Chapter 14

Merchandiser’s Financial Statements

and the Closing Process

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

LO1

Learning Objective 1

Prepare a work sheet for a merchandising business.

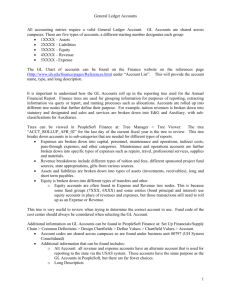

Step 1: Enter unadjusted trial balance.

Step 2: Enter adjustments.

Step 3: Prepare adjusted trial balance.

Step 4: Sort adjusted trial balance amounts to

financial statements.

Step 5: Total statement columns, compute

income or loss, and balance columns.

14-2

Learning Objective 2

LO2

Define and prepare multiple-step and single-step income statements.

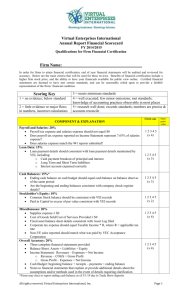

Multiple-Step Income Statement

The multi-step format has multiple subtotals before arriving at net income. This provides more detailed

information for users.

A multiple-step income statement has three main parts:

1. Gross profit, determined by subtracting cost of goods sold from net sales.

2. Income from operations, determined by subtracting operating expenses from gross profit.

3. Net income, determined by adjusting income from operations for nonoperating items. When a

company has no reportable nonoperating activities, such as SuperSub, its income from operations is

simple labeled net income.

Operating expenses are classified into selling expenses and general and administrative expenses.

14-3

LO2

Multiple-Step Income Statement

Nonoperating activities consist of other expenses, revenues, losses, and gains that

are unrelated to a company’s operations. They are reported in two sections:

1. Other revenues and gains, which often include interest revenue, dividend

revenue, rent revenue, and gains from asset disposals.

2. Other expenses and losses, which often include interest expense, losses from

asset disposals, and casualty losses.

Partial Income Statement Showing Nonoperating Activities

Income from operations

Other revenues and gains (expenses and losses)

Interest revenue

$ 1,000.00

Gain on sale of building

2,500.00

Interest expense

(1,500.00)

Total other revenues and gains (expenses and losses)

Net income

$ 12,900.00

2,000.00

$ 14,900.00

14-4

LO2

Single-Step Income Statement

This is the same information for Z-MART presented as a single-step income statement. In a

single-step income statement, all revenues are grouped together and totaled and all the

expenses are grouped together and totaled. Then, a single step is needed to subtract total

expenses from total revenues to arrive at Net Income.

As you can see, the Net Income is the same whether the multi-step or the single-step is

used. The only difference is in the amount of detail that is provided on the income

statement.

14-5

Learning Objective 3

LO3

Prepare a statement of owner’s equity.

The statement of owner’s equity summarizes changes in the

owner’s equity account during the

year due to:

The owner’s capital

account is updated

during the year for

additional owner

investments.

14-6

Learning Objective 4

LO4

Explain and prepare a classified balance sheet.

A classified balance sheet lists current assets before noncurrent assets and current

liabilities before noncurrent liabilities. This consistency in presentation allows users to

quickly identify current assets that are most easily converted to cash and current

liabilities that are shortly coming due. Items in current assets and current liabilities are

listed in the order of how quickly they will be converted to, or paid in cash.

Categories for assets :

Plant

Assets

Current

Assets

Long-term

Investments

Intangible

Assets

Categories for liabilities :

Current

Liabilities

Long-Term

Liabilities

Equity:

Equity

14-7

LO5

Learning Objective 5

Prepare journal entries to close temporary accounts.

Resets revenue,

expense, and

withdrawal account

balances to zero at

the end of the period.

Helps summarize a

period’s revenues

and expenses in the

Income Summary

account.

Identify accounts for

closing.

Record and post closing

entries.

Prepare post-closing trial

balance.

14-8

LO5

Closing Entries

Close expense accounts to Income

Summary.

a. Close inventory and purchase-

Expenses

Summary.

Income

Summary

related accounts to Income

Summary.

Assets

Close Withdrawals to owner’s

capital.

Liabilities

owner’s capital.

Permanent

Accounts

Owner’s Capital

b. Close other expense accounts to

Income Summary.

Close Income Summary account to

Temporary

Accounts

Withdrawals

Close revenue accounts to Income

Revenues

The closing process applies

only to temporary accounts.

14-9

Learning Objective 6

LO6

Prepare a post-closing trial balance.

After journalizing and posting the closing entries

a post-closing trial balance is prepared using

only the balances in the permanent accounts

from the work sheet.

Since all the temporary accounts have

been closed, they have zero balances and do

not appear on the post-closing trial balance.

14-10

LO7

Learning Objective 7

Prepare reversing entries and explain their purpose.

Reversing entries

are optional and are intended

to simplify a company’s

bookkeeping.

As a general rule, adjusting entries that

create new asset or liability accounts

are likely candidates for reversing entries.

The following adjusting entry is made to accrue

earned but unpaid salaries on December 31:

Dec. 31 Salaries Expense

Salaries Payable

210

210

Employees are paid $700 on January 9. The $700

includes the $210 accrued on December 31.

Jan. 9

Salaries Expense

Salaries Payable

Cash

490

210

700

A reversing entry was not made on January 1.

14-11

LO7

Accounting without Reversing Entries

General Ledger

Salaries Payable

Date

Debit

Credit Balance

Dec. 31

210

210

General Ledger

Salaries Expense

Date

Debit

Credit Balance

Dec. 12

700

700

26

700

1,400

31

210

1,610

December 31 adjusting entry

General Ledger

Salaries Expense

Date

Debit

Credit Balance

Jan. 9

490

490

General Ledger

Salaries Payable

Date

Debit

Credit Balance

Dec. 31

210

210

Jan. 9

210

-

January 9 payment entry

14-12

LO7

Accounting with Reversing Entries

The following adjusting entry is made to accrue

earned but unpaid salaries on December 31:

Dec. 31 Salaries Expense

Salaries Payable

210

210

The adjusting entry made on December 31

is reversed on January 1.

Jan. 1

Salaries Payable

Salaries Expense

210

210

Employees are paid $700 on January 9. The $700

includes the $210 accrued on December 31.

Jan. 9

Salaries Expense

Cash

700

700

14-13

LO7

Accounting with Reversing Entries

General Ledger

Salaries Expense

Date

Debit

Credit Balance

Dec. 12

700

700

26

700

1,400

31

210

1,610

General Ledger

Salaries Expense

Date

Debit

Credit Balance

Jan. 1

210

(210)

General Ledger

Salaries Payable

Date

Debit

Credit Balance

Dec. 31

210

210

December 31 adjusting entry

General Ledger

Salaries Payable

Date

Debit

Credit Balance

Dec. 31

210

210

Jan.

1

210

-

January 1 reversing entry

General Ledger

Salaries Expense

Date

Debit

Credit Balance

Jan.

1

210

(210)

9

700

490

January 9 payment entry

14-14

End of Chapter 14

14-15