Hair Care Category

advertisement

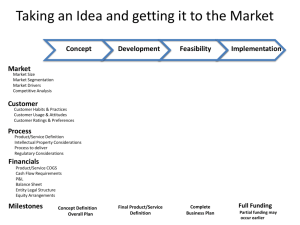

INTRODUCTION In this report, the final state of the systems design project, performed in Procter & Gamble, is explained. Starting from October 2008, the project group BigM has analyzed the current problematic situation in the sponsoring firm for the first three months. By the end of January 2009; the group started to generate alternative ways to solve the problem. The problematic situation can be explained as the inaccurate weekly forecasting occurred during the pricing periods due to the unexpected purchasing behaviour of the customers, briefly. This report consists of the following parts: First the sponsoring firm and the current forecasting system is explained. By the guidance of the current system analysis, the problem formulation is given in order to clarify the problematic situation. After giving the formulated problem; alternative solution approaches and models are given. The results obtained by using these models are given right after the explanation of models. These results are compared in order to find the best solution. This report shows the last frame of the work done. It is a good reference to compare the previous situation and the new offered situation for the forecasting process in Procter & Gamble. The detailed explanation of each step in the project process is explained in detail on the following pages. FIRM INTRODUCTION Procter & Gamble Turkey is one of the biggest companies in Turkey, which is operating in the fast moving consumer goods industry. P&G Turkey has six main categories of products and under these categories 24 brands and 973 SKU (stock keeping units). These main categories are; laundry care, P&G beauty, baby care, men care, small appliances and batteries. P&G Turkey has six main categories of products and under these categories 24 brands and 973 SKU (stock keeping units)*. The project given to METU Project Team is about the case whenever there is a price change in the market; monthly forecasts cannot be splitted accurately into the weeks and SKU level. This issue is explained below in detail. In the context of the project, the project team specifically focused on Hair Care Category due to being affected by pricing activities dramatically and being in a very competitive market. The main competitors and their respective shares in the market are shown in Appendix (Graph A). Under the Hair Care Category, 2 main brands: Pantene and Blendax are taken under consideration. There are several reasons for this selection. First; hair care category is one of categories which is most sensitive to change in P&G’s shelf prices or competitors prices. Secondly; these two brands are the brands which have the highest volume in total hair care category sales. Thus, if the analyses are done on these brands, they can be easily expanded to the other categories or other brands. Under these two brands there were 75 stock keeping units to be analyzed. CURRENT SITUATION Current Forecasting Process Main relevant process of demand planning is forecasting by considering different dynamics as market size, past shipment data, reflecting marketing activities and pricing effect. Forecasting process starts with the initial statistical forecasting. Main input of this statistical forecasting is past shipment data. Actualized past three years shipment values are taken as input of statistical forecast. For making statistical forecast, GDF (Global Demand planning Foundation) is used. GDF (Global Demand planning Foundation) is a tool of SAP that uses different kind of profiles like seasonality, trend, stationary, etc. By fitting appropriate profile for past three years shipment values, GDF produces monthly and SKU (stock keeping unit) based forecast for 18-month horizon. As a result of the GDF (Global Demand planning Foundation) output, 18-month statistical pure forecast is obtained for each SKU. Statistical forecasting is the first step of the forecasting process. After making statistical forecasting, adjustments are made on the statistical forecast. Adjustments on the forecasts are made by the category team. Category team includes demand planner of the category, MS&P (Market & Strategic Planner), CMK (Consumer Marketing Knowledge) and the financier from the Finance Department. Before making adjustments on statistical forecasts, monthly and SKU based forecasts are aggregated to brand based in order to reflect marketing activities, pricing activities and other activities on brand level. Then, adjustment activity is made by considering the market information as stock amount, pricing activities, promotion activities etc. At this point, P&G makes a significant assumption that all the market activities have the same impact on every SKU. For example, increase in the price level of Blendax brand is assumed to affect all the SKUs of Blendax. After making adjustments, forecasts are firmed and sent to the General Manager. If the General Manager approves the adjusted forecast, this adjusted forecast is taken as final forecast and sent to European P&G General Office. This final forecast includes 18-month brand based forecast and updated every month by rolling the horizon. In the figure below, summary of the current monthly forecast process can be seen. Figure-1: Current monthly forecast process. The next step of forecasting process is splitting the monthly brand based forecasts into weeks and SKU (stock keeping unit) level. Category Demand Planner is responsible for this step of forecasting process. Firstly, weekly split will be explained. After statistical forecasts are adjusted, monthly brand based forecast is distributed into weeks of the month. If P&G does not consider any activity, weekly splitting for Hair Care Category