Chinese Market Profile

advertisement

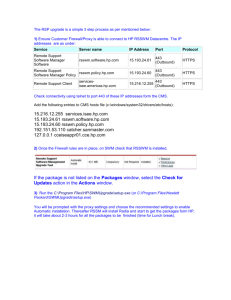

PHILIPPINE MARKETING PLAN FOR CHINA Outline of Presentation Background on China Outbound Travel from China – 10-year Chinese Outbound Travel Market – China Outbound vis-à-vis East Asian Countries – Destinations of Chinese Tourists – Travel Preferences Arrangements Sources of Information – Profile of Outbound Chinese Traveler Demographic Profile Travel Profile – Growth trend – Factors fueling outbound travel growth Chinese Tourists to the Philippines – 10-year Visitor Arrivals from China – Profile of Chinese Visitors – Flight frequencies between the Philippines and China Outline of Presentation Competitive Analysis – Arrivals from China to ASEAN Countries – Air Seats Capacity between China and ASEAN Countries – Comparative Profile of Chinese Visitors in the Philippines and Thailand – Tour Products and Packages – Marketing Strategy and Tools Issues and Action Plan Philippine Tourism Marketing Plan for China – Objectives – Strategies – Marketing Tools – Work and Financial Plans – Communication Plan – Monitoring and Evaluation Background Demographic Population – 1.298 Billion as of July 2004 – 15 – 64 years account for 70% of the population – 56 ethnic groups with the Han as the largest group accounting for approximately 91% of the population Mandarin is the standard dialect widely spoken and understood with Cantonese commonly used in the province of Guangdong Fourth largest country in the world with 9.3 million sq. km. land area 23 provinces, 5 autonomous regions and 4 municipalities Major business centers are Beijing, Shanghai, and Guangzhou Economic Growth Gross Domestic Product (%) GDP per capita Current Price in Yuan Current Price in US$ % 1999 2000 2001 2002 2003 7.1 8.0 7.3 7.0 7.4 6,551 789 6.2 7,086 853 7.3 7,651 921 6.8 8,214 990 6.5 9,073 1,093 6.9 Source: Asian Development Bank Outlook 2003 Report Family Income and Outbound Travel Plans Family Monthly One Journey Two Journeys Three Journeys Income Less than US$ 180 25% US$ 180 – US$ 360 55% 2% US$ 361 – US$ 550 70% 9% More than US$ 550 34% 58% Source: SSIC 2000: Survey of Five Cities 3% Outbound Travel from China Top Tourist Destinations, 2003 France Spain United States Italy China United Kingdom Austria Mexico Germany Canada Visitor Volume Visitor Receipts ( in Million) (in US$ Billion) 75.0 52.5 40.4 39.6 33.0 24.8 19.1 18.7 18.4 17.5 36.6 41.7 65.1 31.2 17.4 19.4 13.6 n/a 19.1 n/a Chinese Outbound Travel (in Thousand) 25,000 20,200 20,000 16,602 15,000 12,133 10,472 10,000 9,066 8,426 8,170 6,230 4,520 5,000 3,730 3,740 0 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 Growth Rate 21% 37% 16% 13% 7% 3% 32% 38% 21% (.002%) China Outbound Travel vs. Outbound Travel from East Asia (2003) Country China Japan Korea Taiwan Hong Kong Volume 20,200,000 13,296,330 7,086,323 5,923,072 8,380,467* *exclude outbound to Mainland China China Outbound Market Total Outbound to Asia in 2002 – 14,271,519 (which includes outbound travel to Special Administrative Regions) By 2020, WTO predicts China will have more than 100 million outbound travelers Source: WTO Report Destinations of Chinese Tourists Destinations Hong Kong SAR Macao SAR Thailand Vietnam Russia Republic of Korea Malaysia Japan Australia 2001 2000 Growth Rate 4,448,583 3,005,733 695,372 672,372 606,102 482,308 453,206 391,384 171,900 4,142,191 1,644,421 707,456 n/a n/a 400,958 n/a 595,660 126,852 7% 82% (1%) n/a n/a 20% n/a (34%) 36% Preferences of Chinese Travelers Extremely price – conscious – – – – Price is a major consideration Tour cost has to be cheap Mass market and not high-end nor deluxe No optional tours but would not mind paying extra to go shopping or take part in activities not included in the package. Extra cost must not be too high – 3-star accommodation – Demand compliance with tour description Information in Chinese language – Word-of-mouth