MIM700

advertisement

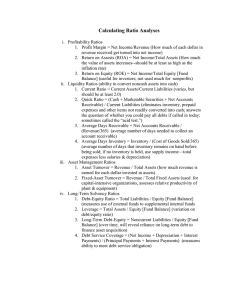

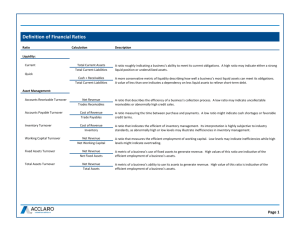

Business Finance FIN449 Michael Dimond The key to good ratio analysis • Identify the important question to be answered, then find a legitimate financial ratio which does a good job of answering that question. • “Legitimate” means the ratio was not conveniently made up • I can divide any two numbers, but that does not create a relationship • Does this ratio get discussed and scrutinized in academia? • Does it appear in finance textbooks? • Does management follow a specific set of rules we can apply in our predictions & forecasts? Michael Dimond School of Business Administration Income Statement Strawman Corporation Income Statement For year ended 12/31/… 2013 Revenue 2014 $ 10,102.0 $ 11,112.0 COGS 6,881.0 7,569.0 Gross profit 3,221.0 3,543.0 SG&A 1,362.0 1,498.0 Operating income 1,859.0 2,045.0 Other revenues & gains Gain on sale of investments - Earnings before interest and taxes (EBIT) 80.0 1,859.0 2,125.0 Interest expense, net 193.0 212.3 Earnings before taxes 1,666.0 1,912.7 666.4 765.1 Income tax expense Net income $ 999.6 $ 1,147.6 Michael Dimond School of Business Administration Balance Sheet Strawman Corporation Balance Sheet As of 12/31/… 2013 Cash 2014 $ 2,765.3 $ 3,496.8 Receivables 2,562.2 2,818.4 Inventory 2,562.2 2,818.4 Total current assets 7,889.7 9,133.6 PP&E, gross 4,245.9 4,670.5 (1,353.1) (1,401.4) 2,892.8 3,269.1 1,420.0 1,300.0 Accumulated depreciation PP&E, net Long-term investments (held-to-maturity) Total Assets Accounts payable $ 12,202.5 $ 13,702.7 1,756.9 1,932.6 366.1 402.7 16.1 17.7 276.8 304.5 Total current liabilities 2,415.9 2,657.5 Long-term debt @ 5% 3,513.8 3,865.2 Deferred taxes 14.6 16.1 Total liabilities 5,944.3 6,538.8 Preferred Stock 100.0 100.0 Common Stock 1,700.0 1,900.0 Retained earnings 4,458.2 5,163.9 Total shareholders' equity 6,258.2 7,163.9 Short-term note @ 10% Interest payable Other accrued liabilities Total Liabilities + Shareholders' Equity $ 12,202.5 $ 13,702.7 Michael Dimond School of Business Administration Statement of Cash Flows Strawman Corporation Statement of Cash Flows For year ended 12/31/… 2013 2014 Cash flows from operations (INDIRECT) Net income $ 999.6 $ 1,147.6 Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense Deferred taxes Gain on sale of investments 43.9 48.3 1.3 1.5 - (80.0) Change in inventory (232.9) (256.2) Change in receivables (232.9) (256.2) 159.7 175.7 1.5 1.6 25.2 27.7 765.4 810.0 Change in accounts payable Change in interest payable Change in other accrued liabilities Net cash provided (used) by operating activities Cash flows from investing activities Sale of held-to-maturity investments - 200.0 Purchase of plant assets (386.0) (354.6) Net cash provided (used) by investing activities (386.0) (154.6) Cash flows from financing activities Issuance of common stock - 130.0 Proceeds from (repayment of) long-term debt 319.4 351.4 Proceeds from (repayment of) short-term debt 33.3 36.6 Payment of cash dividends to preferred stock (1.0) (1.0) Payment of cash dividends to common stock Net cash provided (used) by financing activities (384.0) (32.3) (441.0) Michael Dimond 76.0 School of Business Administration Meaningful Ratio Analysis • Analysis means to break something down to understand it. • Ratio analysis should be used to answer a specific question or set of questions. • If you were examining the financial statements for a company, you might start with this basic question: “Is this a good use of investors’ money?” • What financial ratio would answer this question? How about Return on Equity? • How do you compute Return on Equity (ROE)? Michael Dimond School of Business Administration Analyzing ROE • ROE = NI ÷ Equity and answers the question, “is this a good use of investors’ money?” • If you were to break this down, there are three basic questions to answer: How profitable is this business? How efficiently are assets being used? How much does financial leverage help the investors? • What financial ratios would answer these questions? Profit Margin (PM) Total Asset Turnover (TAT) Equity Multiplier (EM) Michael Dimond