Opening a Checking Account

advertisement

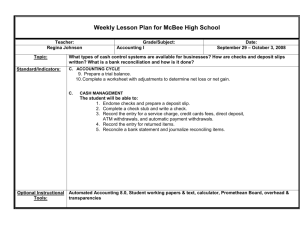

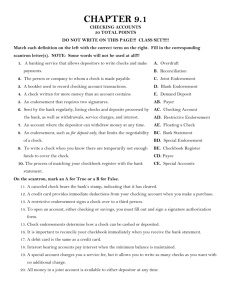

Opening a Checking Account What type of bank will you choose? Skill 1 Types Services – Commercial Banks – Checking – Savings and Loans – Savings – Credit Unions – Credit Cards – Loans – Safe-deposit boxes – Other services How is your money protected? Commercial Banks – FDIC Insurance (Federal Deposit Insurance Corporation) Savings and Loans – Savings Assoc Insurance Fund Credit Union – National Credit Union Admin. All deposits protected up to $100,000 per institution by the Federal Govt. (Now $250,000) Skill 2 Opening a Bank Savings or Checking Account Goals for Skill 2 How do we open a bank checking account? How do I complete a signature card? How do I complete a deposit slip for a personal checking account or a savings account? Vocabulary ABA Number Forged signature Individual checking account FDIC Joint checking account Personalized deposit slips Signature card Understanding the Job How do we pay our bills? – – – – – Cash? Don’t pay at all? With money orders? Go to the business in person? Credit cards? What if a credit card is not an option? Write a check! 1. Convenient Why? 2. Safer than cash 3. Provides a paper trail Understanding the Job cont. What types of checking accounts are available at a bank? Individual Checking account Joint Checking account Money Market Checking account How do you decide which bank to choose? Is the bank convenient to your home or business? Does the bank provide the services you need? Does the bank charge for a checking account? Is it FDIC insured? Understanding the Job cont. What forms might you need to fill out when you go to the bank? – Application • Why? – To have all your current information on file. – Signature Card • Why? – To prevent forged signatures – Personalized Deposit Slips • Why? – Save time at the bank • Less chance of bank or personal errors • Contains the ABA Number Let’s fill in the blank signature card Understanding the Job cont. Steps to fill out a deposit slip. 1. 2. 3. 4. 5. Enter the date Enter bills deposited Enter coins deposited Enter checks deposited Calculate and enter the total. Fill in the Sample as we follow the steps. Questions Let’s Review What do we need to do to open up a checking account? How do we complete a signature card? What are the steps to complete a deposit slip? Practice Classwork/Homework Application Problem Job 27 Define vocabulary words and put them in your binder Points = 45 Skill 3 Endorsing Checks Goals for Skill 3 How do I transfer a check from one party to another? How do I cash and/or deposit a paycheck? How do I handle a split deposit of a check? Vocabulary Blank endorsement Canceled checks Clearinghouse Endorsement Full endorsement Leading edge Negotiable Restrictive endorsement Split deposit Trailing edge Understanding the Job What do you do with a check that you receive? – Cash it – Deposit all of it – Deposit part of it You need to transfer ownership from you to the bank by …? – Endorsement • “Pay to the order of” • Allows you to transfer ownership to another party – Bank Understanding the Job cont. Why is a check considered negotiable? – It can be transferred to another party – Just like money Follow me with demo problem Job 26 What do you do with the check at the bank? – Trailing edge – 1 ½” of the top of the check where a signature can be written (Left side of check front) – Blank endorsement – signature only • What happens if you lose this signed check? • A blank endorsement does not state who the check is being transferred to. – MICR numbers are encoded onto the check Understanding the Job cont. – The first bank (Manuel’s) endorses the check Who goes to get the money from Marty’s bank? – The check is sent to a clearinghouse for processing – The clearinghouse computers read the MICR numbers and complete the transactions – Money comes out of Marty’s bank and into Manuel’s – The second bank to touch the check (Clearinghouse) endorses the check near the Leading Edge (Right side of check front) of the check Now what happens to the check? – Check goes back to Marty’s bank and money is taken from Marty’s account – Check is now stamped “PAID” and becomes a cancelled check. Understanding the Job cont. What other types of endorsements are available to