Professional Development Days

advertisement

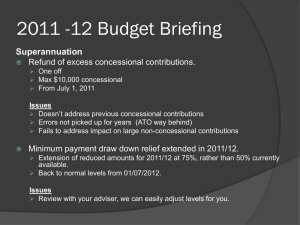

A(nother) new era of super contributions advice Tim Sanderson– Senior Technical Manager June 2013 Disclaimer This presentation is given by a representative of Colonial First State Investments Limited AFS Licence 232468, ABN 98 002 348 352 (Colonial First State). Colonial First State Investments Limited ABN 98 002 348 352, AFS Licence 232468 (Colonial First State) is the issuer of interests in FirstChoice Personal Super, FirstChoice Wholesale Personal Super, FirstChoice Pension, FirstChoice Wholesale Pension and FirstChoice Employer Super from the Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557 and interests in the Rollover & Superannuation Fund and the Personal Pension Plan from the Colonial First State Rollover & Superannuation Fund ABN 88 854 638 840 and interests in the Colonial First State Pooled Superannuation Trust ABN 51 982 884 624. The presenter does not receive specific payments or commissions for any advice given in this presentation. The presenter, other employees and directors of Colonial First State receive salaries, bonuses and other benefits from it. Colonial First State receives fees for investments in its products. For further detail please read our Financial Services Guide (FSG) available at colonialfirststate.com.au or by contacting our Investor Service Centre on 13 13 36. All products are issued by Colonial First State Investments Limited. Product Disclosure Statements (PDSs) describing the products are available from Colonial First State. The relevant PDS should be considered before making a decision about any product. Stocks referred to in this presentation are not a recommendation of any securities. The information is taken from sources which are believed to be accurate but Colonial First State accepts no liability of any kind to any person who relies on the information contained in the presentation. This presentation is for adviser training purposes only and must not be made available to any client. This presentation cannot be used or copied in whole or part without our express written consent. © Colonial First State Investments Limited 2013. What we’ll cover… Changes since 1 July 2012 Super guarantee moves to 9.25% and age limit removed Concessional caps permanently reduced for over 50s Reduced co-contribution, introduced low income earner contribution 15% extra tax on concessional contribution where income > $300,000 Reforms to excess concessional contributions Strategy impact to consider Saving for retirement generally Lower income earning clients – finding the right mix of contributions Transition to retirement Super guarantee opportunities and traps Year Rate 2012/13 9% 2013/14 9.25% 2014/15 9.5% 2015/16 10% 2016/17 10.5% 2017/18 11% 2018/19 11.5% 2019/20 or later 12% Upper age limit removed from 1 July 2013 Employers must ensure contributions updated to avoid SG charge Particularly for employees aged 75 and over Employees should consider effect on salary sacrifice arrangements Opportunity for those over 75 to derive OTE and add to super via SG contributions Concessional cap changes Transitional cap for over 50s ended on 30 June 2012 Higher cap for those over 50 (with total super balance under $500,000) proposed, then delayed to 2014, then abandoned Flat higher cap of $35,000 now proposed If aged 60 or over from 1 July 2013 If aged 50 or over from 1 July 2014 While simple to administer, higher cap is not indexed Standard cap estimated to go to $30,000 in 2014 and $35,000 in 2018 Higher cap irrelevant once this occurs Voluntary concessional contributions further limited by gradual increase in SG Contribution cap changes Under age 35 Aged 35 to 49 Aged 50 to 59 Aged 60 or over 2006/07 $15,260 $42,385 $105,113 $105,113 2007/08 $50,000 $50,000 $100,000 $100,000 2009/10 $25,000 $25,000 $50,000 $50,000 2012/13 $25,000 $25,000 $25,000 $25,000 2013/14 $25,000 $25,000 $25,000 $35,000 2014/15 $30,000 $30,000 $35,000 $35,000 % change since 2006/07 +97% -29% -67% -67% Cumulative contributions over 10 years $1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 07/08 08/09 pre simpler super rules 09/10 10/11 11/12 Simpler super standard caps 12/13 13/14 14/15 15/16 Simpler super transitional / higher caps 16/17 Getting to $1 Million by retirement $600,000 $500,000 $400,000 John needs to use $525,000 of his gross income to get there $300,000 Linda needs to use $264,000 of her gross income to get there $200,000 $100,000 $0 30 35 40 John's contributions 45 50 Linda's contributions 55 Recent cases highlight end of year timing issues Contribution made to a clearing house by an employer on 27 June of FY1, not passed to fund until late July of FY2. Salary sacrifice agreement required employer to pay salary sacrifice on a monthly basis, paid late and after end of FY1 Client made contribution by EFT on Saturday 28 June. Funds received in super fund bank account 1 July. Other things to be aware of: Salary sacrifice and bonuses Deductible contributions and taxable income Changes to excess concessional contributions Allow members to withdraw any excess contributions from 1 July 2013 not limited to $10,000 on one