1754-B MS-Word - Maine Legislature

advertisement

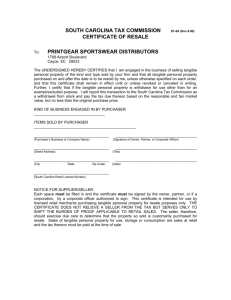

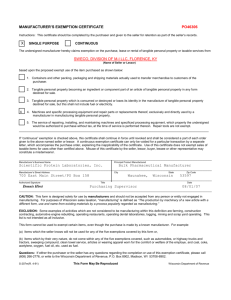

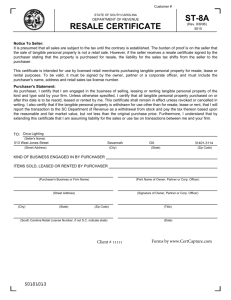

Maine Revised Statutes Title 36: TAXATION Chapter 211: GENERAL PROVISIONS §1754-B. REGISTRATION OF SELLERS 1. Persons required to register. Except as otherwise provided in this section, the following persons, other than casual sellers, shall register with the assessor and collect and remit taxes in accordance with the provisions of this Part: A. Every seller of tangible personal property or taxable services, whether or not at retail, that maintains in this State any office, manufacturing facility, distribution facility, warehouse or storage facility, sales or sample room or other place of business; [1995, c. 640, §3 (NEW).] B. Every seller of tangible personal property or taxable services that does not maintain a place of business in this State but makes retail sales in this State or solicits orders, by means of one or more salespeople within this State, for retail sales within this State; [1995, c. 640, §3 (NEW).] C. Every lessor engaged in the leasing of tangible personal property located in this State that does not maintain a place of business in this State but makes retail sales to purchasers from this State; [1995, c. 640, §3 (NEW).] D. Every person that has a substantial physical presence in this State sufficient to satisfy the requirements of the due process and commerce clauses of the United States Constitution and that makes retail sales in this State of tangible personal property or taxable services on behalf of a principal that is outside of this State if the principal is not the holder of a valid registration certificate. For purposes of this paragraph, paragraph E and paragraph G, the following activities do not constitute a substantial physical presence in this State sufficient to satisfy the requirements of the due process and commerce clauses of the United States Constitution: (1) Solicitation of business in this State through catalogs, flyers, telephone or electronic media when delivery of ordered goods is effected by the United States mail or by an interstate 3rd-party common carrier; (2) Attending trade shows, seminars or conventions in this State; (3) Holding a meeting of a corporate board of directors or shareholders or holding a company retreat or recreational event in this State; (4) Maintaining a bank account or banking relationship in this State; or (5) Using a vendor in this State for printing; [2013, c. 200, §1 (AMD).] E. Every agent, representative, salesperson, solicitor or distributor that has a substantial physical presence in this State sufficient to satisfy the requirements of the due process and commerce clauses of the United States Constitution and that receives compensation by reason of sales of tangible personal property or taxable services made outside this State by a principal for use, storage or other consumption in this State; [2013, c. 200, §2 (AMD).] F. Every person that manages or operates in the regular course of business or on a casual basis a hotel, rooming house or tourist or trailer camp in this State or that collects or receives rents from a hotel, rooming house or tourist or trailer camp in this State; [2005, c. 218, §19 (AMD).] G. Every seller of tangible personal property or taxable services that has a substantial physical presence in this State sufficient to satisfy the requirements of the due process and commerce clauses of the United States Constitution. [2013, c. 200, §3 (AMD).] Generated 12.14.2015 | 1 MRS Title 36 §1754-B. REGISTRATION OF SELLERS H. Every person that makes retail sales in this State of tangible personal property or taxable services on behalf of the owner of that property or the provider of those services; [2009, c. 373, §5 (AMD).] I. Every person not otherwise required to be registered that sells tangible personal property to the State and is required to register as a condition of doing business with the State pursuant to Title 5, section 1825-B; and [2009, c. 373, §6 (AMD).] J. Every person that holds a wine direct shipper license under Title 28-A, section 1403-A. [2009, c. 373, §7 (NEW).] [ 2013, c. 200, §§1-3 (AMD) .] 1-A. Persons presumptively required to register. This subsection defines the basis for and obligations associated with the rebuttable presumption created by this subsection that a seller not registered under subsection 1 is engaged in the business of selling tangible personal property or taxable services for use in this State and is required to register as a retailer with the assessor. A. As used in this subsection, unless the context otherwise indicates, the following terms have the following meanings. (1) "Affiliated person" means a person that is a member of the same controlled group of corporations as the seller or any other entity that, notwithstanding its form of organization, bears the same ownership relationship to the seller as a corporation that is a member of the same controlled group of corporations. For purposes of this subparagraph, “controlled group of corporations” has the same meaning as in the Code, Section 1563(a). (2) "Person" means an individual or entity that qualifies