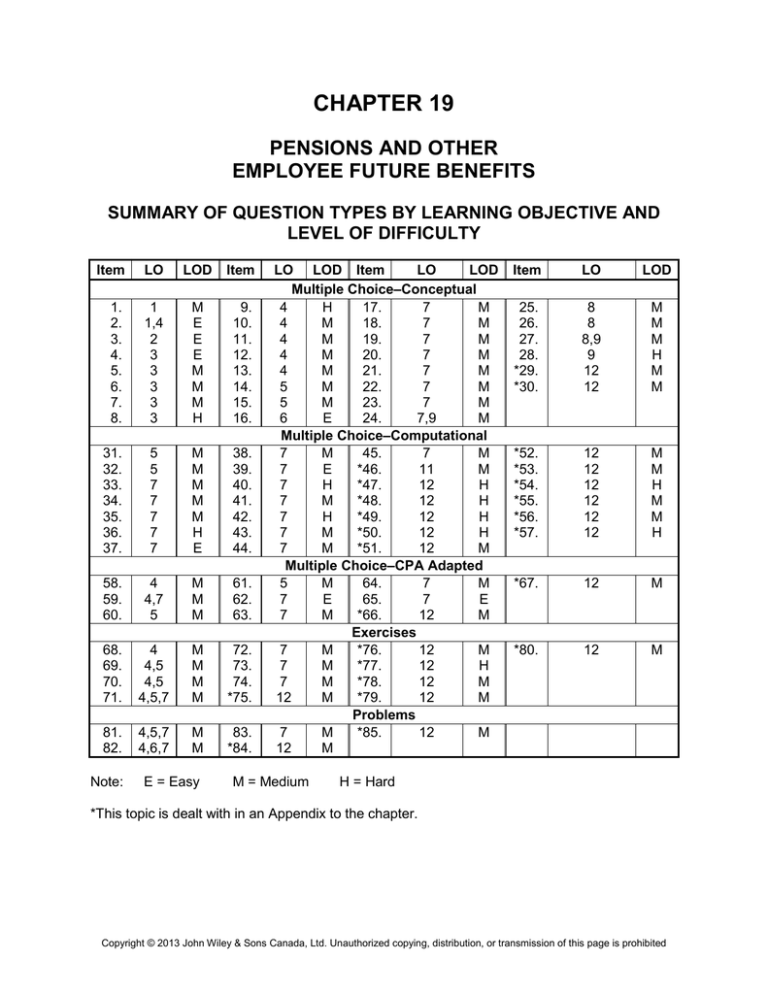

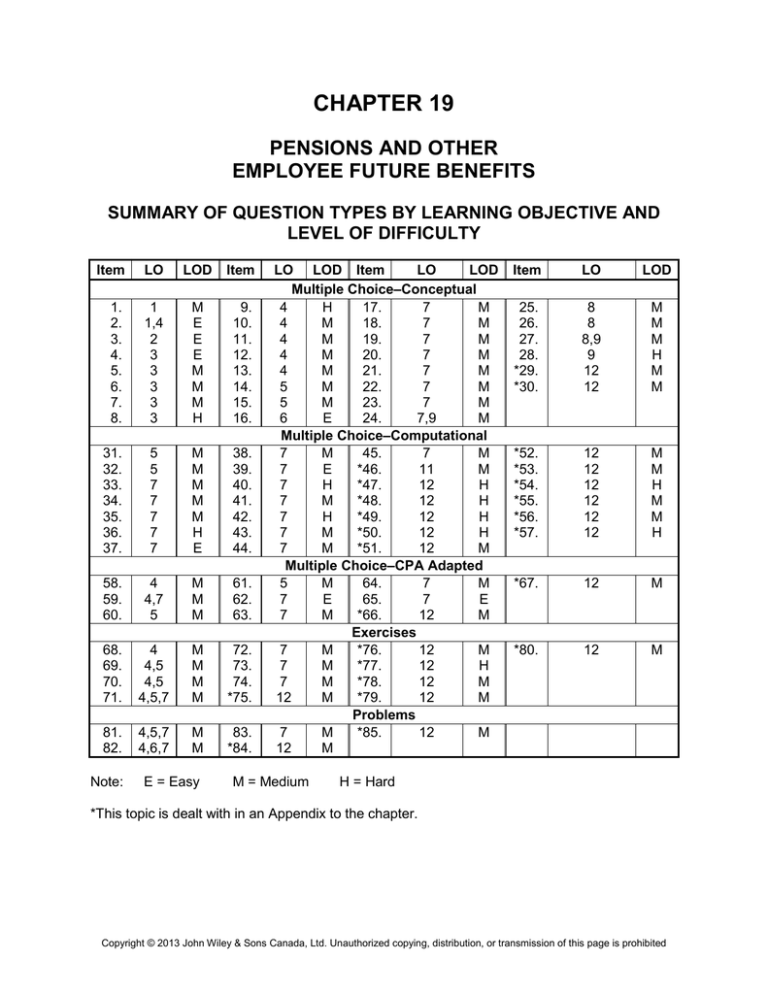

CHAPTER 19

PENSIONS AND OTHER

EMPLOYEE FUTURE BENEFITS

SUMMARY OF QUESTION TYPES BY LEARNING OBJECTIVE AND

LEVEL OF DIFFICULTY

Item

LO

LOD

Item

1.

2.

3.

4.

5.

6.

7.

8.

1

1,4

2

3

3

3

3

3

M

E

E

E

M

M

M

H

9.

10.

11.

12.

13.

14.

15.

16.

31.

32.

33.

34.

35.

36.

37.

5

5

7

7

7

7

7

M

M

M

M

M

H

E

38.

39.

40.

41.

42.

43.

44.

58.

59.

60.

4

4,7

5

M

M

M

61.

62.

63.

68.

69.

70.

71.

4

4,5

4,5

4,5,7

M

M

M

M

72.

73.

74.

*75.

81.

82.

4,5,7

4,6,7

M

M

83.

*84.

Note:

E = Easy

LO LOD Item

LO

LOD

Multiple Choice–Conceptual

4

H

17.

7

M

4

M

18.

7

M

4

M

19.

7

M

4

M

20.

7

M

4

M

21.

7

M

5

M

22.

7

M

5

M

23.

7

M

6

E

24.

7,9

M

Multiple Choice–Computational

7

M

45.

7

M

7

E

*46.

11

M

7

H

*47.

12

H

7

M

*48.

12

H

7

H

*49.

12

H

7

M

*50.

12

H

7

M

*51.

12

M

Multiple Choice–CPA Adapted

5

M

64.

7

M

7

E

65.

7

E

7

M

*66.

12

M

Exercises

7

M

*76.

12

M

7

M

*77.

12

H

7

M

*78.

12

M

12

M

*79.

12

M

Problems

7

M

*85.

12

M

12

M

M = Medium

Item

LO

LOD

25.

26.

27.

28.

*29.

*30.

8

8

8,9

9

12

12

M

M

M

H

M

M

*52.

*53.

*54.

*55.

*56.

*57.

12

12

12

12

12

12

M

M

H

M

M

H

*67.

12

M

*80.

12

M

H = Hard

*This topic is dealt with in an Appendix to the chapter.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 2

Test Bank for Intermediate Accounting, Tenth Canadian Edition

SUMMARY OF LEARNING OBJECTIVES BY QUESTION TYPE

Item Type

1.

MC

Item

Type

2.

MC

Item Type Item Type

Learning Objective 1

Item

Type

Item

Type

Learning Objective 2

3.

