirates Group went public in 1985 (Funding Universe, 2001). Both companies have been public for a long enough period of time to be considered acceptable by Buffett, however Singapore has a longer history to draw from, and more proven longevity. Commodity Reliance. Typically Buffet stays away from companies that rely solely on a commodity to operate. Obviously, in this case both airlines rely on the availability of affordable oil to operate. Though both companies claim to be seeking ways to reduce their dependence on oil and become more sustainable, in 2012 Emirates Airlines actually saved 500,000 gallons of fuel by utilizing highly efficient engines on their A380 fleet (Emirates Group, 2012). Competitive Advantage. The concept of an “economic moat” or competitive advantage is extremely important to the value investing strategy. The concept holds that the more differentiation that the business has over its competitors, the wider the “economic moat” they have to protect their market share (Investopidia, 2005). Emirates flights make up more than 40% of total aircraft movement in and out of Dubai (Emirates Airlines, 2012). Encroachment on their hub territory is highly unlikely as the UAE’s government and royal family are the majority owners of the Emirates Group (Funding Universe, 2001). Singapore 6 ANALYZING FINANCIAL STATEMENTS Airlines, on the other hand, have a vastly diminishing role in Singapore’s Changi Airport, and are currently facing competition in the destination from luxury middle-eastern brands such as Emirates and Qatar Airways as well as discount providers like AirAsia and JetStar (Fickling, 2012). Emirates Airline’s virtual stranglehold over travel to a profitable destination – specifically to expanding markets Dubai and Abu Dhabi- provides them with a very significant point of differentiation in the market. Intrinsic Value. This tenet of Buffett’s investing philosophy holds that a company’s “intrinsic” or “real” value is usually higher than its liquidation value (Investopedia, 2005). Intangible factors such as brand recognition, goodwill, and customer loyalty make the value of the business more than the sum of its tangible parts. As there is no set method to determine Intrinsic Value, we have developed the formula: Liquidation value + Intangibles = Intrinsic Value. Using this measurement tool, Emirates Airlines Intrinsic Value is $3,235,360,000, compared with Singapore Airline’s valuation of $6,461,900,000. Buffett’s strategy when considering investment is based on how much higher their Intrinsic Value is than their Liquidation Value. Typically, Buffet invests in companies with a 25% higher real value than their current market 7 ANALYZING FINANCIAL STATEMENTS capitalization. Using the formula Intangible Assets/ Liquidation Value x 100, Emirates Airlines is thought to be 8.2% undervalued, compared with 1.7% for Singapore Air. The market currently undervalues neither of these companies significantly enough to warrant meet Buffett’s investment standards, as they are both well-regarded and established global business conglomerates. However, Emirates Airlines has a far higher differential between its Intrinsic and Liquidation Values. Investment Recommendation Neither airline would likely pass Buffett’s investment feasibility test. Comparing levels of debt, Singapore Airlines provides a much safer approach contrasted to Emirates Airlines. Buffet prefers advocates investing in companies with lower levels of debt. Singapore Airlines achieves low levels of debt through issuing great sums of shares; contradictory to Singapore Airlines, Emirates issues fewer shares for investors, instead opting for other methods of financing. As a result of incorporating greater levels of debt, Emirates is able to provide investors with