Jordan's WTO Commitments…

advertisement

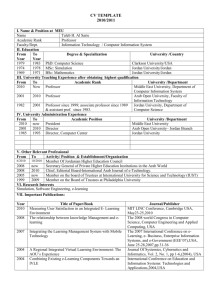

Jordan’s Experience…. Foreign Trade Mr. Ahmad Hammad Deputy Director, Foreign Trade Policy Directorate Jordan’s Foreign Trade Policy A foreign trade policy based on the norms of economic openness and integration into the world economy. It incorporates the country’s vision in viewing economic partnerships as necessarily achieving both mutual interests and fair dividends. World Wide Market Access Opportunities… Multilateral World Trade Organization (WTO) 2000 Regional Greater Arab Free Trade Area (GAFTA) Agadir Agreement Organization of Islamic States (OIC) 1997 2004 1993 Bilateral Unites States of America FTA European Union Association Agreement EFTA States FTA Singapore FTA Canada FTA Turkey FTA 2000 1997 2001 2004 2009 2009 Jordan and the WTO Jordan’s Accession to the WTO in brief…. 1994 • Jordan applied for accession to the General Agreement on Tariffs and Trade (GATT). 1995 • The application was changed to a request to join the WTO (the legal successor to GATT) 2000 • Signing the Accession Protocol that became part of Law No. 4 for the year 2000 (Law of Ratification of Jordan's Accession to the World Trade Organization). • Jordan became the 136th Member of the WTO in April 2000. Jordan’s WTO Commitments… Schedule of Concessions in Goods In general, concessions were made over a ten year transitional period for a number of items under tariff rates 30% and 35%. A 20% tariff rate will be reached by the year 2010 according to the following reductions (with some exceptions): 30% - March 2000 25% - March 2005 20% - March 2010 6 Exceptions: -Cigarettes & Tobacco -Tomatoes -Cucumbers -Olive Oil Jordan’s WTO Commitments… Schedule of Concessions in Goods - Information Technology Agreement (ITA): bound at 0% - Medical Equipment Sectoral Initiative: bound at 0% - Agricultural Equipment Sectoral Initiative: bound at 0% - Chemical Harmonization Sectoral Initiative: bound at 0%, 5.5%, 6.5% 7 Jordan’s WTO Commitments… Schedule of Specific Commitments in Services Specific Commitments Commitments covered (106) services sectors and sub-sectors out of 155 sectors of the UN CPC Commitments covered four modes of supply for services as identified in GATS Full foreign equity participation in investments allowed in various sectors such as: financial, telecommunications, computer and related services, research and development, hotels and catering services, management consultancy, market research, packaging services, production and projection of movies, …etc. 8 Jordan’s WTO Commitments… Schedule of Specific Commitments in Services Transitional periods - Telecommunications sector - Insurance services sector - Courier services - Education services - Health and Social services 9 Regional and Bilateral FTAs Jordan – US FTA The FTA was signed on 24/10/2000 and entered into force on 17/12/2001, and by 1/1/2010 it entered its full implementation. Jordan is the fourth country to sign an FTA with the United States. Comprehensive agreement covering trade in goods and services, protection of intellectual property rights, environment, labor and electronic commerce Jordan – US FTA Simple rules of origin: the cost or value of materials produced in Jordan and/or the direct cost of processing performed in Jordan account to at least 35% of the US customs appraised value of the good. Possibilities of accumulation of origin among countries that have concluded FTA’s with the US (Arab countries and Singapore) Since the entry into force of the agreement, Jordanian exports to the United States had more than tripled, reaching 1037 and 863 million USD in 2008 and 2009 respectively. Jordan - EU Association Agreement Jordan and the EU signed the Association Agreement on November 24th, 1997 with the aim of creating a free trade area as well as establishing a comprehensive framework for political, economic, trade and investment, social, cultural and financial cooperation. The agreement was concluded within the framework of the Barcelona Process 1995, the goal of which is to create a larger area of peace and economic prosperity in the Mediterranean Area. Jordan - EU Association Agreement The agreement entered into force on May 1st, 2002. From date of entry into force, Jordanian exports into EU-member countries will be exempted from customs duties and other charges having equivalent effect. While EU exports are allowed entry into Jordan free of customs duties and charges having equivalent effect over a transitional period of 12 years. Jordan - EU Association Agreement The Agreement contains comprehensive provisions on the conduct of trade in agricultural and industrial products, right of establishment and services, payments and movement of capital, competition, intellectual property rights, financial co-operation, economic co-operation in the field of industry, standards, transportation, telecommunications, energy, science and technology, environment