MC

4.

MC

5.

MC

2.

9.

10.

MC

MC

MC

11.

12.

13.

MC

MC

MC

14.

15.

MC

MC

31.

32.

MC

MC

16.

MC

82.

Pr

17.

18.

19.

20.

21.

22.

MC

MC

MC

MC

MC

MC

23.

24.

34.

35.

36.

37.

MC

MC

MC

MC

MC

MC

25.

MC

26.

MC

24.

MC

27.

MC

46.

MC

*29.

*30.

*47.

*48.

MC

MC

MC

MC

Learning Objective 3

6.

MC

7.

MC

Learning Objective 4

58.

MC

69.

Ex

59.

MC

70.

Ex

68.

Ex

71.

Ex

Learning Objective 5

60.

MC

69.

Ex

61.

MC

70.

Ex

Learning Objective 6

Learning Objective 7

38.

MC

44.

MC

39.

MC

45.

MC

40.

MC

59.

MC

41.

MC

62.

MC

42.

MC

63.

MC

43.

MC

64.

MC

Learning Objective 8

27.

MC

Learning Objective 9

8.

MC

81.

82.

Pr

Pr

71.

81.

Ex

Pr

65.

71.

72.

73.

74.

81.

MC

Ex

Ex

Ex

Ex

Pr

82.

83.

Pr

Pr

*76.

*77.

*78.

*79.

Ex

Ex

Ex

Ex

*80.

*84.

*85.

Ex

Pr

Pr

Learning Objective 11

Note:

*49.

*50.

*51.

*52.

MC

MC

MC

MC

MC = Multiple Choice

Learning Objective 12

*53.

MC

*57.

MC

*54.

MC

*66.

MC

*55.

MC

*67.

MC

*56.

MC

*75.

Ex

Ex = Exercise

Pr = Problem

*This topic is dealt with in an Appendix to the chapter.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 3

CHAPTER STUDY OBJECTIVES

1. Understand the importance of pensions from a business perspective. A pension plan,

together with post-retirement health care, is often part of an employee’s overall compensation

package. The size of these plans, in terms of both the number of employees and cost of benefits,

has made their costs very large (on average) in relation to companies’ financial position, results of

operations, and cash flows. With the vast majority of defined benefit plans being underfunded,

more and more companies are moving toward defined contribution plans.

2. Identify and account for a defined contribution benefit plan. Defined contribution plans are

plans that specify how contributions are determined rather than what benefits the individual will

receive. They are accounted for similar to a cash basis.

3. Identify and explain what a defined benefit plan is and the related accounting issues.

Defined benefit plans specify the benefits that the employee is entitled to. Defined benefit plans

whose benefits vest or accumulate typically provide for the benefits to be a function of the

employee’s years of service and, for pensions, compensation level. In general, the employer’s

obligation for such a plan and the associated cost is accrued as an expense as the employee

provides the service. An actuary usually determines the required amounts.

4. Explain what the employer’s benefit obligation is, identify alternative measures for this

obligation, and prepare a continuity schedule of transactions and events that change its

balance. The employer’s benefit obligation is the actuarial present value of the benefits that have

been earned by employees for services they have provided up to the date of the statement of

financial position. The vested benefit method, accumulated benefit method, and projected benefit

method are three methods that could be used to measure companies’ obligations. The third

method is the one used to determine the defined benefit obligation, basing the calculation of the

deferred compensation amount on both vested and non-vested service using future salaries. This

last method is used under both IFRS and the deferral and amortization approach under ASPE.

The funding approach specified by legislation is the measurement of the obligation under ASPE’s

immediate recognition approach. The DBO is increased by current service cost, interest cost, plan

amendments that usually increase employee entitlements for prior services, and by actuarial

losses. It is reduced by payment of pension benefits and by actuarial gains.

5. Identify transactions and events that change benefit plan assets, and calculate the

balance of the assets. Plan assets are increased by company and employee contributions and

the actual return that is earned on fund assets (including realized and unrealized gains and

losses), and are reduced by pension benefits paid to retirees.

6. Explain what a benefit plan’s funded status is, calculate it, and identify what

transactions and events change its amount. A plan’s funded status is the difference between

the defined benefit obligation and the plan assets at a point in time. It tells you the extent to which

a company has a net obligation (underfunded) or a surplus (overfunded) relative to the benefits

that are promised. All items that change the plan assets and DBO with the exception of the

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 4

Test Bank for Intermediate Accounting, Tenth Canadian Edition

payments to retirees change the funded status.

7. Identify the components of pension expense, and account for a defined benefit pension

plan under the immediate recognition approach. Pension expense under the immediate

recognition approach is a function of: (1) service cost, (2) interest on the liability, (3) actual return

on plan assets, (4) past service costs, and (5) net actuarial gains or losses. Under ASPE, all are

immediately included in current expense in their entirety. The pension obligation amount is

determined under a funding basis measure. Under IFRS, pension costs relating to current

service, past service, and net interest on the net defined benefit obligation are included in pension

expense. Actuarial gains and losses, and any return on plan assets excluding amounts included

in the net interest on the net defined benefit obligation (asset), are recognized in OCI.

8. Account for defined benefit plans with benefits that vest or accumulate other than

pension plans. Under ASPE, any non-pension defined benefit plans with benefits that vest or

accumulate are accounted for in the same way as defined benefit pension plans. Under IFRS,

short-term employee benefits are generally recognized (without discounting) at the amount

expected to be paid in exchange for the services provided. Other long-term benefits include items

such as paid absences for long service, unrestricted sabbaticals, and long-term disability plans.

IFRS requires the same recognition and measurement for these long-term benefits as for pension

plans. Specifically, changes in the liabilities related to these benefits should be reflected in

income. For termination benefits, IFRS requires the cost of the benefits to be recognized at the

earlier of when the company can no longer withdraw an offer of employment and when it

recognizes the related restructuring costs.

9. Identify the types of information required to be presented and disclosed for defined

benefit plans, prepare basic schedules, and be able to read and understand such

disclosures. ASPE requires a description of the plans, major changes made in the plans, dates

of the actuarial valuations, the fair value of the plan assets, the ABO, and the funded status and

how this relates to the balance sheet account. IFRS requires substantial information, such as

reconciliations of changes in the DBO and plan assets, details of amounts included in net income,

underlying assumptions and sensitivity analysis, and other information related to help determine

cash flows.

10. Identify differences between the IFRS and ASPE accounting for employee future

benefits and what changes are expected in the near future. IAS 19 is broader based and

covers more employee benefits than does CICA Handbook, Part II, Section 3461. ASPE permits a

choice of the immediate recognition approach or the deferral and amortization approach, whereas

IFRS permits only the former approach, but with options within it. With recent changes to IAS 19,

most companies are expected to recognize the net defined benefit liability (or asset) on the

statement of financial position with items such as current service cost, past service cost and

interest on the DBO and plan assets recognized in net income, and remeasurement changes and

actuarial gains and losses reported in OCI. At the present time, ASPE still allows companies to

use the deferral and amortization approach, although this option is expected to be eliminated

eventually.

11. Explain and apply basic calculations to determine current service cost, the defined

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 5

benefit obligation, and past service cost for a one-person defined benefit pension plan.

The current service cost is a calculation of the present value of the benefits earned by employees

that is attributable to the current period. The defined benefit obligation is the present value of the

accumulated benefits earned to a point in time, according to the pension formula and using

projected salaries. Past service cost is the present value of the additional benefits granted to

employees in the case of a plan amendment.

