University Department of Management Science, Sub

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Chapter 1

st

Introduction Of Project

Introduction:-

I have completed the In-plant project in Birla Sun Life Insurance, Osmanabad. In Life

Insurance Industry in the duration 45 days. In that Organization I have learned following things and on that gaining knowledge I have completed the project work.

1.

What is the life Insurance?

2.

How those organizations do the work?

3.

What are different types of the Life Insurance?

4.

Which kinds of services are provided by the organization to its customer?

5.

How to speak and behave with organization peoples and employees.

6.

Personal development.

7.

How to prepare book of account.

8.

Organizations Environment.

9.

Punctuality & Time management in organization.

What is Insurance?

Life is a big gamble. Things don’t always turn out the way you want them to. Anything can happen to you or to your valuables. An accident, a theft, death, the possibilities are endless.

The problem before society was this uncertainty that hung over like a sword. How could society protect its members from such random risks that could strike anyone, anytime?

The solution was pooling .

Pooling together of risks among an entire population so that the impact of hazard is minimized for everyone. Notice how similar this simple financial innovation has much in common to how we humans organize ourselves. We stay together in groups and help each other. Insurance works in a similar way. People pool together their risks and help the guys who run out of luck.

Let’s say you have 2% chance of being killed pre-maturely. If you are killed, your dependents like your parents and children will be left helpless. You can ensure that they are not harmed incase anything happens to you by signing up for life-insurance. The life insurance company will pay your dependents the sum for which you were covered in case you die within

1

University Department of Management Science, Sub-Campus, Osmanabad 2012-13 the period for which you were covered and will charge you a yearly fee called premium for this service. The company will collect premiums from all individuals who signed up for life insurance and pay an individual’s dependents from this pooled premium incase he loses his ability to earn (death/permanent disability). Of a very large sample of people, statistically if the

2% chance probability is correct, 2 out of every 100 people will die and will need to be paid.

This probability becomes stable as the sample size increases. This stability enables companies to be sure they won’t be bankrupted by lots of claims. Therefore, you should try to opt for large, trustworthy insurance companies over small ones. The premiums are determined by Actuaries and Appraisal Agencies after calculating the risk involved.

Insurance companies need to obviously be financially sound so that they can pay off claimants. As a result they have to follow regulations of the countries in which they are operating. In India, the insurance industry is regulated by IRDA

Remember that you are not gambling with your life while buying life insurance. You are buying your piece of mind. A Life Insurance policy is extremely essential for an individual who wants to stay secure and happy and has dependents. After all, our money is not an end in itself. Of what use is all our income if we cannot promise security to our family?

Insurance can assume a lot of forms

Life Insurance (Term Plans, Endowment Plans, ULIPS)

In a plain vanilla term life insurance, you will not get back your premium in case you outlive your covered period. Yet, term life insurance is much better than some other products like

ULIPS or Endowments that are currently on offer.

Nowadays, insurance can be purchased for seemingly small and trivial things. A good rule of thumb to follow is that if you will be completely devastated by the loss of an object, you should purchase insurance for it. A good example is your home. If your life will not be thrown off-track by the loss of a particular object, there is no sense purchasing insurance for it.

Also remember that Insurance is not an Investment product, it is a Risk Management product.

Stay away from products like ULIPS and Endowments that combine Insurance and

Investment. They make for poor Insurance products (High Premiums) and poor Investment products (Low Returns). When you forget this distinction, you will be taken for a ride by insurance agents who get hefty commissions for ULIPS.

Typically, Insurance Companies frame policies in a way so that Moral Hazards are minimized.

2

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Objectives:-

To study the actual organization’s working.

To analyze insurance sector’s problem & Opportunity.

To get basic information about insurance.

To know terms & conditions of insurance.

To study policies of Insurance toward employee & customer.

To understand customer awareness.

Over all information about insurance & scope insurance.

To analyze of customer satisfaction.

To study all the information about insurance.

To study actual working of an organization; insurance.

To gain practical knowledge about Insurance sector.

3

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Scope:-

It is useful to understand and analyze consumers buying behaviors of insurance policy for various insurance companies.

During the doing study of BSLI it will help to me understanding strategies of organization.

In the market like Osmanabad there is vast scope for expanding the business because there is less amount of people are having insurance policies

It would also enable the companies to know about the problem (if any) encountered by the customers.

Limitation:-

1.