is assumed to be approximately equally distributed. However, if any activity, especially pricing activity, is considered, then weekly split of the brand based monthly forecast is changed. Weekly split is not anymore approximately equally distributed. If an activity like pricing occurs, splitting of brand based monthly forecast is done by looking the past weekly splits when similar pricing activity occurred. There are mainly three types of pricing activities: Price ups, price cuts and temporary price reductions (TPR). These types of pricing activities are applied generally on brand base. For instance, if P&G decides to make pricing activity, it includes all Pantene products or Blendax products. Price cuts and temporary price reductions are applied abruptly - without informing the customers i.e. distributors and National Accounts. In contrast to price cut and temporary price reduction, buyers are informed before P&G makes price up activity. Exactly one month before, all buyers i.e. distributors, National Accounts (Migros, Kipa, Real, etc...) and retailers located under the distributor in the supply chain know that price up activity is going to be done one month later. At this point during pricing periods, the demand planner tries to estimate the consumers tendencies based on the pricing type. Basically, demand planner checks the past weekly splits of the time when the similar pricing activity was applied, then sets the weekly split values of the month. As a result, weekly brand based forecast is obtained. The process of splitting the monthly forecast to weekly forecast can be seen in figure-2. Figure-2: Splitting monthly forecast to weekly forecast Secondly, SKU split is explained. After, monthly brand base forecast is distributed into weeks of that month; weekly brand based forecast has to be split into SKU (stock keeping unit) of that brand. This SKU splitting is done by using statistical forecasting tool, GDF (Global Demand Foundation). GDF gives SKU (stock keeping unit) based monthly forecast. Demand Planner uses the ratio of each SKU over brand from the monthly forecast of GDF. Then, she finds the weekly SKU splits by multiplying weekly split value and the ratios found from GDF. The process of splitting weekly forecast to stock keeping unit is summarized in Figure-3, below. Figure-3: Splitting weekly forecast to stock keeping unit This process can be easily seen from the example provided below. Example: For January 2008, 1) Demand Planner enters the each SKU’s shipment values of 3 years period (2005- 2008) to GDF. 2) Obtain 18 month SKU (A1, A2 and A3 SKUs) based monthly forecast from GDF. Total of 50 kg A1 = 15 kg A2 = 25 kg A3 = 10 kg SKU split from GDF: s1 = 15/50 = %30 s2 = 25/50 = %50 3) Demand Planner aggregates SKU to brand. A1, A2 and A3 SKUs Brand A A = 50 kg s3 = 10/50 = %20 4) Adjustments Demand Planner (MS&P and CMK) Adjustment factor of %20 %20 increase in the quantity demanded Brand A After adjustments A = 50*1,2 = 60 kg 5) Weekly splits Demand Planner 1st week : %10 W1 = 60*0,1 = 6 kg 2nd week : %20 W2 = 60* 0,2 = 12 kg 3rd week : %30 W3 = 60 * 0,3 = 18 kg 4th week : %40 W4 = 60 * 0,4 = 24 kg 6) Finally, weekly splits of brand are disaggregated into weekly SKU splits by using SKU split from GDF (found in part 2) and Demand Planner obtains the final forecast value. 1st week : W1 = 60*0,1 = 6 kg For SKU of A1, 1st week’s forecast s1 * W1 = 0,3 * 6 = 1,8 kg For SKU of A2, 1st week’s forecast s2 * W1 = 0,5 * 6 = 3 kg For SKU of A3, 1st week’s forecast s3 * W1 = 0,2 * 6 = 1,2 kg 2nd week : W2 = 60* 0,2 = 12 kg For SKU of A1, 2nd week’s forecast s1 * W2 = 0,3 * 12 = 3,6 kg For SKU of A2, 2nd week’s forecast s2 * W2 = 0,5 * 12 = 6 kg For SKU of A3, 2nd week’s forecast s3 * W2 = 0,2 * 12 = 2,4 kg 3rd week : W3 = 60 * 0,3 = 18 kg For SKU of A1, 3rd week’s forecast s1 * W3 = 0,3 * 18 = 5,4 kg For SKU of A2, 3rd week’s forecast s2 * W3 = 0,5 * 18 = 9 kg For SKU of A3, 3rd week’s forecast s3 * W3 = 0,2 * 18 = 3,6 kg 4th week : W4 = 60 * 0,4 = 24 kg For SKU of A1, 4th week’s forecast s1 * W4 = 0,3 * 24 = 7,2 kg For SKU of A2, 4th week’s forecast s2 * W4 = 0,5 * 24 = 12 kg For SKU of A3, 4th week’s forecast s3 * W4 = 0,2 * 24 = 4,8 kg By the way, it is noted that the reason why demand planner aggregate the SKU based statistical forecast to brand level before making adjustment is that pricing and promotion activities are done on brand based. As a result, demand planner aggregates the SKU forecast to brand level to be able to adjust forecasts and then again split forecasts into SKU level. At this point, BigM team try to imply systematic model to split aggregate adjusted monthly forecast into SKU (stock keeping unit) and weekly. Problem Situation and Formulation: Throughout spring and fall semester, it is observed that P&G Turkey Demand Manager complain is that P&G Turkey has very high weekly SKU (stock keeping unit) based APE (Absolute Percentage Error) values and high weekly brand based WAPE (Weighted Absolute Percentage Error) values during pricing periods. This value shows the error between the weekly SKU based forecast value and the actual shipment of this SKU for this week. High WAPE values cause P&G Turkey to mislead the supply chain and production plans are dramatically affected. In addition to this, stock-out situations and high inventories can occur. High weekly SKU APE (Absolute Percentage Error) values and high weekly brand WAPE (Weighted Absolute percentage Error) are first symptoms we faced. The relevant processes and their steps are explained above. The main interest of system is splitting step of forecasting process. After statistical forecasts are obtained and adjustments are made on these statistical forecasts, monthly brand level forecast is occurred. This