12. Identify the components of pension benefit cost, and account for a defined benefit

pension plan when using the deferral and amortization approach under ASPE; determine

the pension plan accounts reported in the financial statements and explain their

relationship to the funded status of the plan. Pension cost under the deferral and amortization

approach is a function of: (1) service cost, (2) interest on the liability, (3) expected return on plan

assets, (4) past service costs, and (5) net actuarial gain or loss. Items (1) to (3) are included in

current expense entirely, while items (4) and (5) are usually recognized through a process of

amortization. The unamortized balances of items (4) and (5) are reported in the notes to the

financial statements. An accrued benefit liability or asset is reported in the balance sheet. Under

the deferral and amortization approach, the balance is equal to the funded status adjusted for any

unamortized past service costs and unamortized actuarial gains and losses. The pension

expense is reported in the income statement.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 6

Test Bank for Intermediate Accounting, Tenth Canadian Edition

MULTIPLE CHOICE—Conceptual

Answer

c

d

c

b

b

c

a

d

a

d

b

c

d

a

b

b

a

c

c

b

a

c

a

c

b

c

b

c

b

d

No.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

*29.

*30.

Description

Employee future benefits

Pension funding and pension expense recognition

Nature of a defined contribution plan

Nature of a defined benefit plan

Objective of accounting for defined benefit plans

Meaning of funding a pension plan

Accounting problems in pension plans

Main purpose of an actuary

Definition of defined benefit obligation

Characteristics of vested benefits

Increase in defined/accrued benefit obligation

Definition of attribution period

Definition of experience gain or loss

Nature of plan assets

Nature of return on plan assets

Plan funded status

Adjustment for actuarial valuations

Application of immediate recognition approach

Recognition of past service costs using immediate recognition approach

Recognition of net defined benefit asset

G/L accounts under immediate recognition approach

Rationale for expensing past service costs using immediate recognition

Advantage of immediate recognition approach

Identify correct statement.

Post-employment benefits

Post-employment benefits

Recording/disclosure of post-employment benefit obligations

Disclosure of post-employment benefits

Unrecognized actuarial gains/losses using deferral and amortization

approach.

Corridor amortization

*This topic is dealt with in an Appendix to the chapter.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 7

MULTIPLE CHOICE—Computational

Answer

b

a

b

c

c

d

a

b

b

d

b

b

c

b

d

c

b

b

d

c

d

c

c

b

a

b

b

No.

31.

32.

33.

34.

35.

36.

37.

38.

39.

40.

41.

42.

43.

44.

45.

*46.

*47.

*48.

*49.

*50.

*51.

*52.

*53.

*54.

*55.

*56.

*57.

Description

Calculate fair value of plan assets.

Calculate fair value of plan assets.

Calculate pension expense.

Calculate pension expense.

Calculate pension expense.

Calculate pension expense.

Calculate pension expense.

Calculate net defined benefit liability/asset.

Calculate net defined benefit liability/asset.

Calculate pension expense.

Calculate pension expense.

Calculate pension expense.

Calculate defined benefit obligation.

Calculate pension expense.

Calculate defined benefit obligation.

Calculate post-employment benefit expense.

Calculate accrued pension liability/asset.

Calculate actuarial gain/loss.

Calculate accrued pension liability/asset.

Calculate actuarial gain/loss.

Calculate accrued benefit obligation.

Calculate fair value of plan assets.

Calculate interest cost.

Calculate actual return on plan assets.

Calculate unexpected gain/loss.

Calculate corridor.

Calculate unrecognized actuarial gain/loss to be amortized.

MULTIPLE CHOICE—CPA Adapted

Answer

b

d

c

b

a

a

c

a

d

c

No.

58.

59.

60.

61.

62.

63.

64.

65.

*66.

*67.

Description

Nature of interest cost included in pension cost

Calculate defined benefit obligation.

Calculate fair value of plan assets.

Calculate fair value of plan assets.

Calculate net defined benefit liability/asset.

Calculate pension expense.

Calculate pension expense.

Reporting net defined benefit liability/asset

Calculate accrued benefit liability/asset.

Calculate pension plan funded status.

*This topic is dealt with in an Appendix to the chapter.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 8

Test Bank for Intermediate Accounting, Tenth Canadian Edition

EXERCISES

Item

E19-68

E19-69

E19-70

E19-71

E19-72

E19-73

E19-74

*E19-75

*E19-76

*E19-77

*E19-78

*E19-79

*E19-80

Description

Pension accounting terminology

Pension asset terminology

Pension plan calculations

Pension plan calculations and journal entries

Approaches to accounting for pension expense

Measuring and recording pension expense.

Measuring the recording pension expense

Corridor amortization

Pension plan calculations and journal entries

Corridor approach for amortization of actuarial gains and losses

Pension reconciliation schedule

Calculating and recording pension expense.

Calculating accrued pension liability/asset.

PROBLEMS

Item

P19-81

P19-82

P19-83

*P19-84

*P19-85

Description

Measuring and recording pension expense.

Calculating pension expense and funded status.

Preparation of a pension work sheet and pension entries

Amortization of past service costs using EARSL

Preparation of a pension work sheet and pension entries (deferral and

amortization approach)

*This topic is dealt with in an Appendix to the chapter.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 9

MULTIPLE CHOICE—Conceptual

1. Employee future benefits do NOT include

a. post-employment pension plans.

b. long-term severance benefits.

c. regular vacation pay.

d. unrestricted sabbatical leaves.

2. The relationship between the amount funded and the amount reported for pension expense is

that

a. pension expense must always equal the amount funded.

b. pension expense will be less than the amount funded.

c. pension expense will be more than the amount funded.

d. pension expense may be greater than, equal to, or less than the amount funded.

3. In a defined contribution plan, a formula is used that

a. defines the benefits that the employee will receive at retirement.

b. ensures that pension expense and the cash funding amount will be different.

c. requires an employer to contribute a certain sum each period based on the formula.

d. ensures that employers are at risk to make sure funds are available at retirement.

4. In a defined benefit plan, a formula is used that

a. requires that the benefit of gain or the risk of loss from the assets contributed to the

pension plan be borne by the employee.

b. defines the benefits that the employee will receive at retirement.

c. requires that pension expense and the cash funding amount to be the same.

d. defines the contribution the employer is to make; no promise is made concerning the

ultimate benefits to be paid out to the employees.

5. The objective of accounting for defined benefit plans is to

a. calculate the actual amounts employees will receive at retirement.

b. recognize the appropriate expense and liability over the accounting periods in which the

related services are provided by the employees.

c. calculate the current service cost.

d. determine which employees’ rights have vested.

6. In a defined benefit plan, for the employer, the term “funding” refers to

a. being responsible for the assets of the pension plan.

b. determining the defined benefit obligation.

c. making periodic contributions to a funding agency to ensure that funds are available to

meet retirees' claims.

d. calculating the amount to report for pension expense.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 10

Test Bank for Intermediate Accounting, Tenth Canadian Edition

7. Accounting problems for all pension plans may include all the following EXCEPT

a. determining the level of individual premiums.

b. reporting the status and effects of the plan in the financial statements.

c. allocating the cost of the plan to the proper periods.

d. measuring the amount of pension obligation.

8. In pension accounting, the actuary’s main purpose is to

a. make predictions about mortality rates and employee turnover.

b. calculate the current pension cost.

c. calculate the interest cost of the pension plan.

d. ensure the employer has established an appropriate funding pattern to meet its pension

obligations.

