ex ante - USC Gould School of Law

advertisement

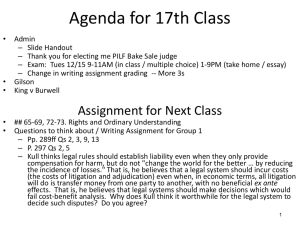

Agenda for 13th Class • Information Assignment for Next Class • ## 65-69, 72-73. Rights and Ordinary Understanding • Writing Assignment / Questions to think about – Pp. 288ff Qs 2, 3, 9, 13 – P. 296 Qs 2, 5 – Kull thinks legal rules should establish liability even when they only provide compensation for harm, but do not "change the world for the better … by reducing the incidence of losses." That is, he believes that a legal system should incur costs (the costs of litigation and adjudication) even when, in economic terms, all litigation will do is transfer money from one party to another, with no beneficial ex ante effects. That is, he believes that legal systems should make decisions which would fail costbenefit analysis. Why does Kull think it worthwhile for the legal system to decide such disputes? Do you agree? 1 Mid-Semester Feedback • Shorter writing assignments – Can get full credit for 2 good pages, even if don’t answer all questions – Single spaced, 12 pt font, reasonable margins • No more group assignments – But can do any individual assignment in groups, if prefer • 2-4 people • Can choose own group members – Sufficient to turn in one assignment for group • Review of key points from prior class • Introductions to readings • Exam information • Cold calling 2 Exam Info • Roughly – 2 hours 45 minutes total – 40 minutes for 12 multiple choice questions – 110 minutes for essay – 15 minutes extra for proofreading, etc. • Open book – Can bring any materials, except those not supposed to have in printed form (e.g. model answers) • Can use Softext • Bring dictionary, calculator • Multiple choice and Essay will test your ability to apply methods of interpretation and normative reasoning to new factual/legal situations – Will not test details of cases or other materials have read – Will be like exercises we have done for class • Warden Grim, Flower, Union Pacific, Cleaner Skies • Cleaner Skies is best indication, because most recent – Integrates interpretive and normative materials – Will give 2 more examples of old exams which integrate normative and interpretive parts of class 3 • Model answer for Cleaner Skies is exam memo and 3 model answers Last Class – Cleaner Skies • Integration of interpretive and normative part of class – Interpretive – 4 methods of statutory interpretation – Normative – Economic analysis • Best integration in this problem was purposivist – Weak purpose – to reduce diesel pollution • Does not explain why construction excluded – Better purpose – to reduce diesel pollution efficiently • Fits better with statute – Reduction of shipping pollution is efficient: WTP>cost – Reduction of construction pollution is inefficient: WTP<cost • Is reducing dredging pollution efficient – Maybe no: WTP<cost – Maybe yes. WTP may be poor measure of value, because of wealth effects • Could also have integrated economic analysis into pragmatic interpretation 4 Integration of Interpretive & Normative Reasoning • Statutory interpretation – Textualist. • Text of statute may require or suggest economic analysis or costbenefit analysis • The EPA shall issue regulations of diesel emissions using costbenefit analysis • The EPA shall issues reasonable regulations of diesel emissions – Intentionalist • Legislators might have mentioned discussed economic analysis, efficiency, or cost-benefit analysis during debates – Purposivist • See Cleaner Skies, National Society – Pragmatic • Always relevant – Also consider other normative frameworks that will start discussing today 5 Integration of Interpretive & Normative Reasoning • Common law interpretation – See Posner opinion in Sarnoff. • Does NY law forbid enforcement of conditions not to compete • NY precedents are murky, so Posner does economic analysis to decide whether conditions not to compete should be enforceable • Consistent with Posner’s view that implicit logic of common law is economic efficiency – More generally, economic analysis may be good way of finding principle which fits precedents and provides guidance for future cases • Or maybe not (see Dworkin) – When law is unclear, judges often turn to favored normative framework • For some judges, that is economic analysis 6 Introduction to Next Readings • Non-economic normative reasoning – One view is that common law legal decisionmaking should track common understandings and expectations – Example. If man gives woman engagement ring and couple does not get married, does she have to return the ring • 2 approaches – 1. Figure out what rule is best » Morally attractive? » Economically efficient? » Reduces litigation and court costs » Best general consequences? – 2. Figure out what rule best accords with what people expect or think is right in such situations » Role of law is to enforce ordinary people’s prior understandings » Analogy to contract law » Role of law is to enforce parties’ understanding, not judge’s views as to what would be best 7 Information • Efficiency of competition assumes perfect information • Imperfect information is a transactions cost – Efficient allocation of resources may be impaired by imperfect information • Imperfect information (like externalities) is ubiquitous – When law school and student choose each other • Law school doesn’t know how smart or hardworking students are • Students don’t know how good school is • Law school tries to gather info – admissions process • Students try to gather info – US News, campus visits, blogs • But information gathering is expensive and imperfect – When promisor breaches • May not know how much harm will cause promisee • May not know whether judge will find breach or not • Judge or jury may not know whether breach intentional or accidental • Judge or jury may not