AIPLA Call Slides 10Jul15

advertisement

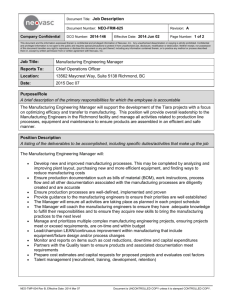

The in-house viewpoint on due diligence for IP acquisition, including best practices for messaging results to management Jen Sieczkiewicz, Ph.D., J.D. Research & Business Development Counsel Biogen Inc., Cambridge MA 1 DISCLAIMER These materials have been prepared solely for educational purposes and reflect only the personal views of the author and not of her employer Biogen Inc. Further, the presentation of these materials does not establish any form of attorney-client relationship with the author, nor does it constitute individualized legal advice. 2 30,000 Foot View • As corporate counsel, knowing the law and IP status isn't enough! • To be successful and trusted by business executives, counsel needs to understand the business operations and perspective, and speak their language. • Your role: to identify risk and help the client evaluate that risk and its potential impact on the business. 3 Agenda • IP Acquisition – Due Diligence – Patent Landscape Analysis • Messaging to the Business 4 IP Acquisition – In-House View • Will the asset give us the strong position that we want? – Evaluate exclusivity (IP strength) and freedom-to-operate – Examine ownership, derivation Approach: How will a generic/biosimilar invalidate? Will it keep out “close competition”? • What should we be paying for this asset? Is it a money pit? – Separate risks that money can solve, and those it cannot – Up to business to decide which risk it wants to take, you inform on consequences of each path • Manage risks and expectations vs. need for speed and budget 5 Discussion Point Managing risks and expectations vs. need for speed and budget in due diligence/landscape analysis 6 My preferred approach: DEAL ENDS No DEAL IDEA “First Look” IP Diligence Gather information early o Size of transaction o Timing o Degree of comfort needed and when o Understand product, market, technology, etc o Get IP landscape from licensor; discuss with them Prepare “assumed LOE” based on composition per se or method of treatment patents and RDP o Use info from licensor, free or library-paid patent databases Form preliminary assessment of technology /competitive landscape o IPD Analytics, Thomson Cortellis o Google Perform brief prelim. FTO o (USPTO, PCT, Espacenet, Thomson) Summarize using “first look” template TERM SHEET Yes Formal Due Diligence CLOSING Continue gathering information re: timing, progress, what is needed. o Engage outside counsel for formal patent, FTO search Leverage what you know from “first look” Send checklist to other party: Update results using formal template 7 Messaging – In-House View • The decision makers trust you know the details, but they need the key metrics to make a decision. – Loss of exclusivity date – Licenses they might need – White space for more inventions • A-C Privilege and Litigation Fodder 8 Discussion Point How do you communicate in a business-friendly way without jeopardizing privilege? 9 One Approach Follows… 10 Due Diligence Readout This readout is based on the information provided to us by the Target Company/Licensor and by our legal analysis of the same. We have based our analysis on our current understanding of the applicable laws, which are subject to change over time. This readout should thus be relied upon only as of the date of this slide deck. 11 Projected LOE Date – Summary Patent • Brief description of key types IP (composition, method) on which LOE is based and then LOE date (noting if applicable that up to 5 years of extension could be available) Regulatory • List current RDP terms unless launch date known; US – 12 years from launch if biosimilar, 5 years if generic All slides should have date stamp and “CONFIDENTIAL – ATTORNEY/CLIENT PRIVILEGED – DO NOT DISTRIBUTE 12 Projected LOE Date Alternative Approach Extendable up to 7.5 yrs from approval 30-mo stay Earliest date for generic entry 5-yr NCE Exclusivity 20XX 20XX 20XX Generic (ANDA) Challenge possible (if s.m.) 20XX 20XX 2025 Patent expires (w/o Ext) 2027 2028 App, if granted, expires Patent expires (w/ Ext) All slides should have date stamp and “CONFIDENTIAL – ATTORNEY/CLIENT PRIVILEGED – DO NOT DISTRIBUTE 13 Landscape Analysis Freedom-to-Operate (FTO) – key jurisdictions Composition cleared? Manufacturing cleared? Risks? Competitors and Competitive Technologies All slides should have date stamp and “CONFIDENTIAL – ATTORNEY/CLIENT PRIVILEGED – DO NOT DISTRIBUTE 14 Executive Conclusions Brief one-line synopsis of IP position, supported by: Good or Excellent Aspects • • Composition of Poor or Missing Aspects • Manufacturing matter claims until process may be 2059 covered by Company Potential Implications of Poor or Missing Aspects • Third party IP may have to license, increasing royalty stack. May need to delay launch until expiry. • Similar therapeutic may be available by 2020 that we cannot block with current IP. • Need to obtain assignments from potentially missing people. X patents RDP expected to be available until X • Company Y is assuming launch of producing a prodrug Y. that may not be covered by composition claims. • Ownership chain has break All slides should have date stamp and “CONFIDENTIAL – ATTORNEY/CLIENT PRIVILEGED – DO NOT DISTRIBUTE 15 Keep as Backup Slides the Details… 16 Details of Key Patents/Patent Applications Detailed summaries of key patents in key jurisdictions. Focus on why they provide meaningful exclusivity (or why they do not, e.g., they claim a formulation that likely can be ‘invented around, an indication that could be ‘skinny labeled,’ etc.). All slides should have date stamp and “CONFIDENTIAL – ATTORNEY/CLIENT PRIVILEGED – DO NOT DISTRIBUTE 17 Opportunities to Strengthen our Position Summarize any opportunities to improve the existing filings, and the potential for new IP to be generated in the future. All slides should have date stamp and “CONFIDENTIAL – ATTORNEY/CLIENT PRIVILEGED – DO NOT DISTRIBUTE 18