9. Under IFRS, the defined benefit obligation for accounting purposes is

a. the present value of vested and non-vested benefits earned to the statement of financial

position date, with the benefits measured using employees’ future salary levels.

b. the present value of vested and non-vested benefits earned to the statement of financial

position date, with the benefits measured using employees’ current salary levels.

c. the present value of vested benefits only earned to the statement of financial position date,

with the benefits measured using employees’ future salary levels.

d. the present value of non-vested benefits only earned to the statement of financial position

date, with the benefits measured using employees’ future salary levels.

10. Which statement is INCORRECT regarding vested benefits?

a. They usually require a certain minimum number of years of service.

b. The employee is entitled to receive such benefits even if s/he is fired.

c. They are not contingent upon additional service under the plan.

d. They are lost when the employee is terminated.

11. The defined benefit obligation (accrued benefit obligation under ASPE) is always increased by

a. current service cost and payments to retirees.

b. current service cost and interest cost.

c. interest cost and actuarial gains.

d. current service cost and past service costs.

12. For defined benefit plans, the attribution period for employees is the time between

a. the hire date and the vesting date.

b. the vesting date and the date the employee becomes eligible for full benefits.

c. the hire date and the date the employee becomes eligible for full benefits.

d. the hire date and the date the employee reaches 65.

13. An experience gain or loss is

a. additional contributions made to the pension fund by the employer.

b. additional contributions made to the pension fund by the employees.

c. reduced payments made to retirees.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 11

d. the difference between what has occurred and the previous actuarial assumptions.

14. Pension plan assets include

a. contributions made by the employer and the employees in a contributory pension plan.

b. plan assets under the control of the employer.

c. only assets reported on the employer’s statement of financial position as the net defined

benefit liability/asset.

d. contribution by the employer/employees, less the actual return, plus benefits paid to

retirees.

15. The return on plan assets

a. is the change in the fair value of the plan assets during the year.

b. includes interest, dividends, and gains or losses from the sale of investments.

c. is the actual rate of return times the fair value of the plan assets at the beginning of the

period.

d. does not include unrealized gains and/or losses on the assets in the plan.

16. The difference between the defined (accrued) benefit obligation and the pension assets’ fair

value at any point in time is known as the plan’s

a. return on plan assets.

b. funded status.

c. experience gain or loss.

d. actual return.

17. Under IFRS, the defined benefit obligation is adjusted to its most recent actuarial valuation,

and the adjustment flows through

a. other comprehensive income.

b. net income.

c. either other comprehensive income or net income.

d. retained earnings.

18. In applying the immediate recognition approach under IFRS, any difference between the

pension expense and the payments into the fund should be reflected in

a. a contra account to the net defined benefit liability/asset.

b. an accrued actuarial liability.

c. the net defined benefit liability/asset.

d. a note to the financial statements only.

19. Using the immediate recognition approach, any past service costs should be included in the

a. pension expense of current and future periods.

b. pension expense of past periods.

c. pension expense of the current period.

d. plan assets.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 12

Test Bank for Intermediate Accounting, Tenth Canadian Edition

20. Using the immediate recognition approach under IFRS, a net defined benefit asset is reported

when

a. the defined benefit obligation exceeds the fair value of pension plan assets.

b. the fair value of pension plan assets exceeds the defined benefit obligation.

c. the pension expense for the period is the same as the contributions made to the pension

plan for the same period.

d. the vested benefits exceed the fair value of pension plan assets.

21. Using the immediate recognition approach under IFRS,

a. there is a general ledger account called net defined benefit liability/asset.

b. there is a general ledger account called defined benefit obligation.

c. there is a general ledger account called Pension Fund Assets.

d. Pension Expense is included in other comprehensive Income.

22. Under the immediate recognition approach, all past service costs are expensed. The rationale

for doing this is that

a. they are usually immaterial.

b. they relate to non-vested services, so there is no justification for deferring their recognition

to future periods.

c. they relate to past services, so there is no justification for deferring their recognition to

future periods.

d. CRA will not allow them to be deferred.

23. An advantage of the immediate recognition approach (IFRS) is that

a. the Net Defined Benefit Liability/Asset account reflects the actual funded status of the

pension plan.

b. unrecognized past service costs are deferred and amortized over future periods.

c. it averages out the pension expense from year to year.

d. it does not recognize actuarial gains and losses.

24. Which of the following statements is INCORRECT?

a. Most pension plan employers report their pension assets or liabilities in the appropriate

long-term classifications.

b. An employer with two or more defined benefit plans is required to measure the benefit cost

of each plan separately.

c. IFRS specifies how the components of pension benefit costs are to be reported on the

income statement.

d. Underlying assumptions, such as how the expected return on plan assets is determined,

are required to be disclosed.

25. Post-employment benefits may include all of the following EXCEPT

a. dental care.

b. severance pay to laid-off employees.

c. legal and tax services.

d. tuition assistance.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 13

26. Regarding post-employment health care benefits,

a. they are generally funded.

b. they are well-defined and level in dollar amount.

c. the beneficiary is the retiree, spouse, and other dependents.

d. benefits are payable monthly.

27. Accrued post-employment benefit obligations are

a. recorded at their present value.

b. recorded in the same manner as pension benefit obligations.

c. not recognized in the financial statements.

d. disclosed in the notes to the financial statements only.

28. Which of the following disclosures of post-employment benefits would NOT be required?

a. the cost of post-employment benefits during the period

b. a description of the accounting and funding policies followed

c. the amount of the actuarial liability for short term benefits such as paternity leave

d. the assumptions and rates used in calculating the benefit obligation

*29. Using the deferral and amortization approach, unrecognized net actuarial gains and losses

should be

a. recorded currently as an adjustment to pension expense in the period incurred.

b. recorded currently and in the future by applying the corridor method which provides the

amount to be amortized.

c. amortized over a 15-year period.

d. recorded only if a loss is determined.

*30. Corridor amortization for net actuarial gains and losses

a. only applies when the immediate recognition approach is used.

b. can be used for either the immediate recognition approach or the deferral and amortization

approach.

c. is only used by the actuary.

d. amortizes the net accumulated gain or loss when its balance is considered too large.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 14

Test Bank for Intermediate Accounting, Tenth Canadian Edition

MULTIPLE CHOICE ANSWERS—Conceptual

Item

1.

2.

3.

4.

5.

Ans.

c

d

c

b

b

Item

6.

7.

8.

9.

10.

Ans.

c

a

d

a

d

Item

11.

12.

13.

14.

15.

Ans.

b

c

d

a

b

Item

16.

17.

18.

19.

20.

Ans.

b

a

c

c

b

Item

21.

22.

23.

24.

25.

Ans.

Item

Ans.

a

c

a

c

b

26.

27.

28.

*29.

*30.

c

b

c

b

d

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 15

MULTIPLE CHOICE—Computational

31. Presented below is information related to Peach Corporation’s defined benefit pension plan

for calendar 2014. The corporation uses the immediate recognition approach under IFRS.

Defined benefit obligation, Jan 1 ................................ $200,000

Fair value of plan assets, Jan 1 ..................................

180,000

Current service cost ...................................................

27,000

Contributions to plan ..................................................

25,000

Actual and expected return on plan assets .................

9,000

Benefits paid to retirees..............................................

40,000

Interest (discount) rate ...............................................

10%

The fair value of the plan assets at December 31, 2014 is

a. $187,000.

b. $174,000.

c. $165,000.

d. $149,000.

32. Presented below is information related to Kiwi Ltd. for calendar 2014. The corporation uses

the immediate recognition approach under IFRS.