The time allotted for conducting the in plant study was only 45 days. It is not enough for understanding about the organization in detail.

2.

Unavailability of some documents which were confidential.

3.

Employees were busy in their work so they could not give more information.

4.

There may be errors due to the bias of the respondents.

5.

The study is limited to my experience and knowledge.

6.

The data collected is totally dependent on respondents’ views, which could be bias in nature.

7.

Sometimes respondents do not give a response or give partial response. It is called non response error. The reason may be lack of knowledge or unwillingness to answer.

8.

The answers given by the respondents are not always correct and may be misleading.

9.

It is very time consuming to go door to door in order to conduct a survey of various homes and find their views and study their buying behavior.

4

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Chapter 2

nd

Profile of the Company:-

Established in 2000, Birla Sun Life Insurance Company Limited (BSLI) is a joint venture between the Aditya Birla Group, a well known and trusted name globally amongst Indian conglomerates and Sun Life Financial Insurance, leading international financial services organization from Canada. The local knowledge of the Aditya Birla Group combined with the domain expertise of Sun Life Financial Insurance, offers a formidable protection for its customers future. With an experience of over 10 years, BSLI has contributed significantly to the growth and development of the life insurance industry in India and currently ranks amongst the top 6 private life insurance companies in the country.

Known for its innovation and creating industry benchmarks, BSLI has several firsts to its credit. It was the first Indian Insurance Company to introduce "Free Look Period" and the same was made mandatory by IRDA for all other life insurance companies. Additionally,

BSLI pioneered the launch of Unit Linked Life Insurance plans amongst the private players in

India. To establish credibility and further transparency, BSLI also enjoys the prestige to be the originator of practice to disclose portfolio on monthly basis. These category development initiatives have helped BSLI be closer to its policy holders' expectations, which gets further accentuated by the complete bouquet of insurance products (viz. pure term plan, life stage products, health plan and retirement plan) that the company offers. Add to this, the extensive reach through its network of 600 branches and 1, 47,900 empanelled advisors. This impressive combination of domain expertise, product range, reach and ears on ground, helped BSLI cover more than 2.4 million lives since it commenced operations and establish a customer base spread

5

University Department of Management Science, Sub-Campus, Osmanabad 2012-13 across more than 1500 towns and cities in India. To ensure that our customers have an impeccable experience, BSLI has ensured that it has lowest outstanding claims ratio of 0.00% for

FY 2010-11. Additionally, BSLI has the best Turn Around Time according to LOMA on all claims Parameters. Such services are well supported by sound financials that the Company has.

The AUM of BSLI stood at 19725 crs. As on April 30, 2011, while the company has a robust capital base of Rs. 2450 crs.

6

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

History, Vision, Mission:-

History:-

When Mathew Hamilton Gaul received a charter for The Sun Insurance Company of Montreal in 1865, few could have foreseen that the fledgling company would grow to become a leading international financial services organization.

What a difference a century and a half makes.

Today, we’re a homegrown success story. Through our operations, subsidiaries and joint ventures, we are proud to serve millions of people in Canada, the United States, the United

Kingdom, Hong Kong, the Philippines, China, Indonesia, India, Japan and Bermuda.

In big cities and small towns, from Montreal to Manila, Sun Life is there.

Expanding the horizon for financial services And designing products and services that are right for the times.

It all started with one man, one great idea, and a company dedicated to the financial success of its customers.

7

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Vision:-

“To be a world class provider of financial security to individuals incorporates and to be amongst the top three private sectors life insurance companies in India.”

Mission:-

1.

To be the first preference of our customers by providing innovative, need based life insurance and retirement solutions to individuals as well incorporates.

2.

These solutions will be made available by well-trained professionals through a multi channel distribution network and superior technology.

3.

Our Endeavour will be to provide constant value addition to customers throughout their relationship with us, within the regulatory framework.

4.

We will provide career development opportunities to our employees and the highest possible returns to our shareholders.

8

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Organization Structure:-

Organization Chart

CEO

Mr. Vikram Mehmi

VP Operations

Mr. Snehal Shah

CFO

Mr. Mayank Bathwa

VP Group VP Marketing

Mr. Amit Punchhi Senio Ms. Anjana Grewal

Senior

Regional

Manager

Branch

Manager

Branch

Manager

Branch

Manager

Marketing

Manager

Marketing

Manager

Marketing

Manager

Agency

Manager

Agency

Manager

Agency

Manage

9

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Social Responsibilities:-

Birla Sun life Insurance introduces its rural initiative at Renukoot on Gandhi

Jayanti, 2nd October:-

Birla Sun Life Insurance recently launched its rural product, Birla Sun Life Bima Kavach

Yojana at a special ceremony in Hindalco Ltd, Renukoot, on Gandhi Jayanti. At the function held to celebrate the occasion, about 170 villagers, who had bought their life insurance, received their policy documents.

