HCR-FAQ-Covered-CA-Individual-Coverage

advertisement

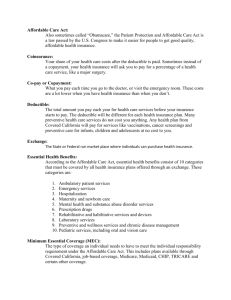

HCR FAQ Covered California – Individual and Family Coverage What is Covered California™? What is “Obamacare”? Are they the same? Covered California is a new, easy-to-use marketplace established for California under the federal Patient Protection and Affordable Care Act where you and your family will be able to compare health coverage options and choose the one that best fits your needs and budget. Through Covered California, you may be eligible to receive financial assistance to make health care more affordable. This marketplace will allow Californians to shop online, over the phone and in person to find the right health insurance option for them. Through Covered California, individuals and small businesses can compare different health insurance companies and learn whether they qualify for federal subsidies and tax credits. Californians will be able to find out if they are eligible for low-cost or no-cost health coverage through Medi-Cal. Covered California is a part of the state of California and is overseen by an independent board appointed by the governor and the Legislature. For more information about available health care options, you can visit www.CoveredCA.com or call (800) 300-1506 (interpretation into languages other than English is available). To learn more about the organization that runs Covered California, please visit www.hbex.ca.gov. The word “Obamacare” generally is used to refer to aspects of the federal Patient Protection and Affordable Care Act. One aspect of that act is the implementation of new health care marketplaces, such as Covered California. What is the Medi-Cal program? Medi-Cal is California's health care program for individuals who make $15,856 or less per year. This program pays for a variety of medical services for children and adults with limited income and resources. Beginning Jan. 1, 2014, California will expand Medi-Cal eligibility for some low-income adults. When you complete a Covered California application, your eligibility for Medi-Cal will automatically be determined. You can apply for Medi-Cal benefits regardless of your sex, race, religion, color, national origin, sexual orientation, marital status, age, disability or veteran status. To find out more about Medi-Cal, please contact Medi-Cal directly at (800) 541-5555 or visit www.dhcs.ca.gov/services/medi-cal/Pages/Medi-CalFAQs1.aspx. Who can buy health insurance through Covered California? Legal California residents, except for currently incarcerated individuals and legal minors, are eligible to buy insurance through Covered California. However, if an enrollee has access to affordable health insurance through another source such as an employer or government program, the enrollee may not qualify for financial assistance through Covered California. Medi-Cal Immigrant Care/Coverage For Medi-Cal, immigration status only affects the scope of service. The services that Medi-Cal provides to undocumented immigrants include, but are not limited to, emergency medical services, prenatal care, pregnancy-related services, nursing home care, and limited breast and cervical cancer treatment. When will I be able to get coverage through Covered California? Covered California began enrollment on Oct. 1, 2013, for coverage that will take effect Jan. 1, 2014. The open-enrollment period for coverage during 2014 runs from Oct. 1, 2013, to March 31, 2014. If you are eligible for Medi-Cal, the open enrollment period does not matter. This open-enrollment period is the period of time that many Californians can get federal premium assistance to reduce their costs. This premium assistance is only available through Covered California. If you have a life-changing event, such as the loss of a job, a marriage or divorce, or the birth of a child, then you qualify for “special enrollment” throughout the year, both in Covered California and in the individual market outside. In the case of a life-changing event, you would be eligible to enroll within 60 days of that event. The next open-enrollment period begins in October 2014 for coverage in 2015. What kind of health insurance will be offered through Covered California? Covered California will offer health insurance plans that are the same quality health insurance plans available on the private market today. These health insurance plans are guaranteed to provide essential levels of coverage and consumer protections required by the federal Patient Protection and Affordable Care Act (Affordable Care Act) Patient Protection and Affordable Care Act. These plans will be offered in categories, or metal tiers, based on the percentage of covered expenses paid by the health plan. The health plan choices offered by Covered California are as good as you can get in any market place — even if you are not eligible for a subsidy. Health insurance companies must offer the same products at an identified price whether they are offered through Covered California or in the open market. In addition to these traditional health plans, Covered California will offer what is called a "minimum coverage plan," which helps protect a person from