Defined benefit obligation, Jan 1 ................................ $720,000

Fair value of plan assets, Jan 1 ..................................

700,000

Current service cost ...................................................

90,000

Contributions to plan ..................................................

125,000

Actual and expected return on plan assets .................

56,000

Past service costs (effective Jan 1) ............................

10,000

Benefits paid to retirees..............................................

96,000

Interest (discount) rate ...............................................

9%

The fair value of the plan assets at December 31, 2014 is

a. $785,000.

b. $805,000.

c. $819,000.

d. $875,000.

33. Presented below is pension information related to Apple Inc. for the calendar year 2014. The

corporation uses the immediate recognition approach.

Current service costs ................................................. $288,000

Interest on accrued benefit obligation .........................

216,000

Expected and actual return on plan assets .................

72,000

Past service costs ......................................................

48,000

The pension expense to be reported for 2014 is

a. $432,000.

b. $480,000.

c. $576,000.

d. $648,000.

34. Presented below is pension information related to Banana Inc. for the calendar year 2014.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 16

Test Bank for Intermediate Accounting, Tenth Canadian Edition

The corporation uses the immediate recognition approach under ASPE.

Current service costs ................................................. $ 50,000

Contributions to the plan ............................................

55,000

Actual return on plan assets .......................................

45,000

Accrued benefit obligation (beginning of year) ............

600,000

Fair value of plan assets (beginning of year) ..............

400,000

Interest cost on the obligation.....................................

10%

The pension expense to be reported for 2014 is

a. $110,000.

b. $ 70,000.

c. $ 65,000.

d. $ 50,000.

35. Presented below is pension information related to Cantaloupe Ltd. for the calendar year 2014.

The corporation uses the immediate recognition approach under ASPE.

Current service costs ................................................. $450,000

Actual return on plan assets .......................................

105,000

Interest on accrued benefit obligation .........................

195,000

Actuarial experience loss ...........................................

45,000

Past service costs ......................................................

82,500

The pension expense to be reported for 2014 is

a. $757,500.

b. $697,500.

c. $667,500.

d. $577,500.

36. At the end of 2014, Lime Inc. has determined the following adjusted information related to its

defined benefit pension plan:

Defined benefit obligation ........................................... $1,320,000

Fair value of pension plan assets ............................... 1,220,000

The corporation uses the immediate recognition approach under IFRS. Assume the net defined

benefit liability/asset account at January 1, 2014 was nil. If the contribution to plan assets in 2014

is $410,000, the pension expense for 2014 is

a. $100,000.

b. $310,000.

c. $410,000.

d. $510,000.

Use the following information for questions 37–38.

The following information is available for Figgy Enterprises Ltd. for calendar 2014. The

corporation uses the immediate recognition approach under IFRS.

Plan assets (at fair value), end of year ....................... $1,800,000 Dr

Defined benefit obligation, end of year ....................... 1,920,000 Cr

Pension expense........................................................

360,000

Contributions for year .................................................

324,000

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 17

37. The pension expense to be reported for 2014 is

a. $360,000.

b. $346,000.

c. $324,000.

d. $120,000.

38. The net defined benefit liability/asset that should be reported at December 31, 2014 is

a. $120,000 asset.

b. $120,000 liability.

c. $204,000 asset.

d. $360,000 liability.

39. Presented below is pension information related to Mango Ltd. at December 31, 2014. The

corporation uses the immediate recognition approach under IFRS.

Defined benefit obligation ........................................... $3,500,000 Cr

Plan assets (at fair value) ........................................... 2,500,000 Dr

Past service costs ......................................................

100,000

Contributions to plan ..................................................

200,000

The amount to be reported as the net defined benefit liability at December 31, 2014 is

a. $1,100,000.

b. $1,000,000.

c. $ 900,000.

d. $ 700,000.

40. Presented below is pension information related to Squash Corp. for the calendar year 2014.

The corporation uses the immediate recognition approach under IFRS.

Current service cost ................................................... $204,000

Discount (interest) rate ...............................................

9%

Defined benefit obligation, Jan 1 ................................ $1,800,000

Benefits paid to retirees..............................................

100,000

Past service cost (effective Jan 1) ..............................

50,000

The pension expense to be reported for 2014 is

a. $266,000.

b. $366,000.

c. $416,000.

d. $420,500.

41. Presented below is pension information related to Watermelon Corp. for the calendar year

2014. The corporation uses the immediate recognition approach under IFRS.

Current service cost ................................................... $126,000

Discount (interest) rate ...............................................

10%

Defined benefit obligation, Jan 1 ................................ $900,000

Actual & expected return on plan assets ....................

24,000

Actuarial loss..............................................................

28,000

The pension expense to be reported for 2014 is

a. $220,000.

b. $192,000.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 18

Test Bank for Intermediate Accounting, Tenth Canadian Edition

c. $164,000.

d. $130,000.

42. Daikon Ltd. received the following information from its pension plan trustee concerning their

defined benefit pension plan for calendar 2014. The corporation uses the immediate recognition

approach under ASPE.

Jan 1, 2014

Dec 31, 2014

Fair value of plan assets

$2,100,000

$2,250,000

Accrued benefit obligation

2,400,000

2,580,000

For 2014, the current service cost is $180,000. The interest rate on the liability is 10% and the

actual rate of return on plan assets is 9%. The pension expense to be reported for 2014 is

a. $265,500.

b. $231,000.

c. $216,000.

d. $180,000.

43. Presented below is information related to Peach Corporation’s defined benefit pension plan

for calendar 2014. The corporation uses the immediate recognition approach under IFRS.

Defined benefit obligation, Jan 1 ................................ $200,000

Fair value of plan assets, Jan 1 ..................................

180,000

Current service cost ...................................................

27,000

Contributions to plan ..................................................

25,000

Actual and expected return on plan assets .................

9,000

Benefits paid to retirees..............................................

40,000

Interest (discount) rate ...............................................

10%

The balance of the defined benefit obligation at December 31, 2014 is

a. $185,000.

b. $187,000.

c. $207,000.

d. $245,000.

Use the following information for questions 44–45.

Presented below is information related to Kiwi Ltd. for calendar 2014. The corporation uses the

immediate recognition approach under IFRS.

Defined benefit obligation, Jan 1 ................................ $720,000

Fair value of plan assets, Jan 1 ..................................

700,000

Current service cost ...................................................

90,000

Contributions to plan ..................................................

125,000

Actual and expected return on plan assets .................

56,000

Past service costs (effective Jan 1) ............................

10,000

Benefits paid to retirees..............................................

96,000

Interest (discount) rate ...............................................

9%

44. The pension expense to be reported for 2014 is

a. $140,000.

b. $109,700.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 19

c. $108,800.

d. $ 60,000.

45. The balance of the defined benefit obligation at December 31, 2014 is

a. $724,000.

b. $779,700.

c. $778,800.

d. $789,700.

*46. The following facts relate to the Tomato Inc. post-employment benefits plan for 2014. The

company follows ASPE:

Current service cost ................................................... $340,000

Discount (interest) rate ...............................................

8%

Accrued benefit obligation, Jan 1, 2014

(transitional amount) .................................................. $2,000,000

Average remaining service to full eligibility .................

20 years

Average remaining service to expected retirement .....

25 years

The post-employment benefit expense for 2014 is

a. $612,000.

b. $600,000.

c. $580,000.

d. $420,000.

Use the following information for questions *47–*50.

The following information relates to Gooseberry Corp. for their past two fiscal years. The

corporation uses the deferral and amortization approach.