communication from friends and relatives is still an important information source Preferences of Chinese Travelers Multi/Single-destination tied with varied interesting spots – Beautiful scenery – Shop authentic but cheap souvenirs for neighbors, colleagues, etc. – Relaxation, knowledge and experience different culture – Taste different food – Give status in the community Sources of Information Travel Agents Books/ Newspapers/ TV Word of Mouth Brochures/ Flyers Internet Source: PATA China Outbound Travel Study, 1994 38% 33% 18% 7% 2% Travel Arrangements for Pleasure Travelers Other, 7% Parent Company, 9% Travel Agency, 33% Own Employer, 9% SemiIndependent TA, 10% Source: PATA China Outbound Travel Study, 1994 Personal, 29% Readership of Different Types of Magazines Type of Magazine Major news magazines Digest magazines General interest magazines Film/TV magazines Travel magazines Professional magazines Sports magazines Source: PATA China Outbound Travel Study, 1994 Pleasure Traveler 50% 44% 44% 34% 24% 24% 22% Business Traveler 61% 46% 35% 18% 13% 45% 27% Demographic Profile of Chinese Traveler Sex Age Male Female 71% 29% 30 or younger 31 – 50 51 and older 27% 49% 22% Education No higher education 20% Less than4 years 27% 4 years and more 52% Source: PATA China Outbound Travel Study, 1994 Position Top/Senior Middle-level Other 33% 50% 15% Monthly household income Less than1600 yuan 30% 1601 – 2400 yuan 32% More than 2401 yuan 34% Marital Status Married Non-married 78% 20% Travel Profile of Chinese Tourist Purpose of Visit Business (64%) Visiting partners Conventions Exchange tours Sports/ Cultural Others 24% 12% 10% 2% 13% Pleasure (39%) Sightseeing Visiting relatives Visiting friends Sports/ Cultural 19% 16% 2% 2% Source: PATA China Outbound Travel Study, 1994 Frequency of travel 1 trip 2 trips 3 or more trips 59% 19% 20% Length of most recent trips One week or less 19% 8 to 21 days 54% More than three weeks 26% Traveled Alone With others (78%) Delegation Company Trip Package Tour Spouse/Children 21% 16% 40% 14% 6% Most Popular Items Chinese Buy When Traveling Abroad Items Food/ candy/ chocolate Liquor/ Tabaco Women’s clothing Souvenir Men’s clothing Jewelry Electronics Leather goods Source: PATA China Outbound Travel Study, 1994 Pleasure Traveler 57% 34% 36% 30% 31% 25% 18% 17% Business Traveler 50% 36% 17% 20% 17% 19% 20% 12% Market Segment Business Purpose 1992 2000 59% 46% Source: PATA China Outbound Travel Study, 1994 Pleasure Purpose 41% 54% Chinese Travel Outlook Type of travelers Pleasure Business (46%) Economic Non-economic 54% 48% 40% Frequency of travel Once Twice Frequent 38% 46% 70% City Beijing Shanghai Guangzhou 61% 39% 38% Source: PATA China Outbound Travel Study, 1994 Place of work Foreign-invested/foreign owned enterprises 51% State enterprises 48% Academic/ research 48% Government 41% Other non-profit orgs 33% Have relatives living abroad Yes 48% No 26% Major Sources of Outbound Travel Beijing (Peking) Population Urban Population (Guangzhou) Per Capita Income Places of interests Shops Historical sites Theme parks Museums Casino/ Bar 13 M 4.7 M Shanghai Guangdong 16 M 7.5 M 72.70 M 2.6 M US$ 13,471 US$ 13,602 US$ 2,029 Capital of China Industrial/ Financial/ Commercial Center 83% 65% 46% 41% 13% 85% 75% 45% 35% 9% Political/Economic Technological/ Cultural Center 93% 66% 58% 41% 15% Chinese Travel Outlook Rising rapidly and will be first tourist source nation by 2020 Major visitor-generating market for ASEAN destinations 7th largest tourism spender in the world Global trend for short - haul travel Workers enjoy seven-day holidays on May 1 (International Workers Day) and October (National Day) for a total of 14 days yearly Factors Fuelling Outbound Travel Growth Growing gross national income which is number six (6) in the world Growing disposable income with household savings in urban and rural areas exceeding 10 trillion RMB. GDP per capita is