Financial Management - SCORE Northern Nevada

advertisement

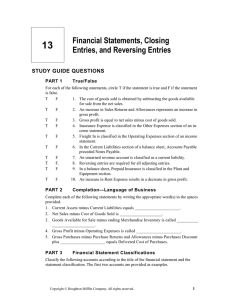

Revised 05/30/13 The benefit is to help you learn to better manage your business Create effective relationships with your trusted advisors Measure your company’s financial health (and yours) Understand basics of Cost Accounting Manage Business Risks and Cash How to utilize Cash Flow Forecasting and Budgeting FINANCING (Description) Month 1 Month 2 (s) Loan Principal Payment (t) Capital Purchases [Specify] (u) Other Start-up Costs (v) Reserve and/or Escrow [Specify] (w) Owner's Withdrawal $ 3,000 $ 3,000 6. TOTAL CASH PAID OUT [Total 5a thru 5w] $ 30,223 $ 34,314 7. CASH POSITION [End of month] (4 minus 6) $ 9,272 $ 10,055 Monthly Cash Flow Projection Enter Company Name Here Enter Date Here Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 (912) Month 10 Month 11 Month 12 TOTAL 1. CASH ON HAND [Beginning of month] $10,000 $ 9,272 $10,055 $ 9,298 $ $ (1,710) $ $12,500 $16,995 $ - $13,875 $16,222 $ 5,000 $14,290 $19,303 $ 2,500 $15,750 $19,851 $ 3,000 $ 16,785 $ 21,231 $ - 8,879 $ $ 17,525 $ 20,909 $ - 5,830 $ $ 18,525 $ 21,139 $ - 2,151 $ $ 17,650 $ 21,815 $ - $ 17,325 $ 21,706 $ - $ 16,350 $ 21,467 $ 2,500 (63) $ $ 15,675 $ 22,174 4,357 $ $ 13,250 $ 20,817 8,005 189,500 243,629 13,000 $29,495 $35,097 $36,093 $38,601 $ 38,016 $ 38,434 $ 39,664 $ 39,465 $ 39,031 $ 40,317 $ 37,849 $ 34,067 446,129 $39,495 $44,369 $46,149 $47,900 $ 46,895 $ 44,263 $ 41,815 $ 38,553 $ 37,321 $ 40,254 $ 42,206 $ 42,072 $11,798 $ 7,500 $ 2,625 $ 100 $ 100 $ 500 $ 1,500 $ 150 $ $ 1,500 $ 250 $ 500 $ 200 $ $ $ 500 $14,039 $ 8,500 $ 2,975 $ 100 $ 100 $ 500 $ 2,000 $ 150 $ $ 1,500 $ 250 $ 500 $ 200 $ $ $ 500 $16,242 $ 8,500 $ 2,975 $ 100 $ 100 $ 500 $ 2,250 $ 200 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 33.33 $ 500 $17,371 $ 9,000 $ 3,150 $ 100 $ 100 $ 500 $ 2,500 $ 300 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 50.00 $ 500 $ 19,008 $ 9,250 $ 3,238 $ 100 $ 100 $ 500 $ 2,500 $ 350 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 70.00 $ 500 $ 19,217 $ 9,500 $ 3,325 $ 100 $ 100 $ 500 $ 2,500 $ 350 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 70.00 $ 500 $ 19,832 $ 9,500 $ 3,325 $ 100 $ 100 $ 500 $ 2,500 $ 350 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 70.00 $ 500 $ 18,943 $ 8,000 $ 2,800 $ 100 $ 100 $ 500 $ 2,500 $ 300 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 70.00 $ 500 $ 17,564 $ 8,000 $ 2,800 $ 100 $ 100 $ 500 $ 2,000 $ 300 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 70.00 $ 500 $ 16,127 $ 8,000 $ 2,800 $ 100 $ 100 $ 500 $ 2,000 $ 250 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 70.00 $ 500 $ 15,140 $ 7,500 $ 2,625 $ 100 $ 100 $ 500 $ 2,000 $ 200 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 86.67 $ 500 $ 15,330 $ 7,500 $ 2,625 $ 100 $ 100 $ 500 $ 1,500 $ 150 $ $ 1,500 $ 250 $ 500 $ 200 $ $ 86.67 $ 500 2. CASH RECEIPTS (a)Sales (45% of Sales) (b) Collections from Credit Accounts (55% of Previous Mo Sales) (c) Loan or Other Cash Injection 3. TOTAL CASH RECEIPTS [2a + 2b + 2c=3] 4. TOTAL CASH AVAILABLE [Before cash out] (1 + 3) 5. CASH PAID OUT (a) Purchases (Merchandise, Inventory, Raw Materials) (b) Gross Wages (excludes withdrawals) (c) Payroll Expenses (Taxes, Benefits, etc.) (d) Outside Services (e) Supplies (Office and operating) (f) Repairs and Maintenance (g) Advertising (h) Auto, Delivery, and Travel (i) Accounting and Legal (j) Rent (k) Telephone (l) Utilities (m) Insurance (n) Taxes (Real Estate, etc.) (o) Interest on LOC (p) Other Expenses [Specify each] (q) Miscellaneous [Unspecified] (r) Subtotal (s) Loan Principal Payment (t) Capital Purchases [Specify] (u) Other Start-up Costs (v) Reserve and/or Escrow [Specify] (w) Owner's Withdrawal 3,000 409,899 38,000 $ 34,201 $ 33,842 447,899 $ $ $27,223 $31,314 $33,850 $36,021 $ 38,065 $ 38,612 $ 39,227 $ 36,263 $ 34,384 $ 32,897 $ 31,201 $ 30,842 $ 3,000 $ 3,000 $ 3,000 $ 3,000 $ $ $ $ $ $ $ $ $30,223 $34,314 $36,850 $39,021 $ 41,065 $ 42,112 $ 42,727 $ 40,263 $ 37,384 $ 35,897 $ 9,272 $10,055 $ 9,298 $ 8,879 $ $ $ $ (1,710) $ $ 3,000 3,500 3,500 4,000 3,000 3,000 200,610 100,750 35,263 1,200 1,200 6,000 25,750 3,050 18,000 3,000 6,000 2,400 677 6,000 3,000 6. TOTAL CASH PAID OUT [Total 5a thru 5w] 7. CASH POSITION [End of month] (4 minus 6) 5,830 2,151 (912) (63) 4,357 8,005 8,230 Monthly Cash Flow Projection Enter Company Name Here Enter Date Here Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 TOTAL 1. CASH ON HAND [Beginning of month] $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ $ $ - $ $ $ - $ $ $ - $ $ $ - $ $ $ - $ $ $ - $ $ $ - $ $ $ - $ $ $ - $ $ $ - $ $ - $ $ - - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - 2. CASH RECEIPTS (a)Sales (45% of Sales) (b) Collections from Credit Accounts (55% of Previous Mo Sales) (c) Loan or Other Cash Injection 3. TOTAL CASH RECEIPTS [2a + 2b + 2c=3] 4. TOTAL CASH AVAILABLE [Before cash out] (1 + 3) 5. CASH PAID OUT (a) Purchases (Merchandise, Inventory, Raw Materials) (b) Gross Wages (excludes withdrawals) (c) Payroll Expenses (Taxes, Benefits, etc.) (d) Outside Services (e) Supplies (Office and operating) (f) Repairs and Maintenance (g) Advertising (h) Auto, Delivery, and Travel (i) Accounting and Legal (j) Rent (k) Telephone (l) Utilities (m) Insurance (n) Taxes (Real Estate, etc.) (o) Interest on LOC (p) Other Expenses [Specify each] (q) Miscellaneous [Unspecified] (r) Subtotal (s) Loan Principal Payment (t) Capital Purchases [Specify] (u) Other Start-up Costs (v) Reserve and/or Escrow [Specify] (w) Owner's Withdrawal - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - 6. TOTAL CASH PAID OUT [Total 5a thru 5w] 7. CASH POSITION [End of month] (4 minus 6) Less Adjustments Minus Cost of Goods Sold Equals Gross Profits Various Expense Categories Equals Net Operating Income INCOME STATEMENT (in thousands) Sales Revenue Less: Cost of Goods Sold Gross Profits Less: Operating Expenses: Selling Expense General / Admin. Exp. Lease Expense Depreciation Expense Total Operating Expenses Operating Profits Less: Interest Expense Net Profits Before Taxes Less: Taxes Net Profit After Taxes 2010 2011 2012 Total Assets = Total Liabilities + Total Equity Current Assets + Long Term = Total Assets Current Liabilities + Long Term = Total Liabilities Equity Total Assets - Total Liabilities = Total Equity BALANCE SHEET ($000) Current Assets: 2010 2011 2012 2013 2014 2015 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Net Fixed Assets $0 $0 $0 $0 $0 $0 Other Assets $0 $0 $0 $0 $0 $0 Total Assets $0 $0 $0 $0 $0 $0 2010 2011 2012 2013 2014 2015 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Cash Accounts Receivable Inventories Total Current Assets Gross Fixed Assets (at cost): Land & Buildings Machinery and Equipment Furniture & Fixtures Vehicles Other (Inc. Fin. Leases) Total Gross Fixed Assets Less: Accumulated Depreciation Current Liabilities: Accounts Payable Notes Payable Taxes Payable Other Current Liabilities Total Current Liabilities L / T Debt (Inc. Financial Leases) Total Liabilities Common Stock Paid-In Capital In Excess of Par Retained Earnings Total Stockholders' Equity Total Liabs. & Stockhldrs' Equity RATIO ANALYSIS 2010 2011 2012 Current Ratio 1.06 1.16 1.40 Quick Ratio 0.64 0.63 0.77 Inventory Turnover Average Collection Period 6.90 5.39 5.20 24.96 35.30 33.88 Fixed Asset Turnover 11.72 11.74 12.59 Total Asset Turnover 3.06 2.80 2.93 Debt Ratio 0.78 0.73 0.57 Debt-to-Equity 0.37 0.25 0.05 Times Interest Earned 3.70 3.07 7.20 33.33% 33.55% 38.82% Operating Profit Margin 5.67% 5.74% 12.71% Net Profit Margin 3.47% 3.10% 10.06% Return on Total Assets (ROA) 10.61% 8.68% 29.43% Return on Equity (ROE) 47.71% 31.58% 68.40% Earnings Per Share $0.10 $0.10 $0.34 Price/Earnings Ratio 29.41 52.08 16.08 Gross Profit Margin Increase Revenue - Profitability Reduce Costs - Profitability Increase Productivity - Efficiencies Forecasting Models - Projections