me? Let’s look at – Restrictive endorsement – Full endorsement Restrictive with sample problem 2. When would you use a Full endorsement? – You don’t have a bank account – You owe somebody money Steps to endorse a check 1) Enter the check 2) Prepare the deposit slip 3) Record the deposit in the check register • Only if you put some of the check into your account. Let’s do the Job 26 Demo together Questions Let’s Review How do I transfer a check from one party to another? How do I cash and/or deposit a paycheck? How do I handle a split deposit of a check? Let’s look at a Split Deposit with sample problem 3 Practice Classwork/Homework Application Problem Job 26 Page 207 Points = 30 Quiz tomorrow on vocabulary. Skill 4 Writing Checks Goals for Skill 4 How do I complete a check register for my checking account? How do I write out checks for my checking account? Packet page: Job 23 overheads Vocabulary Check Check register Check stub Checkbook Drawee Drawer Issue Legible Payee Insufficient funds (NSF) Postdated Void Understanding the Job Now that you have a checking account, how do keep track of all the checks you issue? (write out) – You use the checkbook How do you know how much money you have in your account? – – – – Call the bank? Check on-line? Wait for a statement? Keep a record of your transactions! What is a check stub for a business account? A check register? – A type of permanent record Why is it important to fill it out? – To keep accurate records Understanding the Job cont. Who are the three parties involved in a check. – Drawer – the person who writes the check – Drawee – the bank that is ordered to pay on the check – Payee – the person who is to be paid How do you issue a check? Let’s look at the Practical Money Skills overhead. Follow the steps on the next slide. Understanding the Job cont. Steps to writing a check. Always use ink. (WHY?) Write legibly. Use the current date. (Don’t Postdate) Write the name of the payee. Write the amount of the check in figures. Write the amount of the check in words. Enter a memo if applicable. Sign your name. Understanding the Job cont. What happens if you make a mistake? – Panic? – Throw the check away? – Use wite out? – Cross it out and do it again? – NO! – Write VOID across the check and retain it. What is a check protector? Let’s do a sample problem Questions Skill 5 Using a check register Goals for Skill 5 How do I complete the check register for my personal checking account? How do I write a check for less than one dollar? Understanding the Job When you write checks out with a stub, the checks are attached to the stub and everything is right in front of you. When you write checks for your personal account, the checks and records are separate. The records are put in a check register using a three step method. Let’s continue with the activity we already started Understanding the Job What happens when you are told you have “insufficient funds”? – You don’t have enough money in your account – You may bounce checks – Your payees will be very upset with you – You may not get loans or credit from the bank – You may get fined and/or go to jail Understanding the Job cont. How do we avoid this situation? – Make more deposits – Keep your checkbook accurate and up to date – Don’t write checks if you know you don’t have any $ – Be aware of Check 21 policy? Let’s try another problem 26-5 handout Questions Let’s Review Who are the three parties involved with a check? What are the steps to follow when writing out a check and filling in a register? What procedure do you follow when you make a mistake writing a check. What are insufficient funds? Try a few written exercises, p184 handout. Practice Classwork/Homework Application Problems Job 25-4 Page 200201 Points = 90 Quiz tomorrow on vocabulary. Skill 6 Writing a check for less than a dollar Understanding the Job cont. How do I write a check for less than one dollar? – 1. 2. 