forecast is accepted as given and fixed; the splitting of this monthly brand level forecast into weeks of that month and then splitting into stock keeping unit is defined as target. The main problem is non-accurate forecast during pricing periods sourced from customers’ unpredictable fluctuating demand. As a result, the problem is stated that there is not decision mechanism can be evaluated to make weekly split and then SKU split. The figure below shows the situation clearly: Weekly SKU based WAPE values are out-of- target. Symptom WHY ? Weekly split is not done accurately. WHY ? Pricing effect can not be reflected to weekly splitting WHY ? There are not decision criteria that can be used in the weekly splitting. Problem Figure-4: Problem formulation MODELLING APPROACH The forecasting system involves two stages as it is stated in the current system part. Firstly, monthly brand based forecasts is splitted into weeks. After splitting it into weeks, weekly based brand forecast is gained. At the second stage, weekly based brand forecast is splitted into stock keeping units (SKU) of that brand. In the modeling approach, three different approaches are used to make weekly forecast, Regression models, mathematical model with the objection of forecast error minimization and time-series methods. Firstly, models used for the weekly split stage are explained and then models used for the SKU split stage is explained. Models Used for the Weekly Split Stage Regression Model: The major aim to use regression models is to find the major factors that affect the weekly and SKU splits. By using the regression model, these factors are determined, quantified and used to make better and accurate forecasts. At the first stage, four regression models are used for splitting monthly brand based forecasts into weeks. Each of regression models represents each week of the month. Dependent variable of the regression model is shipment value of week that is desired to forecast. Additionally, independent variables such as prices, shipment values of prior weeks and the cost of living index are used in model. Also price indexes are used in order to evaluate both price of P&G product and the price of its competitor’s product at the same time. Price indexes represent the price of related product versus the price of competitor’s product. Price index is expressed in terms of percentage values for months. It is calculated by the division of price of the related product to price of the competitor’s product. Cost of living index is expressed monthly based in terms of percentage values. Cost of living is the cost of maintaining a certain standard of living. Cost of living index is also expressed monthly. Product prices are directly taken from the P&G. Product prices are the selling price of the product from National accounts and retailers to consumers, namely these are shelf prices. Shipment values represent the actual amount that is shipped from P&G to the distributor. However, there is a significant issue that based on P&G time schedule, some months has 5 weeks and some have 4 weeks that is, some weeks are divided between two months. For instance, week-5 is divided between January and February, 2008, four days of week-5 belong to January and the remaining three days belong to February. Also shipment values are also divided between these two months by considering the fact that week-5 is divided between two months. For those months, shipment values are normalized. Normalization of Shipment Values Since some months have four weeks and other months have five weeks, months with five weeks are adjusted to get each month with four weeks to be able to use regression model. The example presented below will give information about how the problem handled with this situation. Jan 2008 Shipment values # days in week week1 week2 week3 week4 week5 19.08 34.65 158.97 54.49 37.69 6 7 7 7 4 Table-1: Weekly Shipment of Blendax in Jan 2008 Feb 2008 Shipment values # days in week week5 week6 week7 week8 week9 13.59 35.68 82.48 31.72 66.07 3 7 7 7 5 Table-2: Weekly Shipment of Blendax in Feb 2008 In these tables above, the shipment values and number of days in each week are given. As seen, week-5 is included in both months. Firstly, four days of week-5 in Jan 2008 is put into the fourth week on that month. As a result, it is computed for week-4 in Jan 2008 as 11 days with shipment value of 37.68779 + 54.65522 = 92.17685. (This shipment value is for 11 days.) By multiplying it with (7/11), last week shipment value of January is got for 7 days. The same procedure is followed for the first week of the February that shipment value of week-5 with three days into week-6 is taken and then multiplying it by (7/10), in order to get shipment value of first week of February with 7 days. The resulting table is as follows: Jan 2008 Shipment values # days in week week1 week2 week3 week4 19.08 34.65 158.97 58.66 6 7 7 7 Table-3: Weekly Shipment of Blendax in Jan 2008(adjusted) Feb 2008 week6 Shipment values week7 week8 week9 34.49 82.48 31.73 66.08 7 7 7 5 # days in week Table-4: Weekly Shipment of Blendax in Feb 2008 (adjusted) Regression Equations Month 1 Month 2 WEEKS -2 -1 0 1 2 3 4 Blendax Regression Equations for Determining the Weekly Splits For the Blendax brand, significant factors that affect the weekly split are determined. After that, appropriate functional from that will give the highest R^2 values is found. According to this procedure, the regression models are set for weekly split of Blendax is as follows: For the first week of the month; Shipment value of week(1) = β0 + β1 * shipment value of week(0) + β2 * shipment value of week(-2) + β3 * price index + β4 * cost of living index For the second week of the month; LOG(Shipment value of