Travel Tips PowerPoint

advertisement

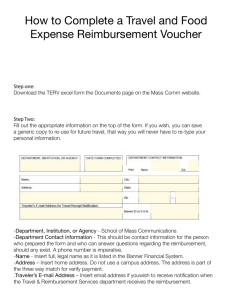

Travel & Expense 1589 Presented by: Kelley Smith Course Outline Introduction to Travel at FSU Before the Traveler leaves… When the Traveler returns… If the traveler goes out of the country… Non-Travel-related reimbursements to employees Legal Authority The payment of travel expenses is governed by: The FSU Policy board Section 112.061 of the Florida statutes Chapter 3A-42 of the Florida Administrative Code The FSU Travel Office http://control.vpfa.fsu.edu/Travel Travel policies & procedures Car rental and airline contracts Mileage tables Foreign travel links Exchange rates … and more… Course Outline Introduction to Travel at FSU Before the Traveler leaves… When the Traveler returns… If the traveler goes out of the country… Non-Travel-related reimbursements to employees Before the Traveler leaves… Travel Authorization (TAuth) Advance Registration Cash Advance (FSU travelers should use the most economic means of travel available.) Travel Authorization (TAuth) All travel requires a TAuth in OMNI, which is an estimate of money needed for the trip or trips Required Approval Authorizations: Project Manager (if applicable; Fund IDs 5XX) Approver(s) The TAuth must include the benefit to FSU in the Benefit Text Message field (max of 240 characters) Blanket TAuth Used for one employee to travel unlimited trips during the same fiscal year Used when a group (5 or more) of students or nonemployees are attending a conference which will be paid from a single department ID. A separate sheet must be submitted with the Expense Report showing names and signatures of all persons NOTE: EMPLOYEES CANNOT BE INCLUDED ON A GROUP TRAVEL ROSTER Before the Traveler leaves… Travel Authorization Advance Registration Cash Advance Advance Registration Advance registrations may be requested for employees or non-employees Registration cannot be paid more than 30 days prior to the earlybird or regular registration deadline, or conference begin date Registration may be paid with a Travel Card (T-Card), or Payment requests must be submitted on the Accounts Payable Payment Request form One Payment Request must be completed for each traveler, even if they are going to the same conference, convention or training on the same dates A registration form from the conference must be submitted along with a registration Payment Request for each traveler Conference Registration Before the Traveler leaves… Travel Authorization Advance Registration Cash Advance Cash Advances: May be made to authorized university employees only May be 100% of the estimated travel expenses that will be reimbursed May be issued for group travel; the group must consist of non-employees Must be for more than $200 Will not be paid earlier than 15 calendar days prior to the first day of travel Cash Advances, Continued Requests for Cash Advances follow work-flow approval routing for the traveler’s payroll Dept ID No traveler is permitted to have a Cash Advance outstanding for more than one trip at a time An advance for group travel (5 or more) must have a list of the travelers’ names and signatures submitted with the Expense Report http://control.vpfa.fsu.edu/Controller-Forms#TravelForm Cash Advances, Continued Cash Advances must be settled within 10 working days after the employee returns from the trip. After 58 days from issuance, the Cash Advance will be sent to Payroll for mandatory settlement All Cash Advances to FSU employees will be disbursed in the same manner as the employee’s payroll (EFT) Outline of the Course Introduction to Travel at FSU Before the Traveler leaves… When the Traveler returns… If the traveler goes out of the country… Non-Travel-related reimbursements to employees When the Traveler returns… The Business Process… The Expense Report Type of travel (State of Florida “Classes”) Per Diem OR Meals & Lodging Transportation (Airfare, Car Rental, or Mileage) Other Expense types (Incidentals) Physically disabled travelers Common Errors on ERs The Business Process… Obtain receipts from traveler Create an Expense Report from TAuth Modify expense items to match receipts Submit ER for approval Fax receipts on Expense Receipts page (Demonstrated in the Lab portion of the class) Expense Report (ER) The Expense Report reimburses the traveler for outof-pocket expenses incurred on their trip After the trip, the traveler must submit their Expense Report (ER) for payment processing within 10 days of trip completion to the appropriate office The Expense Report is also used to reimburse employees for out-of-pocket non-travel-related expenses Determine Type Of Travel Class A Travel Continuous travel of more than 24 hours away from headquarters Class B Travel Continuous travel of 24 hours or less involving overnight absence from headquarters Class C Travel Travel for