The company has developed a complete rural strategy which focuses on marketing the

Birla Sun Life Bima Kavach Yojana in IRDA defined rural areas. Speaking on the occasion, Mr.

Askaran Agarwala, Director (whole time), and Hindalco Ltd. said, "The Aditya Birla Group is completely aware of its responsibility towards the society. We have adopted 332 villages around

Renukoot and are actively involved in improving the lives of the residents. Bima Kavach Yojana, to us, is more than an insurance product; it is a chance to protect the lives we seek to improve".

The company will be actively associating itself with the various rural and social initiatives already launched by the Aditya

Birla Group. The Aditya BirlaGroup has a long history of silently carrying out social up liftment projects, in backward areas. Mrs.

Rajashree Birla, who personally oversees the Group's social and rural

10

University Department of Management Science, Sub-Campus, Osmanabad 2012-13 development initiatives, and Mr. B.L. Shah, Advisor, have been keenly involved in the launch of the maiden rural insurance product of the company Birla Sun Life Insurance has developed Birla

Sun Life Kavach Yojana with a vision to provide insurance cover for the under - privilege.

"Birla Sun Life Bima Kavach Yojana is a unique affordable insurance product which we believe will immensely benefit our target audience. It will provide a security net for the population below the poverty line, who have never experienced insurance, and increase the awareness about life insurance amongst the rural masses. It is a great privilege for us to be able to use the well established infrastructure of the Aditya Birla Group for a great cause," said Mr. S.

K. Mitra, Director, and Group Financial Services. Sun Life Financial has a long term commitment towards the development of rural and social progress in India. It shares a great synergy with the Aditya Birla Group.

Birla Sun Life Bima Kavach Yojana:-

The Birla Sun Life Bima Kavach Yojana is a single premium insurance policy specially designed for the rural underprivileged.

As per IRDA regulations, a rural village must not have a population exceeding 5000; have a population density of not more than 400 per sq. km. and at least 75% of the male population should be dependent on agriculture for the livelihood. Given these specifications, the villages adopted by the Aditya Birla Group around Renukoot became the right place to launch

Birla Sun Life Bima Kavach Yojana.

11

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

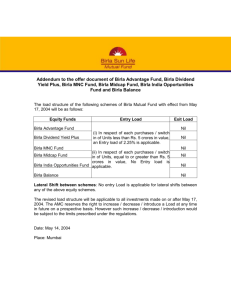

Products:-

Birla Sun Life Insurance Co. Ltd. is a joint venture between Adit ya Birla

Group, an Indian multinational corporation, and Sun Life Financial Inc, a leading global insurance company. Birla Sun Life Insurance is distinguished as the first company in the sector of financial solutions to begin Business Continuity Plan. This insurance company has pioneered the unique Unit Linked Life insurance Solutions in India. Within

4 years of its launch, BSLI became one of the leading players in the industry of Private Life

Insurance Scheme. Birla Sun Life Insurance offers the following policies and products:-

1.

Protection Plan:-

Birla Sun Life Insurance Term Plan

Birla Sun Life Insurance Premium Back Term Plan

2.

