Beckley_WhyMarketingCounts_WIWP_2004

advertisement

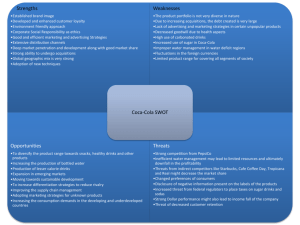

Business Seminar 1. Why Marketing Counts 33rd New York Wine Industry Workshop The Understanding & Insight Group Agenda Background Why Marketing Counts Making Your Product Real (continue through lunch) Integrating Marketing & Selling Wrap-up and Review The U&I Group Copyright 2003 2 Five year old business development company Jacqueline Beckley Both have had extensive industrial experience. Known for: Jacqueline in both Fortune 500 firms and 30 years in consumer understanding and research. The Getting It! System Successful Front End Process Locations in New Jersey, Ohio, and California The U&I Group Copyright 2003 3 Overview Weybright The U&I Group Copyright 2003 4 Marketing is: EVERYTHING you do to promote your business, from the moment you conceive of it to the point at which customers buy your product or service and begin to patronize your business on a regular basis. The key words to remember are everything and regular basis. Jay Conrad Levinson (“Guerrilla Marketing”) The U&I Group Copyright 2003 5 Elements of Marketing Shared by Small & Big Businesses 1. Research 2. Analysis 3. Strategies and Tactics Factors Guiding Strategies and Tactics: PRODUCT Price Promotion Place (& PEOPLE) The U&I Group Copyright 2003 6 Product Identify and understand the product/service being marketed What need is there for your product or service? Sell benefits not just products Question – “Would you buy this product or service?” Why or Why not? The U&I Group Copyright 2003 7 Market Summary (People) Market: past, present, & future Review changes in market share, leadership, players, market shifts, costs, pricing, competition – (regionally, nationally, internationally) Mass Market/ Followers Number of customers Early Adopters/ Pioneers End of Life Time The U&I Group Copyright 2003 8 Competition (useful as a tool for analysis and learning) The Competitive Landscape Provides an overview of product competitors, their strengths and weaknesses (unfilled niches) Positions each competitor’s product against new product (learn what customers do or don’t want) Offers marketing ideas The U&I Group Copyright 2003 B A Price C D Performance 9 “If You Do Not Change, You Can Become Extinct” Who Moved My Cheese, page 46 43% of U.S.farms have internet access This appears to be a large growth from 2 years ago (29% were on the Web then) AgWeb.com says 77% of farmers use the Internet for market and weather information R.Hill says the bigger farmers with buying power are definitely out there on the Web, frequently While you live regionally, think globally EX: Tomatoes Mexican tomatoes Planting Supply Price The U&I Group Copyright 2003 10 “Small Business” Issues I have a great idea, if I don’t move on it someone will take it! I am not good at all the things you need to do to make a business successful. I don’t have the time!! I don’t have the money! (I am afraid – if this doesn’t work……) The U&I Group Copyright 2003 11 The Decision Making Process “Big Guys” Defining the Problem Determining the Objective Understand the impact of possible decisions Making a Choice Leveraging information, being creative Predicting the Consequences Profit maximizing, Benefit-cost analysis Exploring the Alternatives Not the symptoms And being happy with it in the long-run Performing Sensitivity Analysis Understanding the impact of changing assumptions The U&I Group Copyright 2003 12 Common Business Issues In “Big Guy” Terms Product/portfolio strategy & planning Promotional strategy Who are my competitors and what can I offer that my competition cannot? High incidence of failure Who really buys and consumes these products? Competitive benchmarking & differentiation strategy How can I make my advertising more impactful? Consumer/customer segmentation Which products do I invest resources in? What steps can I take to reduce the likelihood of failure? Too much information, not enough guidance I have a lot if information, but what do I do with it? The U&I Group Copyright 2003 13 What’s Going on in a “Big Company” More resources Scale has a way of masking issues that will have great business impact Larger number of people, more people issues The U&I Group Copyright 2003 14 The Product Development Process FRONT-END Planning & Situation Analysis Consumer Needs & Idea Generation Concept Development BACK-END Product Development Product Launch Post-Launch Audit Traditionally, big companies have focused their time and resources on the “back-end” of the PDP. That is the tactical space. The U&I Group Copyright 2003 15 The importance of the “front end” Attention is now being directed on the “Front End” of the Product Development Process because of proposed ability to focus resources and improve chances for successful new product introductions. FRONT-END Planning & Situation Analysis Consumer