Finance Overview 05

advertisement

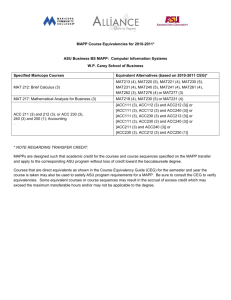

Finance Why We Do What We Do Organizational Chart for Controller What Are Our Goals? Accurate financial transactions Compliance with donor, sponsor, university, state, and federal rules Efficient transaction processing Best value procurement, while using HUB vendors whenever possible Secure and user friendly financial system Accurate Financial Transactions What does this mean? Correct account Appropriate cost center Correct vendor, address, invoice, dates, and amount on vouchers Correct vendor and order information on requisitions and PO’s Correct tax treatment Correct accounting treatment Accurate Financial Transactions Why is this important? Financial data is used by UH management to make decisions Bad data leads to bad decisions Financial data is evaluated for accuracy by internal and external auditors Inaccurate data could mean loss of funding, fines, and bad publicity Accurate Financial Transactions Why is this important? Financial data is evaluated by legislators, sponsors, and donors to determine if we are meeting our goals Ensure the correct items are ordered Ensure vendors are paid correctly Ensure 1099-MISC, 1042S, and W-2 Forms are correct Compliance with Donor, Sponsor, University, State, and Federal Rules External Rules OMB Circular A-81 (supersedes most other circulars; federal funds) US Treasury Regulations Texas Government Code Texas Constitution Texas Education Code Texas Administrative Code External Rulemakers Federal Agencies that Sponsor Research Internal Revenue Service Texas Legislature Texas Comptroller’s Office Government Accounting Standards Board Compliance with Donor, Sponsor, University, State, and Federal Rules External Rules that Apply to Specific Funds State Funds (1xxx and some 7xxx) eXpendit https://fmx.cpa.state.tx.us/fm/pubs/purchase/index.php Textravel https://fmx.cpa.state.tx.us/fmx/travel/textravel/index.php General Appropriations Act (GAA) http://www.lbb.state.tx.us/StateBudgetsGAA.aspx Legislative Budget Board Guidelines for Higher Education Assistance Funds (HEAF) http://www.uh.edu/af/universityservices/policies/mapp/11/ 110201.pdf Auxiliary Funds (3xxx) Auxiliaries, Athletics, and Alumni activities cannot be supported by state appropriated funds (GAA, Article III) Athletics cannot purchase alcoholic beverages with any funds and must follow NCAA guidelines (GAA, Article III) Compliance with Donor, Sponsor, University, State, and Federal Rules External Rules that Apply to Specific Funds Restricted Funds (4xxx) Donor requirements for scholarships Donor requirements for endowment income Sponsored Project Funds (5xxx) Sponsor requirements for research contracts and grants Federal regulations for federal grants http://www.uh.edu/research/sponsored-projects/postaward/ Endowment and Loan Funds (6xxx) Donor requirements for endowment funds Bank requirements for loan funds Agency Funds (9xxx) Owner of fund (not UH) determines how it is used Must meet minimal documentation standards Compliance with Donor, Sponsor, University, State, and Federal Rules Internal Rules UH System Board of Regents Policies UH System Administrative Memorandums (SAMs) http://www.uhsystem.edu/board-ofregents/policies/index.php http://www.uh.edu/af/universityservices/policies/s am/index.htm UH Manual of Administrative Policies and Procedures (MAPPs) http://www.uh.edu/af/universityservices/policies/ mapp/index.htm Compliance with Donor, Sponsor, University, State, and Federal Rules Institutional Compliance Program Identify external rules we must follow Determine the risk of not complying with those rules Develop a plan to reduce the risk of noncompliance Overview of Institutional Compliance Program http://www.uh.edu/compliance/ Report suspected fraud and noncompliance at http://www.mysafecampus.com/ Efficient Transaction Processing Workflow/Document Imaging in Finance System P-Cards for Non-Travel Purchases $5K or Less Fewer employee reimbursements Fewer vouchers to pay vendors Update cost center/account in GCMS $3K limitation for federal funds Travel Cards for Travel Purchases Faster approval Track transactions through approval process Discard paper copy when posted Less out-of-pocket cost for traveler Update cost center/account in GCMS Employee Self-Service for AP Direct Deposit Enter/update bank information in PASS Best Value Procurement While Using HUB Vendors Whenever Possible Texas HUB Vendor Directory http://www2.cpa.state.tx.us/cmbl/cm blhub.html Lists all HUB vendors in Texas See HUB search instructions UH HUB Program http://www.uh.edu/hub/ Contact Purchasing for help in finding a HUB vendor. Secure and User Friendly Financial System Finance System Security Request for UHS Finance System Access (FS002) required for access by UH employees http://www.uh.edu/finance/Forms/Acc ess_Request/FinancialSystem.html Secure and User Friendly Financial System Finance System Security Password must be at least 8 characters and contain at least 1 number, 1 letter, and 1 special character Password must be changed each 60 days Annual Secure Our Systems training must be completed by all employees Secure and User Friendly Financial System User Friendly (We Hope) Single sign-on for Finance, HR and Student Systems, and PASS Workflow and document imaging Custom reports and public queries Verification worksheet to verify cost center transactions Lookup AP payments and update direct deposit information in PASS Secure and User Friendly Financial System PeopleSoft Design Finance, HR, and