week(2)) = β1 * LOG(shipment value of week(1)) + β2 * LOG(price index) + β3 * LOG(cost of living index) For the third week of the month; LOG(Shipment value of week(3)) = β0 * LOG(shipment value of week(2)) + β1 * LOG(shipment value of week(1)) + β2 * LOG(price index) For the fourth week of the month; LOG(Shipment value of week(4)) = β0 + β1 * LOG(shipment value of week(3)) + β2 * LOG(cost of living index) + β3 * LOG(ELIDOR) As seen in the formulations, weekly previous shipment data for Blendax brand, monthly cost of living index, competitor price, Blendax own price and monthly price index are used. In the firm, Blendax and Elidor are seen as substitutes. Blendax is P&G product and Elidor is Unilever product. These two brands are competitors of each other. Therefore, while using regression model, the price index value of Blendax versus Elidor are used. Weekly shipment Blendax data is taken from Shipment file and put together all SKUs’ of Blendax and their weekly shipment values that Blendax from 2007 January to 2008 December is available for the model. Cost of living index are taken from the website of Turkish Central Bank. Price index values are taken from pricing file supported by P&G that presents weighted shelf prices, weighted net prices of P&G and competitors’ brand monthly. By dividing the price of Blendax to price of Elidor, price index is found. Pantene Regression Equations for Determining the Weekly Splits According to the procedure followed for Blendax, the regression models are set for weekly split of Pantene is as follows: For the first week of the month; Shipment value of week(1) = β0 + β1 * shipment value of week(0) + β3 * price index + β4 * cost of living index For the second week of the month; Shipment value of week(2) = β0 + β1 * shipment value of week(1) + β2 * shipment value of week(0) + β3 * shipment value of week(-1) + β4 * PANTENE + β5 * cost of living index For the third week of the month; LOG(Shipment value of week(3)) = β0 + β1 * LOG(shipment value of week(2)) + β3 * LOG(price index) For the fourth week of the month; LOG(Shipment value of week(4)) = β0 + β1 * LOG(shipment value of week(3)) + β2 * LOG(cost of living index) In the above calculations, weekly previous shipment data for Pantene brand, monthly cost of living index, Pantene own price, competitor price and monthly price index are used. After evaluating the different functional forms, the equations stated above are obtained. Model approach for weekly split stage can be summarized in Figure-5, below. Inputs Shipment values of weeks Price change Cost of living index Four Regression Models (Each of them is for each week of specified month) Coefficient of independent variables (i.e. coefficient of shipment values of prior weeks, coefficient of price change, coefficient of cost of living index) By using regression model Weekly shipment value of dependent variable ( (i.e. shipment value of specified week) Figure-5: Model Approach for Weekly Split Stage This picture is generated for every four regression model, for every week of specified month. There is one more step, normalization step that is used. In normalization step by considering monthly brand forecast, normalization is made on the weekly brand shipment, output of regression model, and final weekly brand shipment forecasts is got. At this point, it is assumed that monthly forecasts are close to realized shipments values. Actually, it is examined this relation by using graphs and see that these two values are close to each other. The graphs can be seen in Appendix B. These all models and explanations are for weekly splitting stage. There is also one more stage to handle with. The second stage, splitting weekly brand based forecast into SKUs of that brand is made. Firstly, the SKUs are splitted into groups based on ABC analysis. An ABC classification is performed for the products of brands Blendax and Pantene. The aim in this is to observe the critical SKU’s (stock keeping units). The main criteria used in ABC analysis is the shipment volume of the products. According to the shares of each SKU’s shipment volume in the total shipment volume of the related brand; the SKUs which has the highest share are classified as Category A, second group is classified as Category B and the rest is called Category C. For Blendax, there appears to be 9 SKU’s in Category A, 9 SKU’s in Category B and 15 SKU’s in Category C. Category A consists of the 78% of the whole volume, Category B consists 16% of the whole volume and Category C consists 6% of the whole volume. For Pantene, there appears to be 14 SKU’s in Category A, 10 SKU’s in Category B and 18 SKU’s in Category C. Category A consists of the 81% of the whole volume, Category B consists 12% of the whole volume and Category C consists 7% of the whole volume. For every brand, Category A includes only 750 ml products. This is as expected since these products –products with 750 ml volume- are the most consumed products in the market. Mathematical Model: The main reason to use mathematical model - link network model - is to reflect different dynamics as semantic factors on forecast. The model includes weekly shipment data, price index of competitors for related products and living index to minimize total weekly forecast error. By using the model, the target is to quantify coefficients for each week and make better, accurate forecasts. In this model, four different mathematical models should be run for each brand in order to support the lag among weeks. For the current week’s (week 1) forecast of any brand; the inputs should be the shipment data of week 0, week -1, week -2, price of related product & its competitor, price index and living index. These inputs’ logarithmic and sin(pi) functions are used in the model to