University of California - Berkeley Women in Business

advertisement

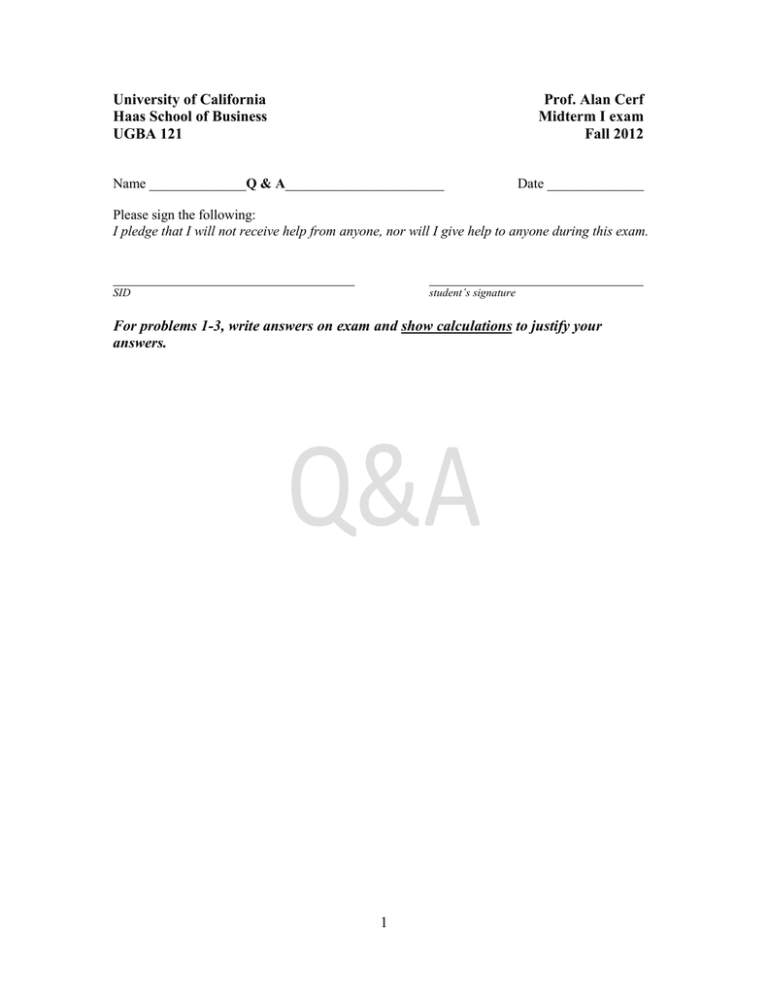

University of California Haas School of Business UGBA 121 Prof. Alan Cerf Midterm I exam Fall 2012 Name ______________Q & A_______________________ Date ______________ Please sign the following: I pledge that I will not receive help from anyone, nor will I give help to anyone during this exam. ___________________________________ _______________________________ SID student’s signature For problems 1-3, write answers on exam and show calculations to justify your answers. 1 Question I. 30 pts Janet, 43, is an employee of Primus University. Her annual salary is $44,000. Primus provides all employees with health and accident insurance (Janet's policy cost $1,800) and group term life insurance at twice their annual salary rounded up to the nearest $10,000 ($90,000 of coverage for Janet). In addition, Primus pays the first $1,000 of each employee's Social Security contribution. The university has a qualified pension and a flexible benefits plan. Janet had $4,000 of her salary withheld and paid (and Primus matches the payment) into the pension plan. She also elects to have $1,300 of her salary paid into the flexible benefits plan. Because her medical costs were lower than expected, Janet gets back only $1,250 of the $1,300 she paid into the plan. What is Janet's gross income for the current year? 2 Question 2. 40 pts Charlotte owns a custom publishing business. She uses 500 square feet of her home (2,000 square feet) as an office and for storage. All her business has come from telemarketing (telephone sales), direct mailings, or referrals. In her first year of operation, she has revenues of $37,000, cost of goods sold of $25,900, and other business expenses of $8,100. The total expenses related to her home are: Home mortgage interest Real property taxes Insurance Utilities Repairs and maintenance House cleaning Depreciation (unallocated) What amount can Charlotte deduct for her home office? . 3 $6,400 2,100 560 800 600 960 5,000 Question 3. 40 pts. Jennifer is single and has the following income and expenses: Salary $76,000 Interest income 5,000 Dividend income 9,000 Long-term capital gain 10,000 Short-term capital loss 14,000 Deductions for AGI 3,000 Deductions from AGI 9,000 Calculate Jennifer's taxable income and income tax liability. 4 Multiple Choice 4 pts each 1. During the current year, Trane invests $35,000 in each of two separate corporations. Each investment gives him a 20% ownership interest. Brazil Corporation is a regular corporation that has taxable income of $200,000 and pays dividends totaling $50,000. China Corporation is an S corporation that has taxable income of $100,000 and pays $50,000 of dividends. As a result of these two investments, Trane I. Has $40,000 of taxable income from Brazil Corporation. II. Has $20,000 of taxable income from China Corporation. a. b. c. d. Only statement I is correct. Only statement II is correct. Both statements are correct. Neither statement is correct. ANS: B 2. Roberta invests $16,000 for a 10% interest in Bowie Partnership. In the first year of operations, Bowie reports net income from operations of $80,000 and distributes $6,000 cash to Roberta. How much gross income must Roberta recognize from her investment in Bowie? a. $ 2,000 b. $ 6,000 c. $ 8,000 d. $80,000 ANS: C 3. Nora receives a salary of $55,000 during the current year. She sells some land that she held as an investment at a loss of $15,000 and some stock at a gain of $10,000. Nora's adjusted gross income is: a. $50,000 b. $52,000 c. $55,000 d. $62,000 e. $65,000 ANS: B 4. Boris, a single individual, has two sales of stock during the current year. The first sale produces a short-term loss of $27,000 and the second sale results in a long-term gain of $57,000. Boris's taxable income without considering