2013

2014

Plan assets (at fair value) ..................... $630,000

$912,000

Pension expense..................................

285,000

225,000

Accrued benefit obligation ....................

810,000

942,000

Annual contribution to plan ...................

300,000

225,000

Unrecognized past service costs ..........

240,000

210,000

*47. The net amount to be recorded as accrued pension liability/asset at December 31, 2013 is

a. $ -0-.

b. $15,000 Dr.

c. $15,000 Cr.

d. $40,000 Dr.

*48. The amount of the actuarial gain/loss at December 31, 2013 is

a. $45,000 loss.

b. $45,000 gain.

c. $60,000 gain.

d. $180,000 loss.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 20

Test Bank for Intermediate Accounting, Tenth Canadian Edition

*49. Assuming the amortization of past service costs is already included in the pension expense,

the amount reported as the accrued pension liability/asset at December 31, 2014 is

a. $ -0-.

b. $30,000.

c. $45,000.

d. $15,000.

*50. The amount of the actuarial gain/loss at December 31, 2014 is

a. $195,000 gain.

b. $180,000 gain.

c. $165,000 gain.

d. $ 30,000 gain.

Use the following information for questions *51–*52.

On January 1, 2014, Quince Inc. reported the following balances related to their defined benefit

pension plan. The corporation uses the deferral and amortization approach.

Accrued benefit obligation .......................................... $1,400,000

Fair value of plan assets ............................................ 1,250,000

The interest rate for the obligation and the plan assets is 10%. Other data related to the pension

plan for 2014 are:

Service cost ...............................................................

$80,000

Amortization of unrecognized past service costs ........

18,000

Contributions ..............................................................

90,000

Benefits paid ..............................................................

75,000

Actual return on plan assets .......................................

88,000

Amortization of unrecognized net actuarial gains .......

6,000

*51. The balance of the accrued benefit obligation at December 31, 2014 is

a. $1,524,000.

b. $1,530,000.

c. $1,543,000.

d. $1,545,000.

*52. The fair value of the plan assets at December 31, 2014 is

a. $1,177,000.

b. $1,263,000.

c. $1,353,000.

d. $1,428,000.

Use the following information for questions *53–*57.

The following information relates to the defined benefit pension plan for the employees of

Raspberry Ltd. The corporation uses the deferral and amortization approach.

Jan 1/13

Dec 31/13

Dec 31/14

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

Accrued benefit obligation

Fair value of plan assets

Unrecognized net actuarial gain

Interest cost on ABO

Expected rate of return

2,325,000

2,125,000

-0-

2,490,000

2,600,000

360,000

11%

8%

19- 21

3,335,000

2,870,000

400,000

11%

7%

Raspberry estimates that the employee average remaining service life (EARSL) is 16 years. In

2014, Raspberry contributed $315,000 to the pension fund, and the fund trustee paid $235,000 in

benefits to retirees.

*53. The interest cost for 2014 is

a. $224,100.

b. $253,000.

c. $273,900.

d. $366,850.

*54. The actual return on plan assets in 2014 is

a. $170,000.

b. $190,000.

c. $245,000.

d. $270,000.

*55. The unexpected gain or loss on plan assets in 2014 is

a. $ 8,000 gain.

b. $16,400 loss.

c. $63,600 gain.

d. $89,400 gain.

*56. The corridor for 2014 is

a. $258,000.

b. $260,000.

c. $282,500.

d. $333,500.

*57. The amount of unrecognized net actuarial gain amortized in 2014 is

a. $6,375.

b. $6,250.

c. $4,844.

d. $4,157.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 22

Test Bank for Intermediate Accounting, Tenth Canadian Edition

MULTIPLE CHOICE ANSWERS—Computational

Item

Ans.

Item

Ans.

Item

Ans.

Item

Ans.

Item

Ans.

Item

Ans.

31.

32.

33.

34.

35.

b

a

b

c

c

36.

37.

38.

39.

40.

d

a

b

b

d

41.

42.

43.

44.

45.

b

b

c

b

d

*46.

*47.

*48.

*49.

*50.

c

b

b

d

c

*51.

*52.

*53.

*54.

*55.

d

c

c

b

a

*56.

*57.

b

b

DERIVATIONS—Computational

No. Answer

31.

b

32.

a

33.

b

34.

c

35.

c

36.

d

37.

38.

39.

40.

41.

a

b

b

d

b

42.

43.

44.

45.

b

c

b

d

*46.

*47.

*48.

*49.

*50.

*51.

*52.

*53.

*54.

*55.

*56.

c

b

b

d

c

d

c

c

b

a

b

Derivation

$180,000 + $9,000 + $25,000 - $40,000 = $174,000

$700,000 + $56,000 + $125,000 - $96,000 = $785,000

$288,000 + $216,000 + $48,000 – $72,000 = $480,000

$50,000 + ($600,000 × 10%) – $45,000 = $65,000

$450,000 + $195,000 + $45,000 + $82,500 – $105,000 = $667,500

funding minus pension expense = accrued pension asset/liab.

$410,000 - X = $1,220,000 - $1,320,000; X = $510,000

$360,000 (given)

$1,920,000 – $1,800,000 = $120,000 liability

$3,500,000 – $2,500,000 = $1,000,000

$204,000 + [($1,800,000 + $50,000) X 9%)] + $50,000 = $420,500

$126,000 + ($900,000 x 10%) - $24,000 = $192,000

Note: the actuarial loss is not part of pension expense, but is charged to OCI

$180,000 + ($2,400,000 × 10%) – ($2,100,000 × 9%) = $231,000

$200,000 + $27,000 + ($200,000 x 10%) - $40,000 = $207,000

$90,000 + [($720,000 + $10,000) x 9%] + $10,000 - $56,000 = $109,700

$720,000 + $10,000 + $90,000 + [($720,000 + $10,000) x 9%] - $96,000 =

$789,700.

$340,000 + ($2,000,000 X 8%) + ($2,000,000 ÷ 25) = $580,000

$285,000 – $300,000 = $15,000 debit

$630,000 + $240,000 – $810,000 – $15,000 = $45,000 gain

$15,000 + $225,000 – $225,000 = $15,000

$912,000 + $210,000 – $942,000 – $15,000 = $165,000 gain

$1,400,000 + $80,000 – $75,000 + ($1,400,000 ×10%) = $1,545,000

$1,250,000 + $88,000 + $90,000 – $75,000 = $1,353,000

$2,490,000 × 11% = $273,900

($2,870,000 – $2,600,000) – ($315,000 – $235,000) = $190,000

$190,000 – ($2,600,000 × 7%) = $8,000 gain

$2,600,000 × 10%) = $260,000

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

*57.

b

19- 23

($360,000 – $260,000) ÷ 16 = $6,250

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 24

Test Bank for Intermediate Accounting, Tenth Canadian Edition

MULTIPLE CHOICE—CPA Adapted

58. The interest cost included in the annual pension cost recorded by an employer sponsoring a

defined benefit pension plan represents the

a. difference between the expected and actual return on plan assets.

b. increase in the defined (accrued) benefit obligation due to the passage of time.

c. increase in the fair value of plan assets due to the passage of time.

d. interest earned on the plan assets for the year.

59. The following information pertains to Rembrandt Inc.'s pension plan for calendar 2014:

Defined benefit obligation at Jan 1/14 ........................

$96,000

Interest (discount) rate ...............................................

10%

Current service costs .................................................

$24,000

Pension benefits paid retirees ....................................

