Chapter 20

advertisement

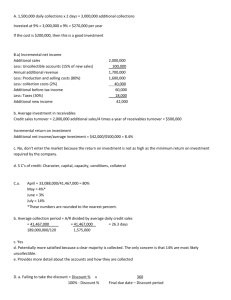

MBA 622 Brief Accounts Receivable and Inventory Management Portions from Emery and Finnerty: Corporate Financial Management – Edited by Del Hawley 1 © Prentice Hall, 1997 Effective Use of Trade Credit Advantages: Readily available Informal Flexible Stretching payments Disadvantages High cost of discounts foregone Excessive stretching of payments 2 © Prentice Hall, 1997 Trade Credit Terms Common credit terms: Net 30 2/10 Net 30 Meaning: (Disc%)/(Days to get discount) (Date Due) 2/10 Net 30 2% discount if paid within 10 days; otherwise pay within 30 days 3 © Prentice Hall, 1997 Cost of Trade Credit Discount Music Stores buys its inventory on “1/10, net 30” terms. What is the cost of not taking the discount? 4 © Prentice Hall, 1997 Cost of Trade Credit Let d = the amount of the discount (= 1%) Let DP = the discount period (= 10 days) Let TP = the total payment period (= 30 days) 5 © Prentice Hall, 1997 Cost of Trade Credit d 365 APR 1 d TP DP .01 365 .1843 1 .01 30 10 6 © Prentice Hall, 1997 Cost of Trade Credit Pay on Day 40 12.29% Pay on Day 60 7.37% So, there is an incentive to pay late that the seller must counter. The cost of foregoing the discount must be higher that cost of short-term borrowing or the buyer will use the trade credit as a loan. 7 © Prentice Hall, 1997 Pursuing Delinquent Accounts Letters Telephone calls Personal visits Collection agencies Legal proceedings 8 © Prentice Hall, 1997 Inventory Management Types of inventories: Raw materials Work-in-process Finished goods 9 © Prentice Hall, 1997 Economic Order Quantity (EOQ) Model Let S = constant usage rate of the inventory F = fixed cost of ordering inventory C = carrying cost per unit of inventory for the period. Q = units of inventory ordered. 10 © Prentice Hall, 1997 Inventory Levels for the EOQ Model Inventory Level Q Q/2 0 Time 11 © Prentice Hall, 1997 Economic Order Quantity (EOQ) Model Total cost = Ordering cost + Carrying cost S Q F C Q 2 2FS EOQ C 12 © Prentice Hall, 1997 Economic Order Quantity (EOQ) Model Annual Cost Total Cost Minimum Cost Carrying Cost Ordering Cost Q* 13 © Prentice Hall, 1997 Order Quantity (Q) EOQ Model The Acer Co. sells 10,000 units per year. The cost of placing one order is $45 and it costs $4 per year to carry one unit of inventory. What is Acer’s EOQ? 14 © Prentice Hall, 1997 EOQ Model 2FS EOQ C a fa f 2 $45 10,000 475 units $4 15 © Prentice Hall, 1997 EOQ Model Average inventory = Q/2 = 475/2 = 237.5 units. Number of orders per year = S/Q = 10,000/475 = 21. Time between orders = Q/S = (475/21)(365) = 17.34 days. 16 © Prentice Hall, 1997 EOQ Model Annual ordering cost = F(S/Q) = $45(10,000/475) = $947 per year. Annual holding cost = C(Q/2) = $4(475/2) = $950 per year. Total annual cost = $947 + $950 = $1,897 per year. 17 © Prentice Hall, 1997 Just-In-Time (JIT) Inventory Systems Materials should arrive exactly as they are needed in the production process. Reduces inventory holding costs Important factors determining success of JIT systems: Planning requirements Supplier relations Setup costs Other cost factors Impact on credit terms 18 © Prentice Hall, 1997