short or day trips not involving overnight stay away from headquarters [ Travel must be more than 50 miles away from headquarters to claim meals/lodging/per diem.] CLASS C MEALS PROHIBITED FOR FY 2008-09 Per Diem vs. Meals & Lodging For purposes of reimbursement rate and methods of calculation the traveler may exercise one of the following for each day of travel: Per diem at $80.00 a day OR Amount permitted for meals, plus actual expenses for lodging Per Diem: $80.00 Per Day Each day is broken into 4 quarters Traveler may receive $20.00 for each quarter in 6 PM which he travels No meals or lodging are allowed if claiming $80.00 per day Per Diem 12 Midnight $20.00 $20.00 6 AM $20.00 $20.00 12 Noon Examples A traveler leaves headquarters at 5:52 a.m. on 2/8 and returns to headquarters at 11:00 a.m. of 2/9 On quarterly per diem, how much would traveler receive for 2/8 and 2/9? $80 for 2/8 & $40 for 2/9 Class A Travel A traveler leaves headquarters at 8:00 p.m. on 2/5 and returns at 3:00 a.m. on 2/6 How much would he receive? $0; no overnight stay Class C Travel Examples, Continued A traveler leaves their headquarters at 7:00 a.m. On 2/8 and returns at 6:30 p.m. Using per diem, how much would the traveler receive on 2/8? None - Class C Travel Subsistence Allowance: Meals Breakfast - travel must begin before 6:00 AM and extend beyond 8:00 AM Current allowance is $6.00 Lunch - travel must begin before 12:00 noon and extend beyond 2:00 PM Current allowance is $11.00 Dinner - travel must begin before 6:00 PM and extend beyond 8:00 PM Current allowance is $19.00 CLASS C MEALS PROHIBITED FOR FY 2008-09 Subsistence Allowance: Meals First Day of Travel – if the traveler departed: Prior to 6 AM – Eligible for Breakfast, Lunch & Dinner Prior to 12 PM – Eligible for Lunch & Dinner only Prior to 6 PM – Eligible for Dinner only Last Day of Travel – if the traveler arrived: After 8 AM – Eligible for Breakfast only After 2 PM – Eligible for Breakfast & Lunch After 8 PM – Eligible for Breakfast, Lunch & Dinner CLASS C MEALS PROHIBITED FOR FY 2008-09 Subsistence Allowance: Meals, Continued Review the Conference Agenda for Meals Traveler may not claim a meal allowance if the meals were included in the registration fee paid by the University; this applies even if the traveler decides not to eat the meals A continental breakfast is considered a meal A reception is not considered a meal Submit necessary portions of the Agenda with ER Sample Conference Agenda Subsistence Allowance: Lodging Lodging requires an itemized receipt. Justification is required if hotel charges exceed $150.00 in the state of Florida or outside the state (excluding tax) Lodging may only be reimbursed for single occupancy rate; if double occupancy, please indicate that hotel has verified that rate is the same If two university travelers are sharing a hotel room, please cross-reference the ERs in comments What to look for on a hotel bill: Airfare No State Contract (at this time) http://control.vpfa.fsu.edu/Travel E-Tickets Boarding passes / Itineraries / Receipts FSU Travelers should fly coach class or cheaper and should purchase non-refundable tickets If checked/excess baggage charge, must provide receipt Two hours is allowed prior to departure or after arrival for check in/out at the airport Car Rental State Contract (Travel Website) http://control.vpfa.fsu.edu/Travel Reserve car in advance at 1-800-338-8211 or www.Avis.com (do not reserve with Orbitz, Travelocity, etc) Use Contract Provided – Avis AWD: A113400 State contract rentals provide necessary insurance Matching the details of the contract! The moral of this story… …use AVIS on State of Florida Contract Other Car Rental Issues State policy says that “Size nor stature” of the traveler are not a valid, reimbursable justification for a larger class vehicle Fuel Service Options are not allowed (fill up the car before returning to AVIS) GPS is NOT reimbursable AVIS-toll pass use is NOT reimbursable Snow & Ice is not a valid, reimbursable justification for a larger class vehicle Mileage Map mileage must be taken from the official Florida map, if the city is listed, or mapquest.com; and is always between cities only, not street addresses Web site for mileage is: (link found on FSU Travel website) http://www2.dot.state.fl.us/CityToCityMileage/viewer.html Vicinity mileage is within the city limits - over 50 miles per day requires justification Current FSU mileage reimbursement rate is $0.445 per mile Mileage Continued Mileage allowance is not paid for travel between traveler’s residence and their headquarters (regular work location) unless travel begins more than 1 hour before or after the traveler’s regular work hours Travel to and from the airport is limited to 6 miles, each way, if the employee works on the FSU main campus Again, two hours is allowed prior to departure or