Saving Plans:-

Birla Sun Life Insurance Guaranteed Bachat Plan

Birla Sun Life Insurance Money Back Plus Plan

Birla Sun Life Insurance Gold-Plus II

Birla Sun Life Insurance Saral Jeevan Plan

Birla Sun Life Insurance Supreme-Life

Birla Sun Life Insurance Dream Plan

Birla Sun Life Insurance Classic Life Premier

Birla Sun Life Insurance Simply Life

Birla Sun Life Insurance Prime Life Premier

Birla Sun Life Insurance Prime Life

Birla Sun Life Insurance Flexi Cash Flow

Birla Sun Life Insurance Flexi Save Plus

Birla Sun Life Insurance Flexi Life Line

Birla Sun Life Insurance Single Premium Bond

12

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

3. Health Solution Plans:-

BSLI Health Plan

BSLI Universal Health Plan

4. Retirement Plans:-

Birla Sun Life Insurance Freedom 58

Birla Sun Life Insurance Flexi Secure Life Retirement Plan II

5. Children Plans:-

Birla Sun Life Insurance Children's Dream Plan

6. Rural Plans:-

Birla Sun Life Insurance Bima Suraksha Super

Birla Sun Life Insurance Bima Dhan Sanchay

Birla Sun Life Insurance Bima Kavach Yojana

7. Group Plans:-

Birla Sun Life Insurance Group Unit Linked Plan

Birla Sun Life Insurance Group Protection Solutions

Birla Sun Life Insurance Group Superannuation Plan

Birla Sun Life Insurance Group Gratuity Plan

Birla Sun Life Insurance Credit Guard Plan

Birla Sun Life Insurance Single Premium Group Term Plan

8. NRI Plans:-

Birla Sun Life Insurance Prime Life Premier

Birla Sun Life Insurance Prime Life

Birla Sun Life Insurance Flexi Life Line Plan

Birla Sun Life Insurance Flexi Save Plus

Birla Sun Life Insurance Flexi Cash Flow

Birla Sun Life Insurance Classic Life Premier

Birla Sun Life Insurance Single Premium Bond

Birla Sun Life Insurance Simply Life

13

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

1.

Protection Plans:-

Life Guard

BSLI offers Life Guard- a set of pure protection plans. Choose from amongst three different product structures to insure your life and provide total security to your family, at a very affordable cost. Level Term Assurance with return of premium.

On death the entire sum assured will be paid.

On maturity, all the premiums paid will be returned Level Term Assurance without return of premium.

On death the entire sum assured will be paid.

No survival or maturity benefits. You can also enhance the above two policies by adding

Accident & Disability Benefit Rider and Waiver of Premium Rider (WOP).

Level Term Assurance - Single premium.

On death the entire sum assured will be paid.

No survival or maturity benefits.

2.

Premier Life:-

Presenting Premier Life – The Preferred plan for the Preferred Customer. The key features of the plan are:

Limited premium payment option: Choose from among a 3, 5, 7 or 10 year premium paying term.

Choice of sum assured: Choose a sum assured, which is a minimum multiple of 1 and a maximum multiple of 25 times the annual contribution.

Additional allocation of units on a periodic basis.

Facility to top-up your investment any time you have surplus funds.

Choose from among four funds, based on your investment objective and risk appetite.

14

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

3.

Secure Plus:-

An insurance plan that gives added protection, savings and multiple options, all in one!

The flexibility to choose your premium contribution.

.The flexibility to choose amongst three levels of cover (in the form of sum assured) for the same amount of total annual contribution.

.The flexibility of shifting between the three levels of cover, as you require.

The flexibility of receiving your maturity proceeds as a lump sum or in equal annual installments over 3 or 5 years. You can also enhance your policy by adding Variety of

Riders.

4. Child Plan:-

As a responsible parent, you will always strive to ensure hassle-free, successful life for your child. However, life is full of Uncertainties and even the best-laid plans can go wrong. Here’s how you can give your child a 100% safe and assured tomorrow, whatever the uncertainties.

Smart Kid is especially designed to provide flexibility and safeguard your child’s future education and lifestyle, taking all possibilities into account. Choose from amongst a basket of 4 plans.

Smart Kid regular premium

Smart Kid unit-linked regular premium

Smart Kid unit-linked regular premium II

Smart Kid unit-linked single premium II

15

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Environment:-

Birla Sun Life Insurance Company Ltd . is a joint venture company between Aditya Birla

Group and Sun Life Financial Inc. of Canada. It was established in the year 2000 and started operations after receiving the license from IRDA in January 2001. Aditya Birla holds 74% stake of the joint venture and Sun Life holds the remaining 26% of the stake.

Aditya Birla Group has its operations in 25 different countries in the world with interests in

Cement, Metal, Fertilizers, etc. On the other hand, Sun Life is a leading international financial services company, building strengths for over 140 years.

Birla Sun Life offers a broad array of life insurance products to meet the actual needs and expectations of individuals and groups through a multi channel distribution network across the country. The company is backed by its skilled and best sales force.