financial disaster in the event of a serious and expensive medical emergency. Minimum coverage plans are designed to cover excessive medical bills that occur above the limit that you would be able to manage financially. Covered California will provide minimum coverage to those up to age 30, or those individuals who prove they are without affordable coverage options or are experiencing financial hardship. What does Covered California health insurance cover? All health insurance plans offered through Covered California's individual and small-group markets cover a comprehensive set of benefits known as “essential health benefits.” They include the following 10 categories: ambulatory patient services emergency services hospitalization maternity and newborn care mental health and substance use disorder services, including behavioral health treatment prescription drugs rehabilitative and habilitative services and devices laboratory services preventive and wellness services and chronic disease management pediatric services, including oral and vision care In addition to the standard coverage levels and coverage of essential health benefits, the Covered California health plans are offered with standard benefit designs so you can make apples-to-apples comparisons between plans. You can find out more about plan designs at www.CoveredCA.com. What are the coverage levels? Covered California health insurance plans — and all health plans in the individual and small-group markets — will be sold in four levels of coverage: Bronze, Silver, Gold and Platinum. As the metal category increases in value, so does the percentage of medical expenses that a health plan will cover compared with what you are expected to pay in co-pays and deductibles. On average, Platinum-level plans will cover 90 percent of health care costs, and you will pay 10 percent; Gold plans will cover 80 percent, while you pay 20 percent; Silver plans will cover 70 percent, while you pay 30 percent; and Bronze plans will cover 60 percent, while you pay 40 percent. Plans in higher metal categories will have higher monthly premiums, but when you need medical care, you will pay less. Alternatively, you can choose to pay a lower monthly premium, and when you need medical care, you will pay more. You can choose the level of coverage that best meets your health needs and budget. In addition to these categories, Covered California will offer a “minimum coverage plan,” which helps protect a person from financial disaster in the event of a serious and expensive medical emergency. Minimum coverage plans are designed to cover excessive medical bills that occur above the limit that you would be able to manage financially. Covered California will offer minimum coverage to those up to age 30, or those individuals who prove they are without affordable coverage options or are experiencing financial hardship. In addition to the standard coverage levels and coverage of essential health benefits, the Covered California health plans are offered with standard benefit designs so you can make apples-to-apples comparisons between plans. You can find out more about plan designs at www.CoveredCA.com How much will it cost me to purchase health insurance through Covered California, and will I be eligible for financial assistance? Health insurance premium costs through Covered California will be based on age, where you live (ZIP code), household size and income, and the health plan and benefit level you select. Use Covered California's online Shop and Compare Tool to see how much health insurance plans cost and to find out whether you are eligible for any premium assistance or cost-sharing assistance. You can also find out whether you qualify for Medi-Cal. Click to use the Shop and Compare Tool. What kind of help is available to reduce the cost of insurance? Starting in 2014, individuals seeking health coverage will be helped to afford coverage in three ways: 1. Premium assistance: Premium assistance is available to reduce the cost of health coverage for individuals and families who meet certain income requirements and do not have health insurance from an employer or a government program. When you enroll in a health plan through Covered California, premium assistance can be immediately applied to the insurance premium, which reduces the amount you pay. To find out more about premium assistance, visit here. 2. Cost-sharing subsidies: Cost-sharing subsidies reduce the amount of out-of-pocket health care expenses an individual or family has to pay. These expenses might include the copayments for health care services or other costs. To find out more about cost-sharing subsidies, visit here. 3. Medi-Cal assistance: Starting in 2014, the state of California is planning to expand the Medicaid program (called Medi-Cal in California) to cover people under age 65, including people with disabilities, or those with income of less than $15,856 for a single individual and $32,499 for a family of four. The coverage is free for those who qualify and is part of the provisions of the Affordable Care Act. Am I eligible for premium assistance? Premium assistance is available to individuals and families who meet certain income