P/B - Fisher College of Business

advertisement

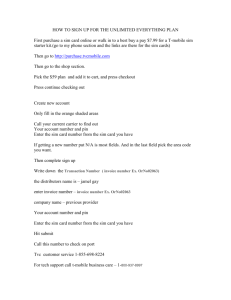

Information Technology Stock Presentation Finance 724/824 SIM Class Summer 2009 Russell Kolmin Zachary McAllister Paul Melko Mahavir Sanghavi Daniel Schuerman Agenda • • • • • • • Agenda Current Holdings Sector Recommendation Recommendation An Omen about Oracle A Bite of Apple Into the Big Blue Recommendation SIM Portfolio Composition SIM Portfolio Composition S&P 500 Weight SIM Weight +/- 9.11% 7.19% -1.92% Consumer Staples 11.81% 11.65% -0.16% Energy 12.04% 10.74% -1.31% Financials 13.86% 8.93% -4.93% Health Care 13.73% 13.30% -0.43% Industrials 9.98% 12.37% 2.39% IT Current 18.72% 20.41% 1.69% IT Proposed 18.72% 19.72% 1.00% Materials 3.40% 4.98% 2% Telecommunication Services 3.41% 3.39% -0.02% Utilities 3.94% 3.61% -0.34% Consumer Discretionary Sector recommendation: Reduce IT holdings by 69 basis points. SIM Weighting Relative S&P SIM Weightings Relative S&P 500 Relative Weightings of SIM vs. S&P 500 Utilities Telecommunication Services Materials IT Proposed IT Current Industrials Health Care Financials Energy Consumer Staples Consumer Discretionary -6% -4% -2% 0% 2% 4% IT Recommendation SIM Portfolio Composition Security Apple Inc. Hewlett Packard Co. Intel Corp. Microsoft Corp. NCR Corp Oracle Corp IBM Ticker AAPL HPQ INTC MSFT NCR ORCL IBM Market Unrealized %age Value Gain/(Loss) Assets Recommendation $258,973.15 $38,851 1.50% Sell 150 bps $650,625.80 ($58,589) 3.77% Hold $537,075.00 ($78,722) 3.11% Hold $706,517.28 ($127,337) 4.09% Hold $521,482.00 ($548,254) 3.02% Hold $850,234.60 $185,882 4.92% Sell 92 bps Buy 173 bps 20.41% New %age Assets 0.00% 3.77% 3.11% 4.09% 3.02% 4.00% 1.73% 19.72% Reduce Oracle • Oracle is nearing 5% of all SIM holdings. • Oracle has shown recent and remarkable increases. • Oracle will continue to do so in the future. • Time to reap some value. • Reduce Oracle Corporation to 4% (sell 92 basis points) Sell Apple– Company Profile • A computer hardware/software company with revenue from: – – – – – – Personal Computers Small Business Computers iPods iPhones Music Sales Americas, Europe, Japan, Retail • Incorporated in 1977 • Symbol - AAPL Sell Apple– DCF Terminal Discount Rate = Terminal FCF Growth = Upside/(Downside) to DCF = 12.0% 5.5% -4.2% Assumes Revenue of Growth: 20% Assumes Margins of: 17% Sell Apple– Valuation Absolute P/Trailing E P/Forward E P/B P/S P/CF High 90.56 49.3 11.4 7.2 82.6 Low Median Current 15.9 37.2 30.9 16.7 30.1 30.3 2.8 6.6 5.8 1.9 3.7 5.5 14.3 35.6 27.3 Relative to the Sector P/Trailing E P/Forward E P/B P/S P/CF High 3.5 2.1 2.5 2.7 5.5 Low Median Current 1.4 1.7 1.7 1.0 1.6 1.7 .7 1.7 1.6 .7 1.6 2.7 1.7 2.4 2.3 Sell Apple– Pros/Cons • Pros to Selling – – – – – Overvalued based on DCF and Valuation Microsoft Windows 7 comes out in October Sales dependent on trendy products Good run in 2009 Other options with better value • Cons to Selling – $27 cash per share – Growth of the iPhone and continued phone/network development – If Apple is able to continue revenue growth through new products or sales in emerging markets large gains will be missed Buy IBM • A Diversified Computer System with revenue tied to – IT infrastructure and business process services – Consulting and systems integration – Computing & storage solutions, including servers, disk & tape storage systems & software – Info Mgmt, integration, intelligence, security, storage, & collaboration software – commercial financing to dealers and remarketers of IT products • Founded 1910 • Symbol - IBM Buy IBM – DCF Terminal Discount Rate = 11.0% Terminal FCF Growth = Upside/(Downside) to DCF = 4.0% 36.60% Assumes Revenue of Growth: 6% Assumes Margins of: 16% Buy IBM – Valuation Absolute P/Forward E P/B (*Removed GW from BV) P/S P/CF Relative to the Sector P/Forward E P/B P/S P/CF High 18.3 10.3 1.9 13.3 High .90 4.0 .90 .90 Low 9.1 3.6 1.1 6.5 Target Median 14.2 5.2 1.6 10.1 $122.40 Current 11.8 10.2 1.6 9.0 Upside = 4% Low .60 .90 .50 .60 Median .70 1.3 .60 .70 Current .70 2.8 .80 .80 Buy IBM – Pros/Cons • Pros – – – – Mature stock with large growth potential Focus on high margin products (i.e. services, integration) 1.80% Dividend Yield Cash On Hand = $12.5B • Cons – Debt ($96B in Tot Liabilities…$42B CL vs $49B CA) • Removing GW and Intang Assets leads to TL > TA – Similarities/Competition with HP – Up 17.6% since July 10th (Overbought??) IT Recommendation SIM Portfolio Composition Security Apple Inc. Hewlett Packard Co. Intel Corp. Microsoft Corp. NCR Corp Oracle Corp IBM Ticker AAPL HPQ INTC MSFT NCR ORCL IBM Market Unrealized %age Value Gain/(Loss) Assets Recommendation $258,973.15 $38,851 1.50% Sell 150 bps $650,625.80 ($58,589) 3.77% Hold $537,075.00 ($78,722) 3.11% Hold $706,517.28 ($127,337) 4.09% Hold $521,482.00 ($548,254) 3.02% Hold $850,234.60 $185,882 4.92% Sell 92 bps Buy 173 bps 20.41% New %age Assets 0.00% 3.77% 3.11% 4.09% 3.02% 4.00% 1.73% 19.72% Appendix Microsoft • There shall not be any action taken upon Microsoft this quarter • However it should be noted that the SIM weight is approaching 5%, therefore the next quarter should look into cutting back • Microsoft appears to have an upside of about 32.3% Other Stocks Considered • • • • • • FLIR GOOG ERTS ADBE HRS RHT • • • • • • PEGA PCLN WEBMD CRM VRSN TSRA