Fair value less costs of disposal (FVLCD)

advertisement

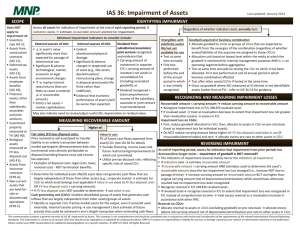

CHAPTER 10 IMPAIRMENT Connolly – International Financial Accounting and Reporting – 4th Edition 10.1 INTRODUCTION • • • Impairment = sudden diminution in value of an individual non-current asset or cash generating unit (CGU) CGU is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets CGUs are likely to follow the way in which management monitors and makes decisions about continuing/discontinuing different parts of the business Connolly – International Financial Accounting and Reporting – 4th Edition 10.2 IAS 36 IMPAIRMENT OF ASSETS Fundamental principles • • • To prescribe the procedures to ensure that non-current assets and CGUs are recorded at no more than their recoverable amounts Recoverable amount is the higher of fair value less costs of disposal (FVLCD) and value in use (VIU) An impairment loss is the amount by which the carrying amount (NBV) of an asset or CGU exceeds its recoverable amount Connolly – International Financial Accounting and Reporting – 4th Edition Figure 10.1: The impairment decision LOWER OF: CARRYING VALUE (NBV) RECOVERABLE AMOUNT HIGHER OF: FVLCD EV or VIU Connolly – International Financial Accounting and Reporting – 4th Edition Example 10.1: The impairment decision (1) Take an asset at 31 December 2012: Carrying amount €10,000 Fair value less costs to sell €12,000 Value in use €13,000 - – take higher No impairment because carrying amount < recoverable amount. Connolly – International Financial Accounting and Reporting – 4th Edition Example 10.2: The impairment decision (2) Take an asset at 31 December 2012: Carrying amount €10,000 Fair value less costs to sell €8,000 Value in use €9,000 – take higher Impairment = carrying amount less recoverable amount = €10,000 - €9,000 = €1,000 Connolly – International Financial Accounting and Reporting – 4th Edition Scope of IAS 36 • IAS 36 to all assets except: Inventories (IAS 2) (See Chapter 11) assets in the course of construction (IAS 11) (See Chapter 12) deferred tax assets (IAS 12) (See Chapter 13) assets arising from employee benefits (IAS 19) (See Chapter 17) financial assets dealt with in IAS 39 (See Chapter 25) investment property measured at fair value (IAS 40) (See Chapter 5) biological assets related to agricultural activity that are measured at fair value less sales costs (IAS 41) (See Chapter 34) assets classified as held for sale (IFRS 5) (See Chapter 20) Connolly – International Financial Accounting and Reporting – 4th Edition Identifying an asset that may be impaired • External sources decline in assets’ market value adverse changes in technological, market, economic or • legal environment market interest rates carrying amount of the net assets is more than market capitalisation Internal sources Obsolescence or physical damage of an asset Plans for a significant reorganisation/discontinuation or sale of an asset evidence that an asset’s performance is worse than expected Connolly – International Financial Accounting and Reporting – 4th Edition Measuring recoverable amount • • Fair value less costs of disposal Value in use Connolly – International Financial Accounting and Reporting – 4th Edition Fair value less costs of disposal (FVLCD) • • • The best evidence of an asset’s FVLCD is a price in a binding sale agreement in an arm’s length transaction, after adjustment for incremental costs of disposal If there is no binding sale agreement, but the asset is traded in an active market, FVLCD is the market price less costs of disposal. (The appropriate market price is usually the current bid price.) If there is no binding sale agreement or active market for an asset, FVLCD is calculated as expected selling price in an arm’s length transaction less direct costs of selling, such as stamp duty or legal costs (but not items such as associated redundancy costs) Connolly – International Financial Accounting and Reporting – 4th Edition Value in use (VIU) or economic value (EV) • • VIU or EV is the present value of the future cash flows derived by the asset from its continuing use and ultimate disposal Two key decisions – the discount rate to be used and estimating future cash flows Connolly – International Financial Accounting and Reporting – 4th Edition Discount rate • • • • • • The discount rate used should be an estimate of the rate that the market would expect on an equally risky investment It should exclude the effects of any risk for which the cash flows have been adjusted It should be calculated on a pre-tax basis Estimates of this market rate may refer to: the rate implicit in market transactions of similar assets the enterprise’s incremental borrowing cost adjusted for specific risks of the projected cash flows the WACC for the entity adjusted for the particular risks of the projected cash flows If cash flows expressed in current prices use a real discount rate If cash flows expressed in future prices use a nominal discount rate Connolly – International Financial Accounting and Reporting – 4th Edition Cash flows • • Expected cash flows should be based on: Reasonable and supportable assumptions of management’s best estimates of the economic conditions over the RUEL of the asset. Greater weight should be given to external evidence Up to date plans and budgets approved by management. These should not cover more than 5 years unless justified Cash flows should be estimated for assets in their current condition. They should not include: future cash inflows or outflows that are expected to arise from a future restructuring to which an enterprise is not yet committed future capital expenditure that will improve or enhance the CGU or asset cash inflows / outflows from financing activities income tax payments or receipts Connolly – International Financial Accounting and Reporting – 4th Edition Recognising an impairment loss for an individual asset • • Should be recognised in the SPLOCI – P/L unless it arises on a previously revalued non-current asset For revalued assets, it is recognised as a revaluation decrease and will be deducted as far as possible from the revaluation surplus on that asset (See IAS 16 revaluation model – Chapter 6) Connolly – International Financial Accounting and Reporting – 4th Edition Recognising an impairment loss for a CGU Example 10.3: Independent cash flows A mine owns a private railway to support its mining activities. It could only be sold for scrap and does not generate independent cash flows from those of the mine. The CGU, in this case is, therefore, the mine as a whole, including the railway as the railways value in use cannot be independently determined and would be very different from its scrap value. Connolly – International Financial Accounting and