know whether promisee could have mitigated damages • Discovery and trial try to get answers to these questions, but expensive and not completely accurate 8 The Market & Information • Market corrects or mitigates some informational problems – Product markets • Consumer Reports, Angie’s List, Amazon consumer reviews, EBay ratings, etc. – Insurance • Medical exam before life insurance – Loan markets • Credit ratings, loan applications – Schools (see previous slide) 9 Information & the Law • Much of law is concerned with information – Litigation is principally about production of information – Much consumer regulation is forced disclosure of information • Nutritional labeling • Securities Law – Prospectus before initial offering – Quarterly reporting of profits • MPG for cars • APR for loans and savings instruments – Contract law • Limitation of damages to those which are “forseeable” forces promisee with high damages to disclose (Hadley v Baxendale) – Product liability law makes price of product reflect producer’s estimate of expected liability • Expected liability likely (otherwise) unknown to consumer – Title recordation in Property law 10 Moral Hazard • Insurance context – Insured has suboptimal incentive to take precautions • If insured against fire, may not install sprinklers or be as careful with fireplace • If have health insurance, may not be as careful to eat right or exercise • If have health insurance, may request treatments that unlikely to be effective – Tort law is form of insurance • Product liability may make consumers less careful • Duty to rescue may make parents (and others) less careful – Government programs are a form of insurance • Welfare may dull incentive to work • Income tax may dull incentives to work • Contracts generally – After contract entered into, party may have incentive to act in way that is detrimental to other party • Employee may not work hard • Lawyer paid by hour may spend too much time on project • Renter may not take good care of apartment 11 Responses to Moral Hazard • • • • Gather information – Moral hazard is result of fact that insurer does not know how insured is behaving • If insurer knew, then could condition insurance on insured behaving properly – Insurer’s “monitor” insured • Fire insurer may inspect home for smoke detectors, brush clearance, roof materials, etc • Government monitors welfare recipients, requires job search, etc. Deny insurance if precautions not taken – Comparative/contributory negligence in tort – Insurance exclusion for arson – Fire employees if shirk Build incentive into contract – Insurance seldom covers full cost of hazard • So insured has some incentive to take precaution – Employer can make pay proportional to output Government regulation seldom helpful – Government doesn’t usually have superior information – But sometimes can help • By using information gathering of criminal law • By threatening larger penalties (e.g. imprisonment) • E.g. imprisonment for securities fraud 12 Moral Hazard, Coase Theorem, & Externalities • Cost of obtaining relevant information is transactions cost – If info could be obtained costlessly, moral hazard wouldn’t exist – Since info is expensive, inefficiency may result • Moral Hazard is kind of externality – Insured imposes costs on insurer – Employee imposes costs (or less benefit) on employer – Sometimes not considered an externality, because • Insured and insurer are in contractual relationship • Employer and employee in contractual relationship 13 Principal-Agent Problem • Many situations where one person (agent) works for another (principal) – Lawyer works for client – Employee works for employer – Promisee works for promisor • Problem – How get agent to act in interest of principal – Problem is often moral hazard • Agent can take actions which adversely affect prinicipal (not work sufficiently hard (shirking), damage equipment, etc.) 14 Responses to Principal-Agent Problem • Monitoring – Terminate contract if agent shirks • Performance-based contract – Pay agent in accordance with some measure of performance • Contingent fee for lawyer – Plaintiff’s lawyer gets 1/3rd of damages, if prevails • Piece work • Pay CEO in stock or option • Bonuses for good performance evaluations • Input-based contacts – Hourly fee or wage – Cost-plus construction contracts • Fixed fee contracts – Salary • Best contract depends on circumstances – Incentive contract -- if performance easy to measure – Fixed fee – if repeated interactions or agent is very concerned about reputation – Input based – if cost unpredictable, agent is risk averse, and efficiency can be monitored Adverse Selection I • Markets may fail where one side lacks information and thus sets prices based on average – Thus inducing those who are above average to leave the market (but price not attractive to them • Classic example: Insurance – If insurer has imperfect information • Insurance priced at average risk • But person who knows low risk may then decide not to insurer • But that raises average risk of those still buying insurance • Thus raising prices • Causing more people to drop out of insurance market – Examples • Health insurance • Product liability/warranty, if voluntary – Those who are careful may opt not to purchase warraty – Thus raising average risk and cost… Adverse Selection Example I • Suppose 2 people want life insurance – A is smoker, 10% probability that will die next year • $10,000 expected cost to insurer for $100,000 policy • A is willing to pay $11,000 for insurance – B is non-smoking marathon-runner • 1% probability that will die next year • $1,000 expected cost to insurer for $100,000 policy • B is willing to pay $2000 for insurance • If insurer can’t get credible information on smoking and exercise habits – Price for insurance, if both A and B