requirements and do not have access to affordable health insurance through their employer that also meets minimum coverage requirements. Eligibility for premium assistance is based on a standard, called the federal poverty level, that looks at family income and the number of people in the family. The size of the premium assistance is based on a sliding scale, with those who make less money getting more financial assistance to reduce the cost of their insurance coverage. Individuals and families who make between 138 percent and 400 percent of the federal poverty level may be eligible for premium assistance. This means that an individual making up to $45,960 and a family of four earning up to $94,200 may be eligible for premium assistance. What are some key facts about premium assistance? Premium assistance reduces the cost of your premium. Premium assistance helps low- and middle-income individuals and families who meet certain income requirements. Premium assistance can be used when you enroll. Premium assistance can be applied to the cost of your health plan when you enroll. Premium assistance is only available through Covered California. You must enroll in a health plan through Covered California if you want to get Premium assistance. Premium assistance is paid directly to your health plan. Premium assistance will be adjusted at the end of the benefit year based on your actual income, if your income is different than you anticipated. This means that you will want to notify Covered California if your income changes. How much financial assistance can I get? The amount of the premium assistance depends on household income and number of eligible individuals in the family. Below are some examples of potential costs to families in California. Covered California will make available the exact premium and plan choices so you can know exactly what your insurance will cost. For more information, please see our Getting Financial Help fact sheet. Can I decline Medi-Cal and enroll in a Covered California health insurance plan and receive the federal premium assistance? Under federal law, you are not eligible to purchase subsidized coverage through Covered California if you are currently enrolled in or are eligible for Medi-Cal. You are eligible for unsubsidized coverage through Covered California if you are eligible for Medi-Cal, so you can still purchase a health insurance plan through Covered California, but you cannot receive premium assistance to reduce its cost. I have health insurance through my employer, but coverage for my spouse and child are too expensive. Would I be eligible for premium assistance for a plan for my child? Whether you or your family are eligible for premium assistance depends on whether you have an offer of coverage that includes your spouse and dependents and (1) is affordable and (2) meets the standard for minimum coverage. The affordability of employer-provided coverage is evaluated on these two criteria: The total annual premium you pay for self-only coverage is 9.5 percent or less of your annual household income. Your employer-provided plan covers at least 60 percent of health care costs for an average population. Your employer or your health insurance plan should notify you as to how much the plan covers. Your employer or your health insurance plan should notify you as to how much the plan covers. If those two criteria are met, your employer's plan is considered “affordable” under the law, and your family members would not qualify for premium assistance through Covered California. If your employer-provided coverage does not include dependent coverage, or if your employer does not offer dependent coverage, your spouse and child may qualify for subsidies through Covered California since they would not be offered coverage. In that case, their eligibility would be based on the family's income. Why should I buy health insurance? Everybody uses the health care system at some point in life. You never know when an accident might happen or your family member will get sick and need to see a doctor. When that day comes, the expenses could be financially devastating. Health insurance will become more affordable, more accessible and easier to buy, so it no longer makes sense to take the risk of going without it. By getting health insurance, you not only buy peace of mind for yourself and your family, but also help the entire community, because we all end up paying the costs of providing care to those without insurance. Do I have to buy health insurance? What are the penalties for not having health coverage? There will be penalties for individuals who choose not to get affordable insurance. These penalties are part of the federal law and will be collected by the Internal Revenue Service as part of individual tax filing for 2014. There are no penalties for small employers (fewer than 50 full-time-equivalent employees), but starting in 2015 large employers may be subject to a penalty if they do not offer affordable coverage to their employees. In 2014, an individual who does not maintain minimum health coverage will face a penalty of $95 or 1 percent of income, whichever is greater. In 2014, a family will be charged a