Reporting – 4th Edition Example 10.4: Lowest aggregation of assets A bus company has a contract to provide a minimum service on five separate routes. Cash flows can be separately identified for each route. Even if one route is operating at a loss, the entity has no option to curtail any one route and the lowest independent level is the group of five routes together. The CGU is the bus company itself. Connolly – International Financial Accounting and Reporting – 4th Edition Example 10.5: Identifying CGUs Example 10.5(A): Retail store chain Store X belongs to retail chain, M. X makes all purchases through M and pricing, marketing, advertising and human resources policies are decided by M. M also owns 5 other stores in the same city as X and 20 other stores in other cities. All are managed in the same way as X and X was purchased with 4 other stores 5 years ago. X generates independent cash inflows and the stores are in different neighbourhoods thus it appears X is a CGU. Connolly – International Financial Accounting and Reporting – 4th Edition Example 10.5: Identifying CGUs Example 10.5 (B): Plant for an intermediate step in a production process A significant raw material used for Y’s final production is an intermediate product bought from X. X sells to Y at a transfer price that passes all margins to X. 80% of X’s output is sold to Y and 40% to outside customers. Case 1: X could sell to Y in active market. Internal prices are higher than market prices. Case 2: There is no active market for the products X sells to Y. Case 1 Likely X is a separate CGU and Y is also. However, internal transfer prices do not reflect market prices for X’s output. Thus, in determining value in use for both X and Y, the entity adjusts financial forecasts/budgets to reflect management’s best estimate of future market prices for those of X’s products. Case 2 It is likely that the recoverable amount of each plant cannot be assessed independently as the majority of X’s production is used internally and could not be sold in an active market and the two plants are managed together. X and Y is the smallest group of assets that are largely independent. Connolly – International Financial Accounting and Reporting – 4th Edition Example 10.9: Liabilities and CGUs A company must restore a mine by law, and it has provided €500 for the cost of restoration which is equal to the present value of restoration costs. The CGU is the mine as a whole. Offers of €800 have been received to buy the mine and disposal costs are negligible. If the mine is sold, the buyer will assume responsibility for the restoration costs. The value in use is €1,200 excluding restoration costs and the carrying amount is €1,000. Requirement What is the impairment loss, if any? Connolly – International Financial Accounting and Reporting – 4th Edition Example 10.9: Liabilities and CGUs Solution: Determine the recoverable amount: Fair value less costs of disposal €800 Value in use (€1,200 – €500) €700 Therefore the recoverable amount is the higher amount = €800 There is no impairment loss as the carrying amount is les than the recoverable amount. Connolly – International Financial Accounting and Reporting – 4th Edition Impairment losses and CGUs • • • First, to reduce carrying value of any goodwill Then, to reduce the carrying values of other assets in the CGU pro rata on the basis of carrying values Subject to proviso that carrying value of an asset is not reduced below highest of: Fair value less costs to sell Value in use Zero See Chapter 10, Example10.11, 10.12 and 10.13 Connolly – International Financial Accounting and Reporting – 4th Edition Reversal of an impairment loss • • • The enterprise should assess at each reporting date whether there is an indication that an impairment loss previously recognised for an asset other than goodwill has reversed or decreased. An impairment loss for an asset other than goodwill shall be reversed if, and only if, there has been a change in the estimates used to determine the asset’s recoverable amount since the last impairment loss was recognised If this is the case, then the carrying amount of the asset should be increased to its recoverable amount (see proviso later) Connolly – International Financial Accounting and Reporting – 4th Edition Indications of a reversal As a minimum the enterprise should consider the following: • External sources of information increase in market value of asset significant favourable changes in technological, market, economic or legal environment favourable changes in market interest rates • Internal sources of information changes in the way the asset is to be used evidence that performance of asset is better than expected Connolly – International Financial Accounting and Reporting – 4th Edition Reversal of an impairment loss for an individual asset • • • The carrying value of an asset should be increased to its recoverable amount but the increased carrying amount cannot exceed the carrying amount that would have been determined had no impairment loss been recognised A reversal of an impairment loss should be recognised immediately in the SPLOCI – P/L, unless the asset is carried at revalued amount (e.g. revaluation model IAS 16 (See Chapter 6)) when the reversal would be treated as a revaluation increase Recalculate depreciation after reversal of impairment loss Connolly – International Financial Accounting and Reporting – 4th Edition Reversal of an impairment loss for a CGU • • • An impairment loss recognised for goodwill shall not be reversed Allocate reversal to the CGU assets pro rata with carrying values Subject to proviso that carrying value of an asset shall not be increased above lower of: Recoverable amount Carrying amount that would have been determined (net of amortisation or depreciation) had no impairment loss been recognised for the asset in prior years Connolly – International Financial Accounting and Reporting – 4th Edition Depreciation After reversal of an impairment loss, depreciation (amortisation) should be adjusted to allocate the asset’s revised carrying amount, less any residual value, on a systematic basis over its remaining useful life. Connolly – International Financial Accounting and Reporting – 4th Edition 10.3 Disclosure • For each class of assets: Amount of impairment losses and reversals recognised in profit or loss and line item in statement of comprehensive income in which they are included Amount of impairments and reversals recognised directly in equity during the period Details of assets or CGU’s subject to impairments or reversal of impairments Whether recoverable amounts are fair value less costs to sell or value in use and any relevant discount rates Connolly – International Financial Accounting and Reporting – 4th Edition