as a person under the Code, Section 7701(a)(1). (3) "Seller" means a person that sells, other than in a casual sale, tangible personal property or taxable services. [2013, c. 200, §4 (NEW).] B. A seller is presumed to be engaged in the business of selling tangible personal property or taxable services for use in this State if an affiliated person has a substantial physical presence in this State or if any person, other than a person acting in its capacity as a common carrier, that has a substantial physical presence in this State: (1) Sells a similar line of products as the seller and does so under a business name that is the same as or similar to that of the seller; (2) Maintains an office, distribution facility, warehouse or storage place or similar place of business in the State to facilitate the delivery of property or services sold by the seller to the seller's customers; (3) Uses trademarks, service marks or trade names in the State that are the same as or substantially similar to those used by the seller; (4) Delivers, installs, assembles or performs maintenance services for the seller's customers within the State; (5) Facilitates the seller's delivery of property to customers in the State by allowing the seller's customers to pick up property sold by the seller at an office, distribution facility, warehouse, storage place or similar place of business maintained by the person in the State; or (6) Conducts any activities in the State that are significantly associated with the seller's ability to establish and maintain a market in the State for the seller's sales. A seller who meets the requirements of this paragraph shall register with the assessor and collect and remit taxes in accordance with the provisions of this Part. A seller may rebut the presumption created in this paragraph by demonstrating that the person's activities in the State are not significantly associated with the seller's ability to establish or maintain a market in this State for the seller's sales. [2013, c. 546, §10 (AMD).] | 2 Generated 12.14.2015 MRS Title 36 §1754-B. REGISTRATION OF SELLERS C. A seller that does not otherwise meet the requirements of paragraph B is presumed to be engaged in the business of selling tangible personal property or taxable services for use in this State if the seller enters into an agreement with a person under which the person, for a commission or other consideration, while within this State: (1) Directly or indirectly refers potential customers, whether by a link on an Internet website, by telemarketing, by an in-person presentation or otherwise, to the seller; and (2) The cumulative gross receipts from retail sales by the seller to customers in the State who are referred to the seller by all persons with this type of an agreement with the seller are in excess of $10,000 during the preceding 12 months. A seller who meets the requirements of this paragraph shall register with the assessor and collect and remit taxes in accordance with the provisions of this Part. A seller may rebut the presumption created in this paragraph by submitting proof that the person with whom the seller has an agreement did not engage in any activity within the State that was significantly associated with the seller's ability to establish or maintain the seller's market in the State during the preceding 12 months. Such proof may consist of sworn, written statements from all of the persons within this State with whom the seller has an agreement stating that they did not engage in any solicitation in the State on behalf of the seller during the preceding 12 months; these statements must be provided and obtained in good faith. A person who enters into an agreement with a seller under this paragraph to refer customers by a link on an Internet website is not required to register or collect taxes under this Part solely because of the existence of the agreement. [2013, c. 200, §4 (NEW); 2013, c. 200, §6 (AFF).] [ 2013, c. 546, §10 (AMD) .] 2. Registration certificates. Application forms for sales tax registration certificates must be prescribed and furnished free of charge by the assessor. The assessor shall issue a registration certificate to each applicant that properly completes and submits an application form. A separate application must be completed and a separate registration certificate issued for each place of business. A registration certificate issued pursuant to this section is nontransferable and is not a license within the meaning of that term in the Maine Administrative Procedure Act. Each application for a registration certificate must contain a statement as to the type or types of tangible personal property that the applicant intends to purchase for resale and the type or types of taxable services that the applicant intends to sell, and each retailer registered under this section must inform the assessor in writing of any changes to the type or types of tangible personal property that it purchases for resale or to the type or types of taxable services that it sells. If the retailer maintains a place of business in this State, the retailer shall make available a copy of the registration certificate issued for that place of business at that place of business for inspection by the assessor, the assessor's representatives and agents or authorized municipal officials. If the retailer does not have a fixed place of business and makes sales from one or more motor vehicles, each motor vehicle is deemed to be a place of business. [ 2011, c. 535, §5 (AMD) .] 