Birla Sun Life Insurance was the first company to offer uniquely designed Unit Linked Life

Insurance Solutions in India. They are also the pioneers in introducing the “Free Look Period” clause with insurance policies in India which has also been adopted by other life insurance companies in India. They also have the lowest outstanding claims ratio of 0.00% for FY 2011-

12. Additionally, BSLI has the best Turnaround Time according to LOMA on all claims

Parameters thus strengthening their base with superior customer services.

16

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Company Achievements And Awards:-

At Birla Sun Life Insurance, winning is a way of life. Our innovative solutions and customer-friendly services have been admired, appreciated and rewarded by customers and the industry at large.

Birla Sun Life Insurance (BSLI) - has bagged the Golden Peacock Award for Excellence in Corporate Governance for the year 2010-11.

Outlook Money Awards 2004 BSLI - Best Life Insurer (Runner Up) 2004 CERTIFICATE.

17

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Chapter 3

rd

Functional Areas

Human Resource Management:-

The first definition of HRM is that it is the process of managing people in organizations in a structured and thorough manner. This covers the fields of staffing

(hiring people), retention of people, pay and perks setting and management, performance management, change management and taking care of exits from the company to round off the activities.

Importance of HRM for Organizational Success:-

The practice of HRM must be viewed through the prism of overall strategic goals for the organization instead of a standalone tint that takes a unit based or a micro approach. The idea here is to adopt a holistic perspective towards HRM that ensures that there are no piecemeal strategies and the HRM policy enmeshes itself fully with those of the organizational goals. For instance, if the training needs of the employees are simply met with perfunctory trainings on omnibus topics, the firm stands to lose not only from the time that the employees spend in training but also a loss of direction. Hence, the organization that takes its HRM policies seriously will ensure at training is based on focused and topical methods.

In conclusion, the practice of HRM needs to be integrated with the overall strategy to ensure effective use of people and provide better returns to the organizations in terms of ROI (Return on Investment) for every rupee or dollar spent on them. Unless the HRM practice is designed in this way, the firms stand to lose from not utilizing people fully. And this does not bode well for the success of the organization.

18

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Human Resource Planning: -

Generally, we consider Human Resource Planning as the process people forecasting. Right but incomplete! It also involves the processes of Evaluation,

Promotion and Layoff.

Recruitment: It aims at attracting applicants that match a certain Job criteria.

Selection: The next level of filtration. Aims at short listing candidates who are the nearest match in terms qualifications, expertise and potential for a certain job.

Hiring: Deciding upon the final candidate who gets the job.

Training and Development: Those processes that work on an employee onboard for his skills and abilities up gradation.

Employee Remuneration and Benefits Administration: The process involves deciding upon salaries and wages, Incentives, Fringe Benefits and Perquisites etc. Money is the prime motivator in any job and therefore the importance of this process. Performing employees seek raises, better salaries and bonuses.

Performance Management: It is meant to help the organization train, motivate and reward workers. It is also meant to ensure that the organizational goals are met with efficiency. The process not only includes the employees but can also be for a department, product, and service or customer process; all towards enhancing or adding value to them.

19

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Financial Management:-

P & L A/c. AND BALANCE SHEET IN COMPARATIVE:-

BIRLA SUNLIFE INSURANCE

Consolidated Profit & Loss account

Income

Sales Turnover

Excise Duty

Net Sales

Other Income

Stock Adjustments

Total Income

Expenditure

Raw Materials

Power & Fuel Cost

Employee Cost

Other Manufacturing Expenses

Selling and Admin Expenses

Miscellaneous Expenses

Preoperative Exp Capitalized

Total Expenses

Operating Profit

PBDIT

Interest

PBDT

Depreciation

Other Written Off

Profit Before Tax

Extra-ordinary items

Previous

Years

in Rs. Cr.

Mar '11

7,874.65

31.47

7,843.18

-42.19

4.4

7,805.39

300.58

65.7

834.21

5,431.84

720.47

89.38

0

7,442.18

Mar '11

405.4

363.21

112.93

250.28

203.01

18.98

28.29

3.58

20

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

PBT (Post Extra-ord Items)

Tax

Reported Net Profit

Minority Interest

Share Of P/L Of Associates

Net P/L After Minority Interest

& Share Of Associates

Total Value Addition

Preference Dividend

Equity Dividend

Corporate Dividend Tax

Per share data (annualized)

Shares in issue (lakhs)

Earnings Per Share (Rs)

Equity Dividend (%)

Book Value (Rs)