estimate the coefficient of these factors. The reason of this is to reduce the variance in the data used in the models. For every brand, first the 10-base logarithmic function is used for each data set. After calculating the 10-base logarithmic values; a forecast result is obtained by multiplying these values with the constants which are obtained by running the model; i.e. the decision variables are the constants of the inputs. By using these obtained forecasts; the errors between the relevant weeks’ shipment values are calculated. The sum of square errors is calculated as the objective function. The common constraint in the model is the distinction between the prices and the price indices. If the price of a SKU and its main competitor is used, then the coefficient of the price index is set as zero; or vice versa. For different iterations; the coefficient of past weeks’ shipment values are set to zero respectively; i.e. for the first iteration only the closest weeks’ coefficient takes a value, for the second iteration the closest two weeks’ coefficients take values and for the third iteration, all of the past three weeks’ coefficient take values. The aim on this is to observe the effect of previous weeks. Generally the best results are obtained by using all of the past three weeks’ shipment data. The same procedure expressed above is applied with only the change in the function. This time, in addition to the logarithmic function, the obtained 10-base logarithmic values are used in the formula Sin(pi*x), where x’s are the parameters. The rest of the procedure is the same with the previous one; and this procedure again iterated by giving zero coefficients for different weeks. Mathematical model forecasting procedure is displayed in Figure-6. Figure-6: Mathematical Model Forecasting Models Used for the SKU Split Stage After conducting brand based weekly split analysis, several SKU split models are implemented. Firstly, time series forecasting model is executed. Since the problem is to forecast shipment with respect to changing price, inserting price into single variable time series models causes some trouble. In order to give place to price in time series models, shipment/price ratios are taken for each SKU. By this way two variables (shipment and price) are reduced into one variable (ratio). Time series forecasts are designed for this ratio, in other words ratio forecasts are carried out rather than shipment forecasts. After getting ratio forecasts for this time series analysis, these ratio forecasts are multiplied by the SKU’s price which becomes clear for the beginning month. Then weekly SKU shipment forecasts are found by this way. Example is provided as follows: Suppose one of the SKUs of Blendax has the following shipment and price data for hypothetical month: Blendax SKU Week 1 Week 2 Week 3 Week 4 Actual Shipment 5 6 8 10 Price 2 2 2 2 Shipment/Price ratios are found as follows for this SKU: Blendax SKU Week 1 Week 2 Week 3 Week 4 Shipment/Price 2,5 3 4 5 Suppose above calculation is done for 2 years and Shipment/Price ratios are found for 2 years. Then time series forecasting is implemented by using these ratios with trying several fitted models such as moving average, exponential smoothing or double exponential smoothing. According to models’ MAPE (Mean Absolute Percentage Error) values, best fitted model is chosen and this model’s forecast values are taken into account. Suppose following ratio forecasts are generated after choosing appropriate model for next month: Blendax SKU Week 1 Week 2 Week 3 Week 4 Shipment/Price 3 3,5 4 2 And the beginning month’s SKU price is 3. By multiplying this price with above ratio values, following forecast shipment scheme is generated for this SKU: Blendax SKU Week 1 Week 2 Week 3 Week 4 Shipment 9 10,5 12 6 Forecast By comparing these forecast values with actual shipments, MAPEs of forecasts are found. This result is shown in the results and findings part. Secondly, regression model is used for weekly SKU splits. At this point there are two alternatives, namely, implementing regression analysis in SKU level or using brand based forecasts and GDF splits for each SKU. In former analysis, two A classified SKU is taken and conducted regression analysis. For this analysis each week’s shipment values are taken. Months which have 5 weeks are reduced into 4 weeks by normalization similar with brand based regression analysis but this time SKU shipments are taken into account. Also price, costs of living, competitors’ price are taken into account. As brand based regression analysis, in order to find each week’s forecasts week’s actual shipment value is taken as dependent variable and preceded 3 week’s shipment values, cost of living and competitor’s price are taken as independent variables. For example for Blendax Antidant 750 ml, the following regression models are applied: Log(w1)= log (w0)+ log (price)+ log (costofliving) w2 = constant + w1 +w(-1)+ price + log(costof living) w3 = price + w 2 + w1 + w0 w4 = constant + w3+w1 + costofliving Pantene Basic Norm 750 ml, the following regression models are applied: w1 = w(-1) + elidor price1 + costofliving w2 = w1 + w0 + price + costofliving w3 = constant + w2 + price + costof living w4 = w3 + w2 + w1 The regression model for SKU level seems to be obsolete for the following reasons: lack of data for SKU shipment variance is so high in shipment data2 the significance levels in the model do not meet specifications R square is low zero values in dependent variable restrict regression implementation Although these reasons hinder regression model implementation, regression models are constructed for above SKUs and MAPE values are calculated. For these reasons second alternative which is multiplying GDF SKU weekly splits with brand based regression weekly splits is conducted. For this alternative brand based weekly split forecasts are taken and multiplied with GDF’s SKU splits. After getting weekly SKU based split forecasts, they are compared with actual SKU shipments and MAPEs are calculated3 and it is found that this method is better than SKU based regression model when MAPEs are compared. For example hypothetical brand based weekly split depend on regression is as follows: Brand Week 1 Week 2 Week 3 Week 4 Weekly Split 20% 20% 30% 30% 1 For Pantene, Elidor is considered as competitor. 