Old Regime Social & Family Structure: 18th Century Europe

advertisement

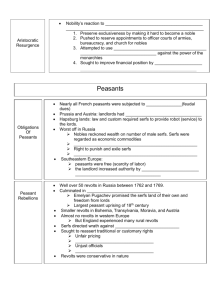

Social and Family Structure of the Old Regime (18th century) Unit 4 – Chap. 15 (Kagan) Nobility across Europe 1-5% of total population Sources of Power: Economic Wealth = LAND, PROPERTY Social Influence Political Power (esp. on a local level BUT ALSO on a national level) PROPERTY = right / ticket to participate in politics Commonalties among Nobility Political Influence Land owners Interested in protecting their property Interested in increasing wealth Almost all nobility across Europe exempt from taxes (exp. English) Aristocratic Resurgence Protecting their class from members of upper-middle & middle class who are climbing the social ladder Nobility in England Smallest and wealthiest of nobility (400 families) Control the House of Peers (peerage) Weak control in the House of Commons Own ¼ of all arable land! Primogeniture = younger sons expanding into other economic areas Involved in commerce, building canals, urban real estate, mine and other industry Country Estates = local centers of society (exclusive) Paid SOME TAXES – helps to keep a somewhat stable balance of power Nobility in France 400,000 Nobles Nobles of the sword; nobles of the robe Nobles with royal favor (18th century) = incredible political, military, clerical influence as well as economic wealth Rural / Provincial Nobles (hobereaux): more like wealthy peasants Most nobles exempt from most taxes (i.e. taille and corvees) Supposed to pay vingtieme but generally didi not Nobility has right to collect feudal dues from peasants Nobility in Eastern Europe Poland Power of life and death over serfs Exempt for all taxes after 1741, although most nobles relatively poor Austria / Hungary Judicial power of serfs Exempt from taxes Prussia Incredible amount of control over serfs: personal & judicial Nobility = high ranking military officers & bureaucrats Russia By 1762 exempted from military conscription 1785 Charter of Nobles defines legal rights of nobility in exchange for loyalty to the Tsarina, Catherine the Great Taxation and Feudal Dues France Taille – property tax Vingtieme – tax on income before the French Revolution Banalites – feudal dues, can also include days of labor Corvee – labor tax requiring peasants to work on roads, bridges and canals Prussia and Austria Robot – required service to the lord Russia Barschchina – labor “tax” = could demand up to six days a week labor Lives of Peasants / Serfs In what way were peasants’ / serfs’ lives similar in the West, the East and the Ottoman Empire? Level of personal freedom Level of taxation / feudal dues In what way(s) could peasants /serfs try to improve their situations? Pugachev Rebellion, Russia, 1773-1775 European Families of 18th Century Western Europe Nuclear Family Father (26), Mother (23), Children (until teens), Servants 5-6 members = 2 generations Married later – earn money and learn skills before developing a family SERVANT – hired under contract to work for household in exchange for room, board, and wages Eastern Europe Extended Family Lg. fam. = cultivation of land to support landowner 9+ people = 3-4 generations Married before 20 Often forced in arranged marriages by landlord Family /Household Economy Describe the idea “household /family economy” Why did everyone in the household work (either in the home or outside)? Describe the role of the father, mother and child within this economy. Hufton’s “economy of expedients” Paris and London Foundling Hospitals Commercial Revolution