Plan Expenses & Gratuities From Service Providers

advertisement

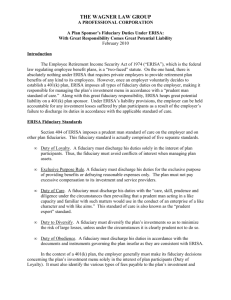

Meals, Entertainment & Gifts Jim Cole Groom Law Group (202) 861-0175 jcole@groom.com NECA Labor Relations Conference October 14, 2009 San Antonio, Texas ERISA Summary Expenses of Fiduciary Already Receiving Full Time Pay: In the interest of participants and beneficiaries Used to defray a reasonable plan expense Not for the “personal account” of the fiduciary The direct expense was properly and actually incurred Business Entertainment from Service Providers What can a third party pay for? Recent developments Applicable law Analysis Prior DOL “Zero Tolerance Policy” “Zero Tolerance Policy” – DOL Enforcement March, 2007 - Speech to Investment Advisors Statements made by DOL Chief of ERISA Enforcement Nothing to do with the plan paying for educational conferences for trustees Casts doubt on prior standards regarding business entertainment from service providers Recent Developments New DOL Enforcement Policy Not everything we asked for but an improvement from the Zero Tolerance Policy DOL Enforcement Manual October 8, 2008 Section 12 See attached handout Recent Developments DOL ERISA Audit Activity Compare Form LM-10 / LM-30 Reporting Regional Offices & “Ten Day Letters” DOL Letters to Service Providers DOL Memorandum of Understanding EBSA & OLMS Coordination DOL & SEC Investment Consultant Enforcement Initiative - CAP Not Just ERISA 18 U.S.C. 1954 – Bribery of Plan Fiduciaries & Employees Honest Services Act Taft-Hartley Act Strict Payment Prohibition Bribery Prohibition Kickbacks . . . ERISA Section 406(b)(3) Prohibited transaction for a Fiduciary to “receive any consideration for his own personal account from any party dealing with such plan in connection with a transaction involving the assets of the plan.” §406(b)(3) Violation Consequences for Recipient (Trustees) Pay to Plan under ERISA § 409 Loss, if any, to plan from fiduciary decision Value of the “kickback” (disgorgement) Pay to IRS excise tax - IRC §4975 15% of amt involved per year til corrected Removal as fiduciary; injunctions Pay 20% of recovery if DOL involved (§ 502(l)) §406(b)(3) Violation Consequences for Payor (Provider) If payor is not a Fiduciary If payor is a Fiduciary Potential non-fiduciary liability. Saloman Bros. Co-fiduciary liability under §405 Impact of DOL challenge on current business relationships and future opportunities §406(b)(3) Elements: “For His Own Personal Account” An Argument: if payment related to plan business and plan assets could have been used, argue no violation because payment benefits plan and not fiduciary personally. DOL Adv. Ops. 97-15, 97-19 Service Provider Gratuities What Might Be a Technical Violation of ERISA § 406(b)(3)? Meetings with Meals? Gifts to Charities? Educational Conferences? Party or Reception for all Clients? Service Provider Gratuities What Might Be a Technical Violation of ERISA § 406(b)(3)? Golf? Sporting & Theatre Tickets? Occasional Gifts? Raffles? Trinkets? New DOL Enforcement Policy Investigators instructed to review: Meals, gifts, entertainment associated with educational conferences; Whether plan fiduciary maintains a reasonable written policy and policy is followed. DOL will treat as “insubstantial” – Gifts, meals, and other gratuities of less than $250 from one source annually; “reasonable” expenses reimbursed in connection with educational conferences. New DOL Enforcement Policy: Educational Conferences Expenses associated with educational conferences are reasonable if plan fiduciary determines in advance, in writing: Plan could prudently pay; Expenses consistent with plan policy; Conference had a reasonable relationship to attendees’ plan duties; and Expenses were reasonable in light of benefits and unlikely to compromise attendees ability to carry out plan duties. New DOL Enforcement Policy: Educational Conferences Some Confusion When are educational expenses included in $250? If Plan payment and reimbursement actually required? Is conference-related entertainment included? Educational Conferences: Special Requirements Plan policy Advance determination/approval New DOL Enforcement Policy Positives Covers all gratuities (other than cash) Relatives included No per event cap Suggests that entertainment not a "per se" violation Challenges Distinguished educational conferences but not business meals No real guidance to investigators for dealing with $250+ gratuities Aggregation of affiliates and individual employee payments from source Meals, Gifts and Entertainment: Form 5500, Schedule C Direct and indirect compensation may include some compensation received by employees of plan sponsors and service providers. Reportable – “other” compensation, including non-monetary compensation, received by a plan sponsor employee or service provider employee