2 Graphs for two SKUs’ shipment variance are provided in Appendix C. 3 Detailed analysis is conducted in results part. And suppose this brand consists of 5 SKUs. Hypothetical GDF output for SKU splits is as follows: SKU Week 1 Week 2 Week 3 Week 4 SKU-1 10% 12% 15% 8% SKU-2 10% 12% 20% 17% SKU-3 20% 36% 15% 26% SKU-4 25% 24% 25% 19% SKU-5 35% 16% 25% 30% So the brand based weekly SKU splits are as follows4: SKU Week 1 Week 2 Week 3 Week 4 SKU-1 2% (20%*10%) 2,4% 4,5% 2,4% SKU-2 2% (20%*10%) 2,4% 6% 5,1% SKU-3 4% (20%*20%) 7,2% 4,5% 7,8% SKU-4 5% (25%*20%) 4,8% 7,5% 5,7% SKU-5 7% (35%*20%) 3,2% 7,5% 9% 4 Detailed SKU forecast analysis is given in results part. The flow chart in Figure-7 shows the general solution approach. Mathematical Model Split for each week (%) Regression Model Split for each week (%) Time Series (Q/P) Method Split for each week (%) Multiplying with Monthly Adjusted Brand based Forecast Week1 forecast at brand level Week2 forecast at brand level Week3 forecast at brand level Weekly forecast at brand level Multiplying with weekly adjusted brand based forecast GDF split for each sku (%) Weekly forecast at sku level Weekly forecast at sku level Week4 forecast at brand level Weekly forecast at sku level Figure-7: Solution Approach VALIDATION/VERIFICATION OF THE MODEL Verification of the Model In model verification, it is tried to understand that the model is structured and specified properly and does not contain an error internally. For the verification phase, different cases and conditions are specified and entered to the model. Firstly, factors that affect the actual shipment of the first week of the month for Blendax brand are directly analyzed and their coefficients are obtained. For each factor, Dependent Variable: W1 Variable Coefficient C 43.25385 0.083763 PINDEX Dependent Variable: W1 Variable Coefficient C 86.73699 0.007162 LIVING By looking the sign of the coefficients, price index and cost of living have negative relation with the weekly shipment. This is a very meaningful result because increase in price or cost of living directly decreases the consumer’s purchasing power. Therefore, weekly shipment value is decreasing. After that, regression model is constructed for determining how much to ship in the first week of the month for Blendax brand. Using different functional forms, following models are found. Shipment value of week(1) = β0 + β1 * shipment value of week(0) + β2 * shipment value of week(2) + β3 * price index + β4 * cost of living index (Eq1) Dependent Variable: W1 Variable Coefficient C W0 W_2 LIVING PINDEX 155.8097 0.153890 0.179655 -0.011595 -0.475914 LOG(Shipment value of week(1)) = β0 + β1*LOG(shipment value of week(0)) + β2* LOG(shipment value of week(-2)) + β3 * LOG(price index) + β4 * LOG(cost of living index) (Eq2) Dependent Variable: LOG(W1) Variable C LOG(W0) LOG(W_2) LOG(LIVING) LOG(PINDEX) Coefficie nt 28.16742 0.160295 0.090479 2.337356 1.031377 Eq1 and Eq2 are the models with the same factors but different functional forms. However, sign of the coefficients are same with each other in the equations. Also, sign of the coefficients are similar with the individual regression models. Since model exactly reflects the real life situation and internally appropriate, regression model is verified. Validation of the Model The project given to METU Project Team is that whenever there is a price change in the market, monthly forecast cannot be accurately splitted into weeks and SKU level. In the context of the project, Hair Care Category is selected as target due to being affected by pricing activities dramatically and being in very competitive market. Under the Hair Care Category, 2 main brands are selected: Pantene and Blendax with 75 stock keeping units. Regression Model, Mathematical Model and time series method is run for Pantene and Blendax brand for its stock keeping units. The constraints in model; past shipment data, competitor and related brand prices, price index and living cost are found relevant and sufficient dynamics for the model by the firm. When the outputs of the models compared with Procter & Gamble forecasts by subtracting from actual shipments regression model gives better error than current forecasting system. The numeric comparisons and graphs could be found in the results and comparisons part. Besides the better forecast results, the model provides easy and systematical way to reach forecasts. Additionally, the firm could add new data and reach next term forecasts by running the model. MODEL RESULTS, FINDINGS, COMPARISONS AND SUGGESTIONS As explained above, three different types of model are suggested for weekly split and SKU split stages. These models are regression model, mathematical model with the objection of error minimization and time series forecasting method. At this part, results of each model, our findings and comparisons of each model with the current system are served. Firstly, these three models we stated above is used for splitting monthly brand basis forecast into weeks. This is done for two brands: Blendax and Pantene. The results of models are as follows: For Blendax: Model Time Series (Q/P) Regression Log-Model Sin(Pi(Log))-Model EXPO (η=0,4) MAPE 42.14 43.09 55.64 51.65 P&G Forecast MA(5) 52.87 51.84 The comparison of models is done on the basis of MAPE (Mean Absolute Percentage Error). MAPE is calculated by averaging the absolute error of each week. As seen on the table, the regression model gives the best result in terms of MAPE. Current system mean absolute percentage error is 51,84. The improvement we get by using regression model is ((51,84-42,14)/51,84)*100 = % 18,7. As a result, it is concluded that regression model should be used in splitting monthly brand basis forecast into weeks. Below, absolute percentage values are shown for Regression model and P&G forecast for weeks of 2008 in Graph-1. (January 2008 to November 2008). 