Needs & Idea Generation BACK-END Concept Development Product Development Product Launch Post-Launch Audit Ability to influence outcome The U&I Group Copyright 2003 16 Small Business Same issues as Big Company – Fewer resources Better grasp of business solutions required Fast to understand, fast to change direction “Adapt To Change Quickly” “Be Ready To Change Quickly and Enjoy It Again & Again” both on pg 74 The U&I Group Copyright 2003 17 Critical Success Factors Superior, differentiated products Products that offer unique benefits & superior value to the consumer/customer Thorough understanding of customers’ needs & wants, competitive situation, and nature of the market The U&I Group Copyright 2003 18 Critical Success Factors Do the Front End Early-on idea screening, market assessment, technical assessment, business & financial analysis, product definition, target market, product concept with attributes & benefits, and positioning Prioritize with Go/Kill procedures Balance speed to market & quality of execution A company culture that supports the business goals The U&I Group Copyright 2003 19 Focused Decision Making A strong (product development) Process with a consumer/customer orientation and a focus on frontend activities can deliver quick market results. A focused Process leads to focused decision making. Defining the Problem Determining the Objective Exploring the Alternatives Research & Predicting the Consequences Analysis Making a Choice Checking impact of the Market The U&I Group Copyright 2003 20 Leveraging Business Information Every business has significant knowledge stored within its people, its documents, its resources, libraries & the world. The goal: leverage this information, identify knowledge gaps, fill those gaps, and act on robust business strategies based on integrated market information. How do you do that? The Getting It!® system The U&I Group Copyright 2003 21 We have entered into a Demand Driven Economy. We are No Longer in a Supply Driven Economy…We have to learn how the rules have changed. – Rick Kash, Cambridge Group Dec 9, 2003 The pressure for change Competition from low cost economies — using new technologies, skilled people and mobile capital. Innovative products, processes and services — spreading rapidly across the globe or down the street. Electronic commerce — radically changing the way business meets customers' demands. Science and knowledge — underpinning the new technologies. The U&I Group Copyright 2003 22 What are the New Rules for a Demand Economy? How High? What is rate limiting behavior? How Wide? What is trade off behavior The U&I Group Copyright 2003 23 Rate Limiting Behavior What is Rate Limiting Behavior? Caloric consumption Income I can only eat/drink so much I can only spend so much Demographics I do certain events at a specific age The U&I Group Copyright 2003 25 Caloric Consumption Approx 530 Calories The U&I Group Copyright 2003 26 Consumption by Major Food Groups The U&I Group Copyright 2003 27 %Consumption of Alcoholic/ Non Alcoholic Beverages has Remained Fairly Constant over 35 years Total Non Alcoholic Total Alcoholic 100% 80% 60% 40% 20% 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 1968 1966 0% Source: USDA Economic Research Service The U&I Group Copyright 2003 28 Consumption of Most Beverages Except for Coffee, Soft Drinks, Bottled Water and Milk has Remained Fairly Constant 50% Whole Milk Other Milk 40% Tea Coffee Bottled water 30% Diet Soft Drinks Regular Soft Drinks Fruit Juices Fruit drinks, 20% Iced Tea (Canned) Vegetable juices Beer 10% Wine Distilled Spirits 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 1968 1966 0% Source: USDA Economic Research Service The U&I Group Copyright 2003 29 Income Impact $7,000 The U&I Group Copyright 2003 30 Spending by Major Categories % Change in per capita spending 1970- 2001 Reading -18% Clothing 4% Food at home 11% Tobacco 13% Furniture 16% Entertainment 17% Health care 19% Personal care 21% Alcoholic beverages 23% Utilities Source: Consumer Expenditure Spending Survey US Bureau of Labor -30% -20% 24% Food away from home 26% Housekeeping 26% Housing 26% Telephone 28% Transportation 29% Education -10% 30% 0% 10% The U&I Group Copyright 2003 20% 30% 40% 31 Demographics 85 years and over 80 to 84 years 75 to 79 years 70 to 74 years 65 to 69 years 60 to 64 years 55 to 59 years 50 to 54 years 45 to 49 years 40 to 44 years 35 to 39 years 30 to 34 years 25 to 29 years 20 to 24 years 15 to 19 years 10 to 14 years 5 to 9 years Under 5 years Source: US Census 0 5000000 10000000 15000000 The U&I Group Copyright 2003 20000000 25000000 32 Demographics – Choice Behavior Average Age of First Marriage Male Female Average Duration of First Marriage Average Age at Childbirth (Female) Average Number of Children in Family Household % of First Marriage Ending in Divorce Average age at Divorce Male Female Average