SOLUTIONS TUTORIAL CHAPTER 13 3.3 Simple deposit multiplier

advertisement

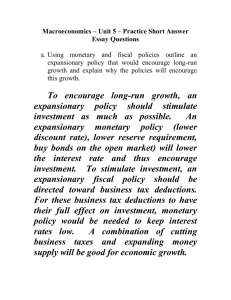

SOLUTIONS TUTORIAL CHAPTER 13 3.3 Simple deposit multiplier = 1 . The maximum increase in checking account deposits would be RR $20,000 × 5 = $100,000. 3.7 Yes, bank runs would substantially decrease the quantity of money. If banks do not have the funds, they cannot make the loans that create the checking account balances. Moving funds from a checking account to currency in circulation creates a multiple contraction of the quantity of money, just like depositing currency into a checking account creates a multiple expansion of the quantity of money. SOLUTIONS TUTORIAL CHAPTER 14 1.4 Many economists consider price stability to be the Fed’s most important policy goal. As we learned in earlier chapters, the problems that inflation causes the economy include the loss of purchasing power of money, menu costs, and an unintended redistribution of income. 2.1 A monetary policy target is a variable that the Fed can affect directly and that, in turn, affects variables that are closely related to the Fed’s policy goals, such as real GDP and the price level. The Fed uses policy targets because it cannot affect its policy goals directly, but must affect the goals indirectly through its policy targets. 2.2 To lower the equilibrium interest rate, the Fed could increase the money supply. 2.3 An open market purchase increases the money supply, which decreases the equilibrium interest rate. 2.4 The federal funds rate is the interest rate banks charge each other for overnight loans. It is the interest rate that the Fed targets for monetary policy. 3.1 An increase in interest rates decreases aggregate demand. Higher interest rates decrease investment spending, including spending on new homes and consumption spending, particularly spending on durable goods. Net exports also drop as higher interest rates raise the exchange rate between the dollar and foreign currencies. Government purchases are not affected by decreases in the interest rate. 3.2 If the Fed believes the economy is about to fall into recession, it should conduct expansionary monetary policy, increasing the money supply and reducing interest rates. If the Fed believes that the inflation rate is about to increase, it should conduct contractionary monetary policy, adjusting the money supply so as to increase interest rates. 4.1 In the basic aggregate demand and aggregate supply model, expansionary monetary policy is illustrated by the aggregate demand curve shifting to the right, while neither the short-run aggregate supply curve nor thelong-run aggregate supply curve shifts. In the dynamic model, the aggregate demand curve shifts to the right. The short-run aggregate supply curve and the long-run aggregate supply curve also shift to the right because the economy experiences increasing inflation and long-run growth. 4.2 In the basic aggregate demand and aggregate supply model, a contractionary monetary policy is illustrated by the aggregate demand curve shifting to the left, while neither the short-run aggregate supply curve nor the long-run aggregate supply curve shifts. In the dynamic model, the aggregate demand curve shifts to the right, but by less than it would have in the absence of the policy. The short-run aggregate supply curve and the long-run aggregate supply curve both shift to the right because the economy experiences increasing inflation and long-run growth. So, in the basic aggregate demand and aggregate supply model, a contractionary monetary policy will cause a decline in both real GDP and the price level. In the dynamic aggregate demand and aggregate supply model, a contractionary monetary policy will cause real GDP and the price level to increase by less than they would have in the absence of the policy.