$20,000

The corporation uses the immediate recognition approach under IFRS. If no change in actuarial

estimates occurred during 2014, Rembrandt's defined benefit obligation at December 31, 2014

would be

a. $85,600.

b. $100,000.

c. $105,600.

d. $109,600.

60. At January 1, 2014, Van Gogh Corp.’s defined benefit pension plan, for which they are using

the immediate recognition approach under IFRS, had a defined benefit obligation of $100,000,

while the fair value of the plan assets was $120,000. During 2014, the plan's current service cost

was $150,000; past service costs were $80,000; Van Gogh contributed $110,000 to the plan; the

actual and expected return on the plan assets was $9,000; and benefits paid to retirees were

$95,000. What is the fair value of the plan assets at December 31, 2014?

a. $239,000

b. $205,000

c. $144,000

d. $135,000

61. Bateman Corp. provides a defined benefit pension plan for its employees, and uses the

immediate recognition approach under IFRS to account for it. The trustee administering the plan

provided the following information for the year ended December 31, 2014:

Fair value of plan assets, Jan 1 .................................. $1,200,000

Defined benefit obligation, Jan 1 ................................ 1,270,000

Current service cost ...................................................

300,000

Employer's contributions ...........................................

360,000

Past service cost (at Jan 1) ........................................

30,000

Benefits paid retirees .................................................

325,000

Actual and expected return .......................................

60,000

Interest (discount) rate ...............................................

8%

The fair value of the plan assets at December 31, 2014 would be

a. $1,235,000.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 25

b. $1,295,000.

c. $1,335,000.

d. $1,535,000.

62. At December 31, 2014, the following information was provided by the defined benefit pension

plan administrator for Leonardo Corp.:

Fair value of plan assets ............................................ $5,000,000

Defined benefit obligation ........................................... 6,200,000

The corporation uses the immediate recognition approach under IFRS. What is the net defined

benefit liability/asset account that should be shown on Leonardo’s December 31, 2014 statement

of financial position?

a. $1,200,000 liability

b. $1,200,000 asset

c. $6,200,000 liability

d. $5,000,000 asset

63. Thomson Corp. provides a defined benefit pension plan for its employees, and uses the

immediate recognition approach under IFRS to account for it. The corporation's actuary has

provided the following information for the year ended December 31, 2014:

Defined benefit obligation, Dec 31 ..............................

525,000

Fair value of plan assets, Dec 31 ...............................

625,000

Current service cost ...................................................

240,000

Interest on defined benefit obligation ..........................

24,000

Past service costs ......................................................

60,000

Expected and actual return on plan assets .................

82,500

Contributions to plan ..................................................

200,000

The pension expense to be reported for 2014 is

a. $241,500.

b. $324,000.

c. $406,500.

d. $524,000.

64. Bateman Corp. provides a defined benefit pension plan for its employees, and uses the

immediate recognition approach under IFRS to account for it. The trustee administering the plan

provided the following information for the year ended December 31, 2014:

Fair value of plan assets, Jan 1 .................................. $1,200,000

Defined benefit obligation, Jan 1 ................................ 1,270,000

Current service cost ...................................................

300,000

Employer's contributions ...........................................

360,000

Past service cost (at Jan 1) ........................................

30,000

Benefits paid retirees .................................................

325,000

Actual and expected return .......................................

60,000

Interest (discount) rate ...............................................

8%

The pension expense to be reported for 2014 is

a. $270,000.

b. $366,000.

c. $374,000.

d. $434,000.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 26

Test Bank for Intermediate Accounting, Tenth Canadian Edition

65. Magritte Inc. provides a defined benefit pension plan for its employees (for which the

corporation uses the immediate recognition approach). At December 31, 2014, the fair value of

the plan assets is less than the defined benefit obligation. In its statement of financial position at

December 31, 2014, Magritte should report a net defined benefit liability/asset of the

a. excess of the defined benefit obligation over the fair value of the plan assets.

b. excess of the plan assets over the defined benefit obligation.

c. defined benefit obligation.

d. fair value of the plan assets.

Use the following information for questions *66–*67.

Lautrec Corp. provides a defined benefit pension plan for its employees, and uses the deferral

and amortization approach to account for it. The trustee administering the plan provided the

following information for the year ended December 31, 2014:

Fair value of plan assets, Dec 31 ............................... $1,200,000

Accrued benefit obligation, Dec 31 ............................. 1,335,000

Pension expense for year ...........................................

300,000

Employer's contribution for year .................................

360,000

Unrecognized past service costs ................................

30,000

On December 31, 2013, the accrued benefit liability/asset account had a debit balance of

$45,000.

*66. At December 31, 2014, what is the amount of accrued benefit liability/asset?

a. $ 15,000

b. $ 60,000

c. $ 90,000

d. $105,000

*67. In the December 31, 2014 financial statements, how much would be reported as the plan’s

funded status (liability)?

a. $ 60,000

b. $105,000

c. $135,000

d. $165,000

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 27

MULTIPLE CHOICE ANSWERS—CPA Adapted

Item

58.

59.

Ans.

b

d

Item

60.

61.

Ans.

c

b

Item

62.

63.

Ans.

a

a

Item

64.

65.

Ans.

Item

Ans.

c

a

*66.

*67.

d

c

DERIVATIONS—CPA Adapted

No. Answer

58.

b

59.

d

60.

c

61.

b

62.

a

63.

a

64.

c

65.

a

*66.

d

*67.

c

Derivation

Conceptual

$96,000 + $24,000 + ($96,000 × 10%) – $20,000 = $109,600

$120,000 + $9,000 + $110,000 - $95,000 = $144,000

$1,200,000 + $60,000 + $360,000 - $325,000 = $1,295,000

$6,200,000 – $5,000,000 = $1,200,000 liability

$240,000 + $24,000 – $82,500 + $60,000 = $241,500

$300,000 + 30,000 + [($1,270,000 + $30,000) x 8%] – $60,000 = $374,000

Conceptual

$360,000 – $300,000 + $45,000 = $105,000

$1,335,000 – $1,200,000 = $135,000

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 28

Test Bank for Intermediate Accounting, Tenth Canadian Edition

EXERCISES

Ex. 19-68 Pension accounting terminology

Briefly explain the following terms:

a. Service cost

b. Interest cost

c. Past service costs

d. Vested benefits

Solution 19-68

a. The (current) service cost component of pension expense is the cost of the benefits to be

provided in future in exchange for services provided in the current period.

b. The interest cost component of pension expense is the interest for the period on the defined

(accrued) benefit obligation outstanding during the period. To simplify the calculation, the amount

of interest is calculated by applying a single rate to the beginning balance of the obligation.

c. When a defined benefit plan is initiated or amended, credit that is given to employees for

services provided before the date of initiation or amendment results in past service costs. If there

is a reduction in the benefit plan, there is a decrease in in the defined (accrued) benefit obligation.

The amount of the past service costs is calculated by an actuary, and is added/deducted to the

beginning balance of the obligation for calculating the interest cost for the year.

d. Vested benefits are those the employee is entitled to receive even if s/he provides no

additional services under the plan, e.g. if his/her employment is terminated.

Ex. 19-69 Pension asset terminology

Discuss the following ideas related to pension assets:

a. Actual return on plan assets.

b. Expected return on plan assets.

c. Unexpected gains and losses on plan assets.