Duration of Divorce Male Female % of Women in the Labor Force 1970 1995 23.4 21.8 27 21.4 2.2 36% 28.6 26.6 26 24.9 1.8 42% 36.4 33.9 39.7 37.3 4 9 42% 8 15 60% Source: US Census. US Dept of Labor The U&I Group Copyright 2003 33 Rate Limiting Behavior Issue: Drives consumers to make trade offs Global Focus The U&I Group Copyright 2003 34 Trade Off Behavior Trade off Behavior Some Trade Off Data Delivering the same experience for the consumer Types of experiences The U&I Group Copyright 2003 36 What Frameworks do Consumers Use to Understand Beverages Imagine you open a refrigerator and you see 35 different beverages. What are the drinks identified top of mind as interesting? What makes them interesting? What are the drinks that when consumers make trade offs are most interesting? What makes them interesting? Is there a difference? The U&I Group Copyright 2003 37 Expected Experience: What are the drinks identified top of mind as interesting? What makes them interesting? These everyday beverages; branded and with their primary attributes… i.e. colored, caffeinated and extreme temperatures are how the consumer makes sense of drinks. Same beverages as 2002, different ranking Cola Ice Tea From a Brand Classic… just the way you like it. Thick slushie An Ice Cream Float Warm smooth flavor 100% natural So Inviting From a Brand Hot Coffee Aroma invites you to sip more Made from 100% Columbian Coffee beans Fresh ground and brewed with all natural flavors Warm and inviting The U&I Group Copyright 2003 38 2003 Trade Off Experience: What are the drinks when consumers trade off are most interesting? What makes them interesting? Many different beverage bases (creamy, fruit based, coffee based). Healthiness, brands, what it is made from and the primary attributes of the beverage themselves are how consumers make sense of drinks. Hot Chocolate Rich Creamy with marshmallows Premium blend of chocolate Made with creamy milk chocolate Warm and inviting Slushies Made with real fruit juice and natural flavors With Tropical flavors Rainbow of colors Satisfy your sweet tooth From a Brand With a light fizz The U&I Group Copyright 2003 39 2003 Trade Off Experience: What are the drinks when consumers trade off are most interesting? What makes them interesting? Many different beverage bases (creamy, fruit based, coffee based). Healthiness, brands, what it is made from and the primary attributes of the beverage themselves are how consumers make sense of drinks. Hot Coffee Aroma invites you to sip more Made from 100% Columbian Coffee beans Fresh ground and brewed with all natural flavors Warm and inviting Flavored Milk Thick with lots of flavor From a Brand 100% natural With Calcium , Vitamins A,D or whatever you need Good for you and healthy for your bones Already prepared…just shake and drink The U&I Group Copyright 2003 40 The U&I Group Copyright 2003 41 White Wine Sports Beverage Flavored Beer Cocktails Red Wine Cola Organic Beverage Fiber Drinks Flavored Tequila Flavored Hard Cider Beer Alternatives Meal Replacement Beverage After Dinner Drinks Pouched Beverage Iced Coffee Drinks Soup Flavored Soy Milk Coolers Lemon Lime Soda Iced Tea Alcoholic Spritzers Energy Drinks Shakes Juice Spritzers Juice Drinks Yogurt Beverage Creamy Fruit Beverage Hot Tea Flavored Water Flavored Milk Fruit Smoothies Hot Coffee Drinks Slushies Hot Chocolate Initial Interest in Beverages - 2003 Hot Chocolate, Slushies, Hot Coffee, and Flavored Milk are the beverages consumers are initially interested in the idea of. 70 60 50 40 30 20 10 0 -20 Sports Organic 42 White wine Flavored Beer Red Wine Cola Soup Cocktails Pouched Beverages After Dinner Drinks Iced Tea Flavored Hard Cider The U&I Group Copyright 2003 Hot Tea Beer Alternatives Fiber Iced Coffee Juice Drinks Constant Flavored Tequila Flavored Soy Milk Lemon Lime Shakes Alcpholic Spritzers Yogurt Coolers Juice Spritzers Flavored Milk Hot Coffee Fruit Smoothies Flavored Water Meal Replacements Slushies Energy Creamy Fruit Beverages Hot Chocolate Overall Interest in Beverages - 2003 Hot Chocolate, Creamy Fruit, Energy, Slushies, and Meal Replacement beverages are the beverages consumers are highly interested in. avg Product Elements 70 60 50 40 30 20 10 0 -10 What’s the Difference? Expected Attributes Similar Branded Fresh 100% Natural Textures So Inviting Trade Off Experience Attributes Classic Warm Smooth flavor Different Unmet Needs The U&I Group Copyright 2003 Branded Pure, Fresh 100% Natural Textures Warm and Inviting Made from… Good for you Nutritious Added Vitamins, Minerals, Antioxidants, etc Lots of flavors, Fruit Flavor All ready prepared 43 Business Development Your new idea or concept should be evaluated & reviewed as a new and independent business The U&I Group Copyright 2003 44 What will we give you today? What to do after they tell you to do The Business Plan? The U&I Group Copyright 2003 45