expected to reach US$ 1,000 Shifting consumption pattern from dressing warmly and eating one’s fill, to living a well-off life Factors Fuelling Outbound Travel Growth Outbound travel restriction are being relaxed – Exit clearance has been lifted since 01 February 2002, However, Chinese traveling abroad must obtain or hold a valid visa issued by a foreign government before they are allowed to exit China – Chinese tourists can take between US$ 3,000 – US$ 5,000 on a trip abroad – Outbound tourists can also buy foreign currency themselves rather than thru travel agency – More travel agencies are being allowed to operate outbound tours Simplification of passport application procedures Factors Fuelling Outbound Travel Growth Improving air capacity infrastructure. By 2019, China is projected to have 22,000 passenger airplanes which is more than 10 times the world’s total Increasing number of destinations being granted ADS from 4 in 1992 (Thailand, Malaysia, Singapore and Philippines) to 73 in September 2004 Outbound tour is no longer a once-in-a-lifetime event. Repeat outbound travel is becoming common. Middle-class families are becoming main force. Middleaged travelers and educated young adults with high incomes comprise a big proportion of outbound tourists List of ADS Countries Year Countries 1983 Hong Kong, Macau 1988 Thailand 1990 Singapore, Malaysia 1992 Philippines 1999 Australia, New Zealand, Republic of Korea 2000 Japan, Vietnam, Cambodia, Myanmar, Brunei 2002 Nepal, Indonesia, Malta, Turkey, Egypt 2003 Germany, India, Maldives, Sri Lanka, South Africa Croatia, Hungary, Pakistan, Cuba 2004 Austria, Belgium, Cyprus, Denmark, Estonia, Finland France, Greece, Italy, Latvia, Lithuania, Luxembourg Netherlands, Poland, Portugal, Ireland, Slovakia, Slovenia, Spain, Sweden, Norway, Iceland, Switzerland, Liechtenstein, Romania, Zimbabwe, Brazil, Tanzania, Russia, Ethiopia Chinese Passport and Visa Before – Chinese citizens wishing to travel overseas need to apply for a passport which is valid only for the journey applied – Invitation from foreign country is required – For ADS countries, invitation is not required but the number of Chinese citizens visiting said countries is established through “quota system” for authorized travel agents only allowed to sell outbound tours – Exit clearance is required Chinese Passport and Visa After – July 2000: Chinese citizens can obtain passport without an invitation letter from foreign country but requirement to obtain “permission” /exit permit or visa for each journey remains – February 2002: Exit clearance has been lifted, however, valid visa from foreign country to be visited must be secured before Chinese tourists are allowed to exit China Chinese Tourists to the Philippines Arrivals from China to the Philippines 1993 - 2003 35000 32,039 30000 27,803 24,252 25000 21,220 19,093 20000 18,937 15,757 14,724 15000 10000 9,259 7,011 8,606 5000 0 % increase/ decrease 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 32% Source: A/D Cards -7% 83% 21% 27% -13% -31% 29% 47% 15.2% Profile of Visitors from China to the Philippines, 2003 Sex Age Male Female 61.61% 33.45% 25 – 34 years old 35 – 44 years old 45 – 54 years old 25.22% 31.51% 17.37% Occupation Professional/ Managerial/ Administrative Clerical/ Sales Services Housewife Student/ Minor Not Stated 24.57% 1.23% 4.54% 4.51% 60.09% Purpose of Visit Holiday Business VFR Convention Official Mission Not Stated 40.69% 8.83% 8.21% 1.19% 0.26% 37.52% Activities Shopping Sightseeing Sports Conference Others Beach Holiday Incentive Travel 94.80% 10.30% 1.90% 1.30% 1.30% 0.60% 0.60% Profile of Visitors from China to the Philippines, 2003 Type of Accommodation Hotel 16.07% Apartel/ Rented Homes 3.76% Homes of Relatives/ Friends 5.63% Not Stated 74.55% Travel Arrangements Package Independent Not Stated 32.27% 17.86% 49.87% Frequency of Visit First Visit Repeat Visit Not Stated 32.92% 