Financial Aid Presentation, January 12, 2016

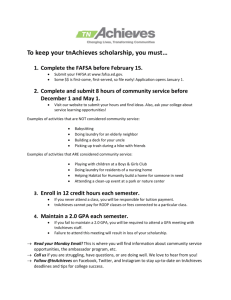

advertisement

How To Apply For Financial Aid Topics to be Covered • • • • • • What is the FAFSA? Obtaining a FSA User ID FAFSA Application Types of Financial Aid Cal Grant DREAM Application What is the FAFSA? • The FAFSA is the Free Application for Federal Student Aid • www.fafsa.gov • 2016-2017 available starting January 1, 2016 • Priority Deadline: MARCH 2, 2016 • Used for federal, state, and some institutional aid – Grants, Work-Study and Federal Student loans Federal Student Aid User ID & Password • Your electronic signature • Each person must obtain one • Used to file the FAFSA, and access other federal websites • Can be requested during the FAFSA application or online at: – www.fsaid.ed.gov FAFSA Application • • • • • • • Step 1 - Student Demographics Step 2 - School Selection Step 3 - Dependency Status Step 4 - Parent Information Step 5 - Financial Information Step 6 - Parent/Student Household Step 7 - Signatures Step 1 - Student Demographics • General information about the student – name, address, SSN, date of birth, degree objective, etc. • Name must match legal name on Social Security Card – Do not use nicknames or abbreviations of your name • Selective Service – If male and 18+ must register with Selective Service • Email Address – Suggest you provide. If provided, notifications received more quickly by email Step 2 – School Selection • Option to list up to 10 colleges that will receive your FAFSA • Search feature available to search for schools or you can directly enter the school code – University of La Verne: 001216 • Housing Plans – On Campus (dorms) – With Parent – Off Campus Step 3 – Dependency Questions • • • • • • • Born before January 1, 1993 Married Seeking Master’s or Doctorate program Have children or dependents Serving in U.S. Armed forces or a Veteran Parents deceased since turned 13 years old Emancipated minor, ward of court, legal guardianship • Homeless or at risk of being homeless Step 4 – Parent Information • Parent(s) is defined as: – Biological, Adoptive or Step-parent • Marital Status – – – – – Single Married Divorced Widowed Unmarried and both parents living together • If parent does not have Social Security Number, report as 000-00-0000 • People in parent’s household Step 5 - Financial Information Student/Spouse and/or Parent • Completed IRS Tax Return • Include adjusted gross income for 2015 and earnings from work – Can provide estimate based on 2015 earnings – Update FAFSA when return is filed • Include additional financial information and untaxed income Step 5 - Financial Information • Asset value as of the date FAFSA is completed • Cash, savings and checking accounts • Investments net worth • Business net worth – Over 100 employees • Investment & farms net worth – Do not include family farm Step 6 – Household Dependent Students • List members of your household – Parent(s) – Self – Siblings – Others living in house that parent provides more than 50% of support for and will continue to do so through June 30, 2017. Sign and Submit • Required – Student – One parent (dependent student) • Ways to Submit – Electronically with FSA ID • User name and password – Print Signature Page – Paper FAFSA (not recommended) Confirmation • When your application is processed you will be notified via E-mail (if you provided one). • Your processed application is the: – Student Aid Report (SAR) – Summary of your FAFSA information • Your processed application is sent to the schools you indicated on the application Next . . . • Schools determine federal, state, and institutional aid you qualify for. • Schools send you an award notification showing what aid you qualify for. • Schools may request additional information from you. Types of Financial Aid • Gift Aid Grants (federal, state, institutional) – Scholarships • Work-Study • Loans – student and parent Federal Aid Programs • Student Aid – Pell Grant – Supplemental Education Opportunity Grant (FSEOG) – Federal Work-Study – Federal Student Loans • Direct Subsidized - Need Based • Direct Unsubsidized – Non Need Based • Perkins Loan – Need Based Federal Aid Programs • Parent Aid – Parent PLUS Loan • Credit based loan offered to parent or step-parent • Fixed interest rate (set July 1st) • Can be requested to cover any remaining educational costs for student State Aid Programs • Cal Grant A, B, or C • CHAFEE Grant • CA Dream Act (DACA Students) • Only State Schools (UC/CSU/Community College) – Middle Class Scholarship (MCS) – Board of Governor’s Fee Waiver (BOG) – Educational Opportunity Grant (EOP) Cal Grant Program • • • • Deadline: March 2nd, 2016 www.calgrants.org Must meet GPA, income and assets ceilings Required Documents – FAFSA – GPA Verification Form • School will file your GPA (check with your school) • Student can obtain a Cal Grant GPA Verification Form. Must be certified by a school official and mailed to CSAC California Dream Act of 2011 • Allows students who meet certain criteria to apply for financial aid, such as: – Private Scholarships – State University Grant (CSU & UC) – Cal Grants, EOP Grants • Applicants include: – AB540 students – Undocumented students – Deferred Action for Childhood Arrival (DACA) students California Dream Act Application • Application opens January 1, 2016 • www.caldreamact.org • Eligibility – Attended a CA school for 3+ years AND graduated from a CA HS or equivalent – Attend a CA college or university • Deadline: March 2nd, 2016 • Submit GPA Verification Institutional Aid • Grants – typically need based • Scholarships – typically merit based – Private (from outside donors) – Institutional (through the school) • Loans Each school may offer different types of aid based on institutional resources. Check with each school you are applying to for additional information. Other Aid Programs • Other Scholarships/grants – Search engines online – Local community groups, clubs, businesses, churches, synagogues, etc. • Vocational Rehab • Veteran’s Benefits – Contact Veteran’s Affairs representative Office of Financial Aid 1950 Third Street La Verne, CA 91750 (800) 649-0160 (phone) (909) 932-2751 (fax) finaid@laverne.edu www.laverne.edu/financial-aid Questions