School of Business Administration Drivers of ROE • Profit Margin (PM) = NI ÷ Sales and answers the question, “How profitable is this business?” • Total Asset Turnover (TAT) = Sales ÷ Total Assets and answers the question, “How efficiently are assets being used?” • Equity Multiplier (EM) = Total Assets ÷ Equity and answers the question, “How much does financial leverage help the investors?” Michael Dimond School of Business Administration The DuPont Identity • ROE is directly driven by profitability, efficiency and leverage. • ROE = PM x TAT x EM How does that work? ROE = PM x TAT x EM NI NI Sales Total Assets = x x Equity Sales Total Assets Equity NI NI Sales Total Assets = x x Equity Sales Total Assets Equity • The numerators and denominators cancel to reduce the equation to NI ÷ Equity Michael Dimond School of Business Administration A word about ROA • ROA = Return on Assets • What’s the difference between Equity & Assets? • Leverage • What’s the difference between ROE & ROA? • Leverage • ROE = PM x TAT x EM • EM represents leverage • ROA = PM x TAT • No leverage Michael Dimond School of Business Administration Digging Deeper with Financial Ratios • How would you analyze profitability, efficiency and leverage? • • • • • • How do profitability, efficiency and leverage relate? What affects profitability? What drives sales? What is the composition of assets? How were assets paid for? How are liabilities managed? • Where shall we begin? Michael Dimond School of Business Administration Common-Size Financial Statements • Shows each line item as a percent of an appropriate total. • Common-size balance sheet • • • • % of Total Assets Shows the composition of assets Liabilities & equity items are also shown as % of total assets Debt Ratio = Total Liabilities ÷ Total Assets • Common-size income statement • % of Sales • PM = Net Income as % of Sales Michael Dimond School of Business Administration Common-Size Income Statement Common-size Income Statement Revenue 2013 2014 100% 100% COGS 68% 68% Gross profit 32% 32% SG&A 13% 13% Operating income 18% 18% Other revenues & gains 0% 0% Gain on sale of investments 0% 1% 18% 19% Earnings before interest and taxes (EBIT) Interest expense, net 2% 2% Earnings before taxes 16% 17% 7% 7% 10% 10% Income tax expense Net income Michael Dimond School of Business Administration Common-Size Balance Sheet Common-size Balance Sheet 2013 2014 Cash 23% 26% Receivables 21% 21% Inventory 21% 21% Total current assets 65% 67% PP&E, gross 35% 34% -11% -10% 24% 24% Accumulated depreciation PP&E, net Long-term investments (held-to-maturity) 12% 9% 100% 100% 14% 14% Short-term note @ 10% 3% 3% Interest payable 0% 0% Other accrued liabilities 2% 2% Total current liabilities 20% 19% Long-term debt @ 5% 29% 28% Deferred taxes 0% 0% Total liabilities 49% 48% Preferred Stock 1% 1% Common Stock 14% 14% Retained earnings 37% 38% Total shareholders' equity 51% 52% 100% 100% Total Assets Accounts payable Total Liabilities + Shareholders' Equity Michael Dimond School of Business Administration We don’t make a common-size CF Statement Strawman Corporation Statement of Cash Flows For year ended 12/31/… 2013 2014 Cash flows from operations (INDIRECT) Net income $ 999.6 $ 1,147.6 Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense Deferred taxes Gain on sale of investments 43.9 48.3 1.3 1.5 - (80.0) Change in inventory (232.9) (256.2) Change in receivables (232.9) (256.2) 159.7 175.7 Change in accounts payable Change in interest payable Change in other accrued liabilities Net cash provided (used) by operating activities Cash flows from investing activities Sale of held-to-maturity investments Purchase of plant assets Net cash provided (used) by investing activities There are other ways to examine cash flows which are more helpful 1.5 1.6 25.2 27.7 765.4 810.0 - 200.0 (386.0) (354.6) (386.0) (154.6) Cash flows from financing activities Issuance of common stock - 130.0 Proceeds from (repayment of) long-term debt 319.4 351.4 Proceeds from (repayment of) short-term debt 33.3 36.6 Payment of cash dividends to preferred stock (1.0) (1.0) Payment of cash dividends to common stock Net cash provided (used) by