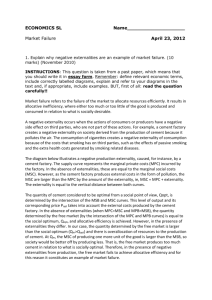

Market Failure

advertisement

Market Failure: Causes and Remedies Messere – IB Economics (CIA 4U7) Outline I. Market Failure A. Definition B. Causes II. Market Power III. Externalities A. Negative B. Positive C. Calculating the Cost D. Allocative Efficiency E. Correcting Externalities IV. Public Goods A. Non-rivalry and Non-excludability B. Free Riding V. Merit and Demerit Goods Market Failure • Market failure occurs when the competitive outcome of free markets is not efficient from the viewpoint of the economy as a whole – This is because the benefits that the market provides individuals or firms carrying out certain action diverge from the benefits to a society as a whole – Results in a sub-optimal amount of good/service being provided • Markets can also fail when firm/individual has insufficient information to recognize returns from undertaking an action Causes of Market Failure • Market dominance and abuse of monopoly power • Imperfect information • Externalities causing private and social costs and/or benefits to diverge • Pure public goods / Merit goods • Factor immobility • Equity (fairness) issues. Market can generate an unacceptable distribution of income and social exclusion Market Power • Imperfect information can lead to resource misallocation eg. firm does not accurately gauge price of key input (oil) • Monopoly prices above those in competitive markets – Loss of consumer surplus – Output below competitive equilibrium level – Loss of allocative & productive efficiency Monopoly Power: Good or Bad? • Monopolists may waste scarce resources – High levels of advertising and marketing to increase brand loyalty and build entry barriers • Monopoly power can bring economic benefits: – Exploitation of economies of scale – Higher profits used to fund research & development, leading to faster pace of innovation & gains in dynamic efficiency – Greater ability to compete internationally as many domestic markets have become more contestable Externalities • Imagine you are in your dorm studying and suddenly a loud explosion is heard shaking the walls of your room as other students next door play Quake 3 on-line. • You complain to your neighbor that “you have an economics exam tomorrow” and they tell you “But I don’t have one tomorrow, so what do I care?” Externalities • You have just had first hand experience with an externality. • When we talk about how in individual maximizes utility or a firm maximizes profit, we are implicitly assuming that these decisions do not affect other firms’ profits or other people’s utility. Externalities • Externalities are the incidental costs (negative externalities) or benefits (positive externalities) that accompany economic activities – Externalities have their effects upon persons whom the market neither compensates for costs or charges for benefits Why Do We Care? • Externalities arise because transactions that occur in the free market don’t always yield socially optimal (or allocatively efficient) outcome – People involved in transaction put their needs first even if they clash with those of society as a whole • When a firm or individual makes a decision without taking into consideration how that action affects others, then that decision (though optimal for that individual & productively efficient for that firm) may not be optimal for the whole of society (Sorry kids – no Simpsons clip on Internet version) Social Cost • Finding the cost of an externality requires us to compare the total social cost with social benefit. • The total social cost is the MC of the first unit + MC of the second unit +… • Marginal social cost (MSC) equals the marginal private cost + the marginal external cost Social Benefit • We can measure social benefit by looking at the demand curve. • The demand curve represents what people are willing to pay (hence the dollar value of the benefit). • Thus, we can also think of the demand curve as the Marginal Benefit curve (MB). Social Benefit • To find the total benefit to society of consuming multiple units of a good, we can add up the marginal benefit of each unit consumed. Allocative Efficiency • Allocative efficiency occurs when firms produce those goods and services most valued by society – This means scarce resources are allocated to the production of the goods and services so that consumer wants and needs are met in the best way possible • Allocative efficiency in a given market involves comparing the cost of producing an extra unit marginal cost (supply curve) - with the benefit gained from its consumption (demand curve) marginal benefit. Allocative Efficiency con’t • If marginal cost of an extra unit is less than the marginal benefit derived from its consumption (10th unit), then it makes sense to increase production. • If marginal cost is more than the marginal satisfaction gained from consumption (30th unit), then it makes sense to reduce production and release resources for alternative, 'better' uses. Allocative efficiency occurs at 20th unit of output Pollution Example • Let’s say that my peanut butter & jam plant is releasing a toxic peanut butter by-product into the groundwater and is making people very ill. • The cost to society AS A WHOLE can be represented as my costs of production (since I am part of society) plus the costs I am making others bear. • We can represent this graphically as... Pollution Example MSC (Marginal Social Cost) $ MPC (Marginal Private Cost) External Cost QSocial QPrivate Q Pollution Example • So, if I only consider my private costs (Peanut Butter, Jelly, Labor, etc), I will produce at QPrivate. • But accounting for the costs to the whole of society, I ought to produce at QSocial. • Notice that the private outcome is higher than the social outcome. – That is, firms create more pollution than is socially optimal. Negative Externalities in Production (MSC > MPC) Price Optimal equilibrium for society is where MSC = MSB at Qopt Free market produces at Qprv where MPC = MPB & overproduces