from a third party. Meals and entertainment? Not reportable – compensation, e.g. salary, received by a plan sponsor employee or service provider employee, from his or her employer. LMRDA / Landrum-Griffin Act Union Officer Imposes fiduciary duties on union officers and employees Solely for the benefit of the union In accordance with the constitution, bylaws & resolutions of the governing bodies Do not act as adverse party Account for profit Form LM-10 & LM-30 reporting Form LM-30’s & LM-10’s: Where ERISA and Labor Law (LMRDA) Collide LM-30’s = union officers & union employees LM-10’s = anyone who employs Employers of union members Service Providers Employee Benefit Trusts – Not for 2007 Final LM-30 Regulations & FAQs Published Filing a Form LM-30 or Form LM-10 does not necessarily mean a violation of ERISA, the TaftHartley Act, or § 1954 Form LM-30’s & LM-10’s: Where ERISA and Labor Law (LMRDA) Collide What Must PLANS File? Plans do not have to file LM-10’s until additional LM-10 guidance is issued Additional LM-10 guidance is not expected for at least a month and probably longer LM-10 Filers may continue to rely on the old FAQs & not the new LM-30 regulations Form LM-30’s & LM-10’s: Where ERISA and Labor Law (LMRDA) Collide What Must Union Trustees File? LM-30 filers may use the old form for their 2009 filing. If the new Form LM-30 is used, Union officers & employees must file a Form LM-30 for expenses they are reimbursed by the plan if another exception (e.g., the $250 de minimis) does not apply. Examples of Form LM-10, Non-Enforcement Policy & Form 5500 Inconsistencies Rule LM-10 DOL Non-Enforcement Form 5500 Deminimis $250 Annual $249.99 Annual $100/Annual $50/Occurrence Tax Deductible and Excludable Per Occurrence Deminimis None for LM-10 (but note under $20 excluded for LM-30) None Items under $10 excluded Event Exclusion Widely attended gatherings Educational Conferences None (but SP’s may allocate among plan clients) Policy Required No Yes Silent (but see §408(b)(2)) Fiduciary Violations Involving Gifts and Gratuities 12. Fiduciary Violations Involving Gifts and Gratuities. Investigations may disclose possible fiduciary violations involving a plan fiduciary’s acceptance, from a party dealing with the plan, of consideration such as meals, gifts, entertainment, or expenses associated with educational conferences. In such cases, the Investigator/Auditor should determine whether the facts support an allegation that the receipt of gifts, gratuities, or other consideration were for the fiduciary’s personal account and received in connection with a transaction or transactions involving the assets of the plan as required for a violation of ERISA §406(b)(3). The Investigator/Auditor should also determine whether the fiduciary or the plan maintained a reasonable written policy or plan provision governing the receipt of items or services from parties dealing with the plan and whether the fiduciary adhered to that policy. Fiduciary Violations Involving Gifts and Gratuities Further, for enforcement purposes only, the Investigator/Auditor generally should adhere to the following guidelines: (1) The Investigator/Auditor should treat as insubstantial, and not as an apparent violation of ERISA § 406(b)(3), the receipt by a fiduciary (including his or her relatives) of the following items or services from any one individual or entity (including any employee, affiliate, or other related party) as long as their aggregate annual value is less than $250 and their receipt does not violate any plan policy or provision: (a) gifts, gratuities, meals, entertainment, or other consideration (other than cash or cash equivalents) and (b) reimbursement of expenses associated with educational conferences. Fiduciary Violations Involving Gifts and Gratuities (2) The Investigator/Auditor should not treat the reimbursement to a plan of expenses associated with a plan representative’s attendance at an educational conference as a violation of ERISA § 406(b)(3) if a plan fiduciary reasonably determined, in advance and without regard to whether such expenses will be reimbursed, that (a) the plan’s payment of educational expenses in the first instance was prudent, (b) the expenses were consistent with a written plan policy or provision designed to prevent abuse, (c) the conference had a reasonable relationship to the duties of the attending plan representative, and (d) the expenses for attendance were reasonable in light of the benefits afforded to the plan by such attendance and unlikely to compromise the plan representative’s ability to carry out his or her duties faithfully in accordance with ERISA. The fiduciary’s determination should be in writing. Meals, Entertainment & Gifts Jim Cole Groom Law Group (202) 861-0175 jcole@groom.com NECA Labor Relations Conference October 14, 2009 San Antonio, Texas