greater EPS, ROE, PM, and ICR but with also greater risk. Emirates delivers a higher ROI for shareholders than Singapore Airlines does; they have also achieved a consistently greater profitability margin. Emirates demonstrates commitment to 8 ANALYZING FINANCIAL STATEMENTS lowering their dependence on the industries greatest expense: oil. Moreover, the carrier has a virtual monopoly of travel to the UAE, giving them a wide “economic moat” of differentiation to protect them competitor encroachment, especially as the destination is developing into a major world centre. Finally, their Intrinsic Value is far higher than that of Singapore Air, meaning that they are currently somewhat undervalued by the market, and have potential to generate great profit margins in the long-term. For an investor not averse to risk, who looking for a large return in the long-term, Team Four Consultants believes that Emirates Airlines is a far superior investment option than Singapore Air. 9 ANALYZING FINANCIAL STATEMENTS 10 References ---(2001): The Emirates Group History, Funding Universe, Retrieved From: http://www.fundinguniverse.com/company-histories/the-emiratesgroup-history/ ---(2011): Singapore Airlines LTD., Mergent Online, Retrieved From: http://www.mergentonline.com.ezproxy.royalroads.ca/companyexecuti ves.php?compnumber=15661 Fickling, David (2012, May 17): Singapore Airlines’ Competition Rises, Bloomberg Business Week, Retrieved From: http://www.businessweek.com/articles/2012-05-17/singapore-airlinescompetition-rises O’Reilly, Laura (2012, March 12): Emirates introduces new brand positioning, Marketing Week. Retrieved From: http://www.marketingweek.co.uk/news/emirates-introduces-newbrand-positioning/4000869.article Singapore Airlines (2012): Annual Report 2011-2012, Singapore Airlines, Retrieved From: http://www.singaporeair.com/pdf/Investor-Relations/AnnualReport/annualreport1112.pdf ANALYZING FINANCIAL STATEMENTS 11 Singapore Airlines (2011): Annual Report 2010-2011, Singapore Airlines, Retrieved From: http://www.singaporeair.com/pdf/Investor-Relations/AnnualReport/annualreport1011.pdf The Emirates Group (2012): Annual Report 2011-2012, Emirates Group, Retrieved From: http://content.emirates.com/english/images/EK-AR-1011_tcm233-750566.pdf The Emirates Group (2011): Annual Report 2010-2011, Emirates Group, Retrieved From: http://www.theemiratesgroup.com/english/factsfigures/archive/2010-2011.aspx ANALYZING FINANCIAL STATEMENTS 12 Appendix A Income statement and Balance sheet of Singapore Airlines Singapore Airlines Income Statement (in $ million) The year ended March 31, 2012, 2011, 2010 Revenue Expenditure Operating profit/loss Finance charges Other income and loss Profit before taxation Income tax expense Profit after taxation 2012-2011 2011-2010 2010-2009 12,070.10 11,739.10 10,145.00 11,889.50 10,887.80 10,183.60 180.60 851.30 -38.60 -65.90 -59.10 -51.30 298.60 401.80 323.20 413.30 1,194.00 233.30 -23.10 -182.80 46.50 390.20 1,011.20 279.80 Singapore Airlines Balance Sheet (in $ million) March 31, 2012, 2011, 2010 Current Assets Intangible Assets Other Non-Current Assets Total Assets Current Liabilities Non-Current Liabilities Total Liabilities Share Capital Treasury Shares Other Reserves Total Equity 2012 2011 2010 6,461.90 9,105.30 5,873.40 111.20 90.80 55.00 15,111.20 14,987.30 16,020.10 21,684.30 24,183.40 21,948.50 5,875.70 6,938.10 2,961.70 3,110.20 8,837.40 10,048.30 5,042.60 3,422.60 8,465.20 1,856.10 1,832.40 1,750.60 -258.40 -43.00 -0.90 11,246.20 12,345.70 11,733.60 12,846.90 14,135.10 13,483.30 ANALYZING FINANCIAL STATEMENTS 13 Appendix B Income statement of Emirates Airlines Emirates Airlines Income Statement (in AED million and in USD million) The years ended March 31, 2012, 2011, 2010 Revenue Other operating income Operating