penalty of $95 per uncovered adult and $47.50 per uncovered child (up to $285 for a family) or 1 percent of the family's income, whichever is greater. For 2015, the penalty increases to $325 per adult and $162.50 per child (up to $975 for a family) or 2 percent of family income, whichever is greater. For 2016, the penalty is $695 per adult and $374.50 per child (up to $2,085 for a family) or 2.5 percent of family income, whichever is greater. However, some individuals may be exempt from paying a penalty, including: people who would have to pay more than 8 percent of their income for health insurance people with incomes below the threshold required for filing taxes (in 2013, $9,750 for a single person and $27,100 for a married couple with two children) people who qualify for religious exemptions undocumented immigrants incarcerated individuals members of federally recognized American Indian tribes and Alaska Natives How will Covered California help me find health insurance I can afford? Covered California is creating a health insurance marketplace that will allow you to shop online, over the phone or in person to find the right insurance option for your health needs and budget. You will be able to compare different health insurance plans and learn whether you qualify for federal financial help such as premium assistance, on a sliding scale that will reduce how much you have to pay each month. What if I already have health insurance? If you already have health insurance provided by your employer that is affordable, you do not need to do anything. If you are paying more than 9.5 percent of your household income toward insurance premiums, then you may be eligible for financial assistance available through Covered California. If you have insurance from your employer and apply for premium assistance, Covered California will determine whether that health plan is affordable and provides adequate coverage. If that coverage is determined to be affordable and adequate, then you cannot receive government premium assistance for new insurance. If you have health insurance that you pay for yourself, you may be eligible for financial help such as premium assistance that can reduce your costs. You can purchase the same kinds of health insurance plans from Covered California as you can in the private market, but you can only receive financial help if you buy insurance through Covered California. Am I eligible for cost-sharing subsidies? In addition to the premium assistance that reduces your monthly premium payments, you may be eligible for cost-sharing subsidies that reduce the amount you pay pit of pocket when you get care. Eligibility for subsidies is based on income level and family size. You may be eligible for subsidies if your income is $28,725 or less for a single person and $58,875 or less for a family of four in 2012, which represents about 2.5 times the federal poverty level. Cost-sharing subsidies are offered by the federal government to reduce the amount of money you have to pay for health care expenses such as copayments or coinsurance. What is considered annual income? Income includes wages, salaries, tips, business or self-employment income, rental income, interest received or accrued, lottery and gambling income, capital gains, pensions, Social Security retirement benefits, foreign-earned income, alimony income and bartering income (i.e., exchange of goods or services without exchanging money). For the purposes of determining eligibility for premium assistance and cost-sharing assistance, Covered California will use your modified adjusted gross income (MAGI). For most taxpayers, MAGI is the same as adjusted gross income (AGI), which can be found on line 4 of a Form 1040EZ, line 21 of a Form 1040A or line 37 of a Form 1040. Taxpayers who receive nontaxable Social Security benefits, earn income living abroad or earn non-exempt interest should add that income to their AGI to calculate their MAGI. It's important to remember that if you claim your spouse or children as dependents, their incomes count toward your household income. In order to receive premium assistance through Covered California, spouses are required to file their income tax returns jointly. What if my income changes? Any eligible Californian without insurance can shop through Covered California for coverage, regardless of income. Your income level helps determine your eligibility for Medi-Cal coverage or a government assistance program, such as premium assistance, to help pay your monthly premium. If your income changes over the year, your premium assistance will be adjusted accordingly. If your income increases, you will have to pay the difference at tax time. It will be important that you keep on top of any income changes so you have an idea of how much you will owe at tax time. If you have Medi-Cal coverage and your income increases to more than $15,856 a year for an individual or $32,499 for a family of four, you would no longer qualify for this no-cost government insurance plan. However, through Covered California, you could find affordable coverage and financial assistance to help pay the premiums. What if I have a pre-existing health condition? You can still