X100 Introduction to Business

advertisement

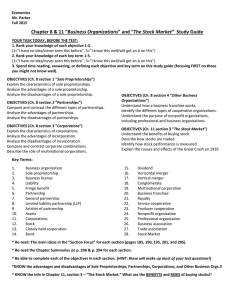

X100 Introduction to Business Business Forms Sole Proprietorships and Partnerships Professor Kenneth EA Wendeln X100 ©2008 KEAW L3 Forms of Business Ownership In the United States, an owner can select from a variety of specific forms of business ownership. The form of ownership that is selected affects: 1. 2. 3. 4. 5. Legal charter & documents needed Regulatory & reporting requirements Financial resources available Owners’ liability & risk of losses Taxes - liabilities & benefits affecting the business affecting the owners (shareholders, partners, or members) 6. Length of life 7. Transfer of ownership 8. Ease of termination X100 Business Forms - Sole Proprietorships & Partnerships L3-2 General Categories of Business Ownership 1. Sole Proprietorship 2. Partnership General Partnership Limited Partnership Limited Liability Partnership or ‘LLP’ 3. Corporation ‘C’ Conventional Corporation ‘S’ Corporation 4. - Limited Liability Company The different forms have evolved in response to the specific needs of business people. X100 Business Forms - Sole Proprietorships & Partnerships L3-3 Other Types of Business Ownership 1. Government-owned Corporations Owned & operated by local, state or federal government Usually provides a service the business sector is unable to offer ‘Quasi-government’ corporations - partly business and partly government owned – eg NASA, TVA, FDIC 2. Not-for-Profit or Nonprofit Corporations Provide social, educational, religious or other services Not intended to earn a profit 3. Cooperatives An association of individuals or firms Purpose is to perform some business function – eg Agricultural Co-op 4. Joint Ventures Agreement between two groups to form a business entity Usually to form a specific goal or for a specific period of time 5. Syndicates X100 Temporary association to perform a task that requires large amounts of capital – eg underwrite insurance, loans, investments Business Forms - Sole Proprietorships & Partnerships L3-4 Relative Business Ownership in the US in 2004-2005 Number of Tax Returns Business Revenues Corporations 5.1 M Corporations 20.0% Partnerships 2.1 M 8.4% Partnerships Non-Farm Sole Proprietorships 18.3 M 71.6% $2,569 B $19,308 B 84.4% 11.2% $1,017 B 4.4% Source: US Census Bureau, Statistical Abstract of the United States, 2004-05, www.census.gov X100 Business Forms - Sole Proprietorships & Partnerships L3-5 Entities Governing Forms of Business Ownership Forms of Ownership IRS Income & FICA Taxes STATE Legal Charters Sole Proprietorships Partnerships • General X100 • Limited • ‘LLP’ Business Forms - Sole Proprietorships & Partnerships L3-6 Entities Governing Forms of Business Ownership Forms of Ownership IRS Income & FICA Taxes STATE Legal Charters SEC Securities Regulations Sole Proprietorships Partnerships • General http://www.IN.gov/sos/ • Limited • ‘LLP’ Limited Liability Companies • Multi-member • Single-member Corporations • ‘C’ Corps http://www.sec.gov/ • Publicly Traded • ‘S’ Corps X100 Business Forms - Sole Proprietorships & Partnerships L3-7 Sole Proprietorship A business owned (and usually operated) by a single owner – the ‘proprietor’. The most popular form of business formation – 13.3 million non-farm sole proprietorships represent 72% of all firms in the United States. Usually small - averaging $50,000 in revenue, or only 4.4% of the total revenues of all US companies. Treated as an ‘extension’ of the owner – Earnings (and losses) are treated as personal income received by the owner and subject to personal income and Social Security taxes imposed by the IRS. Owner has personal liability for all debts & obligations of the sole proprietorship. Minimal formalities are required X100 Business Forms - Sole Proprietorships & Partnerships L3-8 Relative Business Ownership in the US in 2004-2005 Number of Tax Returns Non-Farm Sole Proprietorships 18.3 M 71.6% Business Revenues $1,017 B 4.4% Source: US Census Bureau, Statistical Abstract of the United States, 2004-05, www.census.gov X100 Business Forms - Sole Proprietorships & Partnerships L3-9 Entities Governing Forms of Business Ownership Forms of Ownership IRS Income & FICA Taxes Sole Proprietorships X100 Business Forms - Sole Proprietorships & Partnerships L3-10 Advantages of Sole Proprietorships 1. Ease of startup Minimal legal & filing requirements 2. Retention of all profits (& losses) Startup ‘losses’ may be offset by other personal income 3. High personal control & flexibility 4. Taxed ‘once’ as personal income On schedule ‘C’ or ‘C-EZ’ of IRS form 1040 at personal tax rates 5. Secrecy X100 Minimal or no reporting requirements Business Forms - Sole Proprietorships & Partnerships L3-11 Disadvantages of Sole Proprietorships 1. UNLIMITED personal liability For the debts and obligations of the sole proprietorship 2. Lack of business continuity Sole Proprietor is an ‘extension’ of the owner Ceases when the owner dies or is deemed incompetent 3. Difficult to transfer ownership 4. Limited access to external funding Funds provided by or ‘guaranteed’ by the owner 5. Limited management skills X100 Difficulty in hiring and retaining employees Business Forms - Sole Proprietorships & Partnerships L3-12 IRS Schedule C-EZ (1040) for Sole Proprietorship Tracy Topspin 312 56 2456 and Schedule