off basis Excess taxed at member’s marginal rate plus interest charge Excess non-concessional contributions still taxed at 46.5% Reserve allocations? not technically contributions, but ‘amounts’ that generally count toward concessional cap Contributions for high income earners 30% effective tax rate on non-excessive concessional contributions where income exceeds $300,000 Income includes Taxable income Reportable fringe benefits Total net investment loss LESS taxable component of super lump sum within low rate cap PLUS ‘Low tax super contributions’ Low tax super contributions Generally non-excessive concessional contributions Excludes untaxed rollovers / foreign super transfers DB funds – ‘notional’ amount calculated by actuary Certain state higher level office holders contributions to constitutionally protected funds only counted if made under a salary package arrangement Judges and justices – DB contributions generally ignored What about excess contributions disregarded / reallocated? Contributions for high income earners Is super still viable for those who earn over $300,000? 46.5% salary $350,000 other income $8,530 SG $16,470 salary sacrifice $8,530 $300,000 $250,000 $200,000 $16,470 $16,470 15% 30% $15,000 $16,470 30% 30% 15% $50,000 $50,000 $40,000 $250,000 $250,000 15% tax on all contributions 15% tax / 30% tax on contributions $275,000 $275,000 30% tax on contributions 30% tax / 46.5% tax on contributions $150,000 Contributions for high income earners Collecting the tax – accumulation funds Similar to excess contributions tax Notice of assessment , due within 21 days Voluntary release authority Collecting the tax – defined benefit funds ATO creates a ‘debt account’ against the DB interest, which accrues with interest until an end defined benefit becomes payable (eg, retirement) Client can make voluntary repayments off the debt account Once the defined benefit becomes payable, notice of assessment and voluntary release authority issued Voluntary release authority can only be given to that relevant DB fund What happens where a client has contributed to multiple funds? Contributions for lower income earners Co-contribution: Maximum co-contribution halved from 1 July 2012 to $500 Matching rate reduced from 100% to 50% Still reduces by 3.333c for each dollar of income over $33,516* Reduces to Nil at $48,516* * Proposed income thresholds for 2013/14 Low income earner contribution: To be eligible ATI does not exceed $37,000 10% test is met (same as cocontribution) 15% of concessional contributions, up to maximum of $500 Where no tax return required, ATO will calculate based on available information New ‘rules of thumb’ for low income earners Optimal super contribution for $5,000 pre-tax income $6,000 Total net super contribution $5,000 $4,000 $3,000 $2,000 $1,000 NCC then next $3,333 concessional or NCC then remainder NCC $1,000 $1,000 NCC then next $3,333 concessional then remainder concessional NCC to maximise co-contribution then next $3,333 concessional then remainder concessional NCC to maximise cocontribution then remainder concessional $$10,000 Salary sacrifice $15,000 $20,000 $25,000 Low income super contribution $20,542 $30,000 $35,000 Income Non-concessional contribution $31,920 $40,000 $45,000 Government co-contribution $37,000 $46,920 Transition to retirement – still effective? Transition to retirement still effective $749,931 $746,173 TTR $35,000 cap TTR $25,000 cap $711,814 TTR $50,000 cap $735,935 No TTR Example: Client 55 years of age, earning $100,000 p.a. with existing super balance of $500,000. Comparing impact of various caps over 5 years while maintaining net take home income Assumptions: Return of 7% p.a. Inflation: 3% p.a. Nil indexation on salary Any surplus income (above CC available) re-contributed as non-concessional contribution Retirement balance at age 60 Transition to retirement still effective $784,008 TTR $35,000 cap $763,944 TTR $25,000 cap $711,814 TTR $50,000 cap $773,085 No TTR Example: Client 60 years of age, earning $100,000 p.a. with existing super balance of $500,000. Comparing impact of various caps over 5 years while maintaining net take home income Assumptions: Return of 7% p.a. Inflation: 3% p.a. Nil indexation on salary Any surplus income (above CC available) re-contributed as non-concessional contribution Retirement balance at age 65 TTR considerations Reduced caps will have a different impact depending on: Age MTR Super balance TTR generally remains an effective strategy Can even be effective with after tax contributions where: Over 60 Large tax free component Low income Summary Client situation Strategy/ considerations SG changes • Employers – make changes to avoid SG charge • Employees, review sal sac Low income client • Squeeze every drop of government superannuation incentives All clients in pre-retirement or wealth accumulation stages • Start making concessional contributions earlier! Very high income earners • Pre-tax contribution still tax effective • Watch out for income traps Existing TTR clients • Adjust salary sacrifice amount • Adjust pension payment • Consider alternative strategies for the spare “$25,000” • $35,000 cap provides some additional value