31.87

9.9

21.84

13.17

0

94.16

7,141.61

5

0

0.78

2,324.84

0.72

0

56.43

21

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Balance Sheet:-

Balance Sheet of BIRLA SUN LIFE INSURANCE

11-Mar

Sources Of Funds

Total Share Capital

Equity Share Capital

46.5

46.5

Share Application Money

Preference Share Capital

Reserves

Revaluation Reserves

Networth

Secured Loans

Unsecured Loans

Total Debt

Total Liabilities

105.67

0

2,118.59

0

2,270.76

102.16

521.93

624.09

2,894.85

Application Of Funds

Gross Block

Less: Accum. Depreciation

Net Block

Capital Work in Progress

Investments

Inventories

Sundry Debtors

Cash and Bank Balance

Total Current Assets

Loans and Advances

Fixed Deposits

430.55

101.17

329.38

2.77

1,970.67

41.56

75.25

457.69

574.5

106.49

0

Total CA, Loans & Advances

Deffered Credit

Current Liabilities

Provisions

680.99

0

83.03

5.94

22

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Total CL & Provisions

Net Current Assets

Miscellaneous Expenses

Total Assets

Contingent Liabilities

Book Value (Rs)

88.97

592.02

0

2,894.84

301.86

93.13

23

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

1.

MARKETING MANAGEMENT:-

Marketing Management:

Marketing strategy of Birla Sun life Insurance is closely linked to community awareness building programs on health care& Life care, as the products supplied directly address these issues. This strategy is carried out together with Birla Sun Life Insurance a mother company of

Aditya Birla Group working with rural communities for over 15 years. This enables successful marketing:

Design of the relevant and understandable promotion Insurance Products and activities with connection to local reality

Presence on Important local community events

Customers trust Birla Sun Life Insurance as they are members of their own communities

Marketing activities include:

A product-launching activity is held in the villages of new Birla Sun Life Insurance to initiate community awareness. The event includes demonstrations and prize incentives.

Stalls are set up at weekly markets in large towns. The stalls provide pamphlets and give

Information about Product. Each of two teams promotes for a full month in the same town before shifting to a new location.

Promotional stalls are also set up during major events

The promotion campaign is launched radio and in newspapers

The promotion van with audio advertisement

24

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Newspaper Advertising:-

When it comes to print ads, newspaper advertising is one of the best ways to advertise our agency. Because nearly all households receive a newspaper through a personal subscription or newsstand, newspaper advertising is a great way for your agency gain consumer recognition

Television Advertising:-

It's no surprise that most businesses want to advertise on television—according to the

BSLI. the average Osmanabad watches four hours of TV each day, the equivalent of two whole months a year—making it the largest media outlet of them all.

25

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

2.

INFORMATION TECHNOLOGY:-

1. The Internet has become the prime driver of contemporary electronic Commerce. The increasing use of Internet in the business world has, to a varying degree broadened and redefined the scope of business transactions and services. The insurance industry is by no means lagging behind in engaging the Internet as an Alternative medium for conducting business particularly in marketing of insurance Products and servicing of clients.

2. Different types of insurance-related websites, which are launched by authorized insurers, insurance intermediaries or other parties, have emerged in the market. Some of the websites cover one authorized insurer or a group of authorized

Insurers, whereas others are in the form of a supermarket in which a number of authorized insurers participate. The services provided are wide-ranging, such as introduction of authorized insurers and their respective products, brief comparison of a Particular type of product offered by different authorized insurers, collection of premiums, handling of claims and provision of information on an insurer’s credit rating, etc. It is noticed that there are some other websites which provide affiliated insurance services whilst in the course of conducting the main business which is non-insurance in nature.

3 . The Insurance Authority (“ IA”) notes that the Internet is one of the channels for authorized insurers and insurance intermediaries, etc. to solicit business and to provide services to existing and potential policy holders. Hence, in conducting insurance business over the

Internet, the parties concerned have to comply with the Insurance Companies Ordinance.

4. In this Guidance Note, unless otherwise specified, insurance-related expressions shall have the same meanings as given to them in the Ordinance. Other terminologies shall have their literal meanings.

26

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Chapter 4 th

LEARNING’S:-

1) Organizational:-

1.

Market share of the company.

2.

Daily working of the company.

3.

Innovation about product and services.

4.

Understanding competitors.

5.

Financial Analysis.

6.

Product Differentiation.

7.

Organizational compatibility.

2) Functional:-

1.

Accounting and book keeping procedure.

