Price and Output and

advertisement

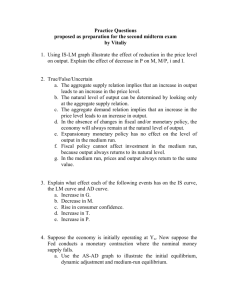

Price and Output and Macroeconomic Policies in an Open Economy The Effectiveness of Macroeconomic Policies in an Open Economy • How do different monetary policies affect the output and price level in an open economy in the medium and long run? • How do adjustments in the price level, interest rates, and the exchange rate would lead the economy toward a long-run equilibrium? Aggregate Demand • An economy’s aggregate demand represents the relationship between the economy’s total total demand for its output of goods and services and its price level. • The aggregate demand is a downward-sloping curve representing a negative relationship between the price level and the quantity demand of goods and services produced in the economy. • Although the aggregate demand looks like a market demand it represents a quite different type of relationship. The Aggregate Demand Curve i LM’ i M/P’ M/P LM i’ i’’ i L(Q,i) L(Q’,i) o M/P IS IS’ o Q P’ P’>P P Changes in G, T, M, e, P*, and X will cause shifts in AD AD o O’ Q Q The Aggregate Supply Curve (Short-Run, Medium-Run and Long-Run) LRAS MRAS P SRAS o Q The Medium-Run Aggregate Supply Curve • What makes the m-r aggregate supply curve upward-sloping? • Imperfect information • Institutional and contractual barriers to price adjustments • Long-run price adjustments do not take place in all sectors at the same time • An increase in the general price level may be construed as a relative price change • What causes the m-r aggregate supply curve to shift? Macroeconomic Policy under a Fixed Rate Regime • The long-run automatic adjustment mechanism • Monetary policy is generally not effective under a fixed exchange rate regime • Fiscal policy could be effective in the medium run in moving the economy toward higher output and price levels: ΔG => shift of AD to the right => Δi => capital inflow=> surplus=> purchase of FX by the central bank => ΔM => further shifts of AD. Furthermore, given e, ΔP => ΔR => changes in exports and imports. • Long-run price adjustments would shift the MRAS curve to the left, if the economy moves beyond the full-employment output, bringing the output level back to the full-employment level while pushing the price further up. Exchange Rate Policy under Fixed Exchange Rates • A devaluation would shift AD to the right: Δe => ΔR=> ΔIM &ΔX=> surplus => purchase of FX by the central bank=> ΔM => further shit of AD to the right • In the long-run, if the economy moves above the L-R full employment output, price adjustments will bring it back to the long-run Q and higher prices. Monetary Policy Under a Flexible Exchange Rate Regime • Automatic adjustments under flexible exchange rates • Fiscal policy not very effective under flexible FX regime • Monetary policy: ΔM => shift of SD to the right: ΔQ, ΔP, Δe => ΔR (lower relative price) • Exchange Rate overshooting.