スライド 1

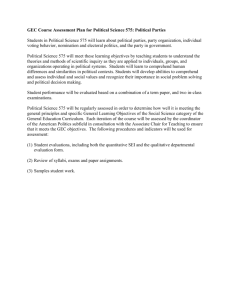

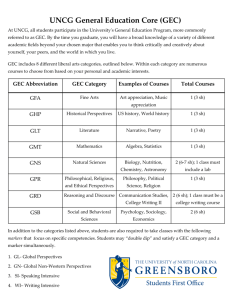

advertisement

Tình hình kinh tế thế giới Liệu có trượt sâu trong suy thoái? Hiroki Shimazu Phòng Nghiên Cứu Thị Trường Kinh Tế Gia Cao Cấp 10 August, 2010 Summary • Thời kỳ “đen tối” nhất gần như đã lùi lại đằng sau . • Mặc dù còn nhiều lo ngại, nhưng sự hồi phục kinh tế đang được hỗ trợ bởi chính sách tiền tệ và tài khóa thông thoáng hơn. • Những nền kinh tế mới nổi và đang phát triển sẽ đóng vai trò quan trọng trong kinh tế thế giới • Chính lược “hiện thực hoá lợi nhuận” áp dụng sớm ở các nền kinh tế phát triển là một trong những rủi ro cho nền kinh tế toàn cầu. 1 This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. Mặc dù thời kỳ đen tối nhất đã lùi lại đằng sau, nhà đầu tưvẫn còn lo ngại Chart. CBOE Volatility Index (VIX) 90 80 70 60 50 40 30 Russian Crisis (Aug 1998) LTCM Shock (Sep 1998) Gulf War (Aug 1990) Events of September 11th (Sep 2001) Greek crisis (May 2010) Lehman bankruptcy (Sep 2008) Hungarian Crisis (Nov 2008) WorldCom bankruptcy (June 2002) Asian Crisis (Jul 1997) 20 10 0 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 Sources: CBOE, NY Fed Note: All dates don't correspond with the very events. (CY) 2 This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. Tăng trưởng kinh tế chậm ở Mỹ trở thành một trong những mối lo ngại lớn 9 8 7 6 5 4 3 2 1 0 -1 -2 -3 -4 -5 -6 -7 -8 Chart. US Real GDP Growth (QoQ annualized, percent) Real GDP Growth Rate Moving Average 00 01 02 03 04 05 06 07 08 09 Source: US BEA 10 11 (CY) 3 This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. Mức cầu từ doan nghiệp tăng trưởng mạnh hơn, và yếu hơn từ các hộ gia dình Chart. US Real Non-residentioal Investment, the Business Cycles Chart. US Real PCE and the Business Cycles (trough=100) (trough=100) 108 106 1991/1Q 2001/4Q 2009/2Q(estimate) 106 104 105 1991/1Q 2001/4Q 104 102 100 2009/2Q(estimate) 103 98 102 96 101 94 92 100 1 2 3 4 5 6 Sources: US BEA and NBER 7 8 (CY) 1 2 3 4 Sources: US BEA and NBER 5 6 7 8 (CY) 4 This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. Tăng trưởng kinh tế Mỹ không còn được hỗ trợ bởi việc chỉnh hóa hàng dự trữ Chart. US Ratio of Manufacturers' Inventories to Shipments, IP (percent point) (YoY, percent) 20 20 Jan 10 26mon 24mon 29mon 17mon 15 24mon Feb 97 Dec 92 Apr 02 10 Dec 94 15 26mon 33mon Apr 04 26mon 10 Jul 99 Sep 05 5 Nov 07 5 0 0 Jul 93 29ヶ月 31mon -5 May 03 Mar 05 -5 22mon 42mon -10 33ヶ月 Feb 96 Jul 98 Feb 01 Jan 90 19mon 25mon Ratio of Inventories to Shipments (LH) Peak of Ratio Trogh of Ratio Industrial production (RH) -15 -20 90 92 94 96 98 00 02 -10 Oct 06 -15 25mon Nov 08 -20 04 06 08 10 Sources: US Census Bureau and FRB Note: Discontinued since 1993 (CY) 5 This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. Chu kỳ kinh doanh có xu hướng dài hơn chu kỳ hàng tồn kho Chart. US Business Cycle Expansions and Contractions Reference Dated Duration in Months/Cycle T-T P-P Peak Trough Contraction Expansion 1945/02 1945/10 8 80 88 93 1948/11 1949/10 11 37 48 45 1953/07 1954/05 10 45 55 56 1957/08 1958/04 8 39 47 49 1960/04 1961/02 10 24 34 32 1969/12 1970/11 11 106 117 116 1973/11 1975/03 16 36 52 47 1980/01 1980/07 6 58 64 74 1981/07 1982/11 16 12 28 18 1990/07 1991/03 8 92 100 108 2001/03 2001/11 8 120 128 128 2007/12 2009/6(?) 1854-2001 (32 Cycles) 17 38 55 56 1945-2001 (10 Cycles) 10 57 67 67 Souce: NBER 6 This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. GDP được kéo bởi việc đầu tư vào nhà ở trong ngắn hạn Chart. US Real GDP Around the Second Expansion (1958/2Q=100) 140 135 130 125 120 115 110 105 100 95 58 59 Sources: US BEA and NBER Note: Shadow indiates the recession. 107 60 図表.米国.景気の「谷」後の実質GDP (「谷」=100) 61 (CY) Chart. US Real GDP Around the Shortest Expansion (1980/3Q=100) 135 Real GDP 130 PCE 125 Residential Investment 120 Non-residential Investment 115 Export 110 105 100 95 90 85 80 75 80 81 82 83 Sources: US BEA and NBER Note: Shadow indiates the recession. 107 (CY) (「谷」=100) 106 106 105 104 103 1991/1Q 2001/4Q 2009/2Q 105 104 1991/1Q 2001/4Q 2009/2Q This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. 