1) Why is maximizing shareholder wealth a better goal than

advertisement

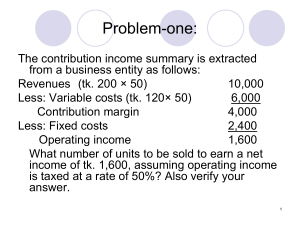

1) Why is maximizing shareholder wealth a better goal than maximizing profits? c. Maximizing shareholder wealth gives superior consideration to the entire portfolio of shareholder investments. 2) Financial management is concerned with which of the following? e. All of the above 3) The debt ratio is a measure of a firm’s: a. leverage. 4) Millers Metalworks, Inc. has a total asset turnover of 2.5 and a net profit margin of 3.5%. The total debt ratio for the firm is 50%. Calculate Millers’s return on equity. a. 17.5% 5) When public corporations decide to raise cash in the capital markets, what type of financing vehicle is most favored? c. 6) Common stock If an investor were to sell 100 shares of Microsoft stock to another investor in the securities market, this would be referred to as what type of transaction? b. 7) A secondary market transaction A company collects 60% of its sales during the month of the sale, 30% one month after the sale, and 10% two months after the sale. The company expects sales of $10,000 in August, $20,000 in September, $30,000 in October, and $40,000 in November. How much money is expected to be collected in October? a. $25,000 8) Which of the following would not be found in a cash budget? c. Depreciation 9) The present value of a $100 perpetuity discounted at 5% is $1200. False 10) You just purchased a parcel of land for $10,000. If you expect a 12% annual rate of return on your investment, how much will you sell the land for in 10 years? b. $31,060 11) The break-even model expresses the volume of output as a unit quantity. True 12) Which of the following is NOT an example of variable costs? b. 13) Depreciation In general, as the level of sales rises above the break-even point, the degree of operating leverage: a. increases. Table 1 Average selling price per unit Variable cost per unit $16.00 $11.00 Units sold 200,000 Fixed costs $800,000 Interest expense 14) $ 50,000 Based on the data in Table 1, what is the break-even point in units produced and sold? d. 15) 160,000 The IRR is the discount rate that equates the present value of the project’s future net cash flows with the project’s initial outlay. True 16) The NPV method: d. 17) all of the above. Net working capital provides a very useful summary measure of a firm’s short-term financing decisions. True 18) Which of the following has the least interest rate risk? a. 19) A six-month unsecured promissory note from International Harvester Dorning Shade Company will use an estimated 50,000 gumbands in its manufacturing process next year. The carrying cost of gumband inventory is $.04 per unit, and the cost of reordering gumbands is $50 per order. What is Dorning Shade’s economic ordering quantity for gumbands (round to the nearest 100 gumbands)? a. 20) 11,200 ABC will purchase a machine that will cost $2,575,000. Required modifications will cost $375,000. ABC will need to invest $75,000 for additional inventory. The machine has an IRS approved useful life of 7 years; it is presumed to have no salvage value. ABC plans to depreciate the machine by using the straight-line method. The machine is expected to increase ABC’s sales revenues by $1,890,000 per year; operating costs excluding depreciation are estimated at $454,600 per year. Assume that the firm’s tax rate is 40%. What is the annual operating cash flow? d. $1,029,811 Need by Thursday August 13th @ 6:00PM Thank you, Godzilla1965