Director Penalty notices(cont)

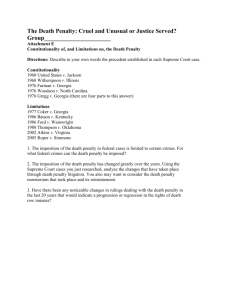

advertisement

Tips for Business Survival Michael Noon Director SRJ Chartered Accountants and Business Advisors Insolvent trading • Director has a duty to prevent the company trading in an insolvent state • Directors are required to be aware of the financial position of the company at the time of incurring debt • Number of statutory defences for a Director against insolvent trading claims - difficult to rely on Insolvent Trading (cont) • Series of Director penalties that may apply - Civil penalties - Compensation for amounts lost by Creditors - Criminal charges for dishonesty - Director liability for employee entitlements - Director Liability for particular unremitted taxes Insolvent Trading (ATO debts) • Directors liable for unremitted taxes when the company has not paid; - PAYG Withholding amounts - Alienated personal service payments • Directors must cause one of the following; - company to make payment by due date - make an agreement with the ATO to pay o/s amount Insolvent Trading - Appoint an Administrator of the company - Begin winding up the company • Non – action means the Director becomes personally liable for the debt. • Director Penalty notice Director Penalty Notices • Penalty notice required to be issued before ATO can action recovery from Director • Notice must state; - unpaid liability - penalty will be remitted if within 21 days if one of the following occurs; * Liability has been paid, * Company enters administration * Company is being wound up • ATO not entitled to recover until 21 days after the issue of the penalty notice. Director Penalty notices(cont) • Penalty notice is served from the time of posting. • Multiple Director penalty notices are common – Parallel liabilities are established. • ATO can “pick and choose” Directors • Defences include; - Illness - reasonable steps taken TIPS for Director Penalty notices • • • • • • Do not ignore. Be decisive as a Board Reach an agreement with the ATO Consider defences Check validity of the notice Director’s should not hold assets where possible. • Consider refinance options Refinancing • Review current facilities and appropriateness. • Consider security held and “excess security” held by the financier. • Revisit term of existing loans. • Can principal repayment component be reduced on existing facilities. • Consider bringing 2nd tier lenders to the table – exert pressure on existing financier • Sale and leaseback of existing assets. • Consider restructure to convert non-deductible debt to deductible debt Refinancing • Always have another banker pursuing your business. • Review Debtor finance options to unlock equity in working capital. • Can succession planning be brought forward to facilitate capital injection. FBT changes • Reforms to Motor Vehicle Fringe Benefits announced in May Budget. • Change to Statutory Formula method FBT changes Distance travelled during the FBT year (1 April – 31 March) Before 10 May 2011 From 10 May 2011 From 1 April 2012 From 1 April 2013 From 1 April 2014 0 – 15,000km 0.26 0.20 0.20 0.20 0.20 15,000 – 25,000km 0.20 0.20 0.20 0.20 0.20 25,000 – 40,000km 0.11 0.14 0.17 0.20 0.20 More than 40,000km 0.07 0.10 0.13 0.17 0.20 Source: Budget Paper No, p23; Treasurer’s Press Release: Reforms to car fringe benefits rules, 10 May 2011.