Social Policy - ohstrailblazers

advertisement

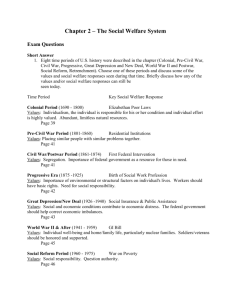

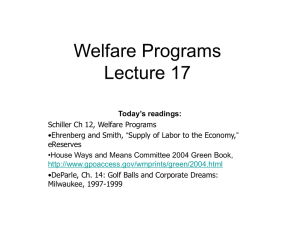

SOCIAL POLICY Roots of Social Welfare Policy Early 19th century attitudes toward social welfare were focused on belt-tightening and charity. NO governmental intervention Late 19th century Farmers and rural Americans sought help Failing commodity prices; exploitation of railroads 1890s severe economic depression Acceptance and expectance of government intervention Income Security Great Depression Social and economic thinking began to change Idea that government could and should be used as a positive influence in society FDR elected in 1932 Unemployment extremely high; bad for economy Created Civil Works Administration by executive order to put people to work Creation of Social Security 1935 law established old-age insurance (Social Security) and assistance for the needy, children, and others, and unemployment insurance Social Welfare Policies Today: Income Security Programs Protect people against loss of income due to retirement, disability, unemployment or deal or absence of family breadwinner Non-means-based programs Social insurance Old age, survivors, and disability insurance Social Security Unemployment Means-tested programs Social insurance Supplemental Security Income TANF Family and Child Support Act Welfare Reform of 1996 Personal Responsibility and Work Opportunity Reconciliation Act of 1996 Required single mothers with a child over five years of age to work within two years of receiving funds Included a provision that unmarried mothers under the age of 18 be required to live with an adult and attend school in order to receive welfare benefits Set a five-year lifetime limit for aid from block grants Included a requirement that mothers must provide information about a child’s father in order to receive full welfare payments Cut off food stamps and SSI for legal immigrants Cut off cash welfare benefits and food stamps for convicted drug felons Limited food stamps to three months in a three year period for persons 18 to 50 years old who are not raising children and not working Earned Income Tax Credit Program Designed to help the working poor Helps them by subsidizing their wages and provides an incentive for people to go to work Results in a net cash rebate for many low-income tax payers who pay no federal income tax Created in 1975 – Senator Russell Long (D-LA) Income, Poverty, and Public Policy What Part Does Government Play? Taxation Progressive tax: people with higher incomes pay a greater share Proportional tax: all people pay the same share of their income Regressive tax: burden falls relatively more heavily on lowincome groups—opposite of a progressive tax Earned Income Tax Credit: “negative income tax” that provided income to very poor people in lieu of charging them income tax Food Stamp Program Initial program was an effort to expand the domestic market for farm commodities -1939-1943 Provided the poor with the ability to buy more food, thus increasing demand for American agricultural produce Made permanent in 1964 Extended nationwide in 1974 Benefits low income families Combats hunger and reduces malnutrition Food stamps went to over 25 million beneficiaries in 2005 at cost of $31 billion. Average participant’s monthly disbursement: $93 in food stamps The Effectiveness of Income Security Programs Entitlement programs Income security programs to which all those meeting eligibility criteria are entitled Spending for such programs is mandatory Funds must be provided for them unless laws creating the programs are changed Difficult to control spending for this reason Often a matter of considerable debate Range of such programs are characteristic of all democratic industrial societies Public Education Until the 20th century, public education had been almost the exclusive province of the state and local governments. Responsibility for public education Vested in the local community 1944 GI Bill began federal government’s involvement in helping people pay for education beyond high school Reliance on local property taxes to fund schools Pell Grants Loan guarantees $62 billion in student loans in 2004-2005 Disparities among different districts Today federal government assumes more responsibility for public education than it has in the past. Public Education 2003: national, state, and local governments in U.S. collected more than $400 billion to spend on public education (K-12) 48.7% from state governments 42.8% from local governments 8.5% from the national government Great variation across states in spending per student Public Education Federal aid to education Goals 2000 No Child Left Behind Inequality in spending among school districts Voucher plans Charter schools Public Education: Voucher Plans and Charter Schools Charter Schools Permit some institutions (those with charters) to operate beyond the reach of school boards Break the monopoly exercised by centralized school boards and allow students as well as parents to exercise choice Freer to choose what to teach, what to spend money on, and whom to hire Numbers have increased Opposition comes from teachers unions; focus on hiring of underqualified teachers Numbers of private education companies (for profit) had questionable practices Other Forms of Social Policy Immigration DOMA