after arrival for check in/out at the airport Incidental Expenses – Requiring Receipts INTERNET & BUSINESS CALLS – include FSU business purpose for calls REGISTRATION FEES – include agenda or brochure showing date, location, amount of registration fee, and meals provided TAXI FARES – excess of $25.00, per occurrence (maximum reimbursable tip of 15%) PARKING CHARGES – in excess of $25.00, per occurrence TOLLS – in excess of $25.00, per occurrence PASSPORT, VISA & HOMELAND SECURITY FEES – for business purposes only LAUNDRY, DRY CLEANING AND PRESSING – after 7 consecutive days of travel with an itemized receipt Incidental Expenses – Not Requiring Receipts MEALS PARKING – under $25.00 TAXI – under $25.00 (maximum reimbursable tip of 15%) TOLLS – under $25.00 MANDATORY VALET – $1.00 per occurrence and justification PORTAGE – $1.00 per bag, per occurrence (5 bag max) All charges should be itemized Physically Disabled Travelers When a physically disabled traveler incurs travel expenses in excess of those ordinarily authorized, and the excess travel expenses were incurred to permit the safe travel of that disabled traveler, those excess expenses will be reimbursed to the extent that the expenses were reasonable and necessary to the safe travel of that individual Individual must have documented disability with Travel Office by way of Human Resources Outline of the Course Introduction to Travel at FSU Before the Traveler leaves… When the Traveler returns… If the traveler goes out of the country… Non-Travel-related reimbursements to employees Similarities to Domestic Choosing between Per Diem and Meals & Lodging Per Diem is same as Domestic Meals & Lodging – develop charts to determine rates http://control.vpfa.fsu.edu/Travel Foreign Travel – Chart #1 Create a chart that details the trip starting & ending point AND every foreign city in which they stop long enough to calculate a meal or lodging rate; including dates and times of departures and arrivals by city and country. Departure City Tallahassee, FL Berlin, Germany Paris, France Departure Date 10/2/2007 Departure Time Arrival Date Arrival City Berlin, 9:00 AM 10/2/2007 Germany 10/3/2007 Paris, 11:00 AM 10/3/2007 France 10/4/2007 Tallahassee, 11:00 AM 10/4/2007 FL Arrival Time 9:00 PM 3:00 PM 10:00 PM Foreign Travel – Chart #2 Create a chart that details the federal maximum lodging rate and meals & incidental expenses (M&IE) rate for each foreign city listed on Chart #1 for the appropriate month & year, using the two links on the Travel Website under “Foreign Meals & Lodging.” Date Country City Max Lodging Rate (M&IE) Rate Brkfst Lunch Dinner . Foreign Travel - Lodging Lodging will only be reimbursed based upon the original paid lodging receipt and only up to the maximum foreign lodging amount as specified in the U. S. Department of State Tables, found at: Foreign Per Diem on the FSU Travel website http://control.vpfa.fsu.edu/Travel Example: Foreign Lodging Hotel bill is for $195 a day Maximum Lodging rate is $264 a day Only $195 will be reimbursed Hotel bill is for $300 a day Maximum Lodging rate is $264 a day Only $264 will be reimbursed Receipts are required for reimbursement of lodging costs. Time Rates for foreign travel do not begin until the date and time of arrival in the foreign country and terminate on the date and time of departure from the foreign country. Put all departure and arrival times when going from one city to another on the ER even if within the same country Put City and Country name on ER such as Paris, France Foreign Incidentals Incidental expenses must be claimed and reimbursed in accordance with Section 112.061(8), Florida Statutes, and Rule 3A42.010, Florida Administrative Code. Incidentals incurred during foreign travel are handled the same as in domestic (US) travel Flat daily rates for incidentals may not be claimed Foreign Meals If a person departs one city going to another, the meal reimbursement will be based on the city of departure until arrival at the destination Receipts are not required for meal expense reimbursement. Foreign Per Diem is not allowed; as an alternative, the standard State Per Diem rate of $80.00 can be used for foreign travel reimbursements in lieu of lodging and meals The State of Florida per diem rate may not be combined with the federal reimbursement rates for the same travel day. Foreign Meals, Continued Travel to Berlin, Germany in October 2007 Step 1: Look up maximum per diem rates Refer to: http://aoprals.state.gov/web920/per_diem.asp LODGING Maximum Lodging Amount M&IE Meals and Incidental Expense (M&IE) $264 $152 Foreign Meals, Continued Travel to Berlin, Germany in October 2007 Step 2: Look up M&IE Breakdown Refer to: http://control.vpfa.fsu.edu/Travel/Foreign-TravelInformation/Foreign-Travel-Meals-Incidental-Expense-Rates Meals & Incidental Expense Rate Breakdown of $152.00 USD Breakfast Lunch Dinner Incidentals $23 $38 $61 not used Foreign Meals, Continued Travel to Paris, France in October 2007 Step 1: Look up maximum per diem rates Refer to: http://aoprals.state.gov/web920/per_diem.asp LODGING Maximum Lodging Amount M&IE Meals and Incidental Expense (M&IE) $310 $163 Foreign Meals, Continued Travel to Paris, France in October 2007 Step 2: Look up M&IE Breakdown Refer to: http://control.vpfa.fsu.edu/Travel/Foreign-TravelInformation/Foreign-Travel-Meals-Incidental-Expense-Rates Meals & Incidental Expense Rate Breakdown of $163.00 USD Breakfast Lunch Dinner Incidentals $24 $41 $65 not used Foreign Meals – Example 1 Depart: US at 8:00 am Arrive: Berlin, Germany 4:00 pm Date: 10/02/07 Breakfast not eligible Lunch US - $11 USD Dinner Berlin, Germany – $61 Foreign Meals – Example 2 Depart: US at 8:00 am Arrive: Berlin, Germany 7:00 pm, instead ??? Date: 10/02/07 Breakfast not eligible Lunch US - $11 USD Dinner Berlin, Germany – $61 Foreign Meals – Example 3 Depart: Berlin, Germany at 11:00 am Arrive: Paris, France 3:00 pm Date: 10/03/07 Breakfast Berlin, Germany - $23 Lunch Berlin, Germany - $38 Dinner Paris, France - $65 Foreign Meals – Example 4 Depart: Paris, France at 11:00 am Arrive: Tallahassee, Florida 10:00 pm Date: 10/04/07 Breakfast Paris, France - $24 Lunch US - $11 Dinner US - $19 Currency Conversion Go to Currency Exchange Rates on the FSU Travel web site or go to: http://www.oanda.com/converter/classic Enter amount to be converted Enter the date the item was paid Select currency it is in and currency to be converted to Click “convert now” Print each conversion and fax with expense receipts Currency Conversion Continued Currency Conversion Continued Remember to print this screen Outline of the Course Introduction to Travel at FSU Before the Traveler leaves… When the Traveler returns… If the traveler goes out of the country… Non-Travel-related reimbursements to employees Non-Travel Expenditures Reimbursements In some rare instances, it may be necessary for a faculty/staff member to pay for materials or services from their personal funds with the expectation that they will be reimbursed by the University for the purchase Non-Travel expense reimbursements are to be limited to $25 or less Reimbursement in excess of $25 must include a Confirming Order justification form, approved by the Purchasing Dept, which explains why the University's purchasing system was not used and what steps will be taken to ensure that the purchasing system will be used in the future Non-Travel Expenditures Reimbursements Prior to making a purchase, it is important that the individual seek confirmation that the purchase is appropriate for reimbursement by the University If it is deemed that the purchase is improper, the Expense Report will be denied and “the charges will be borne at the personal expense of the individual making the purchase” A list of expenditure guidelines follows, and is also available at the following link: http://www.vpfa.fsu.edu/policies/controller/2d-1.html http://www.vpfa.fsu.edu/control/forms/ExpGuidelines.pdf Common Errors on ER’s TAuth number not placed in Reference field Not selecting appropriate and consistent Billing Type (In-State, Out-of State, Foreign, Non-Travel) for each expense line-item No justification submitted when a vehicle other than a compact (Class B) is rented or the state contract Preferred Merchant not used OR when lodging is over the maximum daily rate of $150 Agenda not provided for conference Flight itineraries and airfare receipts clearly stating the total amount paid not provided Destination(s) not provided in description on mileage expense type Vicinity Mileage not separated from Map Mileage Do’s/Don’ts of faxing receipts Fax all receipts using the OMNI-provided receipts page to 645-9501 Never highlight information on the receipt; instead, circle, or draw an arrow, star, etc., to draw attention, without compromising any information on the receipt Do not tape over information on the receipt Do not reduce the receipts in size; the faxed page can be longer than the header page If you have trouble reading the receipt because it’s too light, photocopy to darken the receipt, then attach to header page If the receipt is on colored paper, photocopy onto white paper, then attach to header page and fax Learn how to use your fax machine…make sure you are placing the documents right-side-up for your machine so that blank pages are not sent How a well-faxed receipt looks in Hummingbird! …Like This!... Outline of the Course Introduction to Travel at FSU Before the Traveler leaves… When the Traveler returns… If the traveler goes out of the country… Non-Travel-related reimbursements to employees Questions??? Thank You for Attending! Instructor: Kelley Smith Course: TE 1589 Travel Phone #: 644-5021 Email: Travel@admin.fsu.edu