2.

Auditing of accounts.

3.

Management of different departments.

4.

Inflation of depth equity ratio.

5.

Programming and planning.

6.

Training and performance appraisal of employees.

7.

Evaluation of work.

27

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

3) Personal:-

1.

Communication skill.

2.

Handling of customer and employee.

3.

Maintaining human relation.

4.

Responsibility and work procedure.

5.

Work of unit Head, Employee, Manager, Investment Manager.

6.

Developing personality.

7.

Organizational culture.

28

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Chapter 5 th

SWOT ANALYSIS.

Strengths:-

1.

Working in Urban & rural area.

2.

Promoting to Insurance services sustainable people in rural.

3.

Providing Information of Insurance Services.

4.

Doing nice work & social activities.

5.

Making performance appraisal & 50% remuneration of employee depend on performance.

6.

Concentrated on rural development.

7.

Providing security to customer by insurance.

8.

Proper attention toward rural farmer & giving him Insurance for the farm.

9.

Training to large number of uneducated people.

10.

Has Network of 600 branches and advisors spread over 1500 towns in India having over

130,000 advisors

11. Backed by Birla Brand and Sun Life financial services

12. Emphasis on Customer Satisfaction through Transparent Functioning.

13. Strong Capital Base.

Weakness:-

Some weaknesses to look for:

1.

Poor perception of company’s brand(s) and/or products.

2.

Advantages other companies have?

3.

Lack of management or other employee

4.

Low Presence in Rural Market

5.

Lesser advertising as compared to competitors

29

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Opportunity:-

1.

Development of Insurance Services rural& urban area.

2.

Can change life style of rural people by providing Insurance services.

3.

Branch & expansion can be possible.

4.

Can be entering in Big Insurance sector.

5.

Help to business development.

6.

Growing potential in the Rural Market.

7.

Alignment with Government Schemes.

8.

Better awareness amongst people for getting insurance.

Threats:-

1.

Banking rules can be change in future.

2. Recovery of loan can be creating bad debts & over due.

3. RBI changes banking rules according to current position of Indian economy.

4. Customer behavior towards loan procedure & repaying capacity.

5. Entry of new banks in microfinance.

6. Rising competition on in microfinance sector.

7. Economic crisis and economic instability

8. Entry of new NBFCs in the sector.

9. “OLD HABITS DIE HARD” It’s still difficult task to win confidence of peoples to public towards the private company.

30

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Chapter 6

th

FINDING AND SUGGESTION:-

FINDINGS:-

Through this in plant study I learned so many practical & other techniques for the business.

During this in plant.

1) Most of the people of BSLI are getting rate of interest 8-12%.

2) Most of the people have children plan of BSLI.

3) Most of the people invest due to high interest of the policy in BSLI.

4) People have more faith in govt. Companies than the private.

SUGGESTIONS:-

1) Information regarding new product should be provided to the customers.

2) The company should find out the no. of people who are not having any of the insurance plans through an intensive market research and motivate them to get insured.

3) A t s o m e l e v e l Compan y shoul d provide inform ation t o the customs

About t he charges of the policy.

4) Company should target each and every class of the society.

5) Charges should be low of the policies

6) Annual premium should be reasonable.

7) BSLI Company should work in systematic way.

31

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

Chapter 7

th

CONCLUSION:-

Here in this study I have seen that people have more policies of the BSLI. People have more faith in government companies than private. So it is necessary for BSLI Company that it should give more attention to that points or that areas where it lacks for further future growth.

Insurance sector is very wide and company can grow in future.

The market potential for private insurance companies is found to be greater in the long run as most of the Indians are of the opinion that, private insurance companies would be able to perform well in the future. The private and foreign insurance companies have to take immediate steps in appointing more number of agents and/or advisors in addition to the employees as it has been found out those agents are the best channel to reach the general public regarding selling of insurance products.

The private and foreign insurance companies have to concentrate on the factors like

'Prevention of Loss', 'Assured Returns' and 'Long-term Investment'. They can also focus on an insurance amount of Rs. 1 – 2 laths with 'money back policies'. Hence, the market has potential.

The private and foreign insurance companies that are taking immediate steps can tap it easily & rapidly.

32

University Department of Management Science, Sub-Campus, Osmanabad 2012-13

www.birlasunlife/insurance.com www.google.com www.irda.com www.bse.com www.wikipediya.com

Chapter 8 th

References

33