financing activities (384.0) (32.3) (441.0) Michael Dimond 76.0 School of Business Administration Vertical & Horizontal Analysis • Vertical Analysis compares figures as a percent of a relevant total (“common size” financial statements) • Horizontal Analysis compares the same figure over a series of periods (showing % change or % growth) Growth of Income Statement Items 2013 2014 Revenue 10.0% 10.0% COGS 10.0% 10.0% Gross profit 10.0% 10.0% SG&A 10.0% 10.0% Operating income 10.0% 10.0% Earnings before interest and taxes (EBIT) 10.0% 14.3% Interest expense, net 10.0% 10.0% Earnings before taxes 10.0% 14.8% Income tax expense 10.0% 14.8% Net income 10.0% 14.8% Growth of Balance Sheet Items 2013 2014 Cash 14% 26% Receivables 10% 10% Inventory 10% 10% Total current assets 11% 16% PP&E, gross 10% 10% Accumulated depreciation PP&E, net Long-term investments (held-to-maturity) 3% 13% 0% 4% 13% Michael Dimond School of Business Administration -8% Categories of Financial Ratios • Most finance texts group ratios into categories like these: • • • • • Profitability ratios Efficiency (or Activity) ratios Liquidity ratios Debt ratios Market ratios • It is usually more helpful to think of the questions to be answered rather than just crunching a bunch of numbers. • • • • Uses critical thinking Easier to read Less time consuming Uses fewer resources Michael Dimond School of Business Administration Profitability Ratios • PM = Net Income ÷ Sales • Also called “Net Profit Margin” or return on sales • Gross Margin = Gross Profit ÷ Sales • Gross Profit = Sales – COGS • Also called the “Gross Profit Margin” • Operating Margin = Operating Profit ÷ Sales • Also called the “Operating Profit Margin” • Sometimes also called return on sales • All of these are on the common-size income statement Michael Dimond School of Business Administration Efficiency Ratios • TAT shows overall efficiency, but how hard do specific assets work? • Cash • Cash as % of assets • Cash as number of days sales (Days sales in cash = Cash ÷ [Sales/365]) • Inventory • Two formulas are referred to as “Inventory Turnover” • Inventory Turnover = Sales ÷ Inventory • Inventory Turnover = COGS ÷ Avg. Inventory • These two ratios answer different questions: • How hard is inventory working? (Sales/Inventory) • How many times/year is inventory replaced? (COGS/Average Inventory) • How useful are these computations? • Sales/Inventory provides no new information: If we know TAT and Inventory as a % of assets, Sales/Inventory = TAT ÷ Inv% • Sales/Inventory is relevant relationship in certain industries (e.g. Retail) • COGS/Average Inventory gives a measure of asset replenishment • COGS/Average Inventory is used in computing the operating cycle Michael Dimond School of Business Administration Efficiency Ratios • If you know how long it takes a company to sell inventory, collect accounts receivable and pay its bills, you can compute how long their business takes to function • Operating Cycle: Days in Inventory + Days in Receivables • Cash Cycle: Days in Inventory + Days in Receivables – Days in Payables Michael Dimond School of Business Administration Efficiency Ratios • There is an easy and consistent way to compute and understand the components of the cash cycle. • Each of the “Days in…” figures represents a year divided by the appropriate turnover rate: • Days in Inventory = 365 ÷ Inventory Turnover Rate • Days in Receivables = 365 ÷ Receivables Turnover Rate • Days in Payables = 365 ÷ Payables Turnover Rate • This means the turnover rates can be simplified to these: • Inventory Turnover Rate = COGS ÷ Avg. Inventory • Receivables Turnover Rate = Sales ÷ Avg. Receivables • Payables Turnover Rate = Purchases ÷ Avg. Payables • …and the days in each can be computed as: • Days in Inventory = 365 ÷ (COGS ÷ Avg. Inventory) • Days in Receivables = 365 ÷ (Sales ÷ Avg. Receivables) • Days in Payables = 365 ÷ (Purchases ÷ Avg. Payables) • Purchases can be computed as COGS + Δ Inventory • Purchases = COGS + Ending Inventory – Beginning Inventory Michael Dimond School of Business Administration Liquidity Ratios • The Current Ratio • Does not do a good job of answering a question • Current