purchase health insurance regardless of any current or past health conditions. Starting in 2014, insurance companies will be required to sell policies to everyone regardless of current or past health issues, and they will be prohibited from using your health status to determine how much your health insurance will cost. You can purchase health insurance regardless of any current or past health conditions, and insurance companies cannot charge you a different premium. This requirement means that whether you buy insurance through Covered California or somewhere else, you cannot be denied coverage or even screened based on a pre-existing medical condition. It is important to remember that this requirement only applies during the open-enrollment periods. What if I need help choosing health insurance? There are a number of ways Covered California is helping Californians understand their new health insurance options: helpful tools and tips on the marketplace website. trained state staff available in person or by phone or Certified Enrollment Counselors who will be able to meet with you in person in every part of the state partnerships with a wide range of community organizations and Certified Insurance Agents to provide educational outreach and support services assistance offered in many different languages, reflecting the linguistic diversity of the state How do I apply for Covered California coverage or Medi-Cal? Between Oct. 1, 2013, and March 31, 2014, you can apply for a Covered California health insurance plan online at www.CoveredCA.com or by calling (800) 300-1506. In-person assistance is also available. If you are not interested in seeing if you are eligible for federal help paying for your health care costs you do not need to provide any income information. To apply, you should have the following information available: number of people being enrolled (whole or partial family), including the birth date of each person Social Security numbers for each family member home ZIP code most recent income tax filings, including dependent tax information and head-of-household status (if any) legal immigration information, such as your immigration number information about your status as a member of a federally recognized tribe What documents will be verified for enrollment into Covered California? In accordance with federal law, if you are seeking potential federal premium assistance, you will be asked to provide information during the enrollment process to verify your income, citizenship and residency. This information will include: Social Security numbers for U.S. citizens, or document information for immigrants with satisfactory status. Families that include immigrants can apply. You can apply for your child even if you aren't eligible for coverage. Employer and income information for everyone in your family. A family is defined as the person who files taxes as head of household and all the dependents claimed on that person's taxes. Federal tax information. If you don't file taxes, you can still qualify for free or low-cost insurance through Medi-Cal. If you do not want or do not think you qualify for help paying for your health coverage, all you need to provide is the Social Security numbers described in the first bullet above. I'm pregnant and do not have insurance. What health coverage is available for me? There are two programs to provide immediate care for pregnant women in California. Medi-Cal and Presumptive Eligibility: Pregnant women with low incomes can apply for MediCal and, if they're eligible, get coverage back to the date of the application. Medi-Cal also has a Presumptive Eligibility (PE) program for pregnant women, which provides immediate, temporary, no-cost care while your application for full Medi-Cal coverage is reviewed. The PE program provides pregnancy-related care, some lab tests and prescription coverage related to pregnancy. (It does not cover labor and delivery or inpatient care.) Medi-Cal's PE services for low-income pregnant women are provided by specific PE providers. For information about the Medi-Cal PE program for pregnant women, you can contact a PE provider (ask your provider if he or she participates) or contact the perinatal coordinator at your county health department for a list of PE providers in your area. You also may contact the state's PE support line at (800) 824-0088 or visit www.dhcs.ca.gov/services/medical/eligibility/Pages/PE.aspx. Access for Infants and Mothers (AIM): This program provides low-cost, comprehensive health coverage for middle-income pregnant women who do not have health insurance, who are not eligible for Medi-Cal or Medicare Part A and Part B, and who are less than 30 weeks pregnant. The AIM program is also available to women who have private health insurance plans with a maternity-only deductible or copayment greater than $500. Coverage under the AIM program costs 1.5 percent of your adjusted annual net income and is billed to you over a 12-month period. For more information about the AIM program, or to request an application or handbook, call (800) 433-2611 or visit www.aim.ca.gov. AIM program applications are available in English, Spanish and Chinese. I live in