300 Absolute Percentage Error (%) 250 200 150 REGRESSION P&G Forecast 100 50 Weeks 2008 %0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 Graph-1: Absolute percentage values for Regression model and P&G forecast for weeks of 2008 for Blendax brand. The graph-2 below shows the actual shipment values, forecasted shipment values generated from regression model and currently used P&G forecasts values. 160 140 120 100 ACTUAL 80 REGRESSION P&G Forecast 60 40 20 MSU 0 Weeks 2008 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 Graph-2: Comparison of actual shipment, regression and P&G forecasts for Blendax brand. For Pantene: Model Regression Log-Model MAPE 33.52 36.04 Times Series (Q/P) sin ∏ log MA(1) Expo(0.9) 82.87 60.24 54.17 P&G Forecast 68.81 The comparison of models is done on the basis of MAPE (Mean Absolute Percentage Error). MAPE is calculated by averaging the absolute error of each week. As seen on the table, the regression model gives the best result in terms of MAPE. Current system mean absolute percentage error is 68,81. The improvement we get by using regression model is ((68,81-33,5)/68,81)*100 = % 51,3. As a result, it is concluded that regression model should be used in splitting monthly brand basis forecast into weeks. Below in graph-3, absolute percentage values are shown for Regression model and P&G forecast for weeks of 2008. (January 2008 to November 2008). 400 Absolute Percentage Error (%) 350 300 250 Regression 200 P&G P&G 150 100 50 % 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 Weeks 2008 Graph-3: Absolute percentage values for Regression model and P&G for Pantene. The graph-4 below shows the actual shipment values, forecasted shipment values generated from regression model and currently used P&G forecasts values. 300 250 200 Actual 150 Regression P&G 100 50 MSU 0 Weeks 2008 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 Graph-4: Comparison of actual shipment, regression and P&G forecasts for Pantene. Secondly, we get forecast error results for SKUs of each brand. We follow three main approaches for this stage. The first approach is getting SKU forecasts by multiplying weekly brand basis forecast, obtained from models we used in weekly split stage, with the GDF SKU split values. The second approach is to use regression model for each SKU. The third one is to use time series (Q/P). All of these approaches are explained before. The related results are shown for A class SKUs in Blendax and Pantene brand. For Blendax A class SKUs: Blendax A class SKUs SKU-1 SKU-2 SKU-3 SKU-4 SKU-5 SKU-6 SKU-7 SKU-8 REG-Model 58.34 43.83 55.83 47.23 43.24 42.64 53.82 53.17 MAPE (Mean Absolute Percentage Error) P&G Forecast Q/P Time Series Sin(Pi(log))-Model 90.49 269 66.89 59.92 107 42.83 56.54 77.84 70.13 55.22 260 59.27 61.87 68.8 50.54 56.71 72.2 51.20 58.11 134 57.75 52.47 122 61.43 From the table above, for A class SKUs of the Blendax, the results obtained by multiplying the weekly brand basis forecast value with the GDF split values are better than the current forecasts of the firm for seven SKUs. It is noted that the output of regression model is selected to be multiplied with the GDF SKU split values. The regression output (brand basis weekly forecast) is used due to having lowest MAPE values in the weekly split stage. Below in Graph-5, weekly absolute percentage error of SKU-12 of Blendax is shown. It is noted that SKU-12 is one of the SKU of Blendax having high sales volume. 300 Absolute Percentage Error (%) for SKU-12 250 200 Regression APE 150 Current APE 100 50 % 0 1 2 3 4 5 6 7 8 9 10111213141516171819202122232425262728293031323334 Weeks 2008 Graph-4: Weekly absolute percentage error of SKU-12 of Blendax. The graph-5 below shows the actual shipment of SKU-12, current shipment forecasts and shipment forecasts generated from the model we set. 30 Actual vs. Forecasted Shipments 25 20 Model forecast 15 Actual shipments Current forecast 10 5 MSU 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 Weeks 2008 Graph-5: The actual shipment of SKU-12, current shipment forecasts and shipment forecasts. For Pantene A class SKUs: Pantene A class SKUs MAPE (Mean Absolute Percentage Error) Reg-Model P&G Log-Model SKU-1 SKU-2 SKU-3 SKU-4 SKU-5 SKU-6 SKU-7 112.26 105.05 36.41 44.78 88.32 54.69 49.53 103.41 118.30 64.96 71.73 69.70 73.07 86.48 118.78 103.67 38.08 47.31 89.52 55.27 51.42 From the table above, for A class SKUs of the Pantene, the results obtained by multiplying the weekly brand basis forecast value with the GDF split values are better than the current forecasts of the firm for five SKUs. It is noted that the output of regression model is selected to be multiplied with the GDF SKU split values. The regression output (brand basis weekly forecast) is used due to having lowest MAPE values in the weekly split stage. Time series (Q/P) methods are also tried for these seven SKUs of Pantene. However, results of this method are not good. As a result we skip this method. Below in graph-6, weekly absolute percentage error of SKU-6 of Pantene is shown. It is noted that SKU-6 is one of the SKU of Pantene having high sales volume. 