3. Use the steps from a typical check writing activity except… Use the words Only in front of the written words. Cross out the word Dollars on the check. Be sure to be accurate. Why would I write a check for less than one dollar? – – Shipping and handling on an item Copies from an archive Let’s practice a few on p198 handout Questions Let’s Review What considerations must be followed when using a check register? How do I write a check for less than one dollar? What is the difference between the check register and the check stub? Practice Classwork/Homework Application Problems Job 25-1 Skill 7 Reconciling Bank Statements Goals for Skill 7 How do I read a bank statement? How do I find which checks are outstanding? How do I prepare a bank reconciliation statement? Vocabulary Bank Reconciliation Statement Bank Statement Bank Statement Balance Checkbook Balance Outstanding Checks Reconciled Understanding the Job What do banks do with all those cancelled checks? – Throw them away? – Send them back one by one? – No, they send them back to you once a month. Along with the checks is a statement of your account. – It lists all the activity during the month Understanding the Job cont. What information is on the statement? – Bank statement balance – Deposits – Withdrawals – Checks written – Service Charges – And the dates when all these activities happened What do I do with this information? – Compare the bank statement balance with – The Checkbook balance Understanding the Job cont. What if they don’t match? – You need to reconcile the account (bring into agreement). – Using the bank reconciliation statement. Let’s look at the sample problem on the overheads for guidance. Follow the steps on the next slide. Steps to Reconcile 1. Compare the deposits. 2. Arrange the canceled checks in order. 3. Compare the canceled checks with the stubs. 4. Find the outstanding checks. 5. Prepare a bank reconciliation statement. Let’s do “Learn by Doing” handout together. Questions Let’s Review What are the parts of a bank statement? Which checks are outstanding? How do I reconcile a bank statement? – What are the steps? Practice Classwork/Homework Demonstration Problem Job 28 Points = 45 No Quiz tomorrow on vocabulary. Skill 8 Handling Outstanding Deposits Goals for Skill 8 How do I prepare a bank reconciliation statement when a deposit is outstanding? How do I use a bank-supplied reconciliation form? Vocabulary Outstanding Deposit Understanding the Job What happens when you make a deposit into your account and it doesn’t appear on the bank statement? – Call the bank and complain? – Figure the bank made a mistake? – Maybe you didn’t put the money in the right account? – No, you need to reconcile your checkbook. Let’s take a look at the sample problem? p221 handout Understanding the Job cont. How can I use the reconciliation sheet supplied to me by the bank? 1. 2. 3. Compare the deposits Complete the reconciliation. Compare the canceled checks Same steps we used to complete Job 28. Check out the sample problem. p222 handout Questions Let’s Review How do I prepare a bank reconciliation statement when a deposit is outstanding? How do I use a bank-supplied reconciliation form? Practice Classwork/Homework Demonstration Problem Job 29-1 Points = 40 No Quiz tomorrow on Job 29 and vocabulary. Skill 9 Handling Bank Service Charges, Interest, and Errors Goals for Skill 9 How do I prepare a bank reconciliation statement with bank service charges and interest earned? How do I correct errors made in my checking account? Vocabulary Interest Understanding the Job In the previous two jobs we have prepared a bank reconciliation statement when checks and deposits were outstanding. – We recorded the activities but the bank had not. Now, we need to make adjustments to our checkbook for activities involving fees, interest, and errors. – The bank has recorded the activities but we have not. Steps to handle: Service Charges, Interest, and Errors 1. Enter the heading and balances; handle outstanding deposits and checks. (Jobs 28-29) 2. Subtract the service charge from the checkbook balance. 3. Add the interest earned to the checkbook balance. 4. Handle any errors. 5. Finish the bank reconciliation statement. 6. Correct your check stubs or check register. Sooooo… Item Treatment Outstanding Checks Subtract from bank statement Outstanding Deposits Add to bank statement balance Bank Service Charge Interest Subtract from checkbook balance Add to checkbook balance Questions Let’s Review How do I prepare a bank reconciliation statement with bank service charges and interest earned? How do I correct errors made in my checking account? Practice Classwork/Homework Demonstration Problem Job 30-1 Points = 25 Quiz tomorrow on vocabulary.