2-A. Making sales after revocation. A person whose sales tax registration certificate has been revoked by the assessor pursuant to section 1757 who continues to make retail sales in this State commits a Class D crime. Violation of this subsection is a strict liability crime as defined in Title 17-A, section 34, subsection 4A. [ 2003, c. 452, Pt. U, §3 (NEW); 2003, c. 452, Pt. X, §2 (AFF) .] 2-B. Provisional resale certificates; new accounts. The assessor shall issue a provisional resale certificate to each applicant for initial registration that states on its application that it expects to make annual gross sales of $3,000 or more. A provisional resale certificate issued between January 1st and September 30th is effective for the duration of the calendar year in which it is issued and the 2 subsequent years. A provisional resale certificate issued between October 1st and December 31st is effective until the end of the 3rd Generated 12.14.2015 | 3 MRS Title 36 §1754-B. REGISTRATION OF SELLERS succeeding calendar year. Each certificate must contain the name and address of the retailer, the expiration date of the certificate and the certificate number. If a vendor has a true copy of a retailer's resale certificate on file, that retailer need not present the certificate for each subsequent transaction with that vendor during the period for which it is valid. [ 2005, c. 519, Pt. OOO, §1 (AMD) .] 2-C. Issuance and renewal of resale certificates; contents; presentation to vendor. On November 1st of each year, the assessor shall review the returns filed by each registered retailer unless the retailer has a resale certificate expiring after December 31st of that year. If the retailer reports $3,000 or more in gross sales during the 12 months preceding the assessor's review, the assessor shall issue to the registered retailer a resale certificate effective for 5 calendar years. Each certificate must contain the name and address of the retailer, the expiration date of the certificate and the certificate number. If a vendor has a true copy of a retailer's resale certificate on file, that retailer need not present the certificate for each subsequent transaction with that vendor during the period for which it is valid. A registered retailer that fails to meet the $3,000 threshold upon the annual review of the assessor is not entitled to renewal of its resale certificate except as provided in this subsection. When any such retailer shows that its gross sales for a more current 12-month period total $3,000 or more or explains to the satisfaction of the assessor why temporary extraordinary circumstances caused its gross sales for the period used for the assessor's annual review to be less than $3,000, the assessor shall, upon the written request of the retailer, issue to the retailer a resale certificate effective for the next 5 calendar years. [ 2013, c. 588, Pt. A, §45 (AMD) .] 3. Failure to register. A person who is required by this section to register as a retailer with the assessor and who makes retail sales in this State without being so registered commits a Class E crime. Violation of this subsection is a strict liability crime as defined in Title 17-A, section 34, subsection 4-A. [ 2003, c. 452, Pt. U, §4 (AMD); 2003, c. 452, Pt. X, §2 (AFF) .] SECTION HISTORY 1995, c. 640, §3 (NEW). 1997, c. 504, §8 (AMD). 2003, c. 452, §§U3,4 (AMD). 2003, c. 452, §X2 (AFF). 2003, c. 673, §§AAA1,2 (AMD). 2005, c. 12, §O2 (AMD). 2005, c. 12, §O5 (AFF). 2005, c. 218, §§18-21 (AMD). 2005, c. 519, §OOO1 (AMD). 2007, c. 328, §§5-7 (AMD). 2009, c. 373, §§5-7 (AMD). 2009, c. 496, §17 (AMD). 2011, c. 535, §5 (AMD). 2013, c. 200, §§1-4 (AMD). 2013, c. 200, §6 (AFF). 2013, c. 331, Pt. A, §1 (AMD). 2013, c. 546, §10 (AMD). 2013, c. 588, Pt. A, §45 (AMD). The State of Maine claims a copyright in its codified statutes. If you intend to republish this material, we require that you include the following disclaimer in your publication: All copyrights and other rights to statutory text are reserved by the State of Maine. The text included in this publication reflects changes made through the First Regular Session of the 127th Maine Legislature and is current through October 15, 2015. The text is subject to change without notice. It is a version that has not been officially certified by the Secretary of State. Refer to the Maine Revised Statutes Annotated and supplements for certified text. The Office of the Revisor of Statutes also requests that you send us one copy of any statutory publication you may produce. Our goal is not to restrict publishing activity, but to keep track of who is publishing what, to identify any needless duplication and to preserve the State's copyright rights. PLEASE NOTE: The Revisor's Office cannot perform research for or provide legal advice or interpretation of Maine law to the public. If you need legal assistance, please contact a qualified attorney. | 4 Generated 12.14.2015