Macroeconomic Goals and Instruments

advertisement

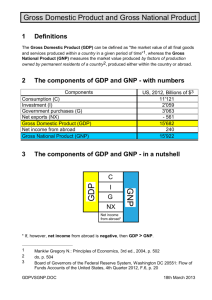

Macroeconomics -Mani Govil Macroeconomics Macroeconomics is the study of the behavior of the economy as a whole. It concerns the business cycles that lead to unemployment and inflation, as well as the longer-term trends in output and living standards. The Roots of Macroeconomics The Great Depression was a period of severe economic contraction and high unemployment that began in 1929 and continued throughout the 1930s. 3 of 31 The Roots of Macroeconomics Classical economists applied microeconomic models, or “market clearing” models, to economy-wide problems. However, simple classical models failed to explain the prolonged existence of high unemployment during the Great Depression. This provided the impetus for the development of macroeconomics. 4 of 31 The Roots of Macroeconomics In 1936, John Maynard Keynes published The General Theory of Employment, Interest, and Money. Keynes believed governments could intervene in the economy and affect the level of output and employment. During periods of low private demand, the government can stimulate aggregate demand to lift the economy out of recession. 5 of 31 Macroeconomic Goals Output High level and sustainable growth Employment High level of employment and low involuntary unemployment Stable Prices International trade Export and import equilibrium and exchange rate stability Output The ultimate objective of economic activity is to provide the goods and services that the population desires. The most comprehensive measure of the total output in an economy is the gross national product (GNP). GNP Nominal GNP is measured in actual market prices. Real GNP is calculated in constant or invariant prices. Potential GNP is the long-run trend in real GNP. It represents the long-run productive capacity of the economy or the maximum amount the economy can produce while maintaining stable prices. Potential and Actual GNP Real GNP ($) Potential GNP Actual GNP Years Employment The unemployment rate measures the fraction of the labour force that is looking for but cannot find the work. The labour force includes all employed persons and those unemployed individuals who are seeking jobs. The unemployment rate tends to move with the business cycle. Stable Prices The third macroeconomic goal is to maintain stable prices within free markets. A market economy uses prices as a yardstick to measure economic values. Rapid price changes lead to economic inefficiency. The most common measure of the overall price level is the consumer price index (CPI). The CPI measures the cost of a fixed basket of goods bought by the typical urban consumer. The rate of inflation measures changes in the level of prices. It denotes the rate of growth or decline of the price level from one year to the next. Inflation or Deflation An inflation occurs when the level of price is growing (the rate of inflation is positive). A deflation denotes that the level of price declines (the rate of inflation is negative). A disinflation is a decrease in the rate of inflation. The slowing of the rate of inflation per unit of time. International trade International trade is becoming increasingly important to most country’s economy. International trade is beneficial to society even if some individuals are harmed by it. International trade includes import and export of goods, services, capital, borrowing and lending money etc. Net export is the numerical difference between the value of a country’s exports and the value of its imports. When net exports are positive, a trade surplus exists. A trade deficit occurs when the value of imports is greater than the value of exports. Exchange Rate Stability Foreign exchange rate represents the price of own currency in terms of the currency of other nation. When a nation’s exchange rate rises, the prices of imported goods fall while exports become more expensive for foreigners the nation becomes less competitive in world markets and net exports decline. Changes in exchange rates can also affect output, employment, and inflation. Macroeconomic Policy Instruments A policy instrument is an economic variable under the control of government that can affect one or more of the macroeconomic goals Macroeconomic Policy Instruments Fiscal Policy Monetary Policy International Economic Policy Growth or supply side policies Fiscal Policy Fiscal policy is the use of government expenditures and taxes to affect aggregate demand and aggregate supply. Fiscal Policy Government expenditure includes government spending on goods and services. It determines the relative size of the public and private sectors. Taxation affects the overall economy in two ways: Taxes tend to reduce the amount people spend on goods and services Taxes affect market prices, thereby influencing incentives and behaviour. Monetary Policy Monetary policy determines the money supply as well as interest rates, in order to achieve desired economic objectives. Changes in the money supply move interest rates up or down and affect spending in sectors such as investment, housing, and net exports. Monetary policy has an important effect on both actual GNP and potential GNP. International Economic Policy International Economic Policy consists of two sets of policies: Trade policies, which consist of