450 Absolute Percentage Error (%) 400 350 300 250 Reg-model 200 Current system 150 100 50 % 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 Graph-6: Weekly absolute percentage error of SKU-6 of Pantene. Weeks 2008 Graph-7, below shows the actual shipment of SKU-6, current shipment forecasts and shipment forecasts generated from the model we set. 100 Actual vs. Forecasted Shipments 90 80 70 60 Model forecasts 50 Current forecasts 40 Actual shipments 30 20 10 MSU 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 Weeks 2008 Graph-7: The actual shipment of SKU-6, current shipment forecasts and shipment forecasts One of our solution approaches to SKU split stage is to use regression model for each SKUs. However, due to having some limitations we stated before, we decide not to use this approach. Although we decide not to use this approach, we try this approach to one of SKUs of Blendax and Pantene. The results of this approach are as follows: For one of the A class SKU of Blendax: The graph-8 below shows the actual shipment values of one of the A class Blendax SKU and forecasted shipment generated from SKU regression. 40 35 30 25 Actual 20 Forecast 15 Weeks 10 MSU 5 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 Graph-8: Actual shipment values of Blendax SKU and SKU regression forecast. MAPE (Mean Absolute Percentage Error) SKU Regression Reg-Model Current System 865.55 42.14 51.84 As seen on the table above, MAPE value of SKU regression is very high. However, by using regression model used in the weekly split stage and then by multiplying its output with the GDF split, we get lowest MAPE value. For one of the A class SKU of Pantene: The graph-9 below shows the actual shipment values of one of the A class Blendax SKU and forecasted shipment generated from SKU regression. 30 Actual vs. Forecasted Shipments 25 20 Actual 15 Forecast 10 5 MSU Weeks 2008 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 Graph-9: Actual shipment values of Pantene SKU and SKU regression forecast. MAPE (Mean Absolute Percentage Error) Reg-Model SKU regression Current System 33.51 62.10 68.81 As seen from the table above, although SKU regression gives better MAPE value for this A class SKU than the current system, it is still worse than the output generated from multiplying the regression weekly forecast with the GDF SKU split. It has 33.51% MAPE value. One another measure we use is WAPE (weighted absolute percentage error) for SKU forecast. WAPE is calculated as follows: SHP n WAPE i * APEi i 1 n SHP i i 1 In this formula, SHP is the shipment value and APE is the absolute percentage error. By weighting each SKUs’ absolute percentage error with the shipment amount of each SKU, WAPE is obtained. For Blendax, WAPE of each week is shown on the graph-10, below. 300 Weighted Absolute Percentage Error for Blendax (%) 250 200 Model WAPE 150 Current WAPE 100 50 % 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 Weeks 2008 Graph-10: WAPE values of P&G’s current system and model constructed for Blendax. It is noted that we use absolute percentage errors generated from regression model while calculating WAPE measure. We use regression model due to having lowest MAPE value. Only during June and July, WAPE measure of regression model worse than the current system WAPE value. For Pantene, WAPE of each week is shown on the graph-11, below. 400 Weighted Absolute Percentage Error for Blendax (%) 350 300 250 Model WAPE 200 Current System WAPE 150 100 50 % 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 Weeks 2008 Graph-11: WAPE values of P&G’s current system and model constructed for Pantene. It is noted that we use absolute percentage errors generated from regression model while calculating WAPE measure. We use regression model due to having lowest MAPE value. Only during July, WAPE measure of regression model worse than the current system WAPE value. 7.) JUSTFY – serhat CONCLUSION In the spring semester final report, project team has explained the relevant processes, the problem situation of the system and also specified the system in order to clarify problem definition. After that, three different modeling approaches –regression model, mathematical model, time-series method- is expressed with their formulations and charts. Moreover the verification and validation analysis are made to support the reliability of the models. Finally, the outputs of the related models are exhibited and compared with current forecasting method in order to proof the best model as regression model. The accurate model gives the lower mean absolute percentage error than the other ones that is generally gives closest numbers to the target percentage error level. In conclusion, the benefits from the new model approach are expressed basically. APPENDIX C Actual shipments of Blendax ShamCond Basic Norm 750 ml: MSU 30 Actual Shipments 25 20 15 Actual shipments 10 5 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 Weeks 2008 Actual shipments of Pantene Antidand 750 ml: MSU 40 Actual Shipments 35 30 25 20 Actual Shipments 15 10 5 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 Weeks 2008 APPENDIX B Monthly actual shipment and monthly forecast for Blendax 300000 250000 200000 150000 100000 Forecast Shipment 50000 0 Monthly forecast and monthly forecast for Pantene 600 500 400 300 forecast shipment 200 100 May 06 June 06 Jul 06 Aug 06 Sep 06 Oct 06 Nov 06 Dec 06 Jan 07 Feb 07 Mar 07 Apr 07 May 07 Jun 07 Jul 07 Aug 07 Sep 07 Oct 07 Nov 07 Dec 07 Jan 08 Feb 08 Mar 08 Apr 08 May 08 Jun 08 Jul 08 Aug 08 0 APPENDIX A Hair Care Category Graph-A: Hair care category market share in Turkey for the period from 2006 to 2008.