California but spend months out of California for work. Will Covered California health insurance plans cover me while I am traveling? Out-of-state coverage is subject to each individual health plan's specific policies and network coverage as detailed within the health insurance policy. Each health insurance policy has a specific list of providers that are in the network for covered services. You will need to check with each individual plan offered to confirm that your provider's services are covered under that plan. This includes providers that are out of state. Provider information will be available at www.CoveredCA.com. Will I be able to purchase a dental plan and a vision plan through Covered California? Dental and vision benefits will be available for children. Covered California is considering adding vision and dental plans as “supplemental plans” for adults through Covered California in 2014. The timing of adding these benefits has not been determined. As a supplemental benefit, the federal premium assistance would not apply to these benefits. When someone enrolls in a health insurance plan during open enrollment but after Jan. 1, 2014, will the effective date be Jan. 1, or is it subject to the actual enrollment date? If you enroll in a Covered California plan before Dec. 15, 2013, you can be eligible to have coverage that starts on Jan. 1, 2014. You will also need to pay your share of the premium before January. During the last three months of the initial Covered California open-enrollment period (from Jan. 1, 2014, through March 31, 2014), an individual who submits a completed application, receives an eligibility determination and makes a plan selection by the 15th of each month will receive a coverage-effective date of the first day of the following month, as long as the person's full premium payment is received. For example, someone who has enrolled in a Covered California health insurance plan by Jan. 15, 2014, will have coverage beginning Feb. 1, 2014 if they pay their share of premium. However, someone who submits a completed application, receives an eligibility determination and makes a plan selection after the 15th of that month will receive a coverage-effective date of the first day of the second following month, as long as the person's full premium payment is received. For example, someone who has enrolled and whose payment has been received by Jan. 16, 2014, will have coverage beginning March 1, 2014.: How much are the premiums if I have pre-existing conditions? Starting Jan. 1, 2014, premium costs will be based only on age, where you live (ZIP code), household size, and the health plan and benefit level you select. Health insurance plans offered through Covered California cannot charge you more or refuse to cover you because you have a pre-existing health condition. For more information on the plans and rates available to you, visit www.CoveredCA.com/fieldcalc/#calculator. In addition, whether you are eligible for premium assistance to reduce what you pay is based on the factors above and your income. How can you use Covered California in conjunction with Medicare parts A, B and D? Individuals who are eligible for Medicare will not be eligible to receive premium assistance through Covered California. Additionally, Medicare supplement insurance (Medigap) plans will not be offered through Covered California. What region am I in? There are 19 pricing regions in California. For health plans that consumers can get through Covered California, either with or without premium assistance, the plans available and their prices vary by region. The easiest way to find the pricing region you live in is to use our Shop and Compare Tool online at www.CoveredCA.com/fieldcalc/#calculator. After entering your home ZIP code, the Shop and Compare Tool will show you your pricing region. You may also call our Service Center for assistance by calling (800) 300-1506. If someone's Medi-Cal coverage is cancelled because of increased income, does that person qualify for special enrollment into Covered California? Yes, losing coverage such as Medi-Cal is considered a qualifying event that would trigger a special enrollment period. Other qualifying events include the loss of a job, a marriage or divorce, or the birth of a child. In the case of such an event, you would be eligible to enroll within 60 days of that event. During that period you could not be denied coverage by a health plan in Covered California or in the individual market, and you could be eligible for the premium assistance that is only available through Covered California. Will patients be able to keep their same doctor when they purchase health insurance through Covered California? Each health insurance plan has a specific list of doctors and hospitals that are considered in-network providers for covered services. Directories of doctors and hospitals will be available at www.CoveredCA.com. It is also always a good idea to check the individual plan that lists your provider to confirm that your doctor and hospital services are covered under that plan. Covered California is providing a searchable directory so you can see which health plan(s) your doctor or hospital is in.