the gain is $125,000. Boris's stock transactions will increase his taxable income by: a. $ -0b. $30,000 c. $34,000 d. $54,000 ANS: B 5 5. Chip, a single individual has two sales of stock during the current year. The first sale produces a short-term loss of $10,000 and the second sale results in a long-term gain of $40,000. Chip's taxable income without considering the gain is $150,000. Chip's stock transactions will increase his income tax liability by: a. $ 3,200 b. $ 4,500 c. $ 6,000 d. $ 8,000 e. $ 8,400 ANS: B 6. Ramona's employer pays 100% of the cost of all employees' group-term life insurance. The life insurance plan is not discriminatory. Ramona’s annual salary is $100,000. What is the maximum amount of coverage that can be provided tax-free? a. $ - 0 b. $ 5,000 c. $ 10,000 d. $ 50,000 e. $100,000 ANS: D 7. Conzo is injured in an accident while working at his job. He received $1,500 in worker's compensation benefits for 5 weeks of lost work. How much should Conzo report as gross income from the receipt of these benefits? a. $ - 0 b. $ 300 c. $ 750 d. $ 900 e. $1,500 ANS: A 8. The information that follows applies to the current year for Aaron and Janelle, a married couple. • Aaron is employed as a shoe salesman; his compensation is $75,000. • Janelle is employed by the state of Indiana; her compensation is $35,000. • Aaron and Janelle have total allowable itemized deductions of $12,000. • Aaron and Janelle have two dependent children. • Aaron and Janelle have other economic income as follows: - Interest on U.S. Treasury notes $1,000. - Interest on Compost Computer bonds $1,500. - Interest on German government bonds $750. - Interest on City of Nashville. bonds $1,200. - Aaron's wealthy uncle gives him $1,000. - Janelle sold Aaron's football card collection for $3,000. It cost $800. 6 - Janelle sells Aaron's fishing boat for $2,000. Aaron had purchased the boat 3 years ago for $2,800. Based on the above information, what is Aaron and Janelle 's adjusted gross income? a. $114,450 b. $114,700 c. $115,450 d. $116,450 e. $116,650 ANS: C 9. The information that follows applies to the current year for Revis and Patrica, a married couple. • Revis is employed as a shoe salesman; his compensation is $65,000. • Patrica is employed as an interior designer; her compensation is $90,000. • Revis and Patrica have total allowable itemized deductions of $15,000. • Revis and Patrica have two dependent children. • Revis and Patrica have other economic income as follows: - Interest on U.S. Treasury bonds $1,000. - Interest on French government bonds $750. - Interest on City of Miami, Fla. bonds $1,200. - Patrica won $500 from the state lottery - Revis's wealthy uncle dies and leaves him $10,000. - Patrica sold Revis's baseball card collection for $3,000. Revis bought it for $800. - Patrica sells Revis's fishing boat for $2,000. Revis had purchased the boat for $2,500. Based on the above information, what is Revis and Patrica 's taxable income? a. $129,450 b. $129,950 c. $129,650 d. $144,450 e. $159,450 ANS: C 10. Mike and Pam own a cabin near Teluride, Colorado. In the current year the cabin was rented for 8 days to friends. Mike and Pam used the cabin a total of 82 days during the same year. After allocating the expenses between personal and rental use, the following rental loss was determined: Rental income $700 Property taxes (250) Mortgage interest (300) Repairs and maintenance (100) Utilities (150) 7 Rental loss $ (100) How should Mike and Pam report the rental income and expenses for last year? a. Report the $100 loss for AGI. b. Include the $700 in gross income, but no deductions are allowed. c. Only expenses up to the amount of $700 rental income may be deducted. d. Report the interest ($300) and taxes ($250) as itemized deductions and the other expenses for AGI. e. No reporting for the rental activity is necessary. ANS: E 8