and tourism, statistics, and the fight against illegal drugs. Jordan - EU Association Agreement Jordan has faced difficulties in seizing the opportunities granted by the Association Agreement as Jordanian exports to the EU are still way below expectations, mainly due to obstacles concerning the rules of origin and standards. The Pan euro-med rules of origin is currently under revision by the regional convention on rules of origin, aiming at simplifying these rules in a way that meets the characteristics and capabilities of the industrial sector in the southern Mediterranean countries, including Jordan. Jordan - EU Association Agreement As for standards, the government has worked intensively with the European partners, to promote and harmonize the current Jordanian standards to meet those applied in the EU, which will also enhance the competitiveness for the Jordanian products in other international markets. GAFTA Greater Arab Free Trade Area was declared within the Social and Economic Council of the Arab League to activate the Trade Facilitation and Development Agreement that has been in force since January 1st, 1998, including in its membership 17 Arab countries. It is one of the most important economic achievements towards establishing the Arab Common Market. As of January 1st, 2005, the agreement reached full trade liberalization of goods (full exemption of customs duties) between all Arab countries members of the GAFTA, except Sudan and Yemen being less developed countries. GAFTA The Agreement’s rules of origin apply a flat rate of 40% as local added value. 12 Arab countries do not require authentication of certificates of origin and accompanying documents by embassies and consulates. About 42% of Jordan’s foreign trade is directed within the GAFTA area. (50% exports and 35% imports – Nov 2010). Jordan - EFTA FTA It was signed on June 21, 2001, with the EFTA states (Iceland, Liechtenstein, Norway and Switzerland), and it entered into force on September 1st, 2002. The Agreement complements both parties efforts to contribute to the creation and strengthening of an enlarged free trade area between European and Mediterranean countries, thus constituting an important contribution to Euro – Mediterranean integration. Agadir Agreement The Agreement Establishing a Free Trade Area Amongst Arab Euro-Mediterranean Countries (Agadir Agreement) was signed in Rabat on Feb. 25th , 2004 between by Jordan, Egypt, Tunisia and Morocco on May 8th. 2001. The Agreement entered into force on July 6th 2006. The Agreement aims as enhancing economic and industrial integration between the member countries as well promoting trade with the EU. Jordan Singapore FTA Jordan and Singapore signed an agreement to establish a free trade area between the two countries on May 16th 2004. The agreement, which entered into force on August 22, 2005, aims at promoting economic relations and developing partnerships between the two countries as well as promoting bilateral trade in goods and services between the two countries. Jordan-Turkey Association Agreement Jordan signed with Turkey on 1/12/2009 and entered into force on 1 March 2011. The agreement covers both industrial and agricultural products. The agreement allows accumulation of origin for the purpose of exporting to the EU. Bilateral Trade between Jordan & Turkey Year Jordan Exports to Turkey Trade balance 39.2 Jordan Imports from Turkey 412.9 2009 2010 60.8 558.4 -497.6 2011 98.1 548.9 -450.8 9/2012 109.2 557.4 -448.2 -373.7 Jordan-Canada FTA The agreement was signed on 26 June 2009 and entered into force on October 1st 2012. The agreement covers industrial and agricultural products. Jordanian products enter into Canadian market duty free as of the date of entry into force while Canadian products are exempted on a transitional period of 5 years. Millions USD Trade with Canada $100 $77 $80 $60 $85 $76 $56 $49 $40 $20 $11 $10 $10 $14 $14 $0 2007 2008 2009 2010 2011 ($20) ($40) ($60) ($39) ($44) ($62) ($66) ($72) ($80) Import Export Balance تطور التجارة للخارجية لالردن 15 10 المستوردات 0 الميزان التجاري 2010 2009 2008 2007 2006 2005 2004 2003 -5 -10 مليار دينار الصادرات الوطنية 5 التوزيع الجغرافي للصادرات الوطنية الدول العربية آسيا امريكا الشمالية اخرى االتحاد االوروبي 2010 2009 2008 2007 2006 مليار دينار 5.00 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 - أهم السلع المصدرة ()2010-2006 1,400,000.00 1,000,000.00 المواد الكيميائية المواد الخام (الفوسفات والبوتاس) 800,000.00 المالبس 600,000.00 المواد الغذائية والحيوانات الحية 400,000.00 200,000.00 0.00 2010 2009 2008 السنة 2007 2006 مجموع الصادرات ( 1000دينار) 1,200,000.00 Trade with FTA Partners (USD Million) Agreement GAFTA EU Association Agreement US FTA EFTA Agadir Agreement Singapore FTA Turkey FTA Canada Exports 3190 315 Imports 6838 3773 1035 20 148 1078 173 784 6.5 89 13 25 549 85 Jordan’s Foreign Trade Imports (2009) Jordan’s Foreign Trade Exports (2009) Thank You! Ahmed.h@mit.gov.jo