Student systems share common fields so they can “talk” to each other Enter data once and it can be reused Enter Requisition Copy to PO Copy to PO Voucher Access via web 24/7 Procurement Education Code State universities may purchase goods and services by whatever method is deemed the best value for the institution (Section 51.9335) http://www.statutes.legis.state.tx.us/ Texas Administrative Code Utilize HUB vendors whenever possible (Title 34, Part 1, Chapter 20, Subchapter B) http://texreg.sos.state.tx.us/public/readtac$ext.viewtac Texas Government Code Prohibits payments to persons and companies “on hold” with the state (Section 403.055) http://www.statutes.legis.state.tx.us/ Texas Constitution Printing must be competitively bid (Article 16, Section 21) http://www.statutes.legis.state.tx.us/ Procurement State fund rules eXpendit https://fmx.cpa.state.tx.us/fm/pubs/purchase/index.php Federal fund rules OMB Circular A-81, etc. http://www.uh.edu/research/sponsored-projects/postaward/ UH rules PO purchases – MAPP 04.01.01 Voucher purchases – MAPP 04.01.03 P-Card purchases – MAPP 04.01.11 Contracts – MAPP 04.04.01A HEAF purchases – MAPP 11.02.01 Procurement UH resources Procurement Rules Checklist Best Practices for Vendor Payments State Fund Procurement Restrictions P-Card and Travel Card Matrix P-Card Guidelines Vendor Hold Status http://www.uh.edu/finance/pages/Ref erences.htm Procurement UH resources http://www.uh.edu/administrationfinance/purchasing/ Addendum A: Vendor Selection Flowchart Addendum B: Pre-Approval Form for Requisitions Addendum C: Purchase Requisitions Exceeding $100,000 Justification for Proprietary (Sole Source) Acquisition Buyer’s Checklist Lab Animal Flowchart and Purchase Request Form http://www.uh.edu/finance/pages/forms.htm Travel TX Govt Code 660.007 (all funds) Minimize travel expenses; travel arrangements must be cost effective IRS rules (all funds) Publication 463, Travel, Entertainment, Gift, and Car Expenses http://www.irs.gov/ Accountable plan Documentation Business purpose State fund rules Textravel https://fmx.cpa.state.tx.us/fmx/travel/text ravel/index.php Travel Federal fund rules OMB Circular A-21, etc. http://www.uh.edu/research/sponsoredprojects/post-award/ UH rules http://www.uh.edu/af/universityservices/policies/mapp/in dex.htm State fund travel – MAPP 04.02.01A Local fund travel – MAPP 04.02.01B Corporate Travel Card – MAPP 04.02.01C Student travel – MAPP 04.02.04 Travel Card – MAPP 04.02.05 Travel UH resources Travel Voucher Checklist (for State Fund, Local Fund, and Non-Overnight Transportation) Mileage Reports Travel Accounts P-Card and Travel Card Matrix Travel Card Guidelines http://www.uh.edu/finance/pages/AP_ Travel.htm Taxable Payments to Individuals IRS rules Publication 15, Employer’s Tax Guide Publication 15A, Employer’s Supplemental Tax Guide Publication 15B, Employer’s Tax Guide to Fringe Benefits Publication 521, Moving Expenses UH rules Taxable Fringe Benefits – SAM 03.D.06 Moving Expenses – MAPP 02.02.05 Taxable Payments to Individuals UH resources Voucher Workflow Matrix for Scholarships and TaxRelated Payments http://www.uh.edu/finance/pages/References.htm Exhibit A: Tax Treatment of Scholarships, Stipends, and Awards/Prizes/Gifts (SAM 03.D.06) http://www.uh.edu/af/universityservices/policies/sam/ Exhibit B: Taxable Payments or Reimbursements to Employees http://www.uh.edu/finance/pages/forms.htm Exhibit C: Most Frequent Taxable/Non-taxable Fringe Benefits (SAM 03.D.06) http://www.uh.edu/af/universityservices/policies/sam/ Addendum A: Authorization for Moving and Relocation Expenses (MAPP 02.02.05) http://www.uh.edu/af/universityservices/policies/mapp/index.htm Tax Exemption Texas Sales and Use Tax Exemption Certificate http://www.uh.edu/finance/pages/tax_doc.htm UH rules: MAPP 04.01.03 and P-Card Guidelines Do not pay sales tax to Texas vendors when paying by voucher Employees are expected to present Certificate to Texas vendors, except for business meals If vendor refuses Certificate, employee can be reimbursed for full amount of tax (except fund 1 & 5) If employee does not present Certificate, employee can be reimbursed up to $10 sales tax per transaction (except on fund 1 & 5) If Texas vendor charges sales tax on P-Card, ask vendor to refund the sales tax to the P-Card Tax Exemption Texas Hotel Occupancy Tax Exemption Certificate http://www.uh.edu/finance/pages/tax_doc.htm UH rules State Funds - MAPP 04.02.01A Employee must present Certificate to Texas hotel and verify state portion of hotel occupancy tax (6%) is not charged If hotel refuses Certificate, notify AP and employee can be reimbursed for tax If employee does not present Certificate, he/she cannot be reimbursed for tax Local Funds – MAPP 04.02.01B Employee is reimbursed for tax (except fund 5) whether he/she presented Certificate or not; notify AP if hotel refuses certificate Accounting Federal Rules Government Accounting Standards Board (GASB) Accounting Rules http://www.gasb.org/ UH Resources Account List Fund Codes GL Journal Checklist (under GL Journal Workflow Information) Fund Equity Transfers (under Transaction Processing) Service Center and Auxiliary Business Process Matrix (under SC Voucher Workflow Information) http://www.uh.edu/finance/pages/References.htm Fraud Prevention Department Fraud Risk Survey Institutional Fraud Risk Survey Fraud Reporting Hotline http://www.mysafecampus.com Fraud and Institutional Compliance FAQs on the Web http://www.uh.edu/finance/ Fraud Prevention and Awareness Training Code of Ethics Training