103 7 Các điều kiện thuận lợi được duy trì, đặc biệt với các nền kinh tế mới nổi và đang phát triển • Chính sách tiền tệ – Chính sách tiền tệ thông thoán hơn ở các nước phát triển có khả năng lan rộng ra toàn cầu và bù đắp cho chính sách thắt chặt ở các nền kinh tế mới nổi và đang phát triển • Chính sách tài khóa - Mặc dù các nền kinh tế Châu Âu bắt đầu thắt chặt chính sách tài khóa, các nền kinh tế mới nổi và đang phát triển vẫn cần tiếp tục dùng nguồn lực trong nước đầu tư vào cơ sở hạ tầng • Thay đổi cấu trúc – Sự phát triển của tầng lớp trung lưu và thượng lưu ở các nên kinh tế thứ 3 cũng là một yếu tố tích cực 8 This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. Tốc độ tăng trưởng tại các nền kinh tế thứ cấp cao hơn ở các nền kinh tế cao cấp (2008/2Q=100) 116 India Brazil Australia Canada US Japan Germany UK 114 112 110 108 Chart. Real GDP Indices Indonesia Korea NZ Norwaya France Spain Italy Emerging & Developing 106 104 Commodity exporters 102 100 98 96 94 Advanced 92 08 Source:OECD 09 10 (CY) This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. 9 Các nền kinh tế mới nổi và đang phát triển tiếp tục đóng vai trò quan trọng hơn Chart. World GDP Growth Rate (Based on PPP) (YoY, percent) Contribution of Emerging & Developing 10 Contribution of Advanced 8 65 Chart. Advanced vs. Emerging and Developing Economies (GDPshare, percent) 60 Projections 6 55 4 50 Projections Advanced Economies Emerging and Developing Economies 45 2 40 0 Source: IMF; Wourld Economic Outlook Database 65 60 55 50 45 Chart. Advanced vs. Emerging and developing economies (GDPshare, percent) (CY) Source: IMF; Wourld Economic Outlook Database Note: GDP is based on PPP 10 (前年比、%) 図表.世界GDP成長率 8 Projections 6 Advanced Economies This document is created exclusively for your entity and your internal usage. . Information set forth herein 4 relies on general information available at present and Emerging andso,Developing writer’s judgment, they are subject toEconomies change in the future. 2 2014 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1990 2014 2012 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 2010 (CY) 1992 35 -2 IMF予測 10 Sự tăng trưởng kinh tế toàn cầu càng thuận lợi hơn với khu vực đồng tiền chung Châu Âu Chart. Export Function Estimates EMU Germany France Italy Spain US Japan Income Term Price Term 0.747 1.457 (31.955) 0.993 1.768 (47.010) 0.436 1.146 (16.870) 0.638 1.859 (11.396) 0.583 1.471 (14.553) 0.469 1.488 (7.270) 0.823 1.420 (6.125) -0.253 -0.494 (2.893) -0.079 -0.141 (0.775) -0.636 -1.671 (5.490) -0.909 -2.650 (8.304) -0.096 -0.242 (0.981) -0.531 -1.683 (3.356) -0.232 -0.401 (1.110) Adj-R2 DW 0.987 0.304 0.991 0.608 0.935 0.443 0.871 0.316 0.971 0.276 0.952 0.160 0.963 0.451 Sources: OECD, IMF, US Census Bureau, Statistical office Germany, Insee(France), INS(Italy), Cabinet Office(Japan) Notes: Periods;From 1999/1Q to 2009/4Q, Quatary ln(EX) = Const + αln(WTR) + βln(REXPP) WTR: Volume of World Trade REXPP: Relative Export Price in USD This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future. 11 Việc“hiện thực hóa lợi nhuận” sớm làm giảm tính thanh khoản là một rủi ro với sự hồi phục kinh tế toàn cầu 70 (YoY, percent) Chart. World Dollar 60 50 40 30 20 10 0 -10 80 82 84 86 88 90 92 94 96 98 00 02 Source:FRB Note: World dollar = US Base money + US treasury securities in custody for foreign official and international accounts 160 140 (前年比、%) 04 06 (前年比、%) 80 WTI先物(左) 70 NY金先物(右) 60 writer’s judgment, so, they are subject to change in the future. 100 10 (CY) This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and 120 08 50 12 Disclaimer relating to Article 37 of the Financial Instruments and Exchange Law (Regulation of Advertising, etc.) This document introduces or explains various systems and frameworks related to, among others, law/taxation, share valuation, inheritance/business succession, shareholder relations/finance strategy, offerings, M&A/IPO, pensions/insurance or related schemes or other matters, or explains, verifies, etc., the effects of the foregoing, and does not constitute an informational document related to financial instruments for the purpose of soliciting financial instrument or other transactions. You will be responsible for any fees, remuneration, expenses and other payments arising from your transactions or performances in accordance with the information set forth in this document. Please be aware that if you execute a financial instrument or other transaction, you may be required to pay a stipulated