Solution 19-69

a. The actual return earned on plan assets is the income generated on the assets being held by

the trustee, less the cost of administering the fund. This can vary considerably from year to year.

b. The expected return on plan assets is the long-term rate of return (calculated by the actuary)

multiplied by the fair value of the assets at the beginning of the period. A long-term rate is used to

smooth out short-term fluctuations in interest rates, and is usually the rate for high-quality

corporate bonds. Under IFRS, the same rate is used for interest on the defined benefit obligation

and the plan assets.

c. An unexpected asset gain occurs when the actual return on plan assets is greater than the

expected return on plan assets and an unexpected loss occurs when the actual return is less than

the expected return.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 29

Ex. 19-70 Pension plan calculations

The following information relates to the defined benefit pension plan for Strawberry Dale Ltd.:

Dec 31/13

Dec 31/14

Defined benefit obligation

$2,250,000

$3,000,000

Fair value of plan assets

2,300,000

2,640,000

Interest rate

8%

8%

Expected rate of return

7%

6%

In 2014, the corporation contributed $390,000 to the plan, and the trustee paid $210,000 in

benefits to retirees. Strawberry Dale uses the immediate recognition approach under IFRS.

Instructions

For the year ended December 31, 2014:

a. Calculate the interest on the obligation.

b. Calculate the actual return on plan assets.

c. Calculate the unexpected gain or loss (if any).

Solution 19-70

a. $2,250,000 × 8% = $180,000

b.

Fair value of plan assets Dec 31/14 ........................... $2,640,000

Fair value of plan assets Dec 31/13 ........................... (2,300,000)

340,000

Contributions .............................................................. (390,000)

Benefits paid ..............................................................

210,000

Actual return on plan assets ....................................... $ 160,000

c.

Actual return (see b.) .................................................. $ 160,000

Expected return ($2,300,000 × 6%) ............................ (138,000)

Unexpected gain ........................................................ $ 22,000

Ex. 19-71 Pension plan calculations and journal entries

On January 1, 2014, Prune Ltd. reported the following balances relating to their defined benefit

pension plan:

Defined benefit obligation ........................................... $3,200,000

Fair value of plan assets ............................................ 3,200,000

Other data related to the pension plan for 2014 are:

Current service cost ...................................................

140,000

Contributions to the plan ............................................

204,000

Benefits paid ..............................................................

200,000

Actual return on plan assets .......................................

192,000

Interest (discount) rate ..............................................

9%

Prune uses the immediate recognition approach under ASPE.

Instructions

a. Calculate the defined benefit obligation at December 31, 2014.

b. Calculate the fair value of plan assets at December 31, 2014.

c. Calculate pension expense for 2014.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 30

d.

Test Bank for Intermediate Accounting, Tenth Canadian Edition

Prepare the journal entries to record the pension expense and the contributions for 2014.

Solution 19-71

a. Defined benefit obligation, Jan 1 ................................ $3,200,000

Current service cost ...................................................

140,000

Interest cost (9% × $3,200,000) .................................

288,000

Benefits paid .............................................................. (200,000)

Defined benefit obligation, Dec 31 .............................. $3,428,000

b. Fair value of plan assets, Jan 1 ..................................... $3,200,000

Actual return...............................................................

192,000

Contributions ..............................................................

204,000

Benefits paid .............................................................. (200,000)

Fair value of plan assets, Dec 31 ............................... $3,396,000

c.

Current service cost ...................................................

Interest cost (9% × $3,200,000) .................................

Actual return on plan assets .......................................

Pension expense........................................................

$140,000

288,000

(192,000)

$236,000

d.

Pension Expense ..........................................................................

Net Defined Benefit Liability/Asset ..........................................

236,000

Net Defined Liability/Asset ............................................................

Cash.......................................................................................

204,000

236,000

204,000

Ex. 19-72 Approaches to accounting for pension expense

Discuss the difference between the immediate recognition approach and the deferral and

amortization approach when accounting for annual pension expense.

Solution 19-72

Under the immediate recognition approach, pension expense includes current service costs, past

service costs, and interest cost on the opening DBO, less expected return on assets (less the

actual return, if different). This may cause the annual pension expense to fluctuate significantly.

However, an advantage of this approach is that the actual funded status is disclosed on the

statement of financial position via the net defined benefit liability/asset account. Note that under

IFRS, any actuarial gains or losses or remeasurement gains/losses on plan assets are not part of

pension expense (i.e. net income), but flow through OCI.

Under the deferral and amortization approach, the recognition of past service costs and actuarial

gains/losses can be deferred and amortized over current and future periods. This tends to smooth

out the pension expense, but misstates the funded status on the statement of financial position,

as the unrecognized past service costs and actuarial gains/losses are “off balance sheet.”

However, all such amounts must be fully disclosed in the notes.

IFRS now requires the use of the immediate recognition approach only. ASPE currently permits

either approach; however the new Section 3462 of the Handbook will eliminate the use of the

deferral and amortization approach.

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

Pensions and Other Employee Future Benefits

19- 31

Ex. 19-73 Measuring and recording pension expense

Pumpkin Ltd. received the following information from its pension plan trustee concerning their

defined benefit pension plan for the year ended December 31, 2014:

January 1, 2014

December 31, 2014

Defined benefit obligation

$3,500,000

$3,990,000

Fair value of plan assets

1,750,000

2,240,000

For 2014, the service cost is $210,000 and past service cost (effective Jan 1) is $100,000. During

2014, Pumpkin contributed $595,000 to the plan. The actual and expected return on plan assets

is 8%. Pumpkin uses the immediate recognition approach under IFRS.

Instructions

a. Calculate the pension expense to be reported in 2014.

b. Prepare the journal entries to record the pension expense and the employer’s contribution for

2014.

Solution 19-73

a. Current service cost ...................................................................... $210,000

Interest on DBO ($3,500,000 + $100,000) × 8%) ..........................

288,000

Actual/Expected return on plan assets ($1,750,000 × 8%) ............ (140,000)

Past service costs .........................................................................

100,000

$458,000

b.

Pension Expense ..........................................................................

Net Defined Benefit Liability/Asset ..........................................

458,000

Net Defined Benefit Liability/Asset ................................................

Cash.......................................................................................

595,000

458,000

595,000

Ex. 19-74 Measuring and recording pension expense

The following information relates to the defined benefit pension plan for Huckleberry Ltd. for 2014.

The corporation uses the immediate recognition approach under IFRS.

Current service cost ................................................... $260,000

Contributions ..............................................................

250,000

Interest rate for obligation ...........................................

10%

Expected & actual return on plan assets ....................

9%

Defined benefit obligation, Jan 1 ................................

240,000

Fair value of plan assets, Jan 1 ..................................

180,000

Actuarial gain .............................................................

24,000

Instructions

a. Calculate the pension expense to be reported for 2014.

b. Prepare the journal entries to record pension expense and the employer's contributions for

2014.

Solution 19-74

a. Current service cost ................................................... $260,000

Interest on defined benefit obligation ($240,000 × 10%)

24,000

Expected return on plan assets ($180,000 × 9%) .......

(16,200)

Pension expense—2014 ............................................ $267,800

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited

19- 32

Test Bank for Intermediate Accounting, Tenth Canadian Edition

Note the actuarial gain is not part of pension expense, but would be booked through OCI.

b.

Pension Expense ..........................................................................

Net Defined Benefit Liability/Asset ..........................................

267,800

Net Defined Benefit Liability/Asset ................................................

Cash.......................................................................................

250,000

267,800

250,000

*Ex. 19-75 Corridor amortization

Explain corridor amortization.

Solution 19-75

The corridor approach for amortizing pension plan gains and losses is used when they get too

large. The unrecognized net gain or loss gets too large when it exceeds the arbitrarily selected