SE (for social security taxes due) with their IRS Form 1040 individual tax return Tennis Lessons 320 Revenues - Expenses 2136 = Net Profit $ 2456 X100 A sole proprietor would file a Schedule C (or Schedule C-EZ with net profit) Reported on 1040 Business Forms - Sole Proprietorships & Partnerships L3-13 ‘Informal Forms’ - Summary Sole Proprietorships Forms of Ownership IRS Income & FICA Taxes Sole Proprietorships An ‘extension’ of the individual involved: • • • • Easy to form - no legal charter required UNLIMITED personal liability for the business Single taxation at personal tax rates IRS Schedule C or C-EZ (1040) for income reporting X100 Business Forms - Sole Proprietorships & Partnerships L3-14 Partnership A voluntary association of two or more persons who act as co-owners of a business for profit. Popular form of business formation, especially among professional services’ organizations 2.1 million partnerships represent 8.4% of all firms in the US. Vary in size & number of partners - averaging $630,000 in revenue, or 11.2% of the total revenues of all US companies Must have at least one General Partner - General Partners are jointly and severally (individually) liable for all the debts & obligations of the partnership. Earning (and losses) are allocated to the partners – treated as personal income received by each partner. Limited Partnerships & LLPs provide SOME liability protection to certain classes of partners X100 Business Forms - Sole Proprietorships & Partnerships L3-15 Types of Partnerships 1. General Partnership Includes ONLY General Partners General Partners have SHARED RESPONSIBILITY for operating a business Each General Partner can enter into contracts on behalf of all the others Each General Partner assumes FULL LIABILITY for the debts and obligations of the partnership Formal Partnership Agreement recommended but not required 2. Limited Partnership Must have at least ONE General Partner who assumes FULL LIABILITY and operates the business May have Limited Partners who do NOT PARTICIPATE in operating the business but provide capital & have LIMITED LIABILITY 3. Limited Liability Partnership (LLP) X100 Newer type that provides LIMITED ‘PROFESSIONAL’ LIABILITY for the acts of other Partners Must have a Partnership Agreement & meet certain requirements Business Forms - Sole Proprietorships & Partnerships L3-16 Advantages of Partnerships 1. Ease of startup Minimal legal & filing requirements for General Partnerships Limited Partnerships & LLPs must file with the State 2. Greater potential access to funding Partners can pool their funds and contribute assets 3. Retention of all profits (& losses) As in a sole proprietorship, all profits belong to the owners of the partnership 4. Combined business skills & expertise of the partners 5. Partnership income is taxed ‘once’ as personal income to the partners X100 Business Forms - Sole Proprietorships & Partnerships L3-17 Disadvantages of Partnerships 1. UNLIMITED personal liability for General Partners Limited Partners and LLPs provide some limited liability but are more cumbersome to set up 2. Lack of continuity Partnership terminated if any of the General Partners dies, withdraws or deemed incompetent 3. Management by consensus is difficult General Partners must be able to work as a team Each General Partner can enter into contracts on behalf of the others 4. Frozen Investment X100 It is easy to invest in a partnership Sometimes quite difficult to get investments out Business Forms - Sole Proprietorships & Partnerships L3-18 Recommended Partnership Agreement 1. Names of the partners 2. Nature, name & address of the business 3. Duration of the partnership 4. Contribution of capital 5. Duties of each partner 6. Salaries, withdrawals and distribution of profits and losses 7. Termination X100 Dissolution provisions Distribution of assets Business Forms - Sole Proprietorships & Partnerships L3-19 ‘Informal Forms’ - Summary Sole Proprietorships & Partnerships Forms of Ownership IRS Income & FICA Taxes Sole Proprietorships Partnerships • General An ‘extension’ of the individual s involved: • Easy to form - no legal charter required • UNLIMITED personal liability for the business • Single taxation at personal tax rates X100 Business Forms - Sole Proprietorships & Partnerships L3-20 IRS Forms for Partnerships Form 1065 & Schedule K-1 T & C Tennis Pro Shop The Partnership must file a Form 1065 Partnership Return – that determines the Partnership Income NO taxes are paid by the Partnership Tracey Topspin Each partner receives a Schedule K-1 that informs the partner of his share of the Partnership’s income, credits and deductions Each partner includes their share in their Form 1040 individual tax returns http://www.irs.gov/ X100 Business Forms - Sole Proprietorships & Partnerships L3-21 ‘Formal Forms’ of Partnerships Limited & Limited Liability Partnerships Forms of Ownership IRS Income & FICA Taxes STATE Legal Charters http://www.in.gov/sos... Sole Proprietorships Partnerships • General • Limited • ‘LLP’ • Limited Partnerships & Limited Liability Partnerships (LLP’s) offer some ‘limited’ liability • Must have a ‘legal charter’ with the state • Single Taxation at personal tax rates X100 Business Forms - Sole Proprietorships & Partnerships L3-22 X100 Business Forms - Sole Proprietorships & Partnerships L3-23