are both buying insurance must be at least, $5500 (average of $10,000 and $1,000) – But then insurance is not worthwhile to B Adverse Selection II • Lemons problem – Used car purchaser has imperfect information – Willing to pay price that reflects average used car quality – But person who has above average quality used car doesn’t want to sell at average price, so doesn’t sell – But that lowers average quality and thus price, leading more used car owners not to sell – Other examples • Loans for new businesses Responses to Adverse Selection • Ex ante information gathering – So can price product in accordance with individual characteristics, rather than market average – Life insurance – blood pressure and cholestoral screenings, different rates for smokers, etc. – Health insurance – exclusion of preexisting conditions – Inspection and certification of used cars • Warranties • Reputation • Mandatory insurance – So no one can drop out of market – Health insurance “mandates” / universal coverage Questions on pp. 253ff • 4. Consider an employment decision. A law firm is considering whether to offer an associate position to a 2L, and the 2L is deciding whether to accept the offer. • a) What are the information asymmetries in this potential transaction? What relevant information does the 2L know which the firm does not? What relevant information does the firm know which the 2L does not? • b) What can the firm do to (partially) overcome the information asymmetry? • c) What can the 2L do to (partially) overcome the information asymmetry? • d) Note that many law firms and lawyers have no written contracts. In such cases, the law provides default rules. One of those default rules is “employment at will,” which means that the employee can quit at any time, and the employer can fire the employee at any time. How does employment at will help overcome informational asymmetries or at least reduce their adverse affects? • e) Are there any legal rules which help overcome the informational symmetries?. Questions on pp. 253ff • 5. Consider the way home mortgages are often sold. A bank contracts with a mortgage broker. A mortgage broker is an independent businessperson, not an employee of the bank. The mortgage broker solicits customers and, when a customer wants a loan, helps the customer fill out the relevant paperwork and sends the paperwork to the bank for approval of the loan. • a) The contract with the mortgage broker might specify that the mortgage broker gets a fixed salary – perhaps $3000 per month. What problems might occur under such a contract? Would the bank be wise to offer such a contract? • b) The contract with the mortgage broker might specify that the mortgage broker gets a percentage of the value of all loans approved. For example, the mortgage broker might get 0.5% of the value of each loan, which would be $2500 on a $500,000 loan. What problems might occur under such a contract? Would the bank be wise to offer such a contract? • c) What macro-economic problems might occur if most loans were negotiated through contacts such as those described in (b)? • d) Can you think of a better contract between the bank and the mortgage broker? • e) The relationship between a bank and a mortgage broker presents all three types of asymmetric information problems discussed in readings ##5051, supra – adverse selection, moral hazard, and principal-agent. Identify which aspects of the relationship present which kinds of problems. Gilson, Role of Lawyers • Functions of Lawyer – Litigate – Advise – Draft & negotiate contracts (transactional lawyer) • Role of Transactional Lawyer – Transaction Cost Engineer • Reduce transactions costs for benefit of both parties • Solve informational problems • Lawyers often cynically viewed just transactions costs – But Gilson suggests that function of (good) lawyer is to reduce transactions costs – Value Creation • Function of (good) lawyer is to “create value” – i.e. increase the pie – Not just bargaining to get greater share of surplus for client – Other roles • Regulatory compliance • Getting most for client Gilson, Corporate Acquisition Agreement • Lawyer as transactions cost engineer – Lawyer create value (increases pie) by reducing transaction costs, especially informational problems • Representations and Warranties – Detailed statements of facts concerning the relevant business • Including accuracy of financial statements, absence of particular liabilities, ownership and condition of key assets, pending litigation. – Seller liable if turn out to be false – Purpose. Provide credible information that is key to transaction and its pricing • Earn out provisions – Part of price depends on performance of business • Part of payment delayed and contingent on how well business does – Helps parties to agree on deal, even if disagree on profitability of business – Also gives former owners an incentive to help Gilson, Corporate Acquisition Agreement II • Covenants and Conditions – Covenants. Agreement on how owner will conduct business in period between signing of contract and transfer of ownership – Conditions, if not satisfied, relieve buyer of obligation to purchase Question on pp. 272ff • 1. Would you characterize the informational problem in a typical corporate acquisition agreement as primarily an adverse selection, moral hazard, or principal-agent problem? • 2. Gilson mentions “Convenants and Conditions” as one of the four main components of an acquisition agreement (see p. 258), but he doesn’t say much about them. What kind of informational problem do you think they address? Adverse selection? Moral hazard? Principal-agent? • 3. Gilson focuses on private, contractual solutions to the informational problems posed by corporate acquisitions. Is there a role for courts, legal rules, and/or legislation? •