fee for the applicable instrument (e.g., at our branch or office, with respect to a Japanese financial instrument exchange-listed shares (excluding sales of shares that constitute less than a unit), a service fee of up to 1.2075% of the stipulated purchase price (but not less than 5,250 yen; all amounts inclusive of taxes), or with respect to an investment trust, sales fees, trust charges and other costs applicable to each fund. When purchasing a bond in an offering, secondary sale or private transaction, you will pay only the purchase price (you may be required to pay accrued interest separately from the purchase price). Additionally, when exchanging a foreign currency denominated instrument into amounts in Japanese yen or another foreign currency, the exchange rate will be the rate determined by Nikko Cordial based on the foreign currency exchange market (please note that transaction fees through Citigroup Global Markets Japan Inc. differ from those through Nikko Cordial). This document is prepared using information obtained from sources determined by Nikko Cordial to be reliable. Nikko Cordial, however, does not explicitly or implicitly guarantee the accuracy or completeness of the information set forth in this document. Unless otherwise stated, this document was prepared pursuant to laws and ordinances in force at the time of preparation, and in the future, the interpretation of laws and ordinances may change, systems and frameworks may be amended and new laws and ordinances may be enacted. Further, due to the generality of the information set forth in this document, the effects described herein may not be realized in every situation pertaining to you. Therefore, if you execute a transaction or perform in accordance with the information set forth in this document, there is a risk that the expected effects may not be realized. Please be aware that when executing a financial instrument or other transaction, there is a risk of loss, including loss in an amount that exceeds the principal amount, directly as a result of changes in the third-party valuations related to price fluctuations in stock markets, benchmark interest rates, currency exchange markets, real estate markets, financial instruments and other markets, or deterioration in the credit (including financial and management conditions) of the issuers of the relevant securities. Please be aware that when executing a credit or derivatives transaction (the “Derivative Transaction”), the notional principal value of the Derivative Transaction may exceed the required margin or deposit (the “Margin”) furnished by you for the Derivative Transaction, and there is a risk that you may incur losses exceeding the Margin due to fluctuations in the value of the subject security, index or another measure. Further, the price of a financial instrument available at Nikko Cordial may differ from that available through an over-the-counter derivative transaction. As the aforementioned fees, risks and other matters differ depending on the instrument, please be sure to read carefully the informational document for conclusion of contracts (keiyaku teiketsu mae kofu shomen) and prospectus, as well as any other materials for customers, before entering into the contract related to the instrument. When considering entering into a transaction, please review the applicable proposal and other materials; give careful consideration to future amendments to the relevant systems and frameworks, as well as concrete trends in businesses and legal interpretations and your individual circumstances; consult with the competent tax office or an attorney, certified public accountant, tax accountant or another specialist; and execute the transaction at your own discretion. Nikko Cordial Securities Inc. is a financial instruments business operator registered with the Director of the Kanto Local Finance Bureau (Financial Instrument [Kinsho]) No. 2251). Nikko Cordial is a member of the Japan Securities Dealers Association, Japan Securities Investment Advisers Association and the Financial Futures Association of 13 Japan. This document is created exclusively for your entity and your internal usage. . Information set forth herein relies on general information available at present and writer’s judgment, so, they are subject to change in the future.