good Welfare loss (= burden) of producing Qopt - Qprv units MSC MPC Popt Pprv eg. Firm producing petrochemicals dumps effluent in a river MSB(=MPB + zero external benefits) MPB Qopt Qprv Quantity/time Negative Externalities in Consumption (MPB > MSB) Price Optimal equilibrium for society is where MSC = MSB at Qopt Free market produces at Qprv where MPC = MPB & over-provides good eg. Private car use causes other people to suffer from exhaust fumes, traffic congestion & noise Welfare loss of consuming beyond socially optimum level of Qopt units MSC(=MPC + zero external costs) Pprv Popt MPB MSB Qopt Qprv Quantity/time Positive Externalities • Externalities do not always have to be a social cost. • Sometimes an individual’s behavior affects a third party in a positive way • For instance, if that same dorm pal who was loudly playing Quake 3 bakes bread every morning and the smell of the bread makes you happy - there is a positive externality Positive Externalities • With a positive externality, the social benefit is higher than the private benefit. • Thus, the privately optimal amount to produce is less than the socially optimal amount to produce. • There is a loss in net benefit from this underproduction. Positive Externalities in Production (MSC < MPC) Optimal equilibrium for society is where MSC = MSB at Qopt Free market produces at Qprv where MPC = MPB & under-produces good eg. Production of solar panels will benefit society via reduced CO2 emissions / private firms training workers who can then transfer those skills over to rest of society with society benefiting from skilled workers Price Welfare gain not producing to socially optimal output level (Qopt units) MPC MSC Pprv Popt MSB(=MPB + zero external benefits) Qprv Qopt Quantity/time Positive Externalities in Consumption (MSB>MPB) Price Optimal equilibrium for society is where MSC = MSB at Qopt Free market produces at Qprv where MPC = MPB & under-consumes good Welfare gains of producing Qprv - Qopt more units MSC(=MPC + zero external costs) Popt Pprv eg. MSB of immunization shots (school age) exceeds private benefits through reduced transmission of diseases and lost work time from illness MSB MPB Qprv Qopt Quantity/time What Can Society Do To Correct for an Externality? • The solution for economists is to internalize the externality - to make the private cost (or benefit) equal to the social cost (or benefit). • But how to do this is a more difficult problem since it is difficult to calculate & prioritize costs and benefits of activity – How do you assess a firm’s costs of polluting a river? • Must weigh job security (costs) vs. ability to swim in river (benefits) What Can Society Do To Correct for an Externality? What Can Society Do To Correct for an Externality? Property Rights • One way to correct for an externality is to assign property rights – Example: You are assigned the right to peace and quiet. If someone wants to play loud music, they have to compensate you to give up that right. This makes your cost part of their cost. – This works the other way as well, though. They could have the right to play music and you have to compensate them not to play. You pay them what it costs you. Property Rights • Either way, the socially optimal quantity is produced • NOTE: It is important to note that the socially optimal amount of pollution is NOT zero. Think about why that is... Other Solutions • Persuasion • Voluntary Agreements (eg. Kyoto protocol) • Subsidies – Government might subsidize all or part of firm’s costs of implementing pollution control technology – A subsidy will shift the MPC curve to the right towards the MSC curve • Taxes – If the government knows exactly how much to shift the curve to correct for the externality, they simply tax or subsidize the production. – A tax will shift the MPC curve to the left Internalizing Externality: Taxation • Polluting firm can be made to internalize externality by producing at socially optimal output (MSB=MSC) • To correct market failure government would have to apply tax equivalent to external costs Public Goods • Public Goods are goods that are available for all to consume, regardless of who pays and who does not. • Example: National Defence (pure public good) • All public goods must exhibit two characteristics: – Non-rivalry – Non-excludability Non-rivalry and Non-excludability • Non-rivalry means that one person’s consumption of the good does not limit the ability of someone else to consume the good. – Example: A TV Show • Non-excludability means that you can’t keep anyone from consuming the good. – Example: Police Protection What is Special about Public Goods? • The problem with public goods is getting people to fund them. • Imagine if we expected everyone who wanted national defence to pay for it. You might be tempted to let other people chip in for it and you get the benefit. • This behavior is called “free riding” and is endemic to the provision of a Public Good Free Rider Solutions • Often we let the government provide public goods because they can force people to pay for it via taxes • Find ways to exclude people (scramble TV signals, private police, etc.) Merit Goods • Merit Goods are goods that the government deems necessary for society because the social benefits exceed the private benefits – Example: health care, education, roads • Merit goods can be provided by the private &/or public sector • To encourage increased consumption of merit goods, governments will subsidize consumption (and cause an expansion of demand) in order to reduce the private marginal costs of consumption Demerit Goods • De-merit goods are those goods or services that create negative externalities when the product is consumed – This reduces the social benefit of consumption and also leads to potential market failure through over-consumption. • eg. cigarettes, alcohol • Governments may choose to tax or regulate the consumption of these goods Public, Merit & Private Goods Environment or Profit …..? Environment or Profit ….. ?