Assets ÷ Current Liabilities • Liquidity means something can be converted into cash immediately without significant loss of value. Current Assets includes inventory. Is inventory really liquid? • Quick Ratio (also called the “Acid Test”) • Answers the question, “how well can this firm meet its short-term obligations?” • [Current Assets – Inventory] ÷ Current Liabilities Michael Dimond School of Business Administration Debt Management Ratios • Debt ratio = Total Liabilities ÷ Total Assets • Also called “Debt to Total Capital” ratio • Debt-to-Equity ratio = Total Liabilities ÷ Total Equity • EM (from DuPont) = 1 + D/E • Times Interest Earned ratio = EBIT ÷ Interest • TIE can be altered to cover any financial obligations. • TIE = EBIT ÷ Interest • :. TIE = (EBT + Interest) ÷ Interest • Fixed Payment Coverage = (EBT + Int + Lease Pmts) ÷ (Int + Lease Pmts) • Damodaran uses TIE to help estimate Kd Michael Dimond School of Business Administration Market Value Ratios • Price-to-Earnings ratio = Share Price ÷ Earnings per Share • Earnings per Share (EPS) = Earnings Available to Common Shareholders ÷ Number of Shares of Common Stock • If there is no preferred equity (or an insignificant amount), EPS can be NI ÷ Number of Shares • Because the Numerator and Denominator are both “per share,” the PE ratio can be computed as Market Capitalization ÷ Total Earnings Available • Market-to-Book ratio = Price per Share ÷ Book Value per Share • Book Value per Share = Common Equity on Balance Sheet ÷ Number of Shares • Common Equity = All equity except preferred equity • Again, because the Numerator and Denominator are both “per share,” the MB ratio can be computed as Market Capitalization ÷ Total Common Equity Michael Dimond School of Business Administration Other useful analysis • Dividends & Retained Earnings • d: Dividend Payout Ratio = Dividends ÷ Net Income • b: Retention Ratio = 1 – d Also called the “plowback ratio.” Why do you think that name is used? • Growth Limitations • SGR: Sustainable Growth Rate = b x ROE = b x PM x TAT x EM • IGR: Internal Growth Rate = b x ROA = b x PM x TAT • This suggests that understanding the payout policy and retention by a company is crucial. I usually compute b = 1-d and also compute an alternative to b = ΔRE ÷ NI Michael Dimond School of Business Administration Other useful analysis • Breakeven • BE = Total Fixed Costs ÷ Contribution Margin • Contribution Margin = Price per unit – Variable Costs per unit • Some analysts compute accounting breakeven and financial breakeven. The definition of “Fixed Costs” changes. • Degree of Operating Leverage • Looks a lot like an elasticity formula: %Δ Op. Income ÷ %Δ Sales • This is not a time-based relationship between numbers. It is based on the cost structure of the company. • Because cost structure (fixed & variable costs) will change from year to year, we cannot compute DOL using multiple years’ figures • A point estimate of DOL can be computed as Gross Profit ÷ Operating Income • As firm approaches breakeven, DOL gets larger (and undefined at BE) • DOL indicates how sensitive operating income is to forecast errors in sales • If DOL = 2.0, a 1% error in sales forecast results in a 2% error in operating income • What if the sales forecast is 10% off? Michael Dimond School of Business Administration A starting point • This set of ratios answer a series of useful questions. Some companies require other ratios. Useful Ratios & Other Figures GM (Gross Margin) OM (Operating Margin) PM (Profit Margin AKA Net Profit Margin) TAT (Total Asset Turnover) EM (Equity Multiplier) ROE (Return on Equity) ROA (Return on Assets) d (Dividend Payout Ratio) b (Retention Ratio AKA Ploughback Ratio) = 1-d Alternativ to Retention Ratio = ΔRE/NI SGR (Sustainable Growth Rate) IGR (Internal Growth Rate) TIE (Times Interest Earned Ratio AKA Interest Coverage Ratio) DOL - point estimate (Degree of Operating Leverage) EPS (Earnings Per Share) Days of sales in cash Inventory Turnover = COGS/Avg Inv Receivables Turnover Purchases Payables Turnover Days in inventory Days in receivables Operating cycle Days in payables Cash cycle Michael Dimond School of Business Administration