costs Operating profit Finance costs Other income and loss Profit before income tax Income tax expense Profit after taxation (in AED) 2012-2011 61,508.00 (in USD) (in AED) 2011-2010 16,748.01 52,945.00 (in USD) (in AED) 2010-2009 14,416.39 42,477.00 (in USD) 11,566.06 779.00 212.11 1,286.00 350.16 978.00 266.30 -60,474.00 1,813.00 -657.00 -164,592.23 493.66 -178.89 -48,788.00 5,443.00 -506.00 -13,284.48 1,482.07 -138.78 -39,800.00 3,565.00 -355.00 -10,837.14 970.71 -96.66 517.00 140.77 608.00 166.56 455.00 123.89 1,673.00 455.54 5,545.00 1,509.85 3,665.00 997.94 -53.00 1,620.00 -14.43 441.11 -78.00 5,467.00 -21.24 1,488.61 -50.00 3,615.00 -13.61 984.33 As of exchange rate on November 11, 2012 USD/AED=0.27229 1AED=0.27229USD 14 ANALYZING FINANCIAL STATEMENTS Appendix C Balance sheet of Emirates Airlines Emirates Airlines Balance Sheet March 31, 2012, 2011, 2010 Current Assets Intangible Assets Other Non-Current Assets Total Assets (in AED) (in USD) (in AED) (in USD) (in AED) (in USD) 2012-2011 2011-2010 2010-2009 25,190.00 6,858.99 21,867.00 5,954.17 18,677.00 5,085.56 902.00 245.61 901.00 245.33 927.00 252.41 50,994.00 13,885.16 42,322.00 11,523.86 35,943.00 9,786.92 77,086.00 20,989.76 65,090.00 17,723.36 55,547.00 15,124.89 Current Liabilities Non-Current Liabilities Total Liabilities 25,765.00 29,855.00 55,620.00 7,015.56 21,290.00 8,129.22 22,987.00 15,144.78 44,277.00 5,797.05 18,520.00 6,259.13 19,552.00 12,056.18 38,072.00 5,042.81 5,323.81 10,366.62 Share Capital Retained Earning Other Reserves Non-controlling interests Total Equity 801.00 21,256.00 -833.00 242.00 21,466.00 218.11 801.00 5,787.80 20,370.00 -226.82 -565.00 65.89 207.00 5,844.98 20,813.00 218.10 801.00 5,546.55 16,794.00 -153.84 -321.00 56.36 201.00 5,667.17 17,475.00 218.10 4,572.84 -87.41 54.73 4,758.26 As of exchange rate on November 11, 2012 USD/AED=0.27229 1AED=0.27229USD 15 ANALYZING FINANCIAL STATEMENTS Appendix D Ratios Current Ratio: CA/CL 2012-2011 25,190/25,765 0.977682903 2011-2010 21,867/21,290 1.027101926 2010-2009 18,677/18,520 1.008477322 6461.9/5,875.7 1.099766836 9,105.3/6,938.1 1.312362174 5,873.4/5,042.6 1.164756277 EBIT interest coverage: EBIT/Int 2012-2011 Emirates 1,813/657 2.759512938 2011-2010 5,441/506 10.75296443 2010-2009 3,565/355 10.04225352 180.6/65.9 2.740515933 851.3/59.1 14.40439932 (38.6)/51.3 -0.752436647 2012-2011 55,620/77,086 0.721531796 2011-2010 44,277/65,090 0.680242741 2010-2009 38,072/55,547 0.685401552 7655.4/19229.2 0.398098794 8777.8/21771.3 0.403182171 7381.0/19586.0 0.376850812 Emirates Singapore Singapore Debt Ratio: TD/TA Emirates Singapore Return on Equity: Net Income/ Shareholder Equity 2012-2011 2011-2010 Emirates Shareholders 21,466.00 20,813.00 Equity Net Income 1,236.00 5,166.00 5.8% 24.8% 2010-2009 17,475.00 3,495.00 20.0% Singapore Shareholders Equity Net Income 13,247.90 14,174.30 13,420.00 390.20 1,132.00 321.70 2.9% 8.0% 2.4% 16 ANALYZING FINANCIAL STATEMENTS Profit Margin: NI/Rev Emirates Net Income Revenues Singapore Net Income Revenues 2012-2011 2011-2010 2010-2009 1,236.00 61,508.00 2.0% 5,166.00 52,945.00 9.8% 3,495.00 42,477.00 8.2% 390.20 12,070.10 3.2% 1,132.00 11,739.10 9.6% 321.70 10,145.00 3.2% 2011-2010 2010-2009 44,277 38,072 20,813 17,475 2.13 2.18 15,808.6 17,245.3 16,905.9 13,247.9 14,174.3 13,420 1.19 1.22 1.26 2011-2010 2010-2009 5,074 3,418 801 801 6.33 4.27 390.2 1,011.2 297.8 1,856.1 1,832.4 1,750.6 0.21 0.55 0.17 Debt/ Shareholder Equity 2012-2011 Emirates Total Debt 55,620 Shareholders 21,466 Equity TD/SE 2.59 Singapore Total Debt Shareholders Equity TD/SE Earnings Per Share: NI/AO shares 2012-2011 Emirates Net income-Dividends 1,118 on Preferred Shares Average Outstanding 801 Shares 1.40 Singapore Net income-Dividends on Preferred Shares Average Outstanding Shares