20.79% 46.29% Average Daily Expenditure (in US$) Accommodation 20.06 Shopping 11.35 Food/ Beverage 9.72 Local Transport 3.19 Entertainment/ Recreation 2.93 Guided Tour 0.19 Miscellaneous 8.77 US$ 56.21 Average Length of Stay 11.10 nights Visitor Receipts US$ 19,900 M Profile of Visitors from China to the Philippines, 2003 Things like most about the Philippines Warm, hospitable and kind people Beautiful scenery/ nice beaches Good climate Good food/ liquor/ fruits 37.60% 20.70% 14.10% 8.50 Things dislike most about the Philippines Heavy traffic 36.20% Air/ water pollution/ dirty environment/ bad roads 32.10% Crime incidents/ poor peace and order 23.30% Widespread poverty beggars 4.80% Cheating, reckless/ dishonest taxi drivers 2.60% Flight Frequencies between Philippines and China (as of October 2004) Entitlements 624,000 Utilized entitlements 214,084 China Southern Airline (96,252) > Peking (Beijing) – Xiamen – Manila (Daily) > Canton (Guangzhou) – Laoag (Wed, Fri, Sun) > Shanghai – Laoag (Fri, Sun) Philippines Airlines (117,832) > Shanghai - Manila (Daily) > Xiamen - Manila (4 times) Cebu Pacific (38,688) > Canton (Guangzhou) – Subic – Manila (Fri, Sun) > Manila – Xiamen (Sun) Based on CAB Summer Schedule Visas Issued by Philippine Consulate General January – September 2004 Type of Visa Beijing Pleasure Individuals Tour groups Business Official Crew members Student Total Shanghai Total 4,597 2,399 1,523 6 96 1 4,836 8,622 13,458 Strengths, Weaknesses, Opportunities and Threats (SWOT) of the Philippines as a destination for Chinese tourists Weaknesses Strengths - natural scenery (beaches, etc.) - friendly to Chinese (Chinese heritage of Filipinos) - different culture - variety of seafood (for southern Chinese) and sunny island resorts (for northerners) - proximity to China - English-language facility - lack of information on Philippine destinations (consumers and tour operators) - pricing (high price and not one price) - negative image re: security problems - no variety in tour offerings - lack of infrastructure development - lack of professional Mandarinspeaking tour guides - aside from Manila, no direct flights from China to Cebu and Davao - fragmented private sector Strengths, Weaknesses, Opportunities and Threats (SWOT) of the Philippines as a destination for Chinese Threats tourists Opportunities - compared to Bali and Phuket, several Chinese tour operators prefer Boracay - More countries granted Approved Destination Status (ADS) as of 2003 especially in Europe - China is a seller’s market, so with enough local advertising and information to operators and consumers , Philippine tour packages can be pushed more - terrorism and security problems - China is used to charters - good relationship established between DOT and CNTA and local officials - large portion of outbound market are first-timers out of China - Future events in China require them to learn English fast (i.e., 2008 Olympics) - aggressive marketing and sufficient budget Approved Destination Status (ADS) According to the China National Tourism Administration (CNTA), several countries who have been granted ADS , have not been successful in getting substantial share of the Chinese outbound market due to : – no advertising for tour offerings in publications of travel agencies – high price is a major obstacle – no brochures and lack of communications making it difficult for Chinese travel agencies to promote new destinations – more professional tour guides required COMPETITORS’ PACKAGES Thailand - Beijing-Phuket, 6 days – 5 nites, with airfare 3980 RMB or $ 485. - Beijing-Bangkok-Pattaya (full board), 6 days-5 nites, 4480 RMB or $ 545 or $691 during high season (May and Oct) • Thailand spent $200,000 in advertising in China during 1st year of operation Philippines - Beijing-Manila-Cebu, 6 days-5 nites, 5980 RMB or $ 728. MAP OF ASIA China Vietnam Singapore Thailand Indonesia Malaysia Philippines