tarrifs, quotas, and other devices that restrict or encourage imports and exports. Exchange-rate setting. Exchange rate represents the price of one currency in terms of the currencies of the other nations. There are different systems to regulate foreign exchange market. CIRCULAR FLOW IN A TWO SECTOR ECONOMY NATIONAL INCOME ACCOUNTING National Income Structure Definition Circular flow Concepts of National Income Methods of Measurement Challenges in Measurement Importance of Measurement Trends in National Income in India National Income National Income is defined as the money value of goods and services turned out during a given period of time National Income Accounting is the measurement of indicators of national output/income; .e.g. GDP, GNP. National Income Income Period of Time All goods and Services Monetary value Counts only once The Circular-Flow Diagram Revenue Goods & Services sold Spending Market for Goods and Services Firms Goods & Services bought Households Inputs for production Wages, rent, and profit Market for Factors of Production Labor, land, and capital Income CIRCULAR FLOW IN A THREE SECTOR ECONOMY CIRCULAR FLOW IN A FOUR SECTOR ECONOMY The Measurement of GDP GDP is the market value of all final goods and services produced within a country in a given period of time . The Measurement of GDP Output is valued at market prices. It records only the value of final goods, not intermediate goods (the value is counted only once). It includes both tangible goods (food, clothing, cars) and intangible services (haircuts, housecleaning, doctor visits). It includes goods and services currently produced, not transactions involving goods produced in the past. It measures the value of production within the geographic confines of a country. GDP includes all items produced in the economy and sold legally in markets. What Is Not Counted in GDP? GDP excludes most items that are produced and consumed at home and that never enter the marketplace. It excludes items produced and sold illicitly, such as illegal drugs. Other Measures of Income Gross National Product (GNP) Net National Product (NNP) National Income Personal Income Disposable Personal Income Gross National Product Gross national product (GNP) is the total income earned by a nation’s permanent residents (called nationals). It differs from GDP by including income that our citizens earn abroad and excluding income that foreigners earn here. GNP v.s. GDP Gross National Product (GNP) The total value at market prices of final goods and services produced by the citizens in an economy in a specified period. Gross Domestic Product (GDP) The total value at market prices of final goods and services produced within the domestic boundary of a territory in a specified period GNP = GDP + Net factor income from abroad (NFIA) 37 Net National Product (NNP) Net National Product (NNP) is the total income of the nation’s residents (GNP) minus losses from depreciation. Depreciation is the wear and tear on the economy’s stock of equipment and structures. National Income National Income is the total income earned by a nation’s residents in the production of goods and services. It differs from NNP by excluding indirect business taxes (such as sales taxes) and including business subsidies. NP= Value of final goods and services produced= wages+rent+interest+profits= NI Personal Income Personal income is the income that households and noncorporate businesses receive. Unlike national income, it excludes retained earnings, which is income that corporations have earned but have not paid out to their owners. In addition, it includes household’s interest income and government transfers. Disposable Personal Income Disposable personal income is the income that household and noncorporate businesses have left after satisfying all their obligations to the government. It equals personal income minus personal taxes and certain nontax payments. Measurement of National Income Income Approach NNP at factor cost OR National Income Output Approach GDP at factor cost Expenditure Approach GDP at market Prices 42 The Product or Value Added Method GDP ≡ Sum total of gross value added of all the firms in the economy. Value added of a firm is, value of production of the firm minus value of intermediate goods used by the firm. GVAi ≡ Value of sales by the firm (Vi ) + Value of change in inventories (Ai) – Value of intermediate goods used by the firm (Zi) Net value added of the firm i ≡ GVAi – Depreciation of the firm i (Di) Items excluded from National Income Accounting Second-hand goods Intermediate goods Non-marketed goods / services Volunteer work / Housework Unreported / Illegal market transactions 46 Expenditure method The Components of GDP GDP (Y ) is the sum of the following: u u u u Consumption (C) Investment (I) Government Purchases (G) Net Exports (NX) Y = C + I + G + NX The Components of GDP Consumption (C): u The spending by households on goods and services, with the exception of purchases of new housing. Investment (I): u The spending on capital equipment, inventories, and structures, including new housing. u Inventories are treated as capital. Addition to the stock of capital of a firm is known as investment. Therefore change in the inventory of a firm is treated as investment. There can be three major categories of investment. First is the rise in the value of inventories of a firm over a year which is treated as investment expenditure undertaken by the firm. The second category of investment is the fixed business investment, which is defined as the addition to the machinery, factory buildings, and equipments employed by the firms. The last category of investment is the residential investment, which refers to the addition of housing facilities. The Components of GDP Government Purchases (G): u u The spending on goods and services by local, state, and federal governments. Does not include transfer payments because they are not made in exchange for currently produced goods or services. Net Exports (NX): u Exports minus imports. Income Method Limitations of National Income Statistics Factors that may understate the standard of living / the welfare Exclusion of the value of leisure Same Q produced with fewer working hours higher welfare Exclusion of non-marketed / unreported transactions Factors that may overstate the standard of living / the welfare Undesirable Side-effects of Production Air pollution / traffic congestion /… Understate the real / social costs to society externality /divergence between social costs & private costs 52 Some Identities C+I+G+X–M≡C+S+T I+G+X–M≡S+T If there is no government, no foreign trade then G = T = M = X = 0. I≡S GNP ≡ GDP + Factor income earned by the domestic factors of production employed in the rest of the world – Factor income earned by the factors of production of the rest of the world employed in the domestic economy. Hence, GNP ≡ GDP + Net factor income from abroad NNP ≡ GNP – Depreciation. We get the value of NNP evaluated at market prices. But market price includes indirect taxes. Thus, NNP at factor cost ≡ National Income (NI ) ≡ NNP at market prices – (Indirect taxes – Subsidies) ≡ NNP at market prices – Net indirect taxes (Net indirect taxes ≡ Indirect taxes – Subsidies) For calculation Personal income (PI) ≡ NI – Undistributed profits – Net interest payments made by households – Corporate tax + Transfer payments to the households from the government and firms. Personal Disposable Income (PDI ) ≡ PI – Personal tax payments – Non-tax payments. National Disposable Income = Net National Product at market prices + Other current transfers from the rest of the world Diagrammatic representation of the subcategories of aggregate income. NFIA: Net Factor Income from Abroad, D: Depreciation,, ID: Indirect Taxes, Sub: Subsidies, UP: Undistributed Profits, NIH: Net Interest Payments by Households, CT: Corporate Taxes, TrH: Transfers received by Households, PTP: Personal Tax PaymentsNP: Non-Tax Real vs. Nominal GDP Real GDP is calculated in a way such that the goods and services are evaluated at some constant set of prices (or constant prices). Nominal GDP, on the other hand, is simply the value of GDP at the current prevailing prices. The ratio of nominal to real GDP is a well known index of prices. This is called GDP Deflator. Consumer Price index Consumer Price Index (CPI) is the index of prices of a given basket of commodities which are bought by the representative consumer. CPI is generally expressed in percentage terms. Like CPI, the index for wholesale prices is called Wholesale Price Index (WPI). GDP AND WELFARE 1. Distribution of GDP – how uniform is it: Non-monetary exchanges: Externalities: INDIA GDP at factor cost at constant (2004-05) prices in the year 2012-13 is Rs. 55,05, 437 crore showing a growth rate of 5.0 percent over year 2011-12 of Rs. 52, 43,582 crore, released on 31th January 2013. GDP at factor cost at current prices in the year 2012-13 is estimated at 94,61,013 crore, Rs. Gross National Income (GNI) at factor cost at 2004-05 prices is Rs. 54,49,104 crore GNI at factor cost at current prices is now estimated at Rs 93,61,113 crore Per capita net national income in real terms (at 2004-05 prices) during 2012-13 is estimated to Rs. 39,168 per capita income at current prices during 2012-13 is estimated to have attained a level of Rs. 68,757 Agriculture, forestry and fishing Mining and quarrying Manufacturing Electricity, gas and water supply Construction Trade, hotels transport and communication Financing, ins., real est. and business services Community, social and personal services ANNUAL ESTIMATES OF EXPENDITURES ON GDP, 201213 (Expenditure method) Private Final Consumption Expenditure-Rs. 56,94,362crore (at current prices) Government Final Consumption Expenditure-Rs. 11,86,761crore in 2012-13 Gross Fixed Capital Formation-Rs. 29,64,677crore in 2012-13 Exports- Imports Gross domestic product 2010 Ranking USA CHN JPN DEU FRA GBR BRA ITA IND CAN RUS ESP MEX KOR AUS NLD TUR IDN CHE POL 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Economy United States China Japan Germany France United Kingdom Brazil Italy India Canada Russian Federation Spain Mexico Korea, Rep. Australia Netherlands Turkey Indonesia Sw itzerland Poland Millions of US dollars) 14,582,400 5,878,629 5,497,813 3,309,669 2,560,002 2,246,079 2,087,890 2,051,412 1,729,010 1,574,052 1,479,819 1,407,405 1,039,662 1,014,483 924,843 783,413 735,264 706,558 523,772 468,585 National Income Paradigm shift in sect oral